In this episode of On the Record, Analyst Chris Johnson forecasts the ag equipment industry will see a "shallow trough" slowdown. In the Technology Corner, Noah Newman takes a look at precision tech at this year's National Strip-Tillage Conference. Also in this episode, farm production expenditures are up for 2022 and Kubota reports earnings for the first half of 2023.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- 2024 Equipment Outlook: Look for Shallow Trough

- Growing Interest in Precision Technology at National Strip-Tillage Conference

- Farm Production Expenditures Jump in 2022

- Kubota Reports $2.7 Billion in YTD North American Ag Sales

- DataPoint: Farmers’ Large Investments

2024 Equipment Outlook: Look for Shallow Trough

This year has been a strong year for the ag equipment market, says Chris Johnson, a senior research analyst with Cleveland Research. Speaking during the 2023 Dealership Minds Summit, Johnson says as the industry “rolls out of a really strong year, inevitably there’s going to be slower years.”

And while he’s forecasting a slowdown, he does not think the industry will be hit with a slowdown like we saw in 2014-2019. He argues that it will be a more shallow trough, and the market is going to hold up.

"This is I think the biggest variable that we're seeing, and we're starting to see that pop up in our work uncertainty. And if you think, and forecasts have this federal funds rate going from 5 ½ down to maybe 3, 3 ½ , 4 in 12, 18 months, if I'm making a purchase, I might wait. If I can get a cheaper interest rate down the road, maybe I'll pause and take a second shop around and see what's going on. Especially if I've had a delayed delivery that's just come in, and the unit that's technically old is still new. So this is an interesting variable. This is a pain point that's we think is as bad as it could get relatively. It's going to ease over the next 12 months, which creates some noise in the ordering patterns and the ultimate demand of the farmer, but it's interesting to keep an eye on."

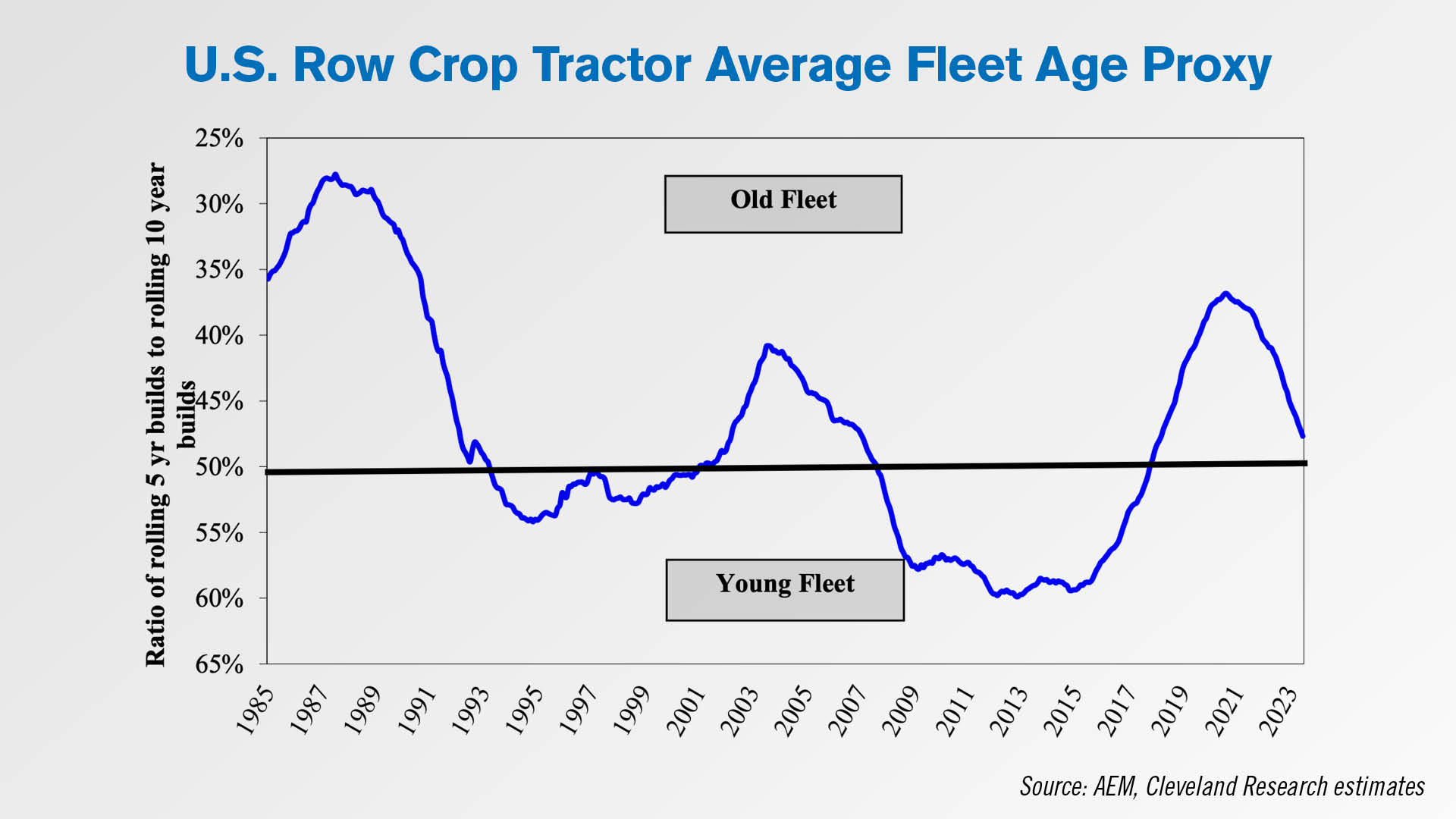

Johnson says the average age of the equipment fleet helps shallow out the trough.

Looking at the ratio of rolling 5-year builds for row-crop tractors compared to the rolling 10-year builds, the fleet got very old in 2021 and 2022 due to delayed deliveries. The age has come back down, but Johnson notes OEMs are not overproducing.

He says, “effectively, what the OEMs have done, as painful as it was to not get your deliveries, they chopped off some of the upside at the peak and delayed it here into the trough, which has helped, and it's going to shallow out what's going on.”

He adds that the current fleet is still old and still in need of support. When the fleet gets very young, he says, that is when the industry sees an extended downturn with a deeper recession.

Growing Interest in Precision Technology at National Strip-Tillage Conference

We just got back from the 10th annual National Strip-Tillage Conference in Bloomington, Ill. Precision technology was a hot topic throughout the 3-day event.

Drones took flight at the Precision Planting PTI Farm workshop. Precision Planting lead agronomist Jason Webster told the crowd of no-tillers and strip-tillers that he’s on board with the potential of these UAVs to provide a significant ROI.

Pete Youngblut, owner and president of Youngblut Ag, a precision dealer in Dysart Iowa, gave a classroom presentation on precision technology, and how certain tools are crucial to the success of a strip-till operation. He’s been to several strip-till conferences, but he’s never seen this much interest from attendees in precision technology.

“It’s been growing — I think in the last two years even I've seen a large jump in it from the precision side. And a lot of guys will come to me and they go, "Hey, I got this monitor from you and we got auto steer in it. Does that mean I could do strips and maybe go in between my old corn rows or what could I do different?" And it's just been phenomenal. So it's caused us to do more with Strip-Till with row units, toolbar attachments, those kind of things. And it's kind of been a progressive step.”

Redekop, Sabanto, InnerPlant and One Smart Spray showcased their cutting-edge technologies during another precision-focused classroom. We’ll have a recap of that session coming soon to PrecisionFarmingDealer.com.

Farm Production Expenditures Jump in 2022

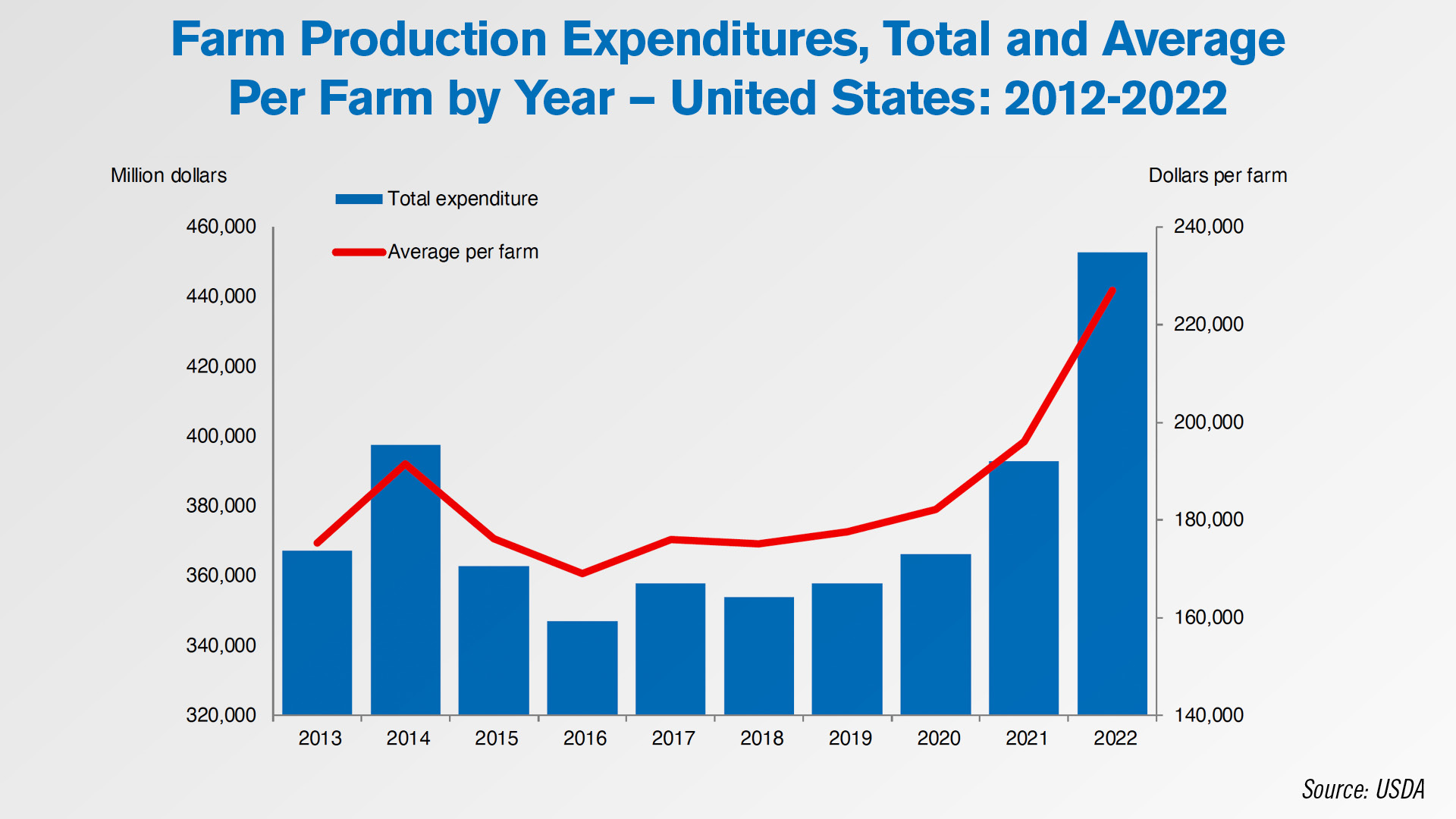

In its annual summary of farm production expenditures, the USDA reported last month that total estimated expenditures in the continental U.S. for 2022 rose to $453.7 billion, up approximately 15% from a 2021 level of nearly $393 billion. All of the 17 line items the USDA counts in determining total expenditures increased from 2021 levels.

The average total expenditure per farm also rose about 16% to nearly $227,000 from approximately $196,000 in 2021.

For crop farms specifically, total expenditures jumped nearly 13% to almost $234 billion.

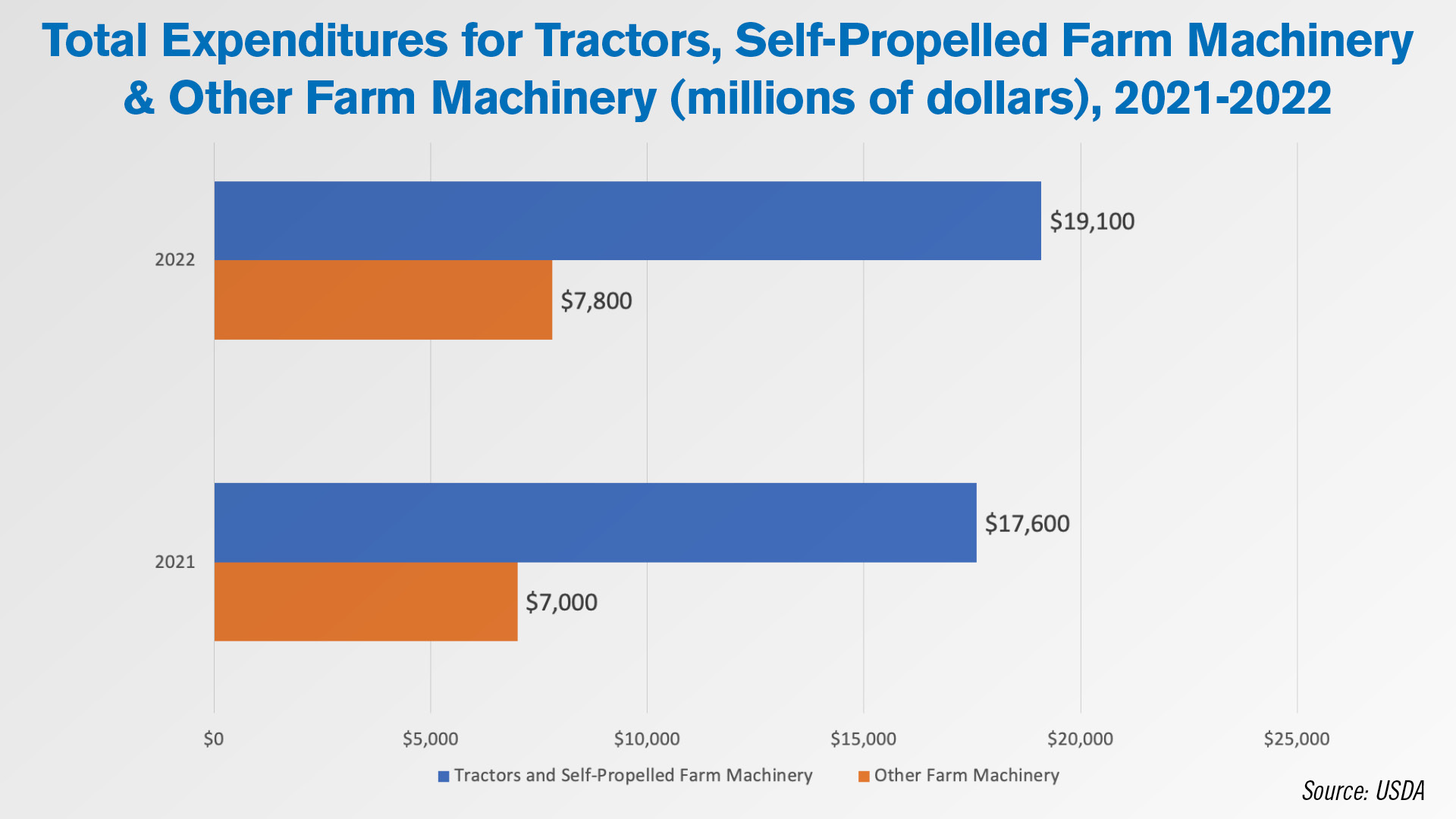

Expenditures for tractors and self-propelled farm machinery were $19.1 billion in 2022 — or 4.2% of total expenditures — which represented an increase of about 8.5% year over year. The category ranked 10th among the USDA’s 17 contributing line items. The “other farm machinery” line item ranked 15th at $7.8 billion, or 1.7% of total farm production expenditures — an increase of about 11.4% over 2021. Other farm machinery includes farm equipment that is not self-propelled, such as implements, as well as equipment necessary for crop or livestock production.

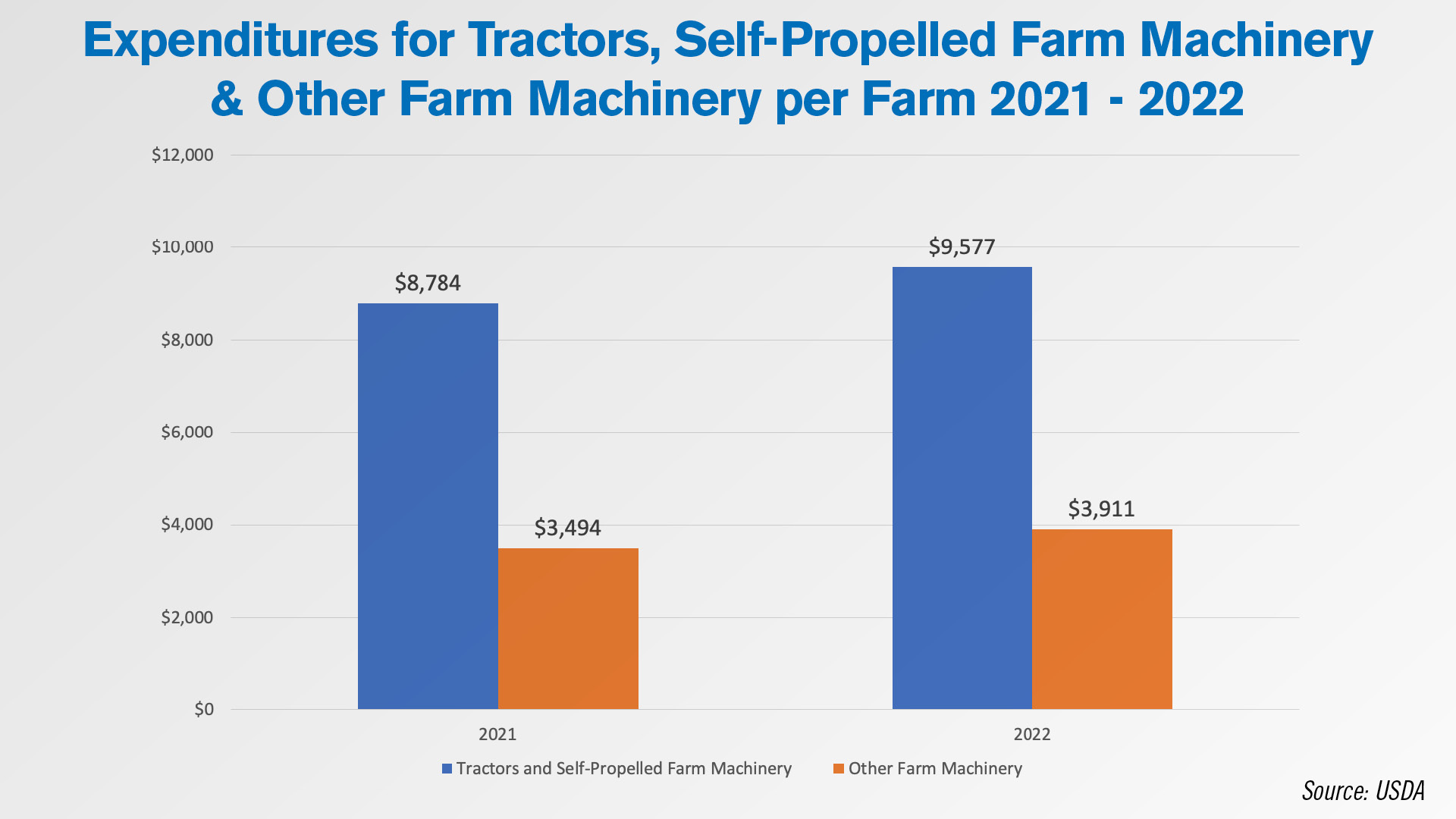

Tractors and self-propelled farm machinery expenditures averaged $9,577 per U.S. farm in 2022, a jump of about 9% over 2021, with other farm machinery coming in at an average of $3,911 per farm or an increase of approximately 11.9% compared to 2021. As with total farm production expenditure line items, these ranked 10th and 15th respectively.

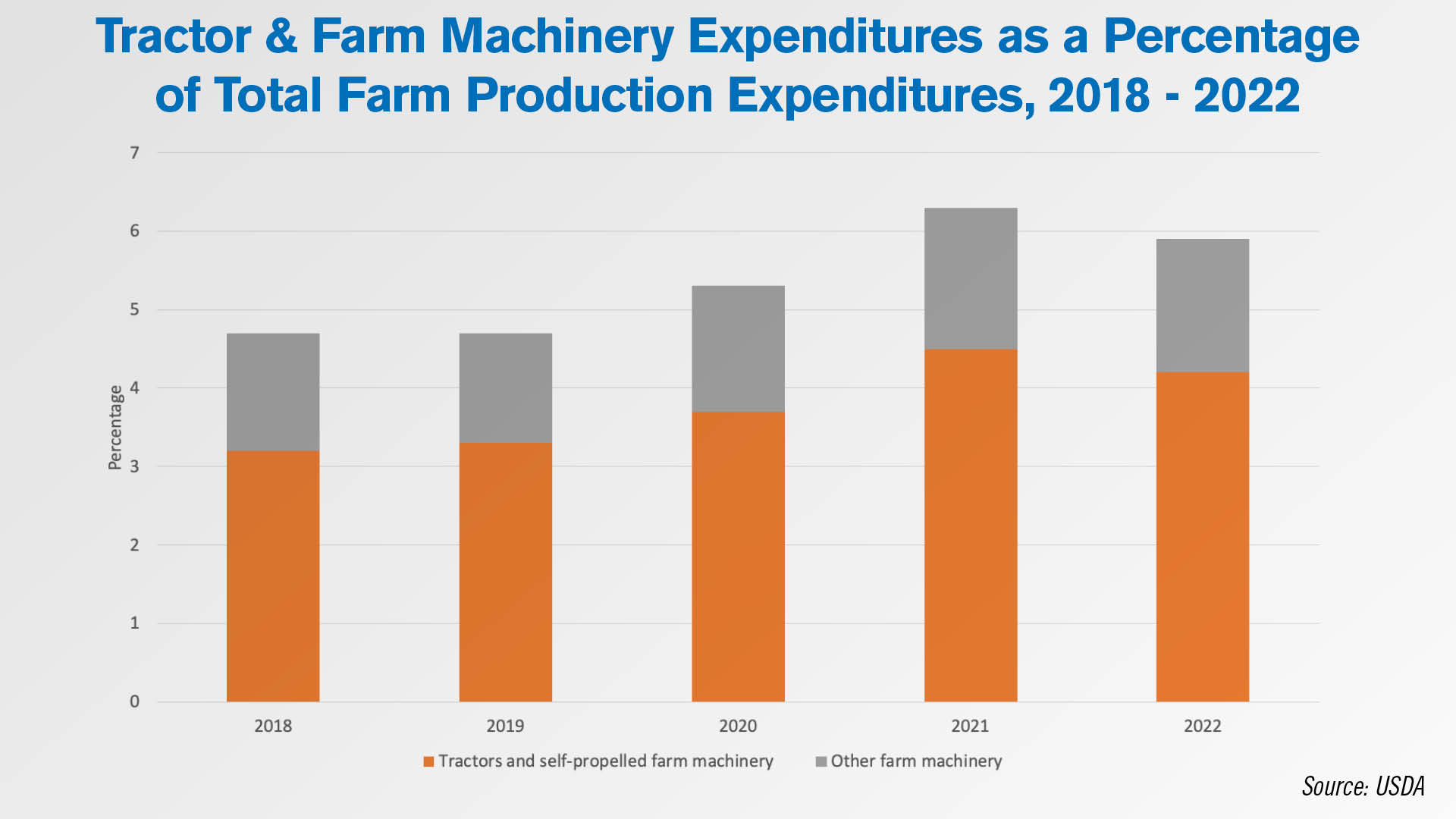

Nonetheless, from 2018-2022, tractors and self-propelled farm machinery as a percentage of total farm production expenditures grew year over year except for 2022, when it declined slightly 0.3% from 2021 levels. When combined with other farm machinery, the two categories saw no increase as a percentage of total expenditures between 2018 and 2019, then grew annually until 2022, when they declined slightly by 0.4% from 2021.

Kubota Reports $2.7 Billion in YTD North American Ag Sales

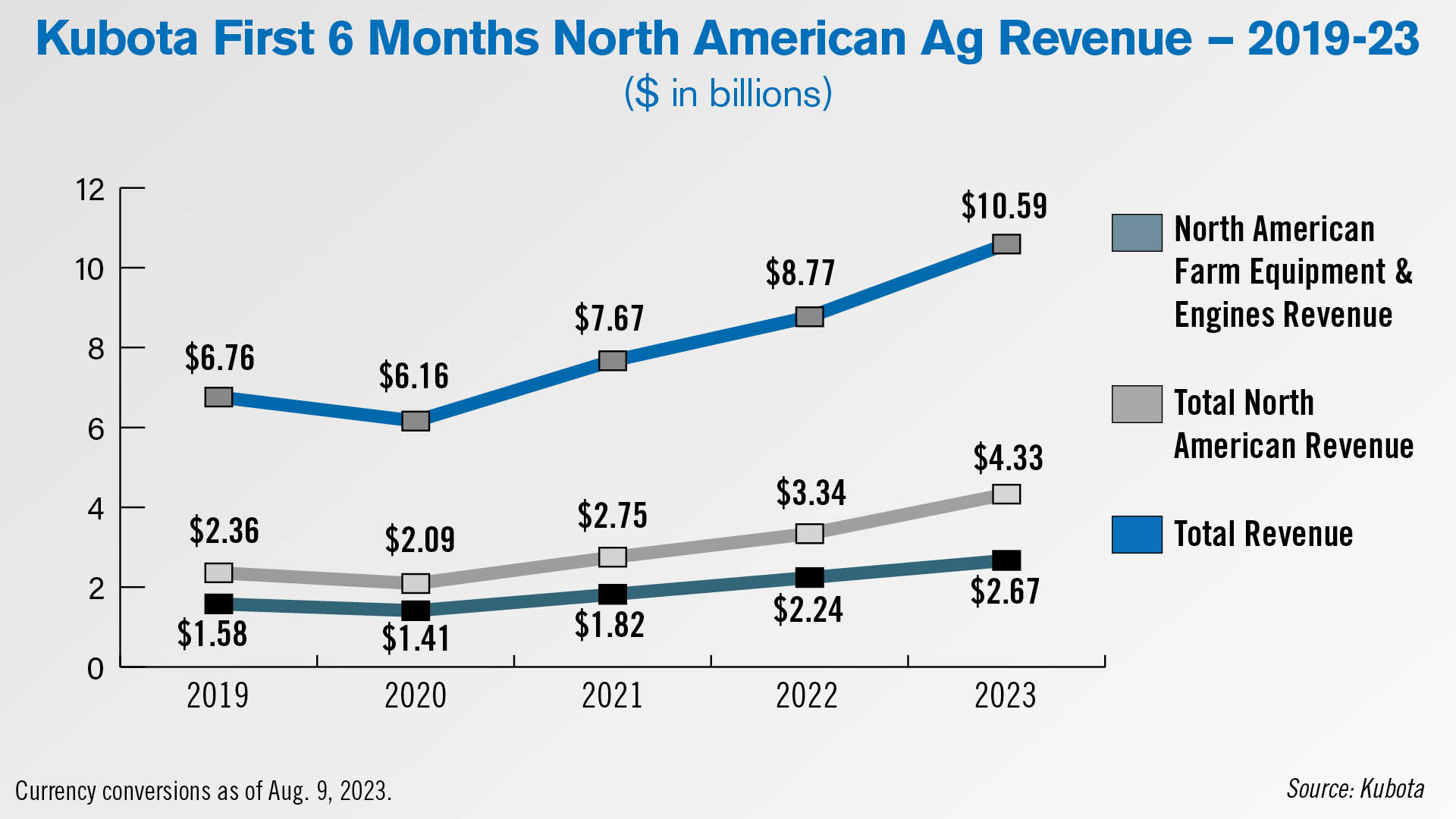

In its 2Q23 earnings released Aug. 9, Kubota reported $10.59 billion in total revenue for the first half of the year, up almost 21% year-over-year. The company reported $2.67 billion in North American ag revenue specifically, listed under its Farm Equipment & Engines division. Kubota does not report its farm equipment sales as an individual segment.

This brought North American Farm Equipment & Engines revenue for the first half of the year to a 5-year high, having risen 19.5% year-over-year. This was also the third year in a row that Farm Equipment & Engines revenue for the first 6 months of the year had risen year-over-year. Kubota’s total North American revenue for the first half of the year, which includes revenue outside its ag equipment business, rose 29.5% year-over-year to $4.33 billion.

Kubota stated in the earnings report that, “In North America, sales of tractors increased due to a replenishment of inventory and sales of construction machinery increased thanks to backorders of home construction and demand for infrastructure construction by the government.”

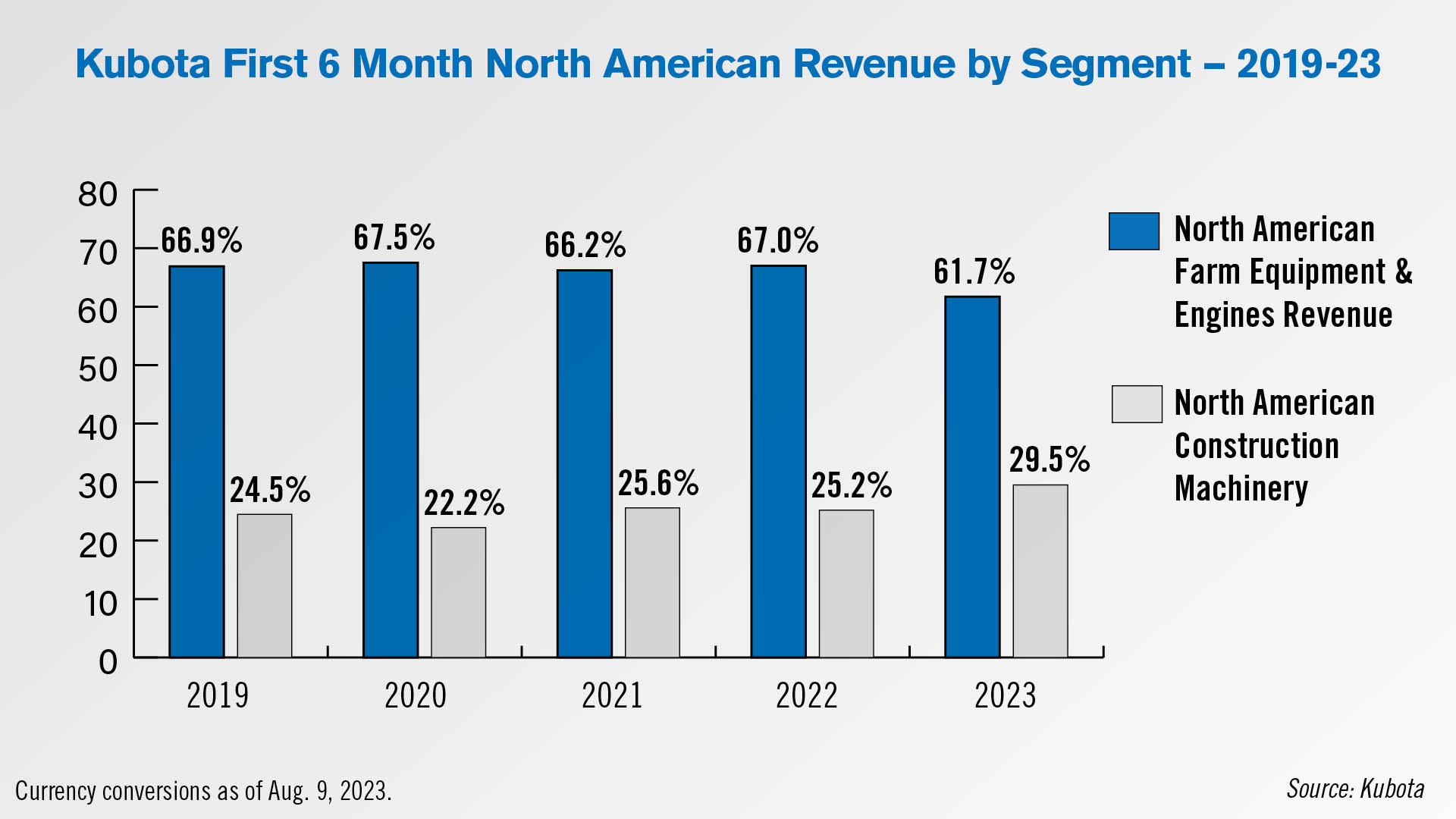

Expressed as a percentage of total North American revenue in the first half of the year, Kubota Farm Equipment & Engines revenue made up just under 62% of the total, the lowest percentage in the last 5 years. This percentage peaked in 2020 at 67.5%. At the same time, the percentage of Kubota’s North American revenue coming from its construction business reached a 5-year peak of almost 30%. Total North American construction revenue for the first half of the year totaled $1.28 billion, up 52% from $841 million in the same period last year.

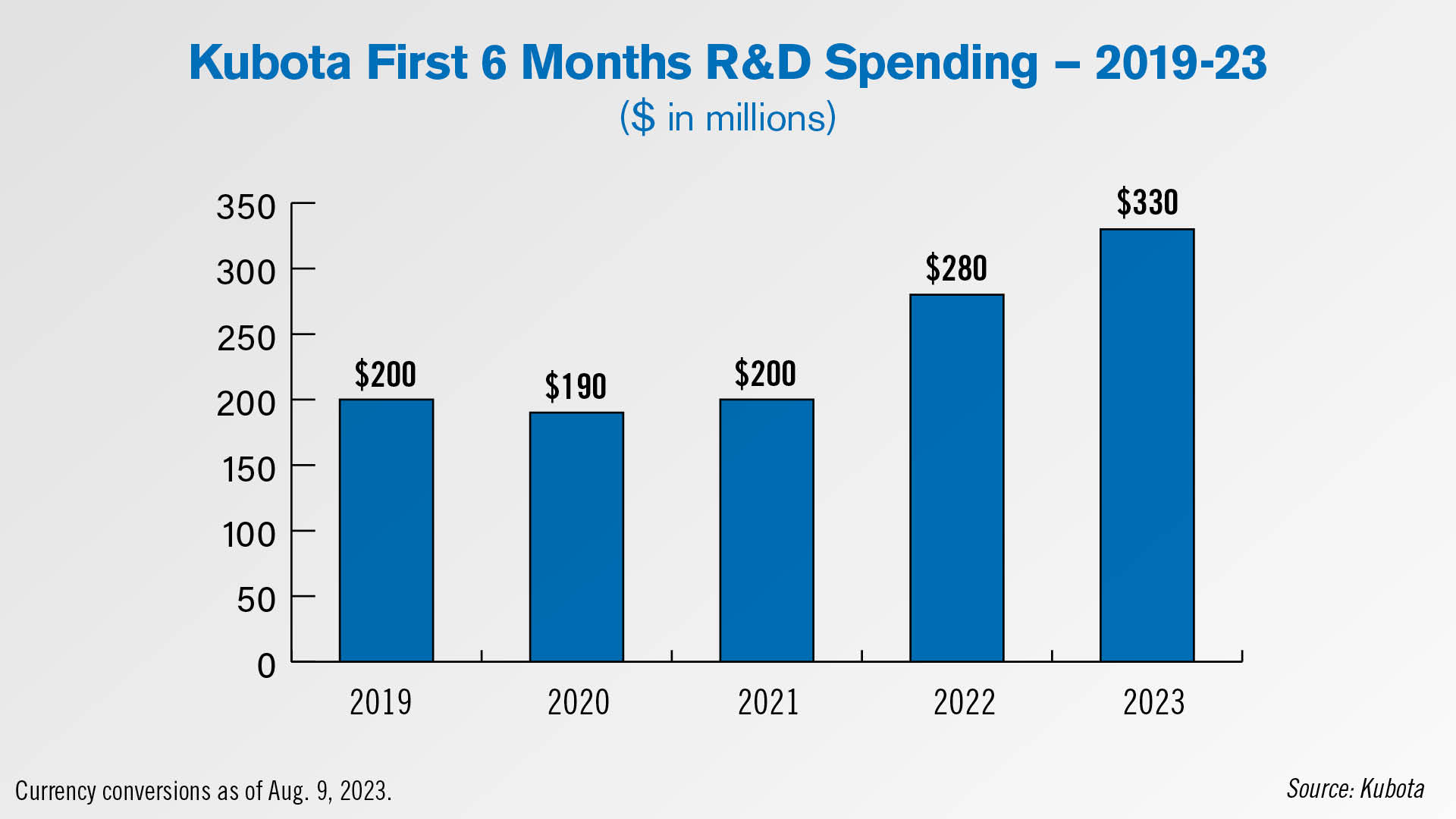

Kubota’s research & development spending for the first half of the year totaled $330 million, up from $280 million in the same period last year and a record high for the past 5 years.

DataPoint: Farmers’ Large Investments

This week’s DataPoint is brought to you by the Ag Equipment Intelligence 2024 Executive Briefing.

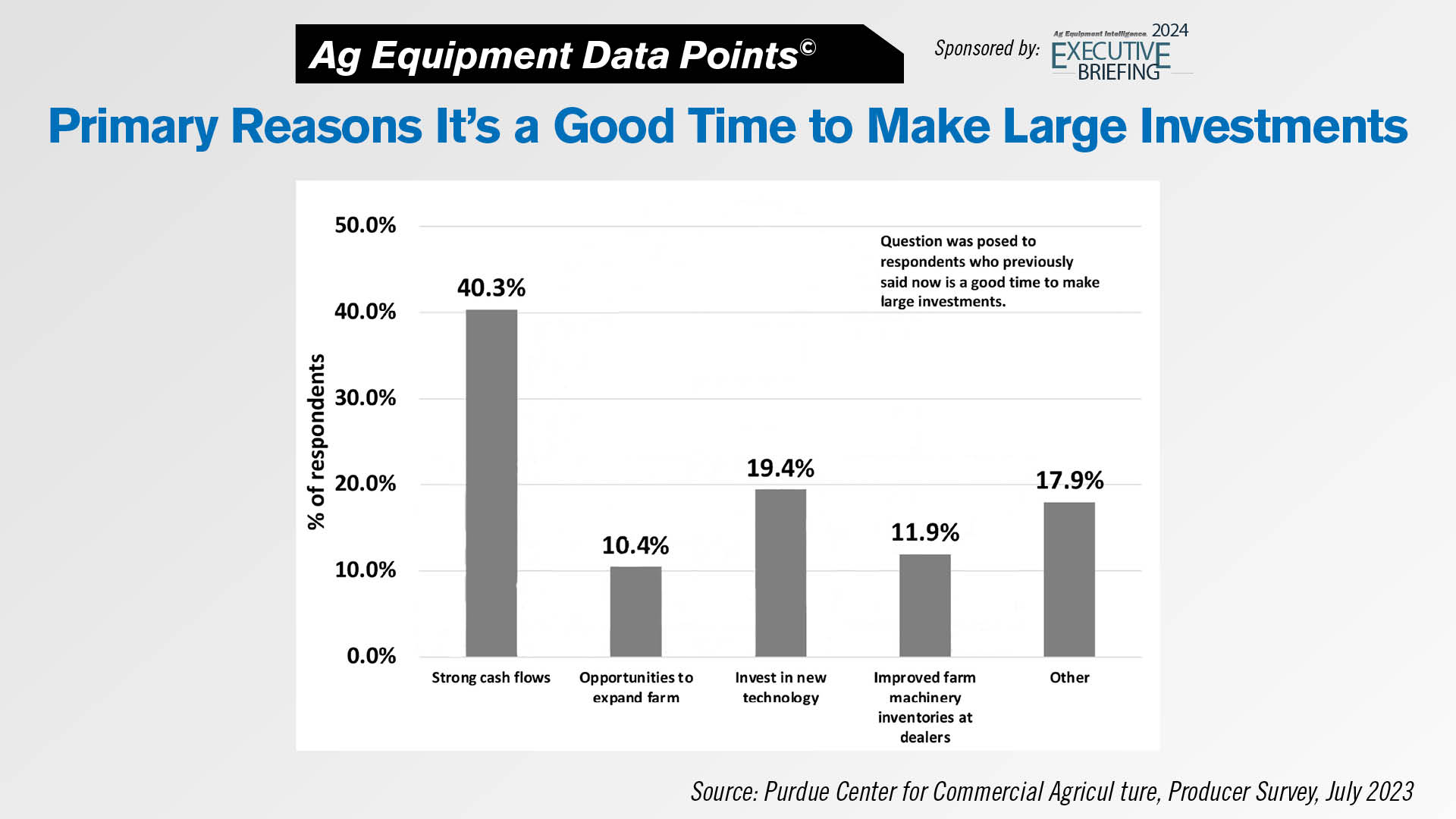

In the August update to the Purdue University Ag Economy Barometer, farmers were asked for the primary reason they considered it a good time to make large investments in things like buildings and farm machinery. A little over 40% of farmers indicated the primary reason was strong cash flows, followed by investing in new tech at 19.4%. Just under 12% of growers said their primary reason to make a large investment was improved farm machinery inventories at dealers.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.