Hutson Inc. is no stranger to turnaround nor the surprise and pivot, even dating back to 2008 when dealer principal Dan Hutson II died in a plane crash at age 54.

The Kentucky-based John Deere dealership had a black eye from a lease program that spun out of control, a change in ownership, an entire turnover in its leadership team, and ill feelings from its OEM as well as inline competition. It was also trying to unite two fierce rivals who suddenly were to be on the same team, not to mention staff having to trust an all-new class of leaders who had no farming or machinery roots.

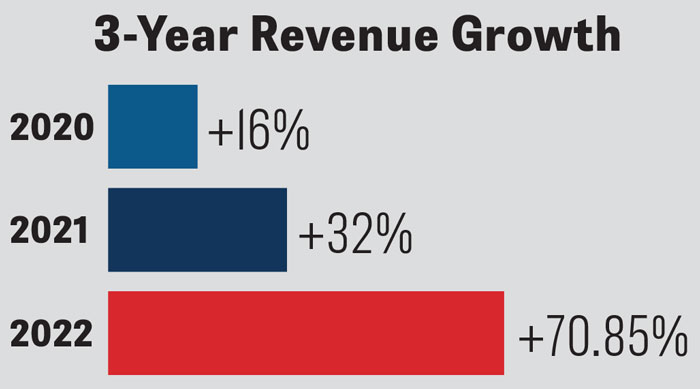

While there are numerous $1 billion companies on the Dealership of the Year Alumni Group roster, Hutson is the first to have achieved the $1 billion level in the year of its selection by the judges. Hutson also saw the largest year-over-year revenue growth at 71% in 2022 of any multi-store dealer group in the 19-year history of the Dealership of the Year (DOY) program. And with a 2022 ROA of 22%, Hutson is among the highest around of any U.S.-based dealer in the program’s history.

Hutson Inc.

Founded: 1990

Employees: 866

Ownership: John Eckstein & Bruce Hahn Leadership

Team: Josh Waggener, President & CEO; Brandy Jared, COO; Shane Osborne, CFO; Chris Dilday, CAO; Travis Kiesel, Vice President of Precision Ag

Locations: 32 2022

Revenue: $1,079,488,092 2022

Large Ag Market Share: 67% South / 69% North Return on Assets: 22.1% (both COGs) 2022 Parts & Service

Absorption Rate: 90.4%

Major Line: John Deere

Shortlines: J&M, Alamo, Unverferth, Billy Goat, AMCO, MacDon, Landoll, Balzer, Geringhoff, Kelly, Martin-Till, Brent, 360 Yield Center, Ag Express, Agri-Cover, Diamond Mowers, Garfield, Honda, LibertySafe, Manitou, Maurer, McFarlane, Pöttinger, Remlinger, Stihl & Smart Apply

Over the last 5 years, Hutson has grown organically by an order of 100%, doing $700 million in its southern region alone despite being down a location in 2022 as the Mayfield, Ky., site was being rebuilt following a tornado.

Today, the 32-store dealership group is owned by majority owner John Eckstein and minority owner Bruce Hahn, who acquired the business in 2010.

The new leadership team — that officially took over the reins in 2019 — consists of Josh Waggener, president and CEO, Brandy Jared, COO, Shane Osborne, CFO, Chris Dilday, chief aftermarket officer, and Travis Kiesel, vice president of precision ag.

Jared started in October 2015 as VP of human resources to lead a substantial growth chapter, yet found her new company in a tumultuous state as the leadership team completely turned over. By 2017, the then-CEO left the business to farm, and soon after the dealership lost 2 members of the leadership team, leaving Jared and one other to rebuild from scratch.

“A lot of these individuals who we brought on — Chris, Travis, Rodney Bohannon [previous vice president of aftermarket] and Josh — came along about the same time in 2017,” she says. “We hired all these individuals because we knew at some point, without a doubt, we’re growing. That’s the mission. That’s the goal.”

Waggener started as a tool and die maker and worked in the metalcasting business for 7 years before eying a move into sales management, which led him to throw his name in the hat for positions at various employers that might have deservedly gone into the circular file. But he got many of those posts, and continued his education along the way, completing his MBA in 2016. He joined Hutson in 2017 as the vice president of sales for nearly 2 years before being promoted to CEO.

A lot of things are different about this president/CEO and his approach and style, notwithstanding being the most sharply-dressed man of any toolmaker turned CEO that Farm Equipment has ever seen.

Waggener is willing to step in where it’s needed, too, taking on the aftermarket responsibility when Hutson lost its aftermarket leaders several months ago.

“I had to directly oversee aftermarket for 7 months, and I was ready to quit. I was like, ‘This clearly is the hardest segment of our business to run.’” The experience gave him a new respect for the aftermarket side of the business and the challenges the staff faces.

Planning & Paying for Growth

The planning Hutson did ahead of its recent acquisition growth in Michigan set the stage for a more successful integration of the new locations. When Jared joined the team, she started looking at ways to standardize the business. To accomplish that, Jared worked with Auburn University.

“They set up standardized work for everybody, job descriptions and built a 300-page sales manual,” Waggener says. “All the stuff that you need that wasn’t here, they built.”

Hutson’s senior leadership team includes (l-r) Chief Aftermarket Officer Chris Dilday, CEO/President Josh Waggener, COO Brandy Jared and CFO Shane Osborne. Photo by: Hutson Inc.

When Hahn hired Jared (previously an HR exec at Briggs & Stratton), he told her the mission was to build a team to grow beyond the last acquisitions completed in 2014. She went to work on that integration playbook even though nothing was on the radar.

The playbook, which would involve building processes, procedures and the team, had to be created. “It took longer than we wanted, but we were ready for the growth,” Jared says.

Part of planning for that growth was making the conscious decision to carry higher expenses. Some of that comes in hiring a larger support staff in non-revenue generating positions, and some of it comes from building the brand, Waggener says. “As a result, our direct personnel expense is hovering around 41%, though that continues to improve every year.”

In a metric comparison of dealers in its Spader “20 group,” Waggener says Hutson now ranks above the group average in the majority of categories after historically ranking toward the bottom.

“Absorption continues to be our Achilles heel, though we’re making great strides again this year,” he says. “Our rolling 12 is sitting at 90% in the southern COG (contiguous ownership group), but there are also other outlying drivers affecting our absorption number. One of those drivers is the fixed cost associated with our brand. We budget for CAPEX accordingly every year in a way that allows us to constantly upgrade our locations to provide a better place of employment for our team and a better customer experience for our partners. We know our fixed costs are high.”

Hutson pays above-industry salaries to recruit the best talent, Waggener says. The dealership shares its annual profits with every employee on the team to help keep them engaged with company strategies and goals. Hutson also invests in new sales and service trucks that represent its brand.

“We have a thick structure, but people go home at night and spend time with their family and friends,” he says. “Shutting down email and phone calls is expected and allows our team to recharge. Creating the separation is critical for the longevity and legacy we’re working to support at Hutson.”

Despite all that, Hutson has moved its absorption rate up about 9% in the last 5 years, Waggener says.

“Our peers do what they’re doing with a lot fewer employees. We’ve got 830 or so now, so we have some extra fat,” he says. “For instance, we have a quality team that stays in the field and helps assess used equipment that in other dealerships a sales rep might be solely responsible for. These roles are comprised of master technicians who are toward the backend of their careers.”

Jared adds these are meaningful positions that open up more capacity for the sales team. “We want the sales team focused on selling, plus they don’t always have the expertise on the technical side of the equipment,” she says. “That quality team will come in and just make sure nothing is getting missed. They’re taking that burden off sales so they can be talking to another customer about a potential sale.”

The annual Hutson Summit brings together managers, support staff and the sales team from all 32 stores to review the year, announce awards and reinforce the culture. Photo: Hutson Inc.

In addition to the quality team, Hutson has a lot coordinator at each location. Those two positions across all of Hutson’s locations add up to 40 posts. These positions and other Hutson support staff positions are sometimes questioned because they are non-revenue generating roles.

Jared says this was a challenge for the team because they were challenging staff jobs that aren’t bringing in revenue. But with that support staff, the sales staff is generating more revenue,” she says.

“Those are difficult decisions to make in this business. But it’s what’s helping us grow. It’s a long-term investment for the team and for growth.”

Saying Yes to Michigan

The decision of southern-based Hutson to move north in 2021 turned a lot of heads, though it had been long-awaited, as the company was staffing itself up for an expansion that hadn’t yet come. In 2014, the 8-location business entered Indiana with 5 stores acquired from Wright Stemle (Jasper, Poseyville, Evansville and Washington, Ind.) and Wright Implement (Newberry, Ind.) but had a 7-year stretch with no acquisitions.

According to Waggener, the group was given the opportunity to pursue Michigan because Hutson is considered to be highly aligned with the Deere organization and was performing at John Deere’s high level. The group had also reached maximum allowable industry size for a contiguous dealership, which was also a factor in the decision to grow into a non-contiguous geography.

“Organically, it’s amazing how much we’ve been able to grow in the South,” Waggener says, pointing out that the 2022 levels of $750 million could have been higher had Mayfield, Ky., not been knocked out by the tornado. “I don’t know how much more we can get out of it. As we’re trying to squeeze blood out of a turnip over here.

“Deere is very strict with contiguous growth max limits, and I respect that decision, but with the investments required to support the vision of both Deere and Hutson moving forward, additional contiguous scale will have to come into play at some point.”

Opportunity Knocks

Some of the dealer groups in Michigan were performing well in the aftermarket but were less aggressive than Deere would’ve liked in market share, which made the state ripe for a change in dealer presence. “You need to be concerned about market share when your key supplier is,” says Waggener.

He describes Hutson as the type of high-volume, low-margin dealer that Deere embraces. “We move iron, and we know our aftermarket and precision team are going to take care of things so we can make our money back. When you hit market share metrics, it does pays well. You can’t bank on that or live on it, but it’s nice when it hits.”

Michigan Almost Didn’t Happen

President/CEO Josh Waggener recalls that while deep into his pursuit of the stores in the Wolverine State, the owners hadn’t exactly “bought in.” Though they were adamant they wanted to grow, the concern around spreading the leadership team thin was weighing heavily on them, and they had decided Michigan was too far away.

Waggener heard objections, but was so adamant about going to Michigan that he persevered and kept negotiating and working the deal with the anticipation he’d eventually get the needed buy-in from ownership. He laughs that some on the team were on the brink of having heart attacks because he was pushing forward hard for the deal while the owners were saying it was off the table. One of the dealerships that was for sale had basically given up and said, “The plane is circling and we’re out of fuel — are we doing this or not?”

The very next week Waggener would get to Jacksonville, Fla., to the family office of majority owner John Eckstein — armed with a consultant and ex-Deere employee to make his case. “After the initial months of discussing with little success, Eckstein made an executive decision on the spot, and 30 minutes later we were executing an letter of intent” Waggener says. “I asked about Bruce (minority owner), and he said, ‘Let me worry about that,’ and the rest is history.

“We were either going to grow or I was going to get fired,” he jokes. Backing out of the deal would have undone all the goodwill and rapport with both their own staff and Deere. “Most important, the team really needed this win,” says COO Brandy Jared. “The team was ready to grow. They were getting bored. We’d brought on these people to grow, had this additional corporate expense we were carrying and weren’t growing.”

But it proved to be a good decision for the relationship with Deere and employees. “People, they like to win,” Waggener says. “They want to grow, they want to be big. And when you get that momentum, I don’t think we’ve gone more than 3-4 months in the last year-and-a-half without buying somebody, and that’s become the norm.”

Waggener points out that there had been “very bad blood” between the two Michigan dealers (D&G Equipment and Bader & Sons) that Deere was attempting to consolidate — so much that the two rival groups would barely speak to each other.

“Jolene Gustafson, the owner of D&G, refused to sell to Bader, so I had to broker a deal with her separately in order to get behind the Bader & Sons deal,” Waggener says. “A quick trip to Michigan for a sit-down with her allowed us to come to an agreement on the same day. Two weeks later we had both letters of intent in place, and we were off to the races.”

Hutson acquired both dealership groups in one swoop in May 2021, meaning an overnight acquisition of 18 stores. “We closed on 2 dealerships with 18 locations in 60 days — right in the middle of planting season,” Waggener recalls. Overnight, it was responsible for a territory that ran from the Mackinac Bridge to the Ohio border (300 miles from north to south).

Waggener was confident that his team could grow market share regardless of the geography and believed he’d found a diamond in the rough. He and Kiesel were also sure they could cut a wider swath in precision ag in a geography considerably behind the trajectory southern farmers and dealers were on.

“The dealers we acquired in Michigan had a good basic level understanding in precision but struggled with the high-end technology adoption,” says Kiesel, in contrast to the technology adoption curve in Hutson’s southern-states regions. “They struggled to train both farmers and employees, and as a result, their customers didn’t pursue it. While our precision had been mainstreamed for 3 years or more, it was just starting to take hold in Michigan.”

Two years later, Hutson has achieved a market share of 69% for large ag in Michigan, 52.1% for mid-tractor hay and forage and 33.5% small tractor sales. From 2021 to 2022, Hutson’s Michigan operations saw market share growth in these same categories of 24%, 31.3% and 14.4% respectively. Waggener is proud to have achieved $350 million in sales in Michigan but believes it can be $100 million higher. “It’s just going to take a little bit to get us there,” he says.

“People like to win. They want to grow, they want to be big…”

Acquisitions in Michigan are likely to continue as Hutson’s reputation and results have taken root. “You don’t go from 44% to 69% market share without doing damage,” he explains. Even the smaller dealers who haven’t found the need to grow are taking notice of their futures.

“In the spirit of our alignment with Deere, when there have been sightings of orange and blue tractors in other areas of Michigan in AOR not previously held by Hutson, we’ve continued our aggressive all-in approach and pursued and acquired 5 additional single-store acquisitions over the last 18 months,” Waggener says.

How to Manage from Afar

Jared recalls those previous 6 years ahead of the 2021 acquisitions prepared the team for growth, but perhaps “not quite this large of a growth opportunity.”

Establishing culture is a challenge with an acquired store that is mere miles away, and the challenge is magnified when locations are a full day’s drive.

“We acquired two competing Deere dealers,” says Jared. “We were firm that we would not tolerate not supporting one another. That is something that we preach a lot — you’re going to come in and you’re going to work together, even if you didn’t in the past. They jumped in and started doing those things, but I would give much credit to those individuals that relocated for us.”

Jared and Waggener “lived” in Michigan initially, but have scaled back to monthly visits now that the team is functioning well. “We still want that visibility, and it’s important to us that the team knows that we’re still going to show up, even if it is challenging sometimes to be at all places,” he says.

Hutson Dealership of the Year 2023

That travel and commitment to showing up is not easy though and got harder due to declining flight schedules (the airlines scrapped the direct Evansville to Detroit flight), which requires the old-fashioned road trip. Waggener’s year-old SUV has 70,000 miles on it, and the drive comes with a productivity cost.

“We could sit here in the office if we wanted to, but you don’t get a real following from an office, which is why we get out there,” he says. “We need and want to be in front of the people but it means we’re living on the road, too. The drives to Northern Michigan’s Alpena location take double-digit hours with traffic and construction.”

Any time a dealership acquires stores, it can be a challenge to bring those locations aboard. The extra challenge of adding a non-contiguous territory is something Waggener and Jared underestimated.

“I think that’s a challenge people probably don’t appreciate when you can grow contiguously,” says Jared. “It’s just easier from a standpoint of workload, management and the time that you don’t have to spend trying to get to that second COG.”

Hutson worked to get a strong organizational structure in place in Michigan, but it took time.

“We are focused on having enough visibility that people know, ‘Hey, we are still here and we do care.’ But the ‘boots on the ground’ team is doing phenomenal,” Jared says.

John Deere’s 60/40 Rule

A big part of why President/CEO Josh Waggener thinks Hutson’s acquisition plan is “anything but done” is Deere’s vision for the size and scope for dealers of the future. “All these 3-, 4-, and 5-store dealerships will find it more difficult to make the investment it will require to meet the capability expectations currently set by Deere and that we’ll need to plan for moving forward. The new rules are that Deere dealers are to be using 40% of resources for team training of customers and our employees. That’s a goal for year one. Travis’ team is at 60% already, so we’re way ahead of the curve.”

It isn’t inexpensive to do — Hutson spends $2 million yearly on training — but it’s only the start. Then there’s the expectations for dealer-staffed call centers and technical communicators. Waggener is a firm believer in the vision and is highly aligned with Deere’s strategy, but notes the additional cost is significant, and not all dealerships will have the resources nor long-term commitment needed to comply.

The success in Michigan has caught Deere’s eye, Waggener says. “In a recent meeting with Deere in Moline, we were given a green light for a 3rd COG once the right opportunity presents itself. We’re grateful for that, but I clearly remember both owners and myself requesting a contiguous opportunity as well, knowing we’re at max size, but it never hurts to ask.

“We have great bench strength, but working with my team to lead the organization — while also meeting our ownership’s expectations and also focusing on staying highly aligned with our OEM — can be incredibly stressful at times.”

Staffing Challenge. The Hutson team knew from its experience recruiting technicians in its southern COG that filling those positions is hard. In Michigan, it was more difficult than even Jared imagined. Most of the skilled trade individuals, she says, are more in the Detroit area, and the rural talent pool is limited.

Hutson has hired 20 techs (net) in Michigan, most without any ag equipment experience, and it required hiring 50 techs to net the 20. “We’re bringing them from the bottom up,” Jared says.

Faced with a technician shortage in the Michigan region, Hutson Inc. created billboards to help introduce the brand to the new communities in which it had acquired dealerships while also recruiting technicians.Photo by: Hutson Inc.

The focus is now on getting into the schools and reaching ag tech students. “That’s our future,” she says. “That’s how we’ve become successful in the South. In the South, we have over 40 students in the pipeline, so we’re just feeding that technician base solely with students. In Michigan, when we acquired those locations, they had one — one ag tech student.”

“Our goal in Michigan is to bring at least 10 students in every year to continue to feed that pipeline with the training and the knowledge it takes to get those individuals up to speed.”

She says that process takes 3-5 years.

Pulling Up Stakes

Like Dealership of the Year Alum Birkey’s Farm Store (who sent its president/CEO to uproot his personal life to oversee a newly acquired location), Hutson doesn’t believe it could have succeeded without sending its own team to the North.

“If we didn’t have 5 people who were willing to give up their life, because that’s what they did, it would not be doing as well or as quickly as it has,” says Jared, pointing to Erin Smith who packed her bags with her 30-plus years of experience in Hutson’s HR department to replant the seeds in the Wolverine State.

Tuesday Talks

To foster the inter-department communication each store holds weekly Tuesday Talks that are typically run by either the parts manager or service manager. During this weekly standing only huddle, the store staff review high-level financials for their location as well as the customer needs they are facing that week for each department. “That’s where the entire team comes together and says, what do you need? What do I need? And what’s important for us to know? So we’ve shared some of the corporate information. If we’re having changes, benefits, things of that nature during those Tuesday Talks,” she says.

The initial round of employee surveys with the new locations revealed that the Michigan teams didn’t feel like they were getting enough communication at the store level. “We just hadn’t got to rolling out Tuesday Talks with the organization up there,” Kiesel says. “And so lo and behold, we went back to the drum board and said, we can do this. We’ve got a playbook. We’ve gotten feedback in the last 6 months, and have rolled that out and are having those conversations in Michigan on a weekly basis..”

Kiesel says as a result of the Tuesday Talks and giving the stores responsibility for their financials, the staff will now come to leadership cost saving ideas. “They are now coming back to the table and pointing things out. Why is our trash collection so expensive? Not glamorous stuff. Why are we paying so much to Cytec for laundering and our refill in toilet paper? Things that aren’t glamorous that quite frankly would never hit our radar,” he says. “We’ve now got locations that are saying, let’s revisit this because we’ve got Posenville, Evansville and Jasper, where all 3 locations are handling their trash services separately. We can push those together and save $400 a month. It has driven that mentality of how you look at your financials and own them because they are yours. It’s your location.”

“Erin paved the way for getting that team together and driving the culture up there for us. And we were very blessed that we had 4 individuals who relocated to Michigan. The others — Craig Hartfield, Rodney Bohannon, Chris Dilday and Chad Denson — all packed their bags and never looked back. We had all our departments covered to put that team together and hit the ground running. I don’t know how we would have done it without them.”

It’s always tough to dictate a new culture, processes and procedures that must be followed to “run business the right way,” Jared says.

Structural Changes

“As we continue to grow in the North, we had to create a whole new region,” says Waggener. “There are 4 of us on the senior team, and Travis might as well be on the senior team because he’s multi-COG. He has responsibility for all precision ag.”

There are separate VPs for both COGs, a VP of sales and a VP of aftermarket for both the North and the South. “It’s a lot of shared responsibilities in the back, which is why we try to keep our goals consistent across both.”

The North and South are two very different and separate businesses, Waggener says. “There’s way more turf and small tractors, way more dairy in the north than what we’re used to, but we’re trying to keep the alignment consistent.”

What Other’s Have to Say...

The Dealership of the Year judges had this to say: “Hutson’s succession plan is really well thought out ... They’re killing it ... Their revenue per employee is really good ... Impressed by their social media presence.

Steve Hunt, H&R Agri-Power: “Hutson has always been great competition ... They are very smart, ethical and do a great job.”

Jared adds that the regional managers and VPs have a team-like collaboration. “We have a regional aftermarket manager and a regional sales manager. They are responsible for 3-4 stores in the south and probably 6-7 stores in Michigan just because these stores are smaller. Together, they work to make sure the team is focused on the things they need to be focused on.

“We don’t have store managers. We have parts managers, and we have service managers — and both report to those regional managers.”

Kiesel notes, “With strong parts managers, service managers and strong account managers at the locations, the regional sales managers and regional aftermarket managers can operate this business. But the strength, especially the parts and service managers at each location, is critical for that success.

Approaches Refined by Michigan

The foray north into Michigan allowed the leadership team to refine its approach to managing a large multi-store operation.

Jared is proud that the playbook, while not perfect, largely worked and is evident in what’s happening 2 years later — what she describes as a positive morale and excitement to be something bigger. A big change was with the support personnel investments that are a benefit of having a larger ownership group. “They’re excited about having the support teams around them, the HR teams and the sales support team,” she says. “Once the culture is established, employees are told ‘This is your store.’”

Staff has understood that Hutson realizes as well as anyone the leadership team can’t be in all places at once. “We said, ‘You guys are going to have to own it and run it,’” she says. “Giving them that leadership and autonomy has really helped with the culture up there because it wasn’t there when it was run by the individual owners where micromanagement often exists.

Tying Sales Comp to Precision

As Deere put a stronger emphasis on precision, Hutson has followed suit. Along with mainstreaming precision, Hutson has also tied its sales compensation to precision.

The sales team is now John Deere Operations Center certified to alleviate some pressure on the precision team, and their compensation is driven by precision ag. The sales team took a 5 point reduction in its commission structure this year, says Josh Waggener, president/CEO.

Previously, salespeople would earn 25% commission on new sales and 20% on used sales. That’s been reduced to 20% and 15%, respectively. “They can get the 5% back if they hit a certain level of precision ag certification,” Waggener says.

Certification tests occur 3 times throughout the year, and Waggener stresses the salespeople can’t just test once and be done. “If you’re not using it, you’ll forget it,” he says. “We don’t want them to have to depend on a precision ag guy every time for the level 100 and 200 questions.”

The training Travis Kiesel’s team is doing with the sales department has Hutson a step ahead of a new directive from Deere. Waggener says Deere recently announced a new requirement for dealers to increase integrated solutions training capacity to dedicate 40% of their resources to training customers and employees. “That’s a goal for year one. Travis’ team is at 60% already, so we’re way ahead of the curve,” he says.

Training and educating the masses is such a core expectation that Hutson has a $2 million budget across both COGs for training in 2023. Another new requirement from Deere is the technical communicator (TC) position. It’s a high-end position that Hutson is filling with its master technicians. The TC assists techs in billable hours.

“I think they were micro-managed in many ways. And so seeing them work together to build their own culture within their locations has been the most rewarding part for me. They’re very excited to be a part of a large organization,” she adds.

Communications and employee engagement studies were essential. The in-person meetings, says Kiesel, evolved from 1-day drop-ins and check-ins to more accountability-type meetings to address gaps. Kiesel gave an example about the directness that follows the identification and documentation after identifying a problem or gap that needs correction. “OK, regional aftermarket manager and regional sales manager, there’s obviously a gap at this location or a communication issue. What are you putting in place?

“The accountability goes back to them. We find out what they’re putting in place to correct that to get that on the right path.”

Jared adds that she and her fellow leaders have learned a few things as well. “When we started, we’d do these meetings, but we were checking off a list, we kept telling them they had a voice.

Teaming Up on Recruitment

Technician recruitment has been a success in the southern stores, and with the Michigan expansion, it has been an important focus for the new stores.

Starting in the south, Hutson partnered its marketing team with the HR team to launch a tech recruiting campaign. In fact, the dealership added a videographer position to the marketing team and has added 2 full-time recruiters. “We went out in the field, and filmed a lot of our technicians. We put TV commercials out. We had some Super Bowl commercials. It’s really helped build the employment brand for Hutson. After that, we started getting a lot more applicants,” Jared says.

“Part of the challenge in Michigan is they didn’t know what Hudson was. So in the last year, we’ve been able to say ‘Hey, here’s who we are’ by putting out a lot of those videos and that content.” The Hutson marketing and HR teams are educating the communities in Michigan on what the dealership’s culture is by creating videos that feature Hutson technicians. The HR team is also making inroads by getting into the schools in those communities and making the right relationships.

“We learned to say if you bring up an issue and we don’t resolve it immediately, bring it up again. Don’t give up. Keep bringing it up. Not everything can be done at once, but priorities can be dealt with in order.

“When our meetings become more about facility updates like changing light bulbs in the parking lot or fixing a pothole, then we’ve accomplished a lot already.”

Employee Surveys

Every 18 months, Hutson sends out an employee engagement survey to ensure the leadership team is addressing the staff’s concerns.

“We wanted a true measure and continue to see those scores grow,” Waggener says. “We take this very seriously, as we want a voice for employees. We know the reason we’re all here and we tell them that.”

Waggener, who self describes as an emotionally-driven people pleaser, was bracing for what employees would say. “They hurt Josh’s feelings, complaining he hadn’t made it to all the stores, but we worked through it,” Jared says pointing out that he still got an 80% approval score. “We want to continue to take that feedback, go back into every individual store and talk to them about their specific results. We come out with action items and follow through on those things. ”

The surveys get into benefits, feelings about the company, teamwork/collaboration and manager effectiveness.

Online Extras

Click here to watch exclusive video interviews with the Hutson leadership team, read more exclusive online content and view a photo slideshow. Topics include:

“We are starting to use them for developmental opportunities,” Jared says. “It’s important to have those candid conversations with our managers. In my experience, if we’re not telling you what you need to improve upon, how do you know? That’s also a valuable tool to come say, ‘Here’s the feedback we got from your team.’ It’s anonymous, but they look forward to those results because they focus on development opportunities.”

Hutson leadership provides those development opportunities to help empower all managers to make decisions for their locations.

“If you’re a parts manager or service manager, you don’t have to ask your regional manager,” Waggener says. “Just make a decision. Sometimes it’s going to be wrong, but there’s no fear of losing your job.”

Taking that a step further, Waggener explains how they tell the store-level staff that the regional managers work for them. The regional managers’ job is to remove roadblocks for the stores, and the VPs remove roadblocks for the regional managers.

“If we make all the decisions, then everything we’ve told them doesn’t matter. They may have to come into a meeting later and talk to us about it, but we want them to have that ability.”

The bottom line is everyone — including the leadership team — makes mistakes, Jared says, so learn and move on. “We talk a lot about owning mistakes and working together,” she says.

Developing Hutson’s Next Leaders

The opportunity for growth at Hutson is there for anyone in the company. It’s a message Waggener loves to put out there to the staff.

“If they want to be the CEO, they can. I came from a trade school. When I was in high school, I was a machine shop machinist, I went to tool and die. And I did that for 5 years. I got my journeyman tool and die papers and putting the focus on the importance of that. Our program that they’re pushing for the ag-tech is, ‘This is a career path start, but you really, if you want to run this company, the option’s there. And we’ll do everything we can support, train and educate you to get you there.’ And it’s just nice to be able to have that in proof.”

Hutson has a leadership development program for frontline employees with an interest in management. Ian Miller is one success story that came out of the program. Miller is a veteran who joined the Hutson team as a lot coordinator. Looking for growth, he moved to the parts counter and ended up being a service manager.

Today, Miller is leading one of the largest regions for Hutson as a regional manager after only 5 years. The leadership development class consists of 10-12 employees, some of whom are recruited by leadership to join and others who self-identify. However, everyone needs to go through a selection process, Jared explains.

“They need their manager’s recommendation, certainly, but we don’t put everyone in that course. If we feel like they don’t have that skill set, we’ll have that conversation,” Jared says. “We’ll tell them what they need to be working on in the meantime. The next time the class becomes available, let’s talk about how you’ve improved there, what focus you’ve put on that.

“We’ve passed them up for the first session and then they joined the second session. It definitely drives the right conversation for development. But we have a selection process and from that, those that want to continue forward, we identify a plan and target a path for them.”

Hutson keeps the group small to foster individualized training. The 42-week program is a mix of hands-on and classroom participation. Classroom courses cover management and leadership material. However, Jared says most of the time is spent with Hutson’s support teams and department leads sharing what, for example, the day in the life of a parts or service manager is like.

“Our accounting team talks about what a manager would have to do from their standpoint. How to read a P&L. The HR team talks a lot about how to manage people. And honestly, the best part of the program has been some of them come out in the end and say, ‘This is not for me.’ And that’s OK,” Jared says.

“We don’t want to put you in a position you’re going to not enjoy and fail. We try to get them to job shadow. If they’re interested in a sales role, we’re putting them in a truck with a sales individual or putting them on the parts counter to see how that manager has to handle that team or service, whatever desire they have.

“And that’s what we talk about, ‘What do you want? Where do you want to go? We need to get you on a path.’” Jared adds that often employees will realize through the program that they were wrong about what they thought they wanted to do. From there, they work to find another career path to help the individual continue to grow internally. The program is still in its infancy, but Jared and Waggener say the overall employee development program is growing as well.

“As we’re getting better at just developing everyone, those class numbers will probably increase, as we have more individuals we can put on the bench for those management positions going forward,” Jared says.

In addition to the leadership development program, Hutson sets career paths for all employees.

“We don’t just have it for technicians, we have a career path for our part sales folks, we have it for our support folks,” says Jared. “That has given our team an opportunity to grow. And in many ways, that’s driving the culture here. When people have opportunities to do other things and achieve their passions, we’re getting behind them to do so.”

The leadership development program as well as the career paths have been important as Hutson has acquired more locations. Those acquisitions bring a need to promote people, and because of these programs Hutson has had the people to promote. “It’s just been great for the culture because those opportunities certainly have helped with employee morale,” Jared says.

“We didn’t grow up in the dealership world,” Jared says, adding that Kiesel provided credibility in the early going. “It took us a long time to get support and respect from people who have been doing this for many years. We dedicated the time to listen to the people and respond because we know we’re not the experts.”

Unusual Backgrounds

While Waggener and Jared’s backgrounds from outside ag added some initial challenges, in the long-run it’s proving to be a benefit.

“What makes Hutson unique is we have taken many different backgrounds and married them together with a genuine respect for one another that we work together and make it work,” Jared says. “People who have not lived in this world, they’re bringing something else to the table, whether it’s leading teams or some technical expertise we haven’t thought about. They work together and learn from one another.”

Kiesel adds their different backgrounds create a good balance, but also a good forum to challenge each other.

“Josh may have a hare-brained idea that I think is going to be a stretch,” he says. “And likewise, I may be stuck in the mud of always seeing it done a certain way. And Brandon will come back and call BS. So we’ll try something different or a different way. To me, that’s mutual respect about finding common ground, to try something different.”

Waggener says with their meetings, it’s hard to tell who is in charge. “That’s how we want it. Titles are for an organization chart,” he says. “We make decisions by collaborating. And because we’ve removed the fear of not being able to speak up, Kiesel is as comfortable challenging me as I am with him.”

Jared adds, “There’s no way one person can know everything necessary to run this business. When your team realizes and accepts that and is open to throw out crazy ideas and share the feedback or admit that you don’t know, it provides a platform to really be innovative and do things differently.

“We have people who are experts in different areas of the business and others who have no expertise in the business, but are good at managing people and setting a strategy, developing goals and crunching the numbers. Marrying all that knowledge and skillset is what’s made us successful today.”

Related content: