In this episode of On The Record, we examine Deere’s Population of 20-Store Dealers On the Rise. In the Technology Corner, we take a look at Carbon Robotics Developing New “Thinning” Function for LaserWeeder. Also in this episode: AGCO & Kubota Sign Right to Repair MOUs, Deere Reports Rising Large Ag Price Realization - Lower Production Costs and Dealers’ Most Pressing Concerns.

This episode of On The Record is brought to you by Agrisolutions.

Improve performance and durability with a wide range of premium tillage parts and extended life solutions, with Agrisolutions. As the market leader in wearable parts, components, accessories and solutions for tillage, seeding, planting and fertilizing, Agrisolutions is proud of their purpose - to build and feed the world. To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

TRANSCRIPT

Deere’s Population of 20-Store Dealers On the Rise

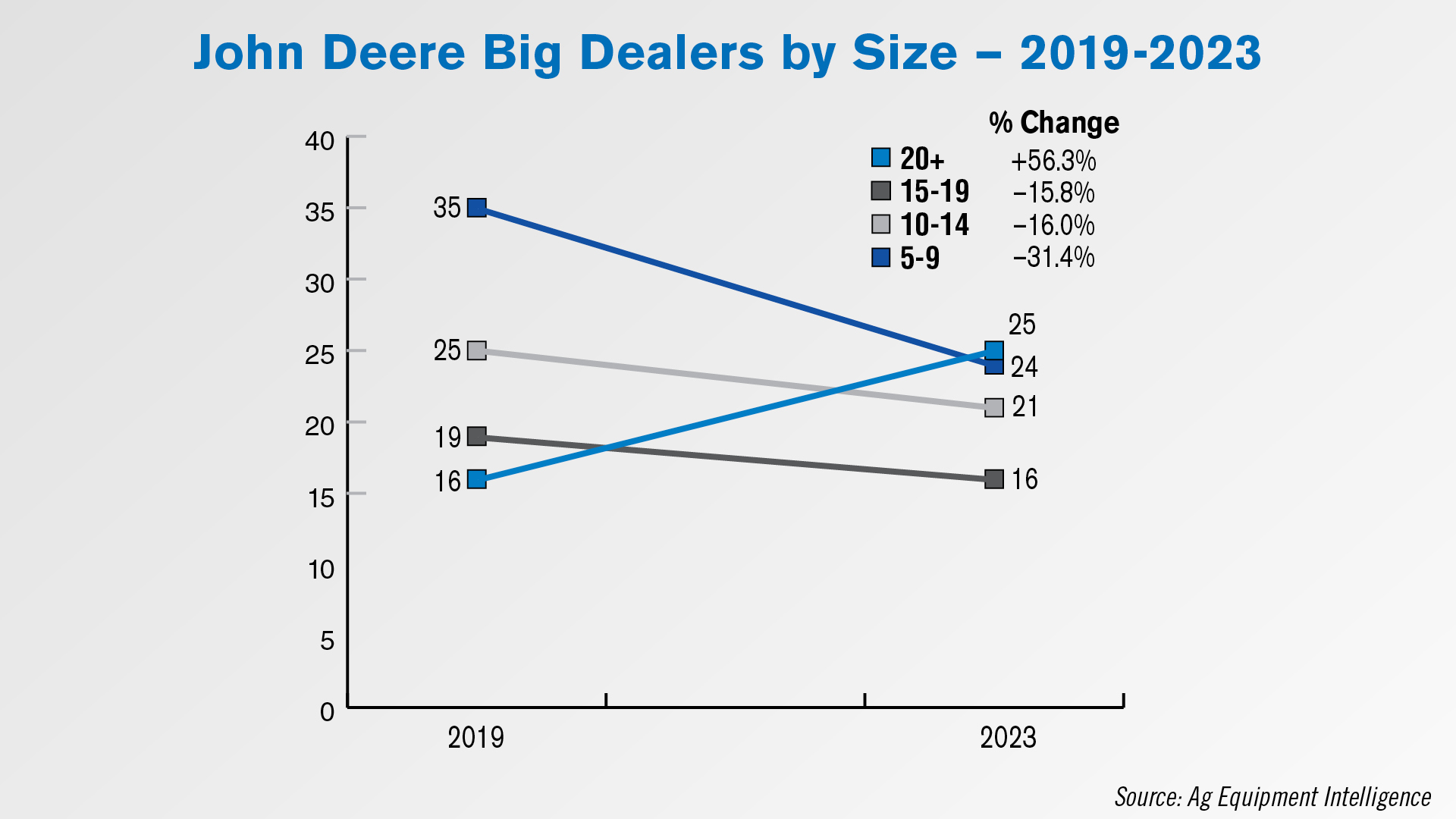

According to the 2023 Big Dealer report, all of John Deere’s categories of “big dealers” have declined over the last 5 years, aside from its 20+ location dealership groups,.

There are 25 John Deere dealers that have 20 or more ag equipment locations, a 56% increase from the 16 dealers reported in this category in 2019. All other category sizes declined, and the largest percentage of decline was among John Deere dealers with 5-9 ag equipment stores, down 31% from 35 to 24 dealership groups.

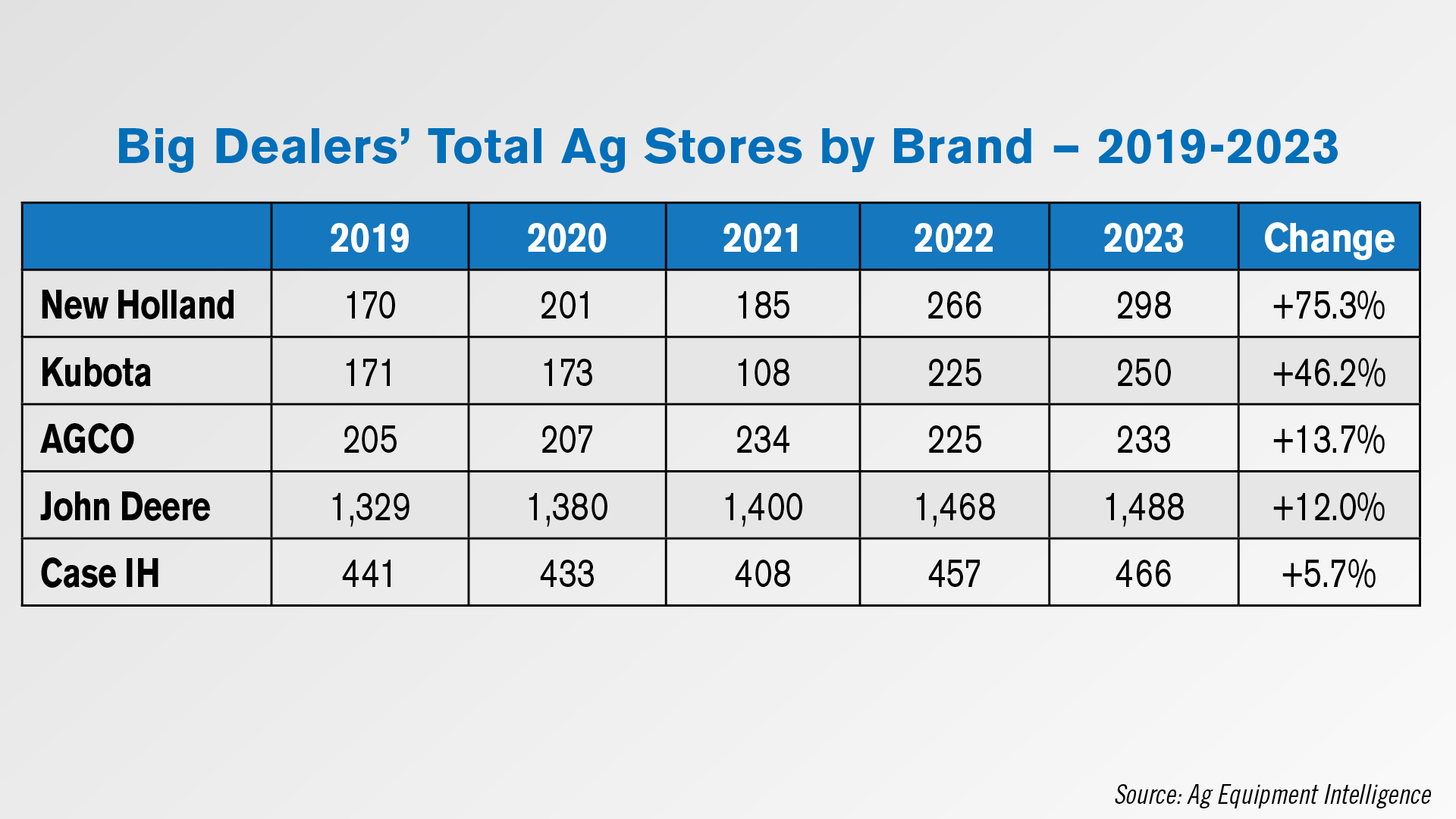

Looking at total ag stores, John Deere big dealers have added the most ag stores over the last 5 years at 159. Relatively speaking, however, this represents only a 12% increase in its total ag stores operated over the last 5 years, ranking Deere behind New Holland, Kubota and AGCO. New Holland big dealers have seen the largest percentage increase in total ag stores operated over the last 5 years. At 298 ag stores in 2023 — the third highest number by brand — these dealers are up 75% from 170 ag stores in 2019. New Holland big dealers also added the second highest number of ag stores over the last 5 years at 128.

By brand, Kubota big dealers saw the second-highest percentage increase in total ag stores operated, up 46% to 250.

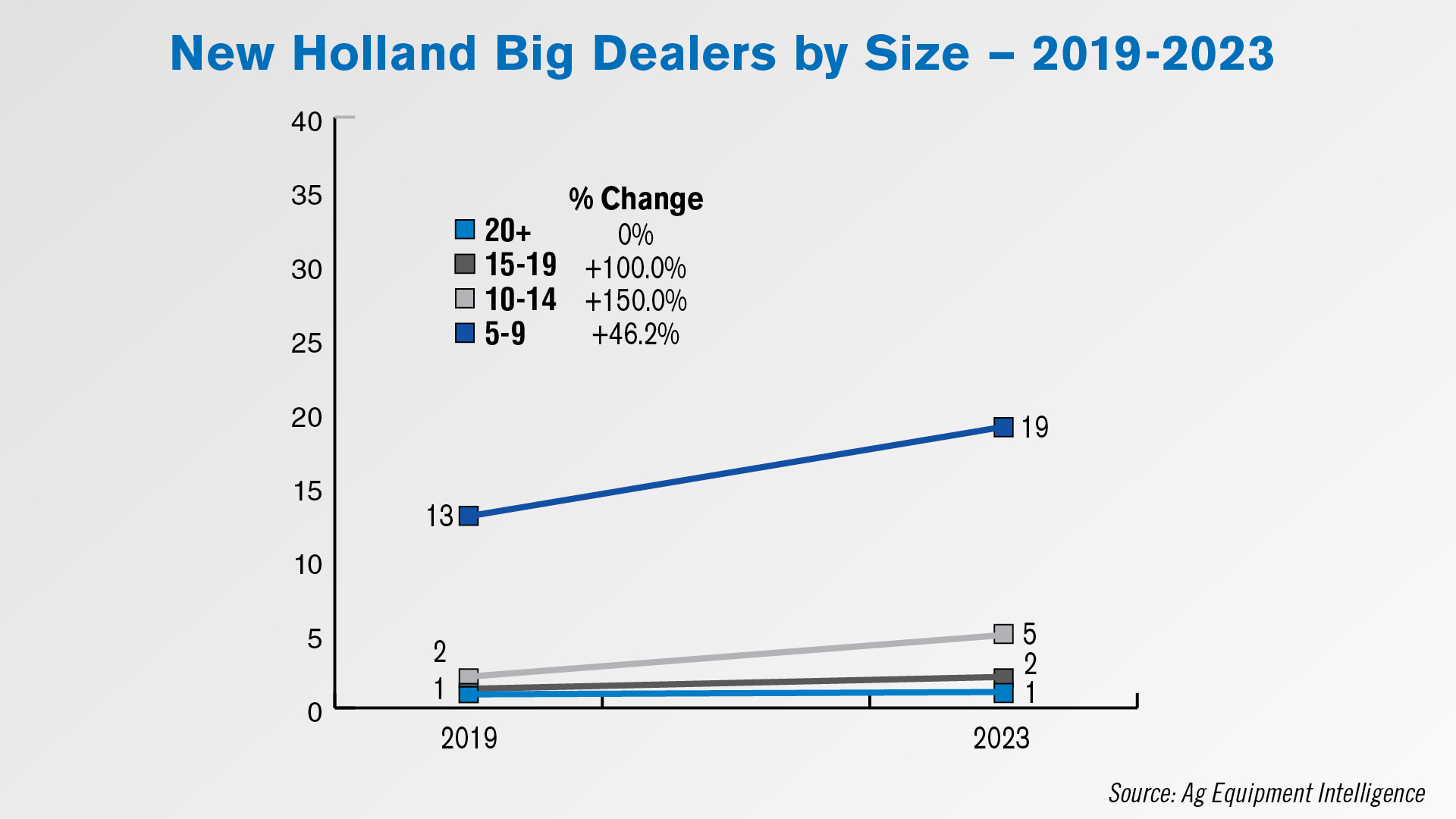

Returning to New Holland, all its big dealer size categories have either risen over the last 5 years or held steady. The category with the highest percentage growth was in the 10-14 location category, which rose 150% to 5 dealers in 2023. The 5-9 locations category saw the smallest percentage growth, up 46.2% to 19 dealers in 2023 from 13 in 2019.

Dealers on the Move

This week’s Dealer on the Move is LandPro Equipment. This John Deere dealer, with locations in New York, Pennsylvania and Ohio, announced earlier this month the grand opening of its new 50,000 square foot store in Batavia, N.Y.

Now here’s Noah Newman with the latest from the Technology Corner.

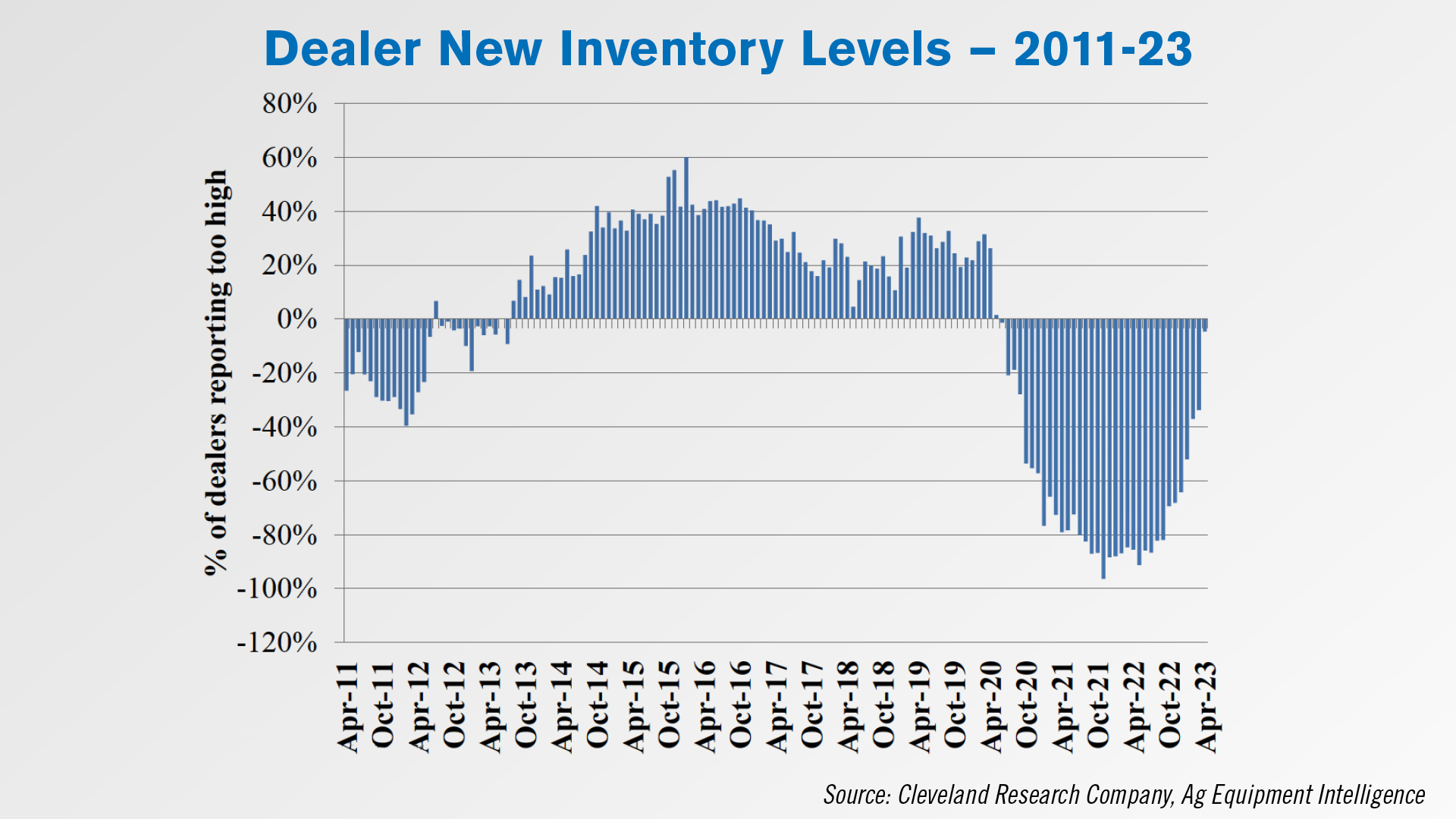

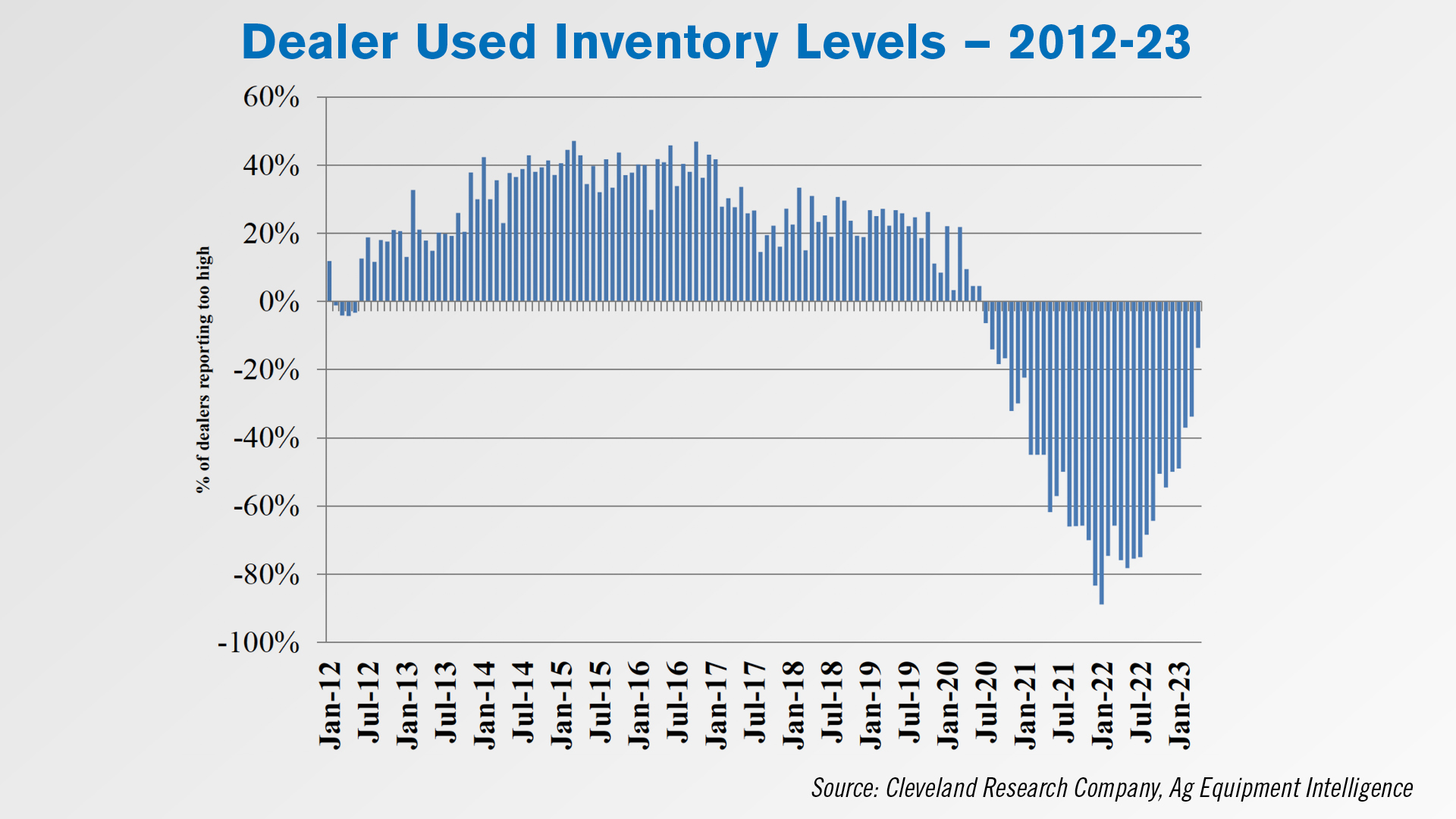

Thanks, Noah. After 3 years of struggling to get equipment, dealers are indicating they may soon have too much inventory, according to the results of the latest Dealer Sentiments report.

In this month’s results, a net 5% of dealers reported their new equipment inventories as “too low” in April. This is the closest inventories have gotten to being “too high” since the beginning of the pandemic. By comparison, in January of this year, a net 50% of dealers said their new equipment inventories were “too high.”

Used combine inventories are also rising. In these latest results, a net 39% of dealers said used combine inventories were “too low” in April, a notable jump from the 2% who said the same the prior month. This is the third “too high” reading since May 2021. High horsepower tractor used inventories remain low, however, with 70% of dealers reporting them as “too low.”

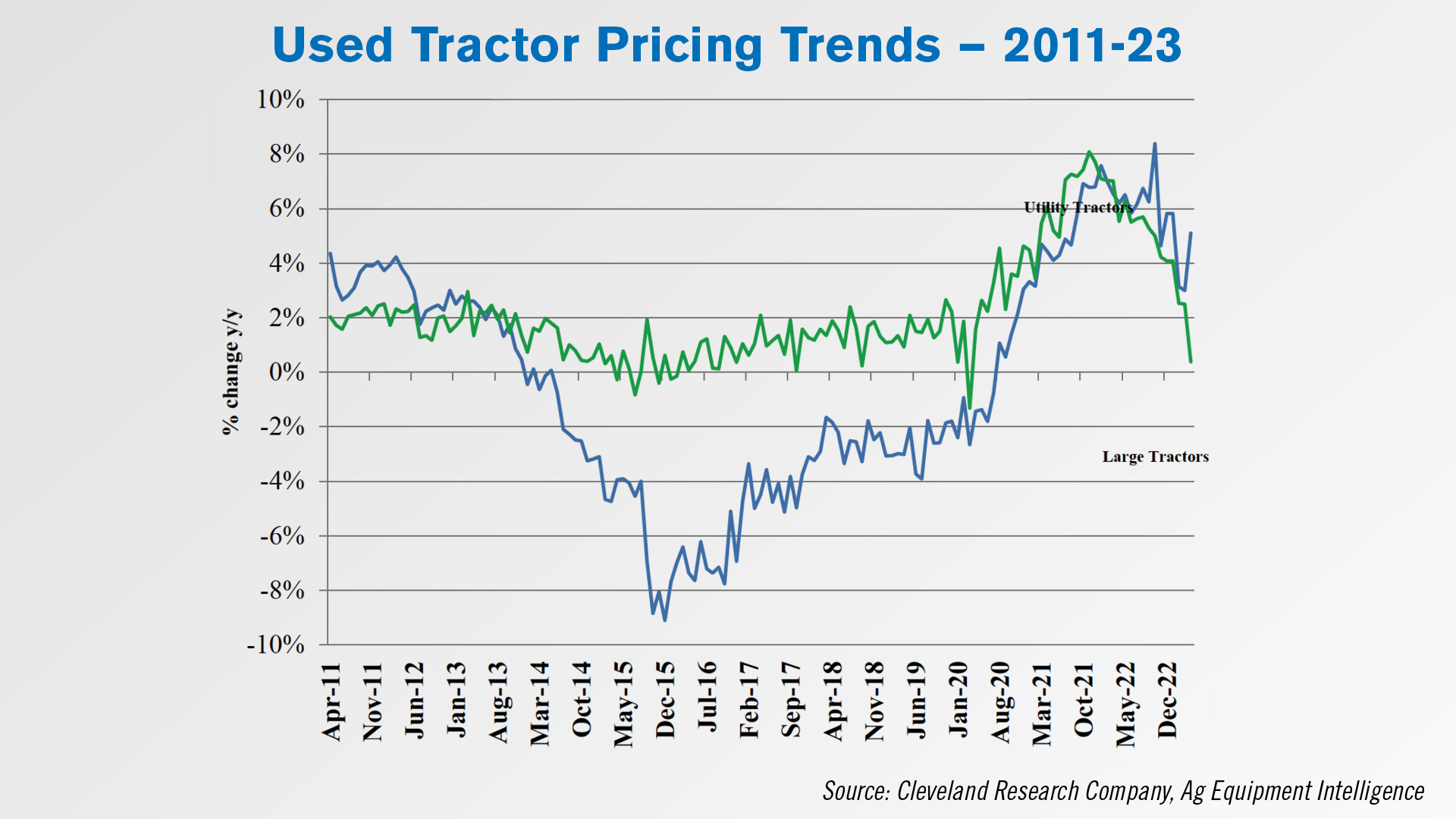

Another notable trend in the latest Dealer Sentiments report is the growing split between used utility and high horsepower tractor pricing. The latest results saw used utility tractor pricing drop to a 1% year-over-year increase, the lowest increase since early 2020. Used 4WD tractor pricing, however, rose to a 6% year-over-year increase in April from a 1% increase in the previous month. Used combine pricing remained unchanged year-over-year for the 3rd month in a row.

AGCO & Kubota Sign Right to Repair MOUs

The American Farm Bureau Federation announced May 22 it had signed two more memoranda of understanding with AGCO and Kubota regarding right to repair. The MOUs, which were negotiated independently with each manufacturer, follow similar agreements the Bureau entered into with John Deere and CNH Industrial earlier this year. The Bureau said that, combined, the four MOUs cover roughly 70% of the agricultural machinery sold in the U.S.

In a May 22 note to dealers, AGCO said the following:

“Today, most diagnoses and repairs on AGCO equipment may already be performed by capable customers with the tools and resources provided by AGCO and third-party vendors. Indeed, AGCO’s over-the-counter fill rate is among the highest in the industry, meaning that most of our parts are already sold to farmers and independent shops for services performed outside AGCO dealerships.

“The MOU signed with Farm Bureau largely formalizes steps AGCO has already taken to meet the repair needs of our customers. It also seeks to create more uniformity around the issue of Right to Repair for all parties.”

With all the majors now having signed MOUs in the U.S., it should be noted that Keith Currie, the president of the Canadian Federation of Agriculture, said in an April 7 report from CBC that the Federation hopes to replicate these MOUs in their own country.

Deere Reports Rising Large Ag Price Realization, Lower Production Costs

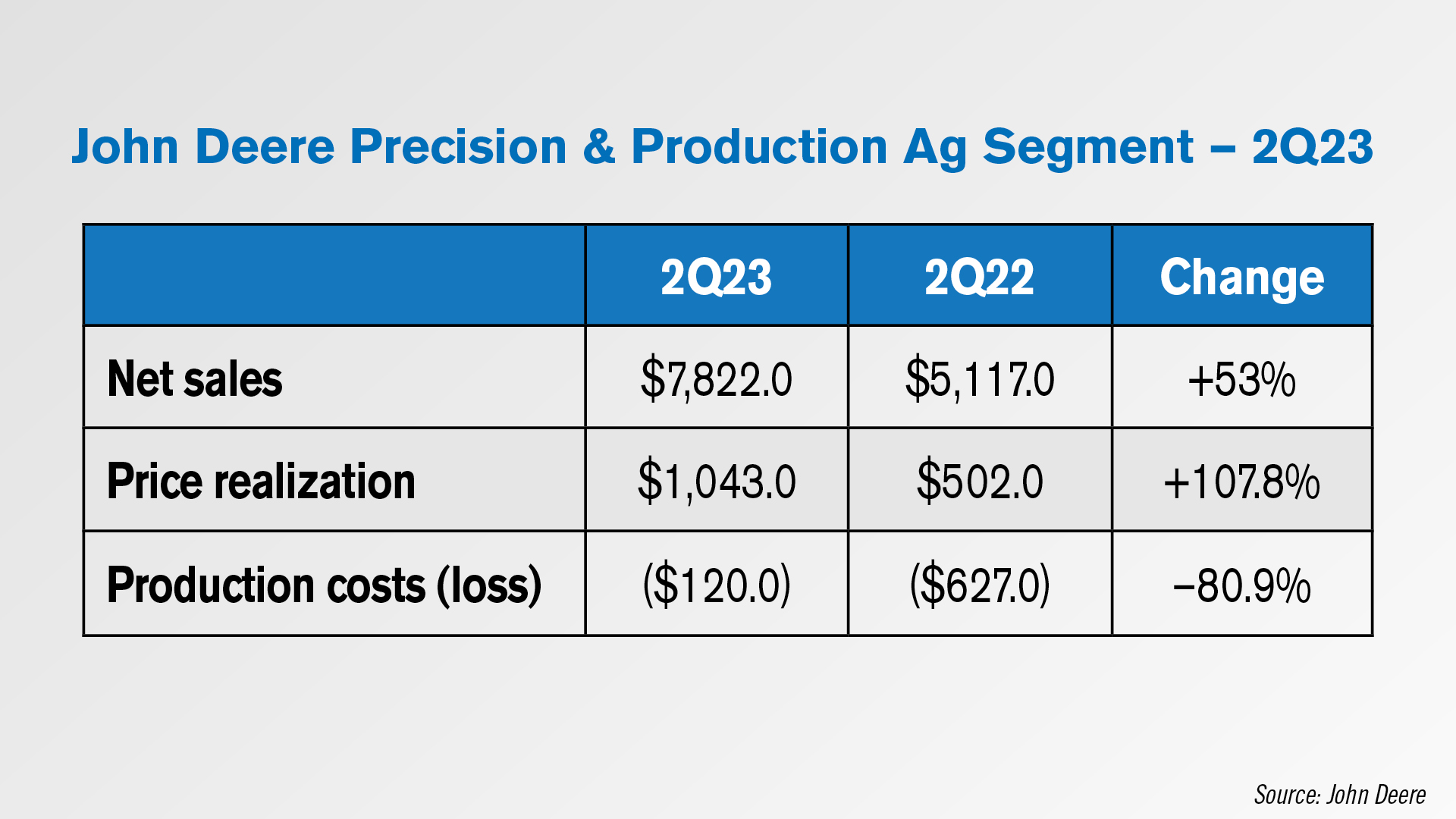

In its second quarter 2023 earnings released May 19, John Deere reported $17.4 billion in total revenue, a 30% year-over-year increase. Production & precision agriculture revenue specifically was up 53% to $7.8 billion, the highest increase among its business segments.

Deere said in its earnings release that the rise in precision and production ag sales was the result of higher shipment volumes and price realization. In its second quarter, Deere reported $1 billion in price realization in its production and precision ag segment. This was above both the $741 million in large ag price realization Deere reported in its first quarter of the year and the $502 million it reported in the second quarter of 2022. Production costs for the quarter came in at $120 million, down 81% from the $627 million in costs reported in the second quarter of last year.

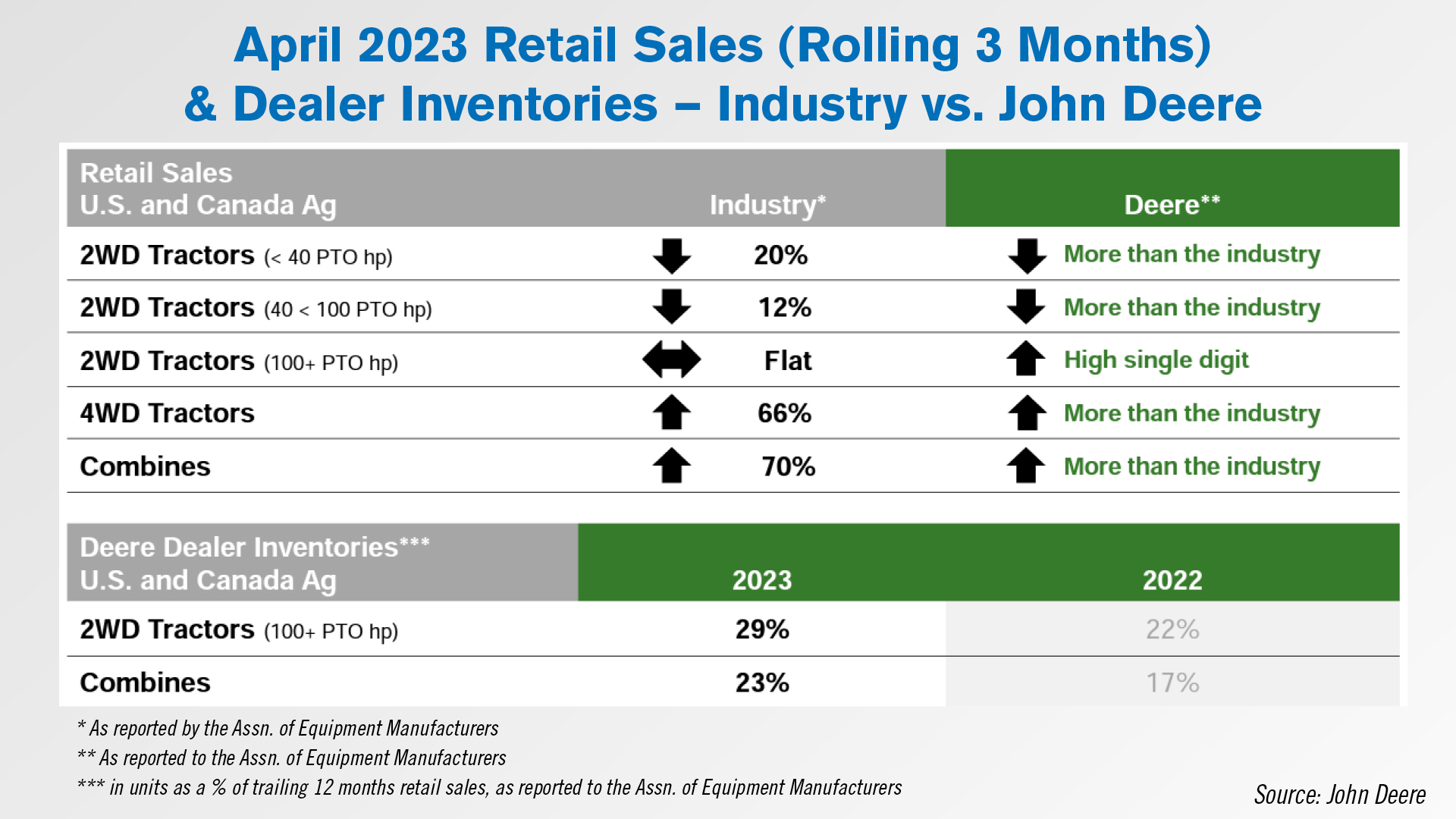

April 2023 Retail Sales (Rolling 3 Months) & Dealer Inventories — Industry vs. John Deere

* As reported by the Assn. of Equipment Manufacturers ** As reported to the Assn. of Equipment Manufacturers *** in units as a % of trailing 12 months retail sales, as reported to the Assn. of Equipment Manufacturers

Deere also looked at how its retail sales on a rolling 3 month basis and dealer inventories are holding up against the rest of the industry, as reported by the Assn. of Equipment Manufacturers.

While the industry is reporting high horsepower tractors to be flat year-over-year as of April, Deere reported their own sales were up by a “high single digit.” Deere also reported its 4WD tractor and combine sales were above the industry’s year-over-year increases, which were 66% and 70% respectively.

Looking at dealer inventories for North America, Deere reported its dealers’ high horsepower tractor inventories made up 29% of trailing 12 month retail sales, up from 22% in the second quarter of last year. Combines came in as 23%, also above the 17% reported the same time last year.

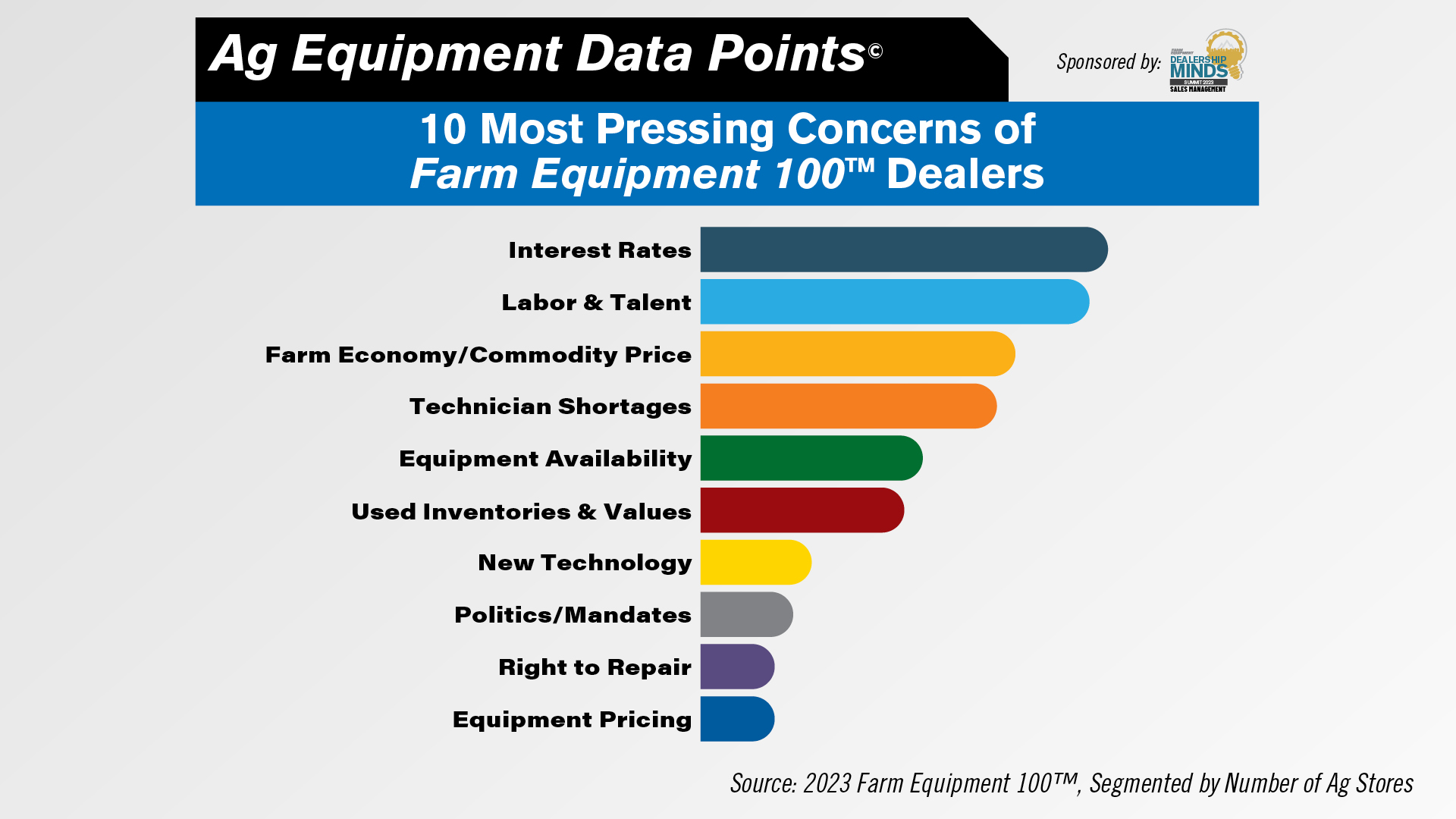

DataPoint: Dealers’ Most Pressing Concerns

This week’s DataPoint is brought to you by the Dealership Minds Summit.

As part of the upcoming June print issue of Farm Equipment, the ag equipment industry’s top 100 dealers — referred to as the Farm Equipment 100 — were asked about their most pressing industry concerns. Interest rates came out as the top concern among these top dealer executives, followed by labor and talent and the state of the farm economy and commodity prices.

As always, we welcome your feedback. You can send comments and story suggestions to bthorpe@lessitermedia.com. Until next time, thanks for joining us.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.