If 2013 farm production costs rise at the rates seen last year, U.S. farmers will need to take on more debt, which could curb spending on farm equipment in 2014. The Federal Reserve Bank of Kansas City reported in its July Agricultural Finance Databook newsletter that rising production costs prompted some agricultural producers to take on more debt.

Federal Reserve economists Nathan Kauffman and Maria Akers, said in the newsletter, “Rising production costs and larger loans for unspecified purposes pushed agricultural loan volumes higher in the second quarter. Survey results indicated the total volume of non-real estate farm loans made during the quarter rose 5.8% from last year.”

According to the USDA’s Farm Production Expenditures 2012 Summary released earlier this month (the latest data available), total production expenditures were up 10.4% compared with 2011. Overall, expenditures were estimated at $351.8 billion in 2012, up from $318.7 billion in the previous year. Crop farmers were hit the hardest by rising production costs as they saw a 17.4% increase to $199.8 billion. Livestock farms expenditures increased to $152 billion, up 2.4%. Production expenses are expected to have risen by 10% or more in 2013.

2nd Quarter Borrowing

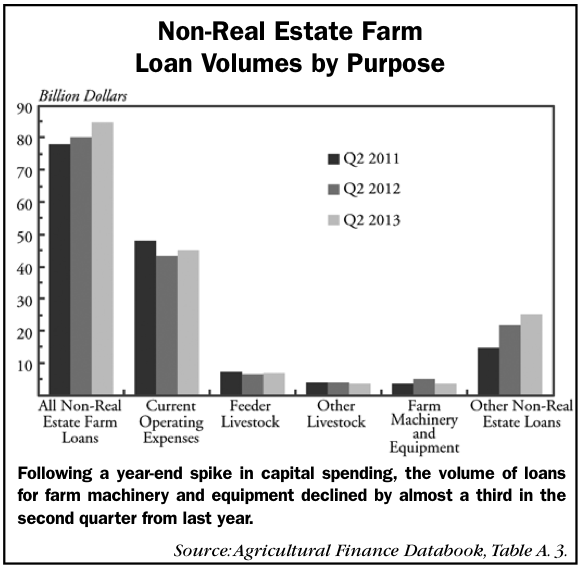

In their July report, Kauffman and Akers cite recent survey data that shows that total non-real estate farm loan volumes continued to trend higher during the April to June period of 2013. Farmers’ increased need for short-term financing tended to offset a decline in loans for farm machinery and equipment during the second quarter.

“Commercial banks financed increased operating expenses and other non-real estate loans for unspecified purposes,” they said. “As farm spending ramped up to pay high input costs for seed, fertilizer and feed, loan volumes for farm machinery and equipment fell sharply. Looking ahead, an anticipated drop in crop prices closer to harvest could further strain farm profit margins, potentially boosting the need for short-term loans and curtailing farm capital spending at year-end.”

According to the data compiled by Kauffman and Akers, loans to fund current operating expenses exceeded year-ago levels by 5.3% as input costs trended up. Following a year-end spike in capital spending, the volume of loans for farm machinery and equipment tumbled by almost a third in the second quarter from last year. Agricultural lenders also extended a substantial amount of intermediate-term credit for other, general purposes, adding to farm sector debt obligations.

Big Bank Trend

The authors also noted the market share of agricultural loans shifted more toward large commercial banks in the second quarter continuing a trend established during the first 3 months of the year. “According to national survey data from the second week of May, the share of non-real estate loans originated by large banks relative to their smaller counterparts jumped to the highest level in nearly 20 years,” Kauffman and Akers said. The shift to borrowing from larger lenders could be due, in part, to attractive and flexible loan terms. Typically, larger banks offered more floating interest rate loans at lower rates than small and midsized lenders, suggesting larger banks may be better able to accommodate the borrowing needs of large producers expanding their operations.”

During the first quarter of the year, the authors noted the average effective interest rate offered by large banks on non-real estate loans was 3.6%, much lower than the average 5.4% effective interest rate at small and midsized banks.

Post a comment

Report Abusive Comment