Paperwork, procedures and performance measurements may be considered necessary evils in the day-to-day workflow of a precision business, but done right, they provide invaluable insights into how to improve operational efficiency in a relationship-driven industry.

While precision farming departments tend to have a lot of latitude and freedom, too much autonomy can produce diminishing returns and erode profit potential. As dealerships look to integrate precision training into parts, sales and service departments, having go-to guidelines and directives are essential — especially to navigate employee turnover and onboarding new hires.

Three precision managers detailed different elements of establishing a solid foundation to build their dealership’s business, including rethinking the traditional inter-departmental dynamic, lessons learned during rapid expansion of a precision department and prioritizing procedural outcomes to improve the efficiency of a precision department.

Maturing Precision Priorities

Since 2016, Chad Moskal has worked to streamline, evolve and improve the structural efficiency of Rocky Mountain Equipment’s precision department as the ag optimization specialist (AOS). A major emphasis has been finding the right reporting process to maintain an effective level of communication and accountability throughout the Case IH dealership’s 36 ag locations in Western Canada.

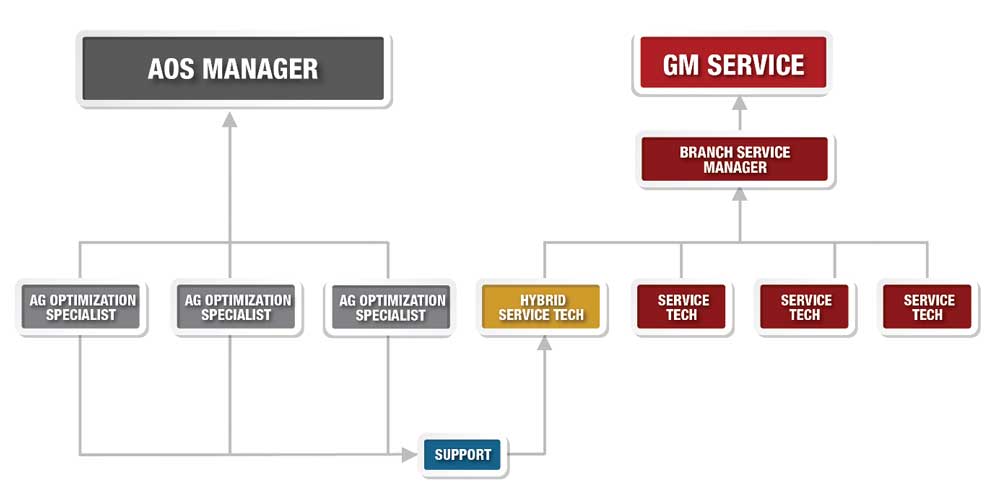

After several iterations of its precision farming business structure, Rocky Mountain Equipment implemented a hybrid structure in 2020, which has helped distribute staff resources and revenue expectations across the dealership’s 36 ag locations.

Source: Rocky Mountain Equipment

Moving from a regional supervisory model, to store-level management and now to each of Rocky Mountain’s 16-precision employees directly reporting to Moskal, the evolution has proven to be both necessary and practical.

“Western Canada covers a lot of territory and I have employees who are a 15-hour drive away,” he explains. “We needed a better way and the last year has forced us to rethink how we ensure that our team is staying connected.”

Working through several iterations of a precision business structure since 2012, starting within the parts department, then flowing operations through branch sales managers and spinning precision off into a standalone business, Rocky Mountain found benefits and challenges to each evolution.

When the dealership shifted to the standalone precision model in 2018, streamlined management, centralized direction, consistency with expectations and what Moskal refers to as “the McDonald’s philosophy” became benefits.

“What I mean by that is any customer of ours should be able to walk into any Rocky Mountain store that has an AOS person employed and get the same type of support, same type of customer service and the same type of knowledge that they do in any other store,” he says. “We want to be very cookie-cutter when it comes to certain things — knowledge, training, support — aspects we take great pride in promoting within our precision group.”

The independent structure started with Moskal at the top as AOS manager and then 2 branch sales managers — neither of whom reported directly to Moskal — but who had peripheral oversight of 2 AOS specialists each. Two regional AOS specialists reported directly to Moskal and had direct supervision of 2 AOS specialists each.

The independence — both financially and operationally — worked well, but Rocky Mountain’s latest evolution in 2020 tried to account for more local diversity among customer expectations and store performance.

“Our branches are completely different from one another, where one might do $80-$100 million in annual sales, and another branch might do $3-$4 million,” Moskal says. “We quickly found out that being financially responsible as a group, we couldn’t necessarily afford to staff branches that were not in the upper sales range, so that led us to a hybrid model we have today.”

At 15-20 of Rocky Mountain’s ag stores, it staffs AOS employees, following the same independent model the dealership implemented in 2018. But at the locations generating less annual precision revenue, Rocky Mountain has moved to “hybrid techs” serving the primary precision needs of customers.

“We quickly found out that being financially responsible as a group, we couldn’t necessarily afford to staff branches that were not in the upper sales range, so that led us to the hybrid model we have today…” – Chad Moskal, Rocky Mountain Equipment

This dynamic retains Moskal’s oversight of the overall precision business, but incorporates the dealership’s general manager of service who oversees the branch service manager in charge of supervising a hybrid service tech at respective locations.

“Obviously, profitability is important with my group being financially independent. With this hybrid model, we’ve been able to shed some loss leaders,” he says. “We evaluated branches on 4 different factors — coverage, revenue potential, machine population and customer requirements — and identified where we knew we just couldn’t turn a profit.”

Communicate, then Coordinate

Spending more than a decade working within the same dealership’s precision department is an anomaly. But since 2010, Nick Rust has been a cornerstone within H&R Agri-Power’s precision team.

In July 2019, he became the 17-location Case IH dealership’s precision ag coordinator, in charge of organization, training and oversight of the precision business and 14-person team. He’s emphasized improved communication and coordination between departments and personalized precision training.

While the department has 65 years of combined precision experience to draw from, the dynamic of the team ranges from 6 months to 15 years of experience and an age range of 21-42 years old.

With talented precision staff often in short supply, Rust wants to maintain stability within H&R’s team, which includes 5 specialists hired within a 6-month span in 2019. He acknowledges it takes 2-3 years of developmental investment to get precision specialists to generate revenue for the dealership.

“Within 6 months, they’re billing some time, they’re selling some product and interacting with customers,” Rust says. “If they’re in a mentoring situation with an experienced member of the team, they will be productive enough to break even that first year.”

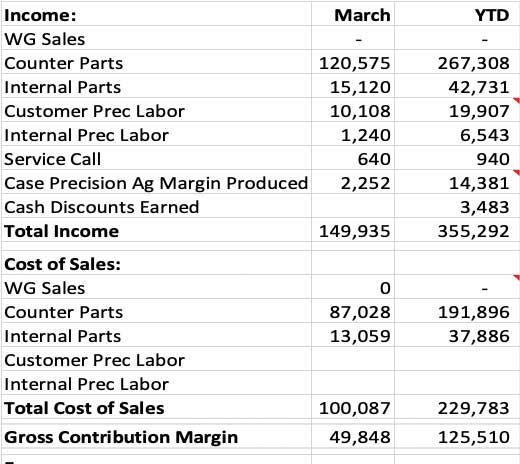

To effectively track and measure precision employee performance, H&R Agri-Power developed a detailed checklist of economic indicators to quantify the bottom-line benefits for each of their 14 precision specialists.

Source: H&R Agri-Power

Rust breaks down H&R’s core precision focus into 4 segments:

1. Purpose: This is defining the reason why the dealership’s specialists show up to work every day. Rust cites H&R’s precision department expectation of being the experts on all things precision at each location as the foundational principle on which the business is built. “We’re an equipment dealership, first and foremost, as a precision department, we view ourselves as a support team for wholegoods sales, service and parts,” he says.

2. Execution: Training is an essential part of fulfilling the support role, Rust says, not only internally within the precision department, but extending that knowledge to other staff. He challenges his team with the question, “What does the precision department do to advance H&R’s purpose?”

“We have semi-annual meetings with the whole precision team, but to really understand and help our specialists, I need to do what they do,” Rust says. “I want retention. I want to keep people. If I’m not constantly training and putting my experience to work, ultimately, we’re not making more money. Turnover is expensive and we can’t afford to be constantly starting over.”

3. Accountability: Measuring employee performance and customer satisfaction need to be quantifiable metrics, according to Rust. He helped develop the dealership’s financial metric to evaluate the bottom-line value of the precision side of the business. This includes tracking income though hardware sales and billed service hours for each specialist, along with expenses which include salaries, trucks, training and fuel, all of which contribute to a precision specialist’s gross contribution margin.

“Gross contribution is a reasonable metric to evaluate the precision team,” Rust says. “This is a sales company and our specialists are in the business of selling. We can go off that financial sheet and decide whether the specialist is producing or not. It’s fair.”

One example Rust shares is a specialist who billed $25,000 during the first 3 months of a year, but when accounted for in contribution margin, he actually made the dealership $34,000 in March alone and $79,000 the first quarter. “He’s really driving the business there,” Rust says. “We also encourage our precision farming specialists by paying them an incentive off of their contribution margin. This specialist got a $7,900 check last April once the quarterly statement came out.”

4. Vision: Beyond the numbers is the ability to look ahead and support growth. A piece of this is continued standardization of procedures not only within the precision department, but dealership-wide. Remote service ended up being a bigger piece of the support puzzle in 2020 than anticipated, but Rust sees opportunity to build on that momentum going forward.

In the future, he sees the potential of the dealership operating a tech support hub, dedicated to remote diagnosis and troubleshooting of ag tech issues. “I want to monetize it and think we could get there in the next 5 years.”

Scaling Precision Priorities

Finding talent in precision ag can be tough, but also a necessary part of expanding a precision business, especially when the plan is for rapid growth.

In 2019, Jeremy Bullington helped facilitate, onboard and train 16 additional precision specialists — a daunting, but necessary expansion — to meet the growing needs of Greenway Equipment’s customers and realign the dealership’s precision focus.

“At the end of 2018, our company’s focus really shifted in how we looked at precision ag, moving away from our salespeople being the primary precision touchpoint for customers,” says Bullington, who serves as the precision ag support center manager for the 31-location John Deere dealership.

“We wanted all of our customers across the entire AOR to have access to the entire portfolio of our technology offerings,” Bullington says. “What we learned was the locations our 6 precision field specialists worked out of as their home stores performed extremely well, vs. the locations where sales was the main precision touchpoint.”

Bullington acknowledges that the expectation of having 6 field specialists (along with 1 manager, 1 assistant manager, 3 data analysts and 2 support center specialists) cover 30 stores was unrealistic. But rather than pursue gradual expansion of the department, Greenway more than doubled the size of its precision team from October 2018-March 2019.

The additional hires included 2 more assistant managers, 5 field managers covering 3-5 locations each, 6 precision specialists covering 1-2 locations each, 4 product specialists covering 1-2 locations each and 2 operations trainees.

One of the more prominent growing pains was getting new hires to understand the diversity of their roles, especially with each coming into the organization with different experience levels.

Some were new college graduates, others were hired from different segments of ag and a few were promoted or transferred from within the dealership.

The first step in getting the entire group acclimated to Greenway’s precision culture, products and expectations was large training clinics, where new hires were educated on the essentials on things like new planter setups.

Then hires participated in a series of smaller, more specialized clinics, which Bullington says were valuable in getting employees to be more vocal with questions or comments.

“We’d run a planter clinic for 5-6 people at a time and our instructor can ask very pointed questions to the employees who are more comfortable to respond or if they don’t know the answer, it’s a hands-on opportunity to actually show us what they do know,” Bullington says. “Then our instructors know what everyone does well and what we need to provide more training on.”

“We want to think on a location-level, how many acres are available to that specialist, what’s out there to manage?…” – Jeremy Bullington, Greenway Equipment

Instructors also role-played as customers, asking typical questions that new hires might get on the farm and working with the employees to build their confidence and comfort with interactions and tech troubleshooting.

Once the new hires graduated to “live” communication with customers, Bullington says the expectation isn’t for them to be experts, but they need to be able to represent Greenway in a business-building capacity, and be measured on that performance. For example, specific goals were set for each field specialist based on their experience, training and location expectations, then matched with Greenway’s Pay for Performance plan. The compensation program tailors goals for each specialist and financial incentives for achieving those goals.

“We want to think on a location-level, how many acres are available to that specialist, what’s out there to manage?” Bullington says. “We want to engage customers and then finding out how involved they are in their data, and how our specialists can assist.

“It’s one thing to create accounts and have accounts, but it’s another thing to have customers engage with that information. Customer engagement and the intensity of that engagement is really what we want to focus on more than anything else.”

The other key metric Greenway uses to measure precision employee performance is tracking hardware demonstrations. Employees log each product demo they conduct and then the dealership has documentation to correlate with a purchase of that product.

“We’re doing it with hardware on large equipment right now, but looking at the possibility of tracking it with other items as well,” Bullington says. “Tracking that demo back to a sales means the specialist did a good job and we want our people to know not only can they be rewarded for that, but we can measure and have a better idea of what we’re doing right or wrong with those demos.”

Creating Precision Opportunity Out of Crisis Training an Entire Dealership to be Precision SavvyPreparing Your Dealership to Sell & Service Autonomous EquipmentManage the Minutia of a Precision Business to Achieve Measurable GrowthNobody Knows it All, But it Pays to Have a LifelineChange is Key to Survival for Precision Farming Dealers

Post a comment

Report Abusive Comment