Dealer’s Choice Awards

Shortline: Vermeer

Gold Level: Bourgault, Bush Hog, Land Pride, Landoll, MacDon, Meyer Mfg., Unverferth

The Equipment Dealers Assn. (EDA) has released the results of its annual Dealer-Manufacturer Relations Survey to equipment dealers. The survey, which enables equipment dealers throughout North America to rate the manufacturer lines they carry in key operational categories, was open from Feb. 13 through March 18, 2020.

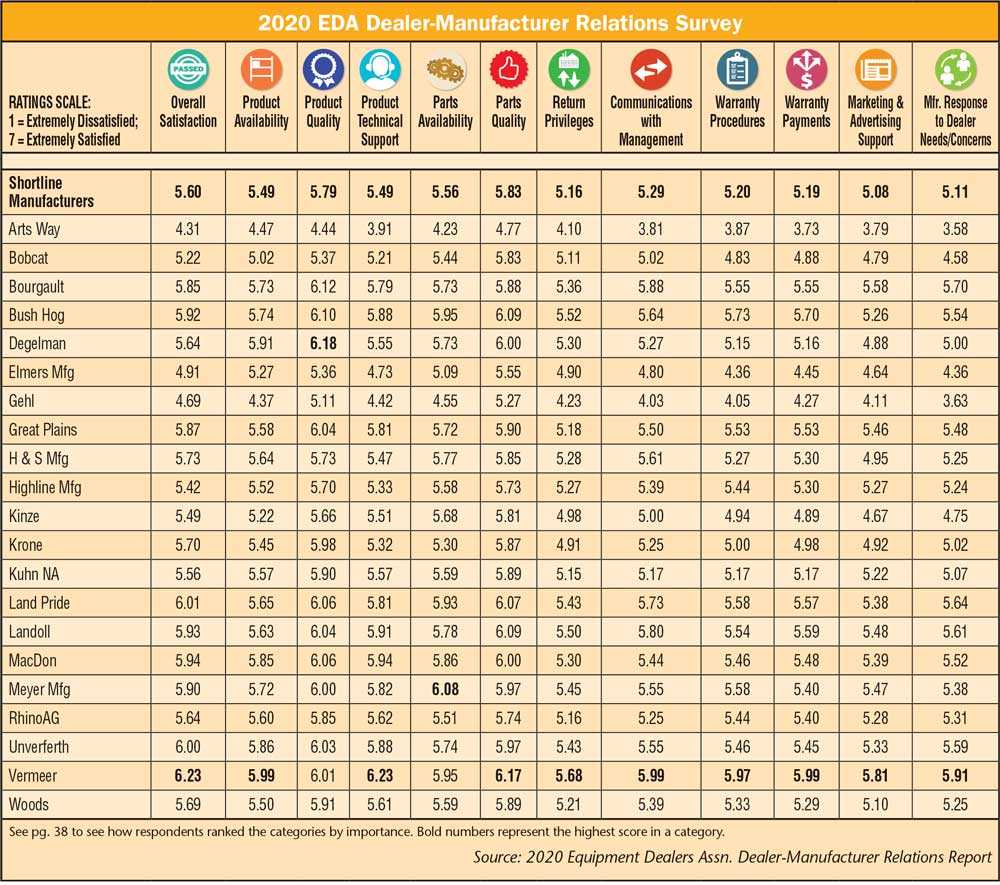

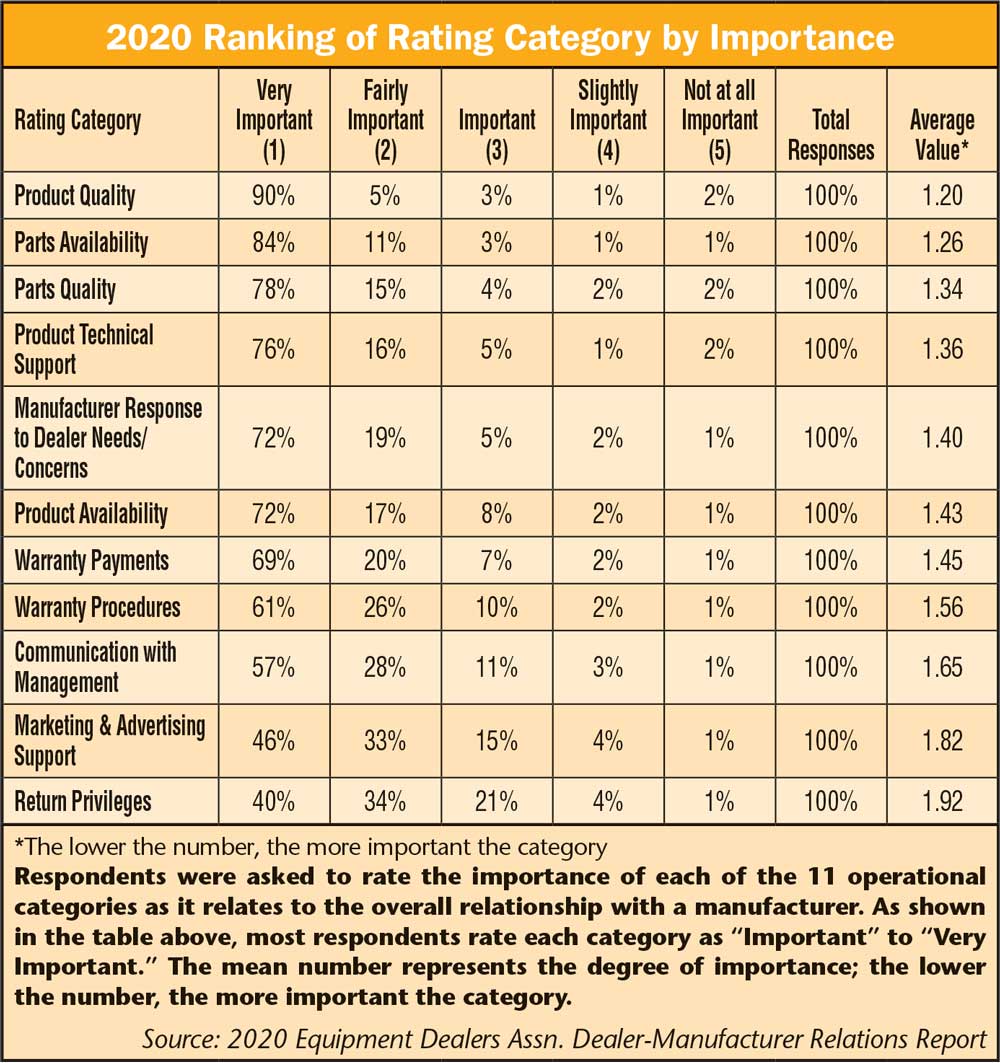

EDA’s survey allows dealers to rate up to 7 manufacturers they carry and collects data on their experience in 11 categories including product quality, availability and technical support; parts availability, quality and return policy; communication, warranty, marketing/advertising support and a separate rating for overall satisfaction. Respondents could rate manufacturers on a scale from 1-7, where 1 is “extremely dissatisfied” and 7 is “extremely satisfied.”

The 2020 survey contains a list of 61 manufacturers that received the minimum number of dealer ratings required to be included in the report, including full-line manufacturers, tractor manufacturers, shortline manufacturers and outdoor power equipment (OPE) manufacturers. This article focuses on the performance of the shortline manufacturers included in the report.

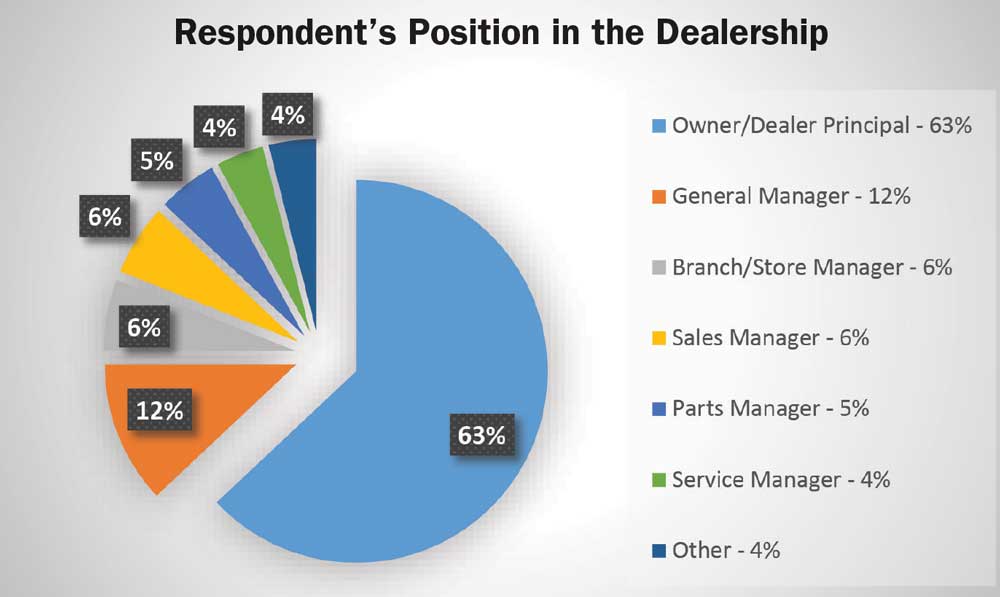

This year’s survey received 9,671 individual manufacturer ratings (a 6.4% increase over the 2019 survey) from 2,659 dealers (a 5.6% increase), gathering responses from all 50 states and 10 Canadian provinces. This means, on average, each dealer rated 3.64 manufacturer lines that they carried. Broken down by occupation, 63% of respondents were dealer-principals, 12% were general managers, 6% were branch/store managers, 6% were sales managers, 5% were parts managers, 4% were service managers and 4% were listed as “other.” It was noted that the “other” category can contain several other positions not included in the survey options, such as COO or CFO.

It was noted that the survey results were only representative of a snapshot of dealers’ thoughts in early 2020, with the potential for results to “change relatively quickly due to a number of external factors or situations.” It is also important to remember it can be difficult to evaluate manufacturers in different segments against one another. There are different expectations and resources for different types of equipment.

The survey results show 81% of respondents were either the dealer-principal/owner, a general manager or store/branch manager. The percentage of respondents self-identifying as a “dealer-principal” was 63%, below the 70% that identified that way in the 2019 study.

Source: 2020 Equipment Dealers Assn. Dealer-Manufacturer Relations Report

Joe Dykes, vice president of industry relations at EDA, highlights the multiple ways dealers can find value in the aggregated findings of the survey.

“The number one incentive for dealers to participate in the study is knowing how their manufacturers are stacking up against the competition,” he says. “And down the line, if they’re considering adding a manufacturer to their dealership, these ratings are a good component to use in making that decision.

“Another way dealers might use the survey is to compare the results to what they hear in their dealer meetings. Often in these meetings, manufacturers will acknowledge areas of concern and outline a plan for improvement. Dealers can use this survey to track their manufacturer’s progress in achieving those goals.”

Aggregated results are also useful to the manufacturers that participate in the study by providing their dealer distribution lists for EDA to send questionnaires to. The full report says manufacturers may use the report to “… promote their performance to their dealer network and end-users. They have also used the results as a means to support change and improvements within their organizations.”

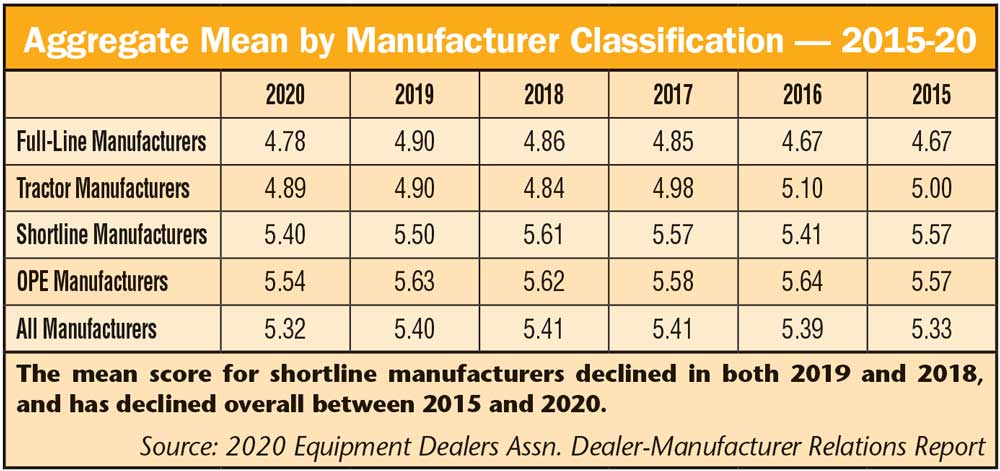

Shortline Scores Decline, Approvals Hold Steady

The average mean score for shortline manufacturers was 5.40, down from the 5.50 average shortline score in the 2019 survey and the 5.61 average in 2018. Shortlines came ahead of full-lines with an average mean score of 4.78, tractor manufacturers at 4.89 and all manufacturers in the survey at 5.32, but below OPE manufacturers at 5.54. Vermeer had the highest average mean score of the shortlines at 5.99.

Overall approval for shortline manufacturers remained nearly flat year-over-year. The average overall satisfaction dealers had with their shortlines was 5.60, just below the 5.63 reported in the 2019 dealer-manufacturer survey. This put shortlines slightly ahead of the average score for all manufacturers included in the survey, which came in at 5.50, ahead of tractor manufacturers at 5.10 and ahead of full-line manufacturers at 4.99. Only OPE manufacturers scored higher with an average overall satisfaction score of 5.69, the highest of the 2020 survey.

Vermeer walked away with 9 first place rankings among the 11 categories that dealers could rate, the same as last year’s survey results. The two slots Vermeer missed were for Product Quality (where Degelman came in first) and Parts Availability (which went to Meyer Mfg.). Vermeer took first marks in overall dealer satisfaction at 6.23. Additionally, for the sixth time in 8 years (2013, 2014, 2015, 2016, 2019 and now 2020), Vermeer received EDA’s Dealer Choice Award in the shortline category, an award based on results of the survey.

When it comes to improvements made in dealer ratings in the last 5 years, RhinoAG stole the show with the most improvement of the shortlines in all 11 categories. Last year, RhinoAG showed the most 5 year improvement in 10 categories, save for Product Quality, which went to Krone.

Tractor Manufacturer 2020 Results

- Branson took the highest average mean score at 5.80

- Branson also took the highest overall dealer satisfaction rating at 5.92

- The average tractor manufacturer mean score was 4.89, down from 4.90 last year

- Tractor manufacturers scored lowest on average in manufacturer response to dealers needs at 4.40

Full-Line Manufacturers 2020 Results

- Deere had the highest average mean score at 5.50

- Deere also had the highest overall dealer satisfaction rating at 5.58

- The average full-line mean score was 4.78, down from 4.90 last year

- Full-lines scored lowest on average in manufacturer response to dealers needs at 4.24

OPE Manufacturer 2020 Results

- Scag (EDA 2020 Dealer’s Choice in the OPE Manufacturer category) took the highest average mean score at 6.19, followed by Walker (EDA 2020 Gold Level Award Recipient) at 6.02

- Scag also came in with the highest overall dealer satisfaction rating at 6.39, followed by Wright at 6.26 and Walker at 6.19

- The average OPE manufacturer mean score was 5.54, the highest of all categories and above the overall average of 5.32.

- Full coverage of the OPE Manufacturer performance will be featured on RuralLifestyleDealer.com.

With nearly 90 pages of data and charts, the 2020 Dealer-Manufacturer Relations Report is available to all EDA dealer members and to participating manufacturers. Manufacturers may also obtain data that includes company breakouts by region and their individual dealers’ comments. For more information, contact Joe Dykes at JDykes@EquipmentDealer.org

Post a comment

Report Abusive Comment