Ethanol usage, which helped fuel the ag equipment sales boom from 2005-2013, has flattened out, but exports continue to prop up its overall production. Nonetheless, the fight to maintain and grow its place in the fuels market has been frustrating.

According to the National Corn Growers Assn., about 30% of all U.S. corn is used for ethanol fuel. When combined with its production byproduct, Distiller Dried Grains with Solubles (DDGS), that figure rises to nearly 40%. So, it’s no wonder why corn growers and ethanol producers are battling with Big Oil to maintain and grow ethanol production.

But the political frustrations Ethanol usage, which helped fuel the ag equipment sales boom from 2005-2013, has flattened out, but exports continue to prop up its overall production. Nonetheless, the fight to maintain and grow its place in the fuels market has been frustrating.

Growing Production

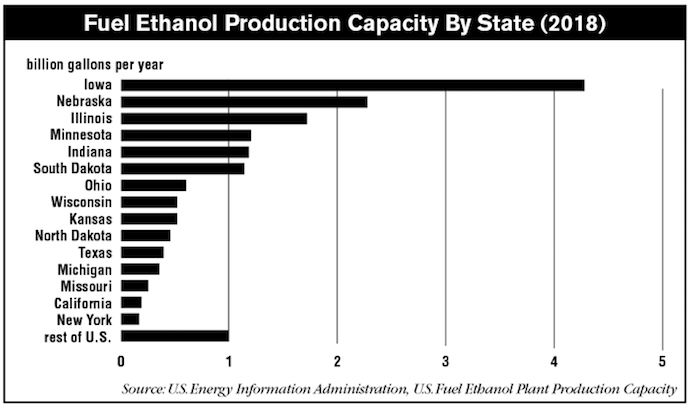

According to the U.S. Energy Information Administration, U.S. fuel ethanol production capacity continues to increase. Fuel ethanol production capacity in the United States reached more than 16 billion gallons per year, or 1.06 million barrels per day (b/d), at the beginning of 2018, EIA said in its most recent U.S. Fuel Ethanol Plant Production Capacity report. Total capacity of operable ethanol plants increased by 5% — more than 700 million gallons per year — between January 2017 and January 2018.

Of the top 13 fuel ethanol-producing states, 12 are located in the Midwest. The top three states — Iowa, Nebraska and Illinois — contain more than half of the nation’s total ethanol production capacity.

Actual U.S. production of fuel ethanol reached a total of 15.8 billion gallons in 2017. It is forecast to reach 15.9 billion gallons in 2018, resulting in 98% utilization of reported nameplate capacity as of January 1, 2018.

Exports to the Rescue

While domestic use of ethanol has plateaued, exports continue to increase. According to the Renewable Fuels Assn., government data shows that U.S. ethanol exports through June stood at 927.7 million gallons (mg), up 33% from the first half of 2017 and on pace to shatter last year’s record of 1.38 billion gallons (bg). RFA says that robust export markets are more important now than ever before, as actions by the Environmental Protection Agency (EPA) are “undermining domestic ethanol demand.”

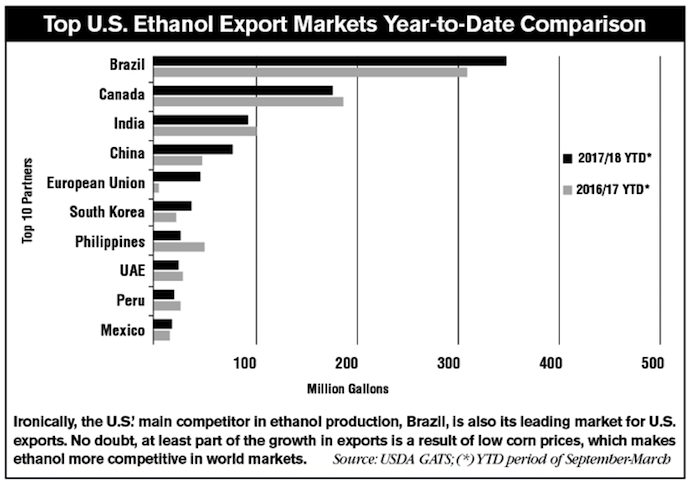

Ironically, the U.S.’ main competitor in ethanol production, Brazil, is also its leading market for exports. No doubt, at least part of the growth in exports is a result of low corn prices, which makes ethanol more competitive in world markets.

Through the first half of 2018, Brazil has imported 345.9 million gallons of U.S. ethanol, or about 37% of total shipments. Exports to Brazil in the first half of 2018 were up 28% over the same period in 2017.

Canada has been the second-leading export market, with 159.5 million gallons of U.S. ethanol ending up there through the first 6 months of the year, which is up 8% from the same period a year ago. Other top markets for the first half of 2018 were India (70.1 mg), China (52.9 mg), South Korea (44.5 mg) and the Philippines (43.7 mg). It should be noted that nearly all of the exports to China occurred in the first 3 months of the year, and fuel ethanol exports to the country collapsed to zero in the second quarter as a result of increased tariffs.