Rabobank is forecasting that median Midwest corn farmers will be working with a margin of about 4% during the next 4-5 years. This is “unacceptable” and means they will need to increase their efficiency while continuing to cut costs, Kenneth Zuckerberg told attendees of the 2018 Precision Farming Dealer Summit in January.

Zuckerberg, a senior analyst for Rabobank, one of the leading financial services providers to North American agriculture, sees digitization of agriculture as farmers’ best opportunity to improve their operations. “I define digitizing agriculture as automating the various precision farming tools, technologies and farming practices, which can add tremendous value,” he says.

He calls “digitization” the fourth and latest wave of agricultural innovation. “This is taking past innovations and merging them with emerging technology,” says Zuckerberg. “The value is higher risk-adjusted returns on invested capital.”

Zuckerberg adds, “This is the last multi-trillion dollar industry that has yet to fully embrace the advantages that technology and automation offers.”

Low Margins Fuel Changes

A 2017 Rabobank report co-authored by Zuckerberg, (Farming Strategies for a Challenging Ag Economic Environment), low grain prices will be a major impetus for farmers to embrace new technologies. It’s understood that grain prices drive row-crop farmer profitability.

“While we expect some recovery in future years, we now expect a median U.S. farmgate corn price of $3.60-$3.80 per bushel between 2018-24. The U.S. Farm Economics Baseline calls only for low-to-mid single digit average profit margins during the subject period, well below the high margin years of 2006-13. Although the farmgate price outlook is substantially higher than in the period from the 1970s to 2006, increased costs make the potential for margins similarly tight,” he says.

To survive tight margin conditions, farmers need to adopt and adapt, according to Zuckerberg. “The most logical, attractive and most-likely-to-succeed option for crop farmers to pursue is adopting proven, cost-reducing, on-farm technologies that optimize input usage and produce greater yield per input dollar spent. While this strategy can be confused with ‘precision farming,’ the key here is investing thoughtfully, based on selected data and technological tools that add value.”

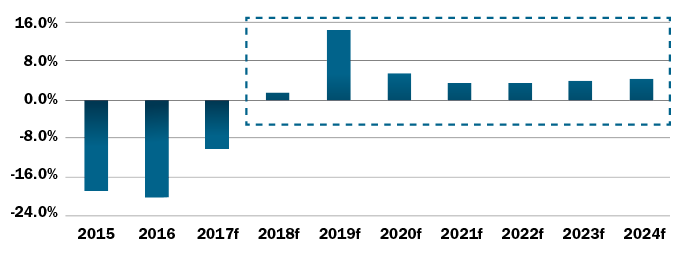

Forcasted Corn Profit Margins

(2015-2024f)

The forecasted profit margin for corn in 2019 is somewhat of a positive anomaly, driven by the assumed temporary retirement of farm machinery debt, which subsequently normalizes after 2020. Source: RaboResearch 2017

Examples of this, he says, are fertilizer measurement and management tools that help detect nutrient deficiencies, as well as over application, by providing decision support for variable-rate fertilizer applications.

According to the Rabobank analyst, $6.5 billion of capital has been invested in new precision farming and data-oriented technologies to modernize farming for the digital age since 2014. “These technologies have taken many shapes, forms and sizes,” he says. “They range from cloud-based software tools to hybrid hardware/software products that are ‘smart’ in that they can communicate with other connected devices wirelessly and digitally, with minimal human intervention.”

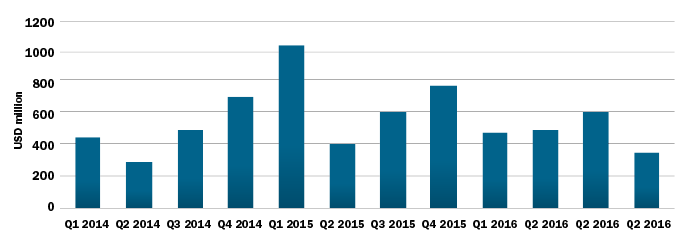

Investments in Ag Technology

(Excluding Food E-commerce — Q1 2014 – Q4 2016)

Since the beginning of 2014, over $6.5 billion has been invested in new precision farming and data-oriented technologies to move farming into the digital age. Source: AgFunder AgTech Investing Report (Year in Review 2016) 2017

Despite all of the talk and all of the money that’s been invested, on the whole, not a lot of this digital technology has found its way into the farm field, yet. One of the reasons for this, says Zuckerberg, is because the industry has yet to adopt a “connected ecosystem.” Agriculture still doesn’t have a common, standardized operating systems that most or all farm machinery can dial into.

Even with a standardized operating system, he says, these systems and their connectivity remains complicated. “Good luck trying to explain these systems to somebody working in the field trying to produce a crop. There’s been a disconnect. There’s been too much in the way of mainstream concepts and not enough in the way of education,” says Zuckerberg.

Components of Digitization

He lists the 4 core components of digital ag as:

- Data Management

- Interpretation & Analytics

- Prescriptions

- Precision Applications

Zuckerberg says simply collecting data adds little if any value to the process. “It’s the interpretation of the analytics of that data that can actually help solve problems.” He adds, there isn’t a single business model out there when it comes to collecting and analyzing data. The jury’s still out on Climate Corp.-Monsanto and DowDuPont’s acquisition of Granular.

Extend the Summit Experience

Continue learning from the 2018 Precision Farming Dealer Summit speakers through exclusive super-session videos, supported by Laforge Systems Inc.

The video library delivers valuable takeaways and the most talked-about presentations at the third annual event in Louisville. Visit www.PrecisionFarmingDealer.com for access and additional coverage of the 2018 Summit and past events.

Ultimately, analyzing and interpreting the data and turning it into a “prescription” is where the value is. “We still have work to do on cracking the code on prescriptions. However, precision applications seem to be where there’s a natural value-creating opportunity for dealers, but how do you get there? What’s missing is the Geek Squad for agriculture; a Geek Squad for farmers. This intersects with a lot of what we’re hearing. We need the ability to create a center of excellence in knowledge, and then teaching and applying that knowledge.”

Needed: A Standard Platform

Beyond transferring operating knowledge to farmers, probably the most significant barrier to adopting digital farming technologies is the lack of a universal operating platform that is capable of connecting “the entire ecosystem,” according to Zuckerberg.

“At present, digital farming lacks a standardized operating system and/or data platform in which the value chain can upload, store, validate, refine, cleanse and analyze data, and in which relevant stakeholders can easily communicate with each other,” he says. “Based on our research interviews with data scientists from various enterprise software and business analytics firms, we believe that a data warehouse and data analytics structure — which connects all stakeholders: farmers, software vendors, equipment manufacturers and data analytics companies and can enable data sharing — is critical for digital agriculture to add value.”

But this will not happen until Deere, AGCO, CNH Industrial and others work together to create a common platform. “Nobody’s going to win if there’s 27 different operating systems and no way to connect them. It’s got to default to an open platform,” says Zuckerberg.

He says his previous experience in the insurance industry has demonstrated that such “partnerships” ultimately benefit everyone. “In 1990, I worked for a company called Insurance Services Office Inc. It was a rating bureau turned consulting firm that hired actuaries to analyze insurance loss information. Those actuaries looked at every line of business — auto, home, boiler, machine, environmental. There were something like 28 or 30 different lines of business.

“In order to develop a standard platform that everyone in the insurance industry could use, all of the big names in the industry came together — AIG, Travelers, Hartford, etc. — and contributed the funds necessary to develop the platform because they realized they couldn’t do that alone. That’s what this industry [ag] needs to do. That’s what we have to do to establish standards and processes with an open architecture,” Zuckerberg explains.

He added that this is the biggest challenge in front of agriculture. The company that was formed is called ISO [Insurance Services Office Inc.] and it’s a publicly traded, risk management company worth $20 billion. “So there’s precedent for this,” Zuckerberg says.

In fact, there’s precedent for it agriculture as well. During Agritechnica 2017, a consortium of farm equipment manufacturers announced it had formed DKE-Data, a firm to commercialize the “agrirouter.” This is an internet-based data exchange platform developed to help resolve the problems with mixing and matching various agricultural systems and applications. (See “Universal Data Exchange Platform Offers Broad Potential for Mixing & Matching Ag System,” Farm Equipment, January 2018.)

There’s no doubt that creating a universal data platform is critical. However, Zuckerberg points out that “going from the ‘concept’ stage to the ‘blueprint’ stage is a complicated exercise. How this happens and who pays for it will depend on which party/parties take leadership in organizing and aligning the industry, and how much capital is set aside for building, testing and maintaining required systems.

“Although it took two decades for electronic commerce to evolve after internet access became available to the general public, we would expect creation of the necessary platforms for digital agriculture to occur much faster,” he says.

Dealers’ Role in Digitization

Zuckerberg sees the best opportunity to capitalize on the trend toward digitization is to form and employ Geek Squads for agriculture. He lists 5 tactical ideas dealers will need to adopt in order to take advantage of the value that precision farming offers:

- Hire a data scientist with production agriculture experience

- Evaluate existing and emerging technologies that intersect with farm equipment (precision planting, applications, harvesting)

- Rank the 5 most impactful tools and technologies that can save farmers time and money from an operational perspective

- Host a series of “Lunch & Learn” workshops to educate customers on specific data tools and technologies

- Set up a dedicated customer support system for questions and guidance

Farm equipment dealers will necessarily play a critical role in the application of digital agriculture, which, according to Zuckerberg “represents the newest — and perhaps the most promising — wave of industry innovation that, in our opinion, can help production agriculture operate more efficiently and sustainably, both in terms of long term financial success and continued environmental stewardship.”

At the same time, he warns that the need for the industry to get its arms around the digital trend goes beyond the farmers’ bottom line. “Midstream food companies and their supply chains (such as processors, storage and transportation companies) are increasingly demanding more data and information. This is largely driven by the end consumer who demands greater transparency about the origin of commercially sold food. In our opinion, consumer sentiment and regulations governing the interest of consumers will ultimately guide the further evolution and adoption of digital agriculture.”

4 Waves of Ag Innovation

Clearly, agriculture has entered a new phase in its evolution with the onset of digital technologies. According to a 2017 report entitled “Cracking the Code on Precision Farming and Digital Agriculture,” Rabobank analyst Kenneth Zuckerberg and strategist Dirk Jan Kennes, say that digital farming is the fourth and most recent wave of ag innovation.

The first was “mechanization,” which started in 1700 and included the horse-drawn seed drill, cotton gin, reaper/binder, combined harvester-thresher and gasoline powered tractor.

The second wave, “ag chemistry” came in the 1940s with the use of chemicals in production farming. The use of nitrogen fertilizers and pesticides moved crop yields far beyond what farmers were capable of producing prior to their utilization. The report authors also point out that “This wave also marked the birth of new farming practices — termed the ‘green revolution’ — that helped improve crop productivity through more effective usage of synthetic fertilizers and crop production chemicals, as well as field irrigation.”

The third wave, “precision farming,” was initiated in the 1980s and ‘90s and initiated the move toward “sustainability” that featured reduced use of inputs and a lowered ag’s environmental impact. The Rabobank report encompassed “gains in plant breeding through genetic engineering and controlled pollination, genetics-based animal breeding, the use of global positioning systems (GPS) on tractors, as well as remote sensing technologies utilizing satellites, drones and other UAVs.”

The report describes “digital agriculture” as the fourth and latest wave of ag innovation. During this stage, tools like cloud-based software and hybrid hardware/software products that are “smart.”

According to the authors, an important “dimension of smart farming involves algorithms, artificial intelligence (AI) and machine learning, which combines mathematics, data analytics and predictive modeling to produce customized recommendations (prescriptions) designed to help growers farm more efficiently, sustainably and profitably.”

Customized prescriptions provide specific advice for managing tasks that occur during the growing season including what to plant, where and when to plant, as well as what to apply to the soil and plants, and how to efficiently apply various inputs. For dairy and livestock farmers, prescriptions offer guidance on when to feed the animal, provide vitamins and/or medicine, when to milk or when to slaughter, as well as other herd management matters.