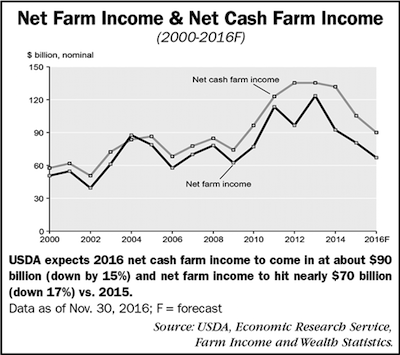

USDA’s Economic Research Service is projecting 2016 net cash farm income will slip to $90.1 billion and net farm income to $66.9 billion, largely the result of declining animal and animal product receipts. Both measures are forecast to decline for the third consecutive year after reaching record highs in 2013 for net farm income and 2012 for net cash income. Net cash farm income is expected to fall by 14.6% in 2016, while net farm income is forecast to decline by 17.2%. These declines follow the 19.8% and 12.7% reductions in net cash income and net farm income, respectively, that occurred in 2015.

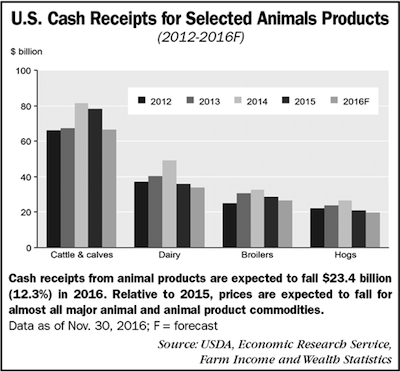

Overall, cash receipts are forecast to fall $23.4 billion (6.2%) in 2016 due to a $23.4 billion (12.3%) drop in animal/animal product receipts; crop receipts are forecast essentially unchanged from 2015. Nearly all major animal specialties — including dairy, meat animals and poultry/ eggs — are forecast to have lower receipts, including a 14.8% drop ($11.6 billion) in cattle/calf receipts. The slight gain in crop cash receipts is driven largely by a $5.3 billion increase in soybeans.

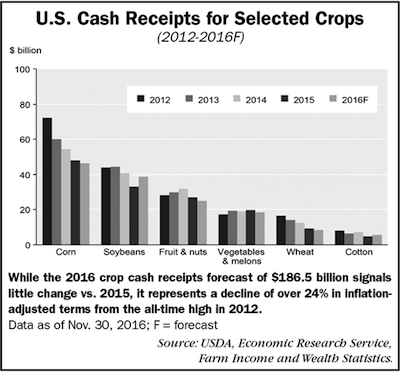

Crop Receipts Unchanged

Crop cash receipts are forecast essentially unchanged i n 2016 as prices continue to decline for most field crops. The crop cash receipts forecast of $186.5 billion represents a decline of over 24% in inflation-adjusted terms from the all-time high in 2012. For corn receipts, the 2012-16 decline is forecast at about 36%, reflecting lower U.S. corn prices. Expected further weakening of corn prices in 2016 more than offset production gains, resulting in corn cash receipts to fall by almost $2 billion (4%) from 2015. Wheat receipts have also declined since peaking in 2012, and are expected to decline almost $1 billion (10%) from 2015 as price declines accompany strong harvests. Increased soybean production is expected to be complemented by higher prices in 2016, buoyed by strong export commitments and indications of higher priced, forward sales. Thus, soybean cash receipts are expected to increase over $5 billion (16%) in 2016.

n 2016 as prices continue to decline for most field crops. The crop cash receipts forecast of $186.5 billion represents a decline of over 24% in inflation-adjusted terms from the all-time high in 2012. For corn receipts, the 2012-16 decline is forecast at about 36%, reflecting lower U.S. corn prices. Expected further weakening of corn prices in 2016 more than offset production gains, resulting in corn cash receipts to fall by almost $2 billion (4%) from 2015. Wheat receipts have also declined since peaking in 2012, and are expected to decline almost $1 billion (10%) from 2015 as price declines accompany strong harvests. Increased soybean production is expected to be complemented by higher prices in 2016, buoyed by strong export commitments and indications of higher priced, forward sales. Thus, soybean cash receipts are expected to increase over $5 billion (16%) in 2016.

Livestock Receipts Sinking

According to the latest ERS report, cash receipts from animal products are expected to fall $23.4 billion (12.3%) in 2016. Relative to 2015, prices are expected to fall for almost all major animal and animal product commodities, especially eggs.

Since reaching a record high of $49.4 billion in 2014, milk receipts are forecast to drop $15.4 billion (31.2%) over 2015-16 as declining prices continue to outweigh expected increases in milk production. Cash receipts from cattle and calves are also expected to decline in 2016, falling $11.6 billion (almost 15%) from 2015. Hog production is expected to continue rising in 2016 as the industry recovers from the porcine epidemic virus (PEDV) in 2014. Hog prices are expected to drop in 2016, leading to a forecast drop in hog cash receipts of nearly 7%. On the other hand, turkeys (up $0.6 billion or 10.6%) and miscellaneous livestock (up $0.2 billion or 2.9%) are both expected to grow in 2016. Poultry and egg cash receipts are expected to fall over 18% in 2016, due primarily to a decline in egg receipts.