A diversified farming operation made up of two partners were committed to planning and sustainable growth. At the same time, they knew they needed a conservative long-term focus that would allow them to adjust quickly to seize opportunities when they were presented.

Case Study Scenario

While it is extremely diversified, this southeastern North Carolina farming operation is not unique to that area. The owners have a business plan in place to guide them through 2018 that will dictate their direction, regardless of where commodity prices go. They view the current climate differently than a lot of operators in that they believe they can use the downturn as a chance to expand.

“This current downturn will create opportunities for somebody. If my client has a chance to double in size in one jump, they want to be prepared with information in place to determine if expansion makes sense,” says Scott Mickey, a farm business consultant with Agri-Directions LLC.

Mickey was brought on board to advise the operators on how they could develop a plan to achieve their far-reaching goals.

The owners are believers in not putting all of their eggs in one basket. They currently raise 1,000 acres of corn, 1,300 acres of soybeans and 1,300 acres of wheat, all no-tilled. Other crops include 175 acres of tobacco, 500 in sweet potatoes, 75 in green beans and 75 in pickle cucumbers. While cotton production is a staple in the area, this operation doesn’t raise it due to low prices and expected profits.

About 500 acres of its corn, produce, sweet potatoes and tobacco are grown under irrigation. In addition, it has a feeder pig finishing enterprise that finishes 22,000 head annually.

Operation at a Glance

Location: North Carolina

Operation: Partnership growing corn, soybeans, wheat, tobacco, sweet potatoes and pickle cucumbers, also a feeder pig finishing operation with 22,000 head annual capacity.

Total Acres: 3,500 (100% cash rent, a portion from the owners’ family)

Employees: 2 owners, 8 full-time employees, 40 part-time/seasonal workers.

Annual Revenue: $5.7 million (average of past 3 years)

The two owners of the operation own no land, at least on paper. The business rents all of its land, both from their family in a separate business entity, and from other landowners. It’s set up that way to ensure all income from each acre is properly accounted for as well as for tax purposes. The two owners employ 8 full-time employees and 40 seasonal workers.

Professional Consultant’s View

Mickey has worked with the farmers for over 15 years and has played a part in developing each step of their scheduled capital expenditure plan. Their earnings before interest, taxes, depreciation and amortization (EBITDA) have been trending higher, averaging $1.2 million the past 3 years.

He says, “The farm operation is quite diverse and requires significant capital investment for the crop and livestock mix. Planning the annual capital expenditures budget has been difficult, as new enterprises required different equipment, and existing enterprises needed equipment upgrades. Evaluating each capital purchase independently might result in good enterprise decisions, but could also lead to excessive exposure, both in liability and cashflow risk, for the whole business. Most equipment is funded via dealer or manufacturer financing programs. The operation needed guidelines to monitor its ability to update equipment while maintaining sufficient capacity for debt service and liquidity.”

You May Also Be Interested In...

Case Study: When is Investing in a New Structure the Right Decision?

In another Harvard Business Review-style case study from this series we explore how a consultant might approach a farmer questioning whether they should invest in a new building.

The owners have maintained a detailed and disciplined business plan throughout the existence of the partnership. One of the key factors in assessing where they stand, related to equipment purchases, is an annual estimate of the EBITDA based on commodity prices and crop mix. Once that number is determined, it is broken down and matched with upcoming machinery needs to determine what purchases can be made.

Sudden market opportunities, such as a “fire sale” by a manufacturer or an opportunity to purchase late model equipment from another producer in distress, may be bypassed if it means exceeding targeted debt levels. The program allows for wise investments when opportunities exist, but only if it suits the longer-term strategy.

Basis of the Strategy

Mickey says their plan is guided by EBITDA, which, he explains, is “simply operating revenue minus operating expenses, so we don’t have any interest expense or depreciation in that number. EBITDA is the money available to spend on family living, interest and debt service. When EBITDA is larger than the amount used for those items, the balance is used to ‘grow’ equity, which could be cash in the bank or funds to purchase other assets. In working with the client, we decided to develop a capital expenditure, or CAPEX, plan based on EBITDA.

“In our CAPEX plan, we are calculating the additional debt that could be serviced, while keeping the farm’s interest and principal payments to less than half of EBITDA…”

“My recommendation is that interest and term principal payments should be less than 50% of EBITDA. In Step 1 of our CAPEX plan, we are calculating the additional debt that could be serviced, while keeping the farm’s interest and principal payments to less than half of EBITDA. Additionally, we are looking at what the farm’s capital expenditure needs are for the next several years. With this information, we determine if our repayment capacity is sufficient to finance those capital expenditures. If not, we then look to see if there is sufficient EBITDA to make the required down payment and keep the payments below the guideline.”

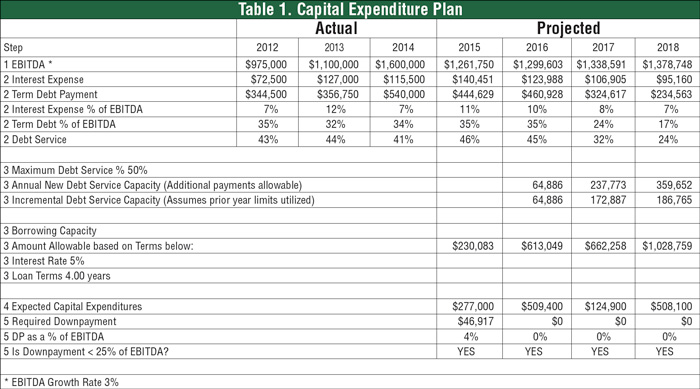

The development of the 2015 business plan (Table 1) started by projecting the farm’s EBITDA for 4 years using the 2012-14 average, and adjusting it upward by 3% annually for inflation. “In Step 2, we calculate interest and principal payments on existing debt for the next 4 years, as if no new purchases were made, estimating operating interest at $75,000 per year,” says Mickey.

“In Step 3, we calculate the additional debt capacity. For this example, we used 50% of EBITDA as our maximum debt service level. Subtracting our scheduled debt service from this amount provides the additional debt service capacity available. Because of equity in equipment trades, most loans have the first payment due a year from initiation.

The capital expenditure plan sets parameters for equipment purchases, which are kept at less than half of earnings.

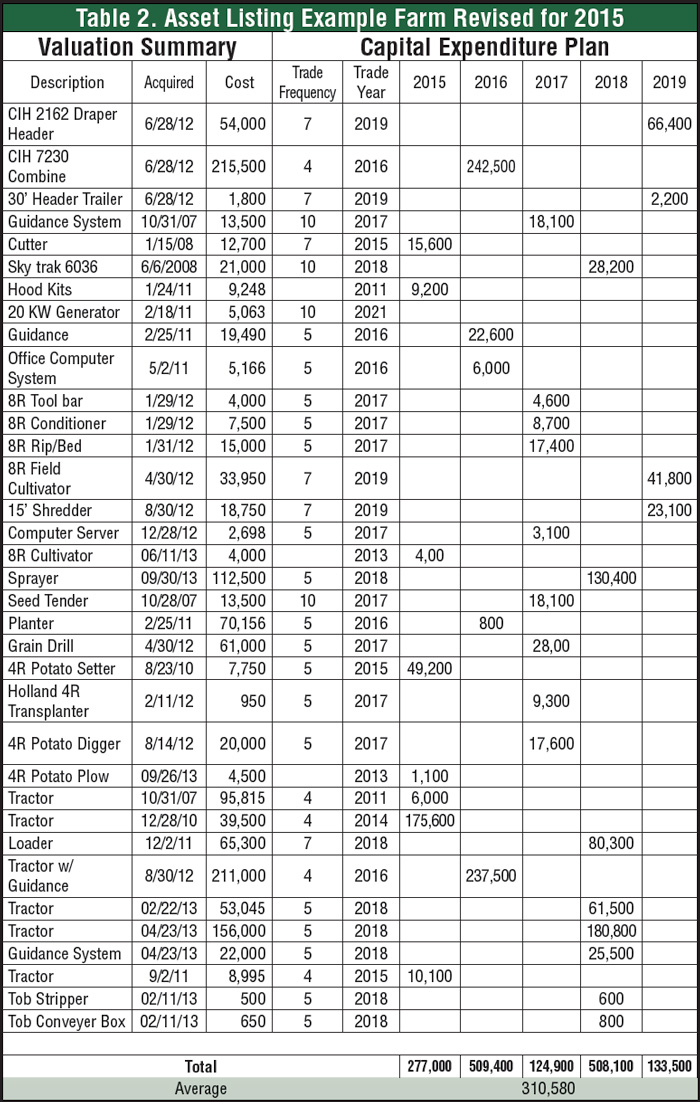

The asset listing details recommended replacement cycles and estimated costs for major equipment.

“We then look to the new capacity in 2016 to determine the maximum we can borrow in 2015. Depending on the loan length and interest rate, different amounts can be borrowed. The incremental debt service capacity is the amount that could be borrowed assuming that all of the available capacity was used in earlier years.”

In 2015, the business’s debt service stands at 46% of EBITDA, with no new purchases, it will stand at 45% in 2016, 32% in 2017 and 24% in 2018. This means much of the debt is being paid down in the next 2 years. Mickey then calculates how much new debt the business can handle and still stay below the 50% level.

What that means in real dollars is that the business can absorb another $64,000 in new payments in 2016. This doesn’t mean there won’t be any purchases during the year since, again, a lot of machinery investments don’t incur payments until the following year. So, figuring a 5% APR, and a 4-year repayment term, a purchase of $230,000 this year would still fit in the business plan.

3 Homework Questions

Scott Mickey, managing partner of Agri-Directions based in Sumter, S.C., says if he was a farmer planning for future capital expenditures, three of the most important questions he would pose include these:

1. How much debt load can my operation sustain?

2. How do I establish guidelines for updating equipment?

3. What can go wrong with this plan?

Click here for the expert’s responses to these three questions.

With the debt percentages dropping sharply in 2017, there’s a dramatic increase in the value of potential machinery purchases. “The maximum debt payment capacity then rises to $237,000 if no purchases are made in 2015. If the debt load capacity were maxed out in the current year, the additional available purchase in 2017 drops to $132,000.” In other words, the more purchases made in the short term, the fewer dollars that will be available in later years.

If interest rates are lower than 5% APR, this will help increase the debt capacity and, if larger needs or opportunities arise, the 48 month term can be changed to 60 months and still fit into the business plan. Mickey recommends keeping a late model pre-owned acquisition financed over 4 years to match the life of the equipment with little upkeep. There is no credit issue with a 5-year note on new equipment.

Documenting Assets

A listing of assets (Table 2) shows a summary of the operation’s major equipment that owners plan to trade between the present time and 2019 with a date of expected replacement. “It shows when we bought the asset and when we thought we would trade it. For the current year, it shows we were expecting to need about $277,000 of new assets. The capital expenditure plan only allows borrowing $230,000. This means we have to make a down payment of $47,000. The plan allows for up to 25% of EBITDA to be used for growth. So on a $1.2 million EBITDA, we actually have $315,000 available for asset growth so the down payment can come from there,” says Mickey.

Having a plan and exercising discipline to follow it is what makes this operation poised for growth through tough times. “What I notice,” Mickey says, “is most of my clients will say, ‘My dealer has a deal, but I have to let them know something tomorrow.’ It’s usually on the 30th and the deal ends the 31st. What happens is that we tend to make a decision in a hurry based on the amount of the new payment. We may forget we have a sprayer, for example, that needs to be replaced in the next 12 months. If we do the deal today, it may make it hard to replace the sprayer when it really needs to be replaced.

“What the asset sheet is trying to do is give us a quick snapshot of what future equipment needs will be,” he explains. “So if a dealer comes to me with a hot deal on a combine, I can look at the list and say, ‘We’re scheduled to trade combines in 2016, but he’s got a deal for me today. Does it really match up with what I want to do? Will it throw my whole plan off? Is there something I need this year that I can put off, kind of trade places with the two items?’

“It’s more a matter of mapping out the business that we’re going to do and making sure that we’re doing the right thing at the right time. We’re trying to make wiser decisions looking at the whole operation, rather than at the current deal in front of us.”

Meet the Expert

Scott Mickey

Managing Partner

Agri-Directions LLC

Sumter, S.C.

803-418-9391

scott@agridirections.com

Scott Mickey is managing partner of Agri-Directions, which provides financial directions to ag businesses specializing in risk management, financial performance and monitoring financial and marketing plans. He grew up on a beef cow-calf operation in West Virginia. Mickey graduated from Virginia Tech in 1986 with a degree in ag economics. He worked 7 years as an extension farm management agent in North Carolina. Since 1995 he has been a farm business consultant with Clemson University, where he provides income tax planning, financial analysis and business planning services to members of the Agribusiness Management Assn.

Built-In Flexibility

The plan does allow flexibility for a “fire sale” type of situation. Mickey acknowledges that the current economic environment may create some real buying opportunities based on the oversupply of equipment. “Say that I’m thinking it’s going to take me $240,000 to trade my combine next year. If the dealer tells me I can trade for $200,000 today, then I’m going to find a way to take advantage of it,” he says. That may include buying some attractively priced used machines as well.

“I’m mainly looking at the dollars and cents, trusting the client knows what he’s getting, used or new. I’m just trying to say, ‘If you’re comfortable with the deal at that price, here’s how the numbers work in the financial plan.’”

So would the overall business plan be dramatically altered if the local dealer wanted to unload a large amount of inventory to get away from interest payments? “Yes, in that situation we’d probably be trading some items that still have debt owed against them. We might have to recalculate a lot of numbers. Once we know what our total payments could be, what we’re looking for is if we can upgrade our entire line and come up with a whole new debt schedule that’s less than 50% of EBITDA. If that’s possible,” Mickey says, “then we’ll strongly consider it. If we were taking on a whole bunch of equipment, then I wouldn’t be trying to pay it off in 4 years. I’d be financing for 5 or even 6 year terms.”

Mickey says the key is to have the plan and make good decisions within it. “If you know what you’re looking for, you’ll make better decisions. So when the dealer comes to you with something he needs to move, you want to compare the offer with what you need. You’ll come to a better decision.”

The operation profiled in this report is somewhat unique for the current business climate. Mickey says 65% of the clients he deals with may have allowed tax consequences to drive their capital purchase decisions. A lot of equipment has been “written off” but not paid for yet. This particular operation is in the other 35% who will navigate through a downturn and possibly emerge better off than before. But, Mickey explains, “They’ve been planning 15 years to be in this position. Proper planning and discipline have allowed them to be on the sidelines waiting to seize the opportunities.”

Web Exclusive: Expert Responses

Click below to view other case studies from this report: