For the last 11 months, we’ve been holding our breath on whether or not Congress would renew Section 179 depreciation limits to 2013 levels — up to $500,000 in deductions. I don’t know about you, but my face is starting to turn blue. The good news is, last week the House voted to pass tax extender breaks that include Section 179 and it looks likely that the Senate will follow suit. Now for the bad news, President Obama has threatened to veto the deal. The reason? “It would provide permanent tax breaks to help well-connected corporations while neglecting the working family,” according to a report in Politico.

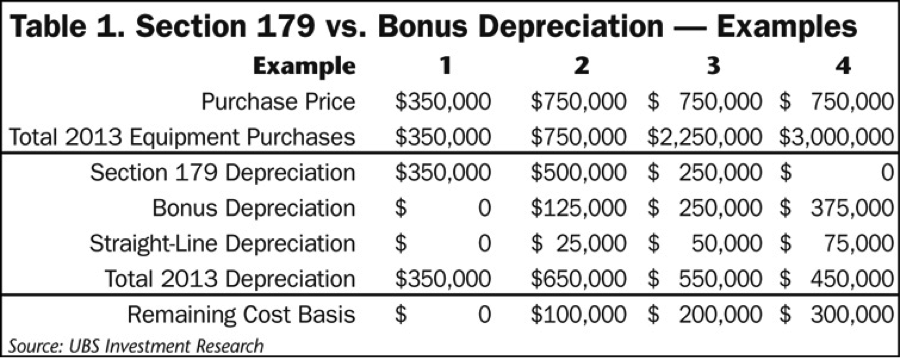

Last time I checked, farmers and farm equipment dealers were working families. When Farm Equipment spoke with Stephen Fisher, an analyst with UBS Investments Research, for a special report on depreciation rules (Farm Equipment, September 2013) he said Section 179 primarily benefits the small to medium-sized farmers. They certainly wouldn’t be considered “well-connected corporations.” Under the 2013 rules, if a farmer made a $750,000 purchase, after the Section 179 Deduction the remaining $250,000 qualifies for 50% bonus depreciation and the remaining basis thereafter ($125,000) qualifies for normal depreciation. The remaining cost basis would be $100,000. If Section 179 was completely eliminated, the $500,000 deduction would go away and while the bonus depreciation ($375,000) and straight-line depreciation ($75,000) would be higher, the remaining cost basis would come out to $300,000. (See table)

If not passed — or worse vetoed by the president — Bonus Depreciation would be gone and Section 179 depreciation would be reduced to a mere $25,000. With lower commodity prices this year it might not be as big of a deal as it would have been with 2012-level commodity prices, as farm incomes are likely to be lower and farmers won’t have their accountant breathing down their neck to make big purchases. However, for those who did have a good year having that $500,000 level in place is often the tipping point to make the decision to buy equipment.

Dealers have grown accustomed to the year-end buying frenzy to qualify for tax breaks. Concern over Section 179 being renewed has been a recurring theme over the last several months in the dealer comments of Ag Equipment Intelligence’s Dealer Sentiments & Business Conditions Update survey. If the Senate doesn’t act soon, it could be a much slower December than in years past. One dealer said, “The farmer that has money is going on a shopping [spree] and is going to get a good deal. Maybe not for the dealer! Section 179 is big. If section 179 is not raised by December it’s going to be a big slow end of year.”

After a year full of dropping commodity prices and farmers holding off on purchases, the passage of the tax break in the next week could be a nice end to the year for dealers.