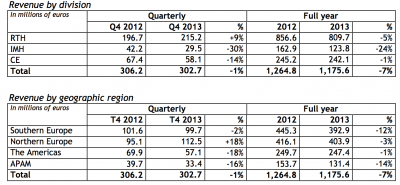

- Q4 Revenue of € 303 million ($410.53 million), a 1% decrease vs. Q4’12

- 2013 Revenue of €1,176 million ($1,593 million), down 7% vs. 2012

- 2013 Revenue decreased -1% at constant scope (Toyota) and exchange rates vs. 2012

- Q4 order intake of 8,900 units vs. 9,000 (including Toyota) in Q4’12

- 2013 Operating margin from continuing businesses is thus revised by approximately 2%

- Anticipation of a stable 2014 Revenue at a constant exchange rate

Michel Denis, President & CEO declared: "The revenue for the quarter is nearly the same as last year’s Q4 revenue (-1%). At constant scope and exchange rates, the revenue is growing by 6%. This growth is the fruit of the strength of our Rough Terrain Handling Division business (RTH) and solid control of our manufacturing operations, which permitted us to produce and deliver to our customers within tight deadlines. The increase in Q4 revenue allows us to partially offset the decrease recorded since the beginning of the year. 2013 revenue decreases by 7% compared to 2012 (-1% at constant scope and exchange rates).

The backlog rises to 7,300 units (vs. 6,200 at the end of Q3) and allows us to be reach a level above end of 2012. Rental firms have already confirmed delivery needs for 2014. This phenomenon is particularly highlighted in the Compact Equipment division (CE), which achieves Q4 revenue well below its traditional seasonality and completes the year with a strong backlog.

At the operating level, our production resources are gradually adapting to diverse market trends in order to maintain our ability to rapidly respond to the demands. The Q4 revenue growth, the backlog level at year-end and our estimates of the evolutions in our three divisions’ markets and geographic regions lead us to foresee a 2013 current operating profit of nearby 2% and a 2014 revenue equal to 2013 at constant exchange rates.”

Business Review by Division

The Rough Terrain Handling Division (RTH) generated a revenue of €m 215.2 increasing its revenue by 9% as compared to Q4’ 12. The demand was especially strong in the access platform business, which reached a historically high level of revenue in 2013. Currency pressures increased during the quarter. Overall, it represented a unfavorable impact of €m 15 on the yearly revenue. Order intake for the quarter once again exceeded the prior year’s fourth quarter, with a marked increase among rentals however less strength in demand within the agricultural sector.

The Industrial Material Handling Division (IMH) realized a quarterly revenue of €m 29.5, a decrease of 30% compared to Q4’12. At a constant scope (excluding the impact of the termination of the Toyota distribution contract), the division reported a revenue growth of +6% compared to 2012. The division has successfully focused its efforts on the development of its industrial forklift-trucks. The very positive reception from end-customers confirms the potential for gradual growth of the product range.

The Compact Equipment Division (CE) reported a decrease of 16% in its revenue compared to Q4’12, at €m 58.1 (-4% at constant exchange rates). Order intake grew strongly to 2,361 units but most deliveries required in 2014. In North America, the Telehandler business for rentals ended the year with the highest backlog since the 2009 crisis. In addition, in this region, the compact skid-steer business is affected by the cost increase linked to the transition towards the Final Tier IV engines.