Art's Way Manufacturing Co. Inc. (NASDAQ: ARTW), a diversified, international manufacturer and distributor of equipment serving agricultural, research and water treatment needs, announces its financial results for the three and nine months ended August 31, 2013.

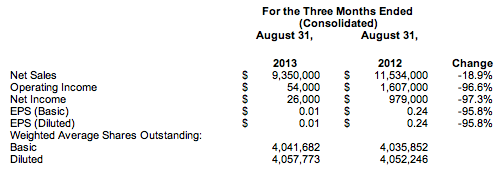

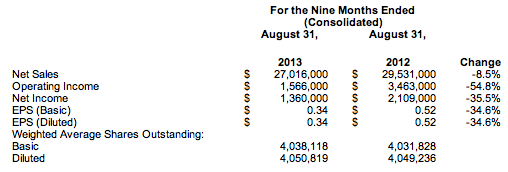

Net Sales: Our consolidated net sales for the three- and nine-month periods ended August 31, 2013 were $9,350,000 and $27,016,000, respectively, compared to $11,534,000 and $29,531,000 during the same respective periods in 2012, a $2,184,000, or 18.9%, decrease for the quarter and a $2,515,000, or 8.5%, decrease year-to-date. As anticipated, this contraction in sales comes primarily from Scientific as detailed below. Consolidated gross profit margin for the third fiscal quarter was 18.5% compared to 29.7% during the same quarter of 2012. Gross profit margin year-to-date of 2013 was 24.7% compared to 27.3% for year-to-date of 2012.

Manufacturing: Our third fiscal quarter sales at Manufacturing were $8,005,000, compared to $8,176,000 during the same period of 2012, a decrease of $171,000, or 2.1%. Year-to-date sales were up to $22,727,000, from $20,170,000 as of August 31, 2012, an increase of $2,557,000, or 12.7%. The year over year increase in revenue was due primarily to additional sales of $1,779,000 attributable to the acquisition of Universal Harvester Co., Inc. ("UHC") in May 2012and $695,000 in increased sales attributable to the self-propelled beet harvester line. Gross margin for the quarter ended August 31, 2013 was 19.4%, compared to 28.1% for the same period in 2012. The third quarter decrease is attributable to additional spending on consumables, inventory write-downs, and labor inefficiency. The year-to-date gross margin was 24.3% in 2013, compared to 28.8% in 2012. The year-to-date decrease is primarily attributable to labor inefficiency.

Vessels: Our third fiscal quarter sales at Vessels were $635,000, compared to $566,000 for the same period in 2012, an increase of $69,000, or 12.2%. Year-to-date sales were $1,671,000, compared to $1,512,000 for the nine-month period ended August 31, 2012, an increase of $159,000, or 10.5%. Gross margin for the quarter ended August 31, 2013 was 16.4% compared to 14.4% for the same period in 2012. Year-to-date gross margin was 10.0% in 2013 compared to 5.9% in 2012. The additional sales have been the main contributor to the improved margins.

Scientific: Our third fiscal quarter sales at Scientific were $710,000, compared to $2,792,000 for the same period in fiscal 2012, a decrease of $2,082,000, or 74.6%. Year-to-date sales were $2,618,000, compared to $7,849,000 for the nine-month period ended August 31, 2012, a decrease of $5,231,000, or 66.6%. The decrease was primarily attributable to the completion of an approximately $7 million fabrication and delivery contract executed in January 2012 and an approximately $1.7 million installation contract executed in April 2012. Scientific was hired to design, fabricate, and install twenty-four modular units over the course of approximately one year for one of the world's leading research and teaching institutions. Most of the revenue for the contract was recognized during 2012. Scientific uses percent complete accounting to calculate revenue and gross margins for all contracts. Gross margin for the quarter endedAugust 31, 2013 was 10.1% compared to 37.4% for the same period in 2012. The third quarter decrease is primarily attributable to the decrease in revenue relative to steady overhead costs. Year-to-date gross margin was 37.3% in 2013 compared to 27.6% in 2012. The gross margin increase was due to the finalization of costs as compared to estimates and miscellaneous reductions in expenses. The team worked hard to control costs as the 2012 fabrication and installation projects were finalized.

Income: Consolidated net income was $26,000 and $1,360,000 for the three- and nine-month periods ended August 31, 2013, compared to $979,000 and$2,109,000 for the same respective periods in 2012. The decrease in net income for the nine-month period is primarily attributable to the timing in net sales and the decrease in sales at Scientific.

Earnings per Share: Earnings per basic and diluted share during the third fiscal quarter ended August 31, 2013 were $0.01 compared to $0.24 for the same period during 2012. Earnings per basic and diluted share during the nine months ended August 31, 2013 were $0.34 compared to $0.52 for the same period in 2012.

J. Ward McConnell Jr., chairman of the Board of Directors said, "The three and nine months quarterly financial results are not as robust as we would like, due to the cyclicality of our business and some labor inefficiency at Manufacturing, which we are addressing. Because of the diverse nature of our business, growth at times can be sluggish. In a challenging consumer and economic environment, we are sharply focused on what's within our control to drive sustained profitable growth, including accretive acquisitions, innovative products, and marketing to new business sectors, as well as labor and cost management.

"As expected, Scientific is down after a record year in 2012, but the Scientific team is taking an aggressive marketing and sales approach to increase revenue. We expect the company to grow with the recently announced acquisitions of Agro Trend and Ohio Metal Working Products Company, additional product offerings and expansion into new markets. We believe our future is very bright. The company believes our targeted agricultural niche products present profitable opportunities and that the agricultural sector remains an attractive investment due to near-record income expected this year on the farm.

"We are optimistic that with the global expansion of our brands in Japan and in Canada, the sound execution of our business strategies will continue to drive long-term growth and shareholder value. We remain confident our customer-focused, diversified business model will help us manage through these periods of slower growth."

About Art's Way Manufacturing, Inc.

Art's Way manufactures and distributes farm machinery niche products including animal feed processing equipment, sugar beet defoliators and harvesters, land maintenance equipment, crop shredding equipment, round hay balers, plows, hay and forage equipment, manure spreaders, reels for combines and swathers, and top and bottom drive augers, as well as pressurized tanks and vessels, modular animal confinement buildings and laboratories and specialty tools and inserts. After-market service parts are also an important part of the Company's business. The Company has four reporting segments: agricultural products; pressurized tanks and vessels; modular buildings; and tools.

For more information, including an archived version of the conference call, contact: Jim Drewitz, Investor Relations 830-669-2466 jim@jdcreativeoptions.com