Despite posting hefty revenue gains through the second quarter and first half of its 2014 fiscal year, Titan Machinery cut its full-year outlook to $2.25-$2.45 billion from its earlier forecast of $2.35-$2.55 billion. Titan, whose biggest brand of ag and construction equipment is Case IH, has 109 locations in the U.S. and Eastern Europe.

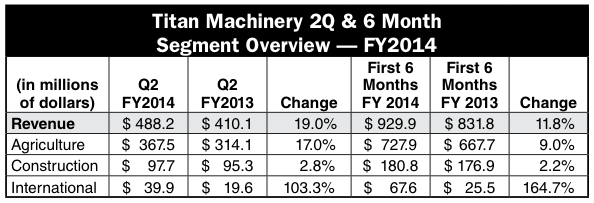

For the second quarter ended July 31, the dealer group posted revenue gains of 19% to $488.2 million vs. $410.1 million for the second quarter last year. Equipment sales were $358.4 million compared to $306.2 million in the second quarter last year. Parts sales were $70.6 million vs. $57.9 million. Revenue from service was $39.9 compared to $30.5 million. Rental and other revenue increased to $19.3 million vs. $15.5 million in the second quarter last year.

Gross profit for the second quarter $83.5 million, compared to $70.4 million last year. The company’s gross profit margin was 17.1% in the second quarter of fiscal 2014, compared to 17.2% last year. Gross profit from parts, service, and rental and other for the second quarter of fiscal 2014 was 65% of overall gross profit and increased to $54.2 million from $43.5 million in the second quarter last year.

The company said that solid performance from its parts, service, rental and other was offset by softer equipment margins.

Rest of the Year

“As we look toward the back half of the year for our agriculture business, we anticipate a challenging environment given lower commodity prices combined with anticipated reduced crop production in our agriculture footprint,” David Meyer, Titan’s chairman and CEO, said.

“We believe these factors will affect our customers’ sentiment, resulting in lower equipment revenues and pricing pressure on equipment margins.”

In a note to investors, Rick Nelson, analyst for Stephens, said he isn’t looking for a significant uptick any time soon in either ag or CE.

“Our fiscal 2015 estimate calls for flat ag and construction comps. We look for slightly higher gross margins as service and rental becomes a bigger proportion of sales. Our estimates may prove conservative if strategies pull together but visibility is limited.”

Nelson says the ag environment is likely to remain challenging given lower commodity prices combined with anticipated reduced crop production in Titan’s ag footprint. “Dry conditions and high temperatures will affect production relative to other areas in the U.S. that have more favorable conditions. These factors are expected to impact equipment sales and pressure margins. Management indicates that costs are rising in advance of new Tier 4 equipment.”

The construction market continues to be a tough nut to crack for Titan Machinery and the company has shaken up top personnel to get that part of its business back on track.

“While we view construction initiatives and key management hires favorably and expansion into Eastern Europe as a positive longer-term driver, we remain cautious until we gain greater clarity into the slope and duration of the North American ag cycle correction,” Mircea (Mig) Dobre of RW Baird told investors in a note.

Slowed Growth

Titan also indicated that it plans to slow its acquisition growth, but indicated that this remains a key factor in its long-term plans.

During a conference call with analysts, Meyer said, “We have slowed our acquisition pace and are focused on integrating our recent acquisitions into our distribution network and positioning our business to achieve improved leverage going forward.”