Money in their pocket entices farmers to upgrade their equipment; generous depreciation allowances simplify their decision.

There's little doubt that escalating commodity prices since 2007 have resulted in higher farm incomes and fueled a steady rise in farm machinery sales. And as farmers' incomes improved, so did their need for deductions to reduce their overall tax burden. Enter a farmer-friendly Section 179 and bonus depreciation rules in 2008. These, together with the rising commodity prices, have allowed equipment dealers and manufacturers to enjoy an extended run of sales that they hadn't seen in some years.

Steven Fisher, machinery analyst for UBS Investment Research, describes the impact of generous depreciation allowances on the sale of ag machinery simply: "Section 179 and bonus depreciation move the needle in the buying decision."

Earlier this year, Fisher and his colleagues at UBS released a research report to investors that focused on the impact of special depreciation on machinery purchases. The report highlights the various depreciation allowances for purchasing new and used machinery and quantifies their impact on cash flows in the purchasing process. "We show that tax deductions offset a significant portion of upfront cash outflows for purchasing a new or used tractor, often offsetting the entire down payment," he says.

The study also looks at "what if" the current Section 179 depreciation limits were to be significantly lowered or if bonus depreciation was eliminated. Fisher says that if this scenario should become a reality, "the upfront cash cost of purchasing new or used machinery would increase materially. In our analysis, we show that buying a new or used $200,000 tractor would require about $50,000 more cash upfront without a meaningful Section 179 allowance."

In other words, lowering depreciation allowances could have an unfavorable effect on the current high sales levels dealers have experienced in the past 5 years. Combine this with falling commodity prices, as is currently projected, and the industry could see a measurable slowdown in ag equipment sales.

"We believe there is strong support for depreciation benefits at the manufacturer and customer level," says Fisher. "We assume the provisions will be part of a broader tax reform discussion, which may take time to resolve. As a result, we think there will be ongoing headline risk, driving concerns of either reductions or eliminations."

Section 179 vs. Bonus Depreciation

There are key differences between allowances under Section 179 and bonus depreciation. Understanding how to best apply each can improve the dealer's sales process and aid farmers in making smart decisions in their capital equipment purchases.

According to the UBS report, Section 179 allows for accelerated depreciation of an asset in the year of purchase; the current law allows for up to $500,000 in deductions in 2013, with this benefit phasing out once buyers purchase over $2 million of equipment in 2013. If a company cannot expense its entire machinery purchase using Section 179, it may write off 50% of the initial purchase price using bonus depreciation.

Other key differences include:

- Bonus depreciation can only offset new equipment, but Section 179 can offset new and used as long as it's "new to you."

- Bonus depreciation can be taken in a year with a net operating loss, and carried forward to future years; Section 179 cannot.

- Bonus depreciation does not have a $500,000 deduction limit and does not phase out with equipment purchases over $2 million.

- "It is important to differentiate Section 179 from bonus depreciation as they may be legislated separately on a go-forward basis," says Fisher.

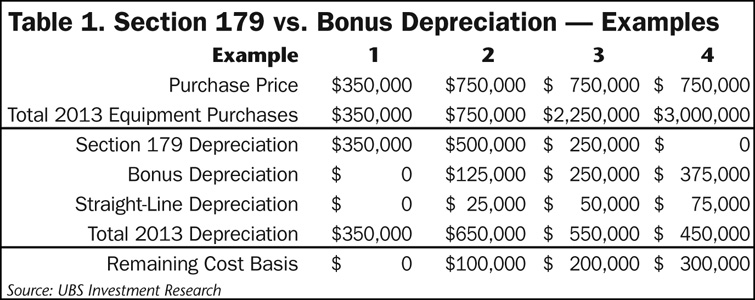

In Table 1, UBS illustrates how the two differ and how they affect different size farmers and purchase amounts. This table shows various examples of Section 179 depreciation vs. bonus depreciation. According to the UBS analyst, Section 179 provides a greater deduction and primarily benefits small to medium sized farmers. Fisher also notes that Section 179 primarily supports the used machinery market, as large new machinery buyers are typically purchasing at amounts where Section 179 no longer provides a benefit. On the other hand, bonus depreciation is a benefit to large new machinery buyers of any size, though this benefit as a percent of total machinery cost is lower than that provided under Section 179.

Example 1 in Table 1 is for a small farm with a single machine purchase. Example 2 shows a single, large machine purchase that exceeds the $500,000 deduction limit of Section 179.

After the Section 179 deduction is exhausted in Example 2, the remaining cost basis ($250,000) qualifies for a 50% bonus depreciation, and the remaining basis thereafter ($125,000) qualifies for normal depreciation, which in this case, is straight line over 5 years.

Example 3 shows the impact of a 50% phase-out of the Section 179 depreciation allowance. Example 4 shows a complete phase-out of the Section 179 depreciation allowance.

No More Section 179?

If a farmer is on the fence about a major equipment purchase, the generous depreciation allowances available through Section 179 have been known to speed up his buying decision. But what if this provision were to disappear?

According to Fisher, buying a new or used $200,000 tractor with a Section 179 depreciation allowance requires about $50,000 less in cash up-front vs. buying a tractor without a significant Section 179 depreciation allowance. "We believe removal of the Section 179 benefit would cause material delays in the purchases of new or used machinery," he says.

According to the UBS report, Section 179 provides two benefits. First, it reduces the year 1 cash outflow by providing a large tax deduction in the year a tractor is placed in service. This is convenient as it largely offsets the impact of higher cash outflows for a down payment.

Second, it provides a time value of money benefit as it provides greater depreciation in the first year of ownership, offset by lower depreciation - and possible depreciation recapture - in later years.

Calculating the Cost of Owning a Tractor

Earlier this year, Steven Fisher, machinery analyst for UBS Investment Research, issued a special report prepared for investors that focused entirely on the impact of special depreciation on farm machinery purchases.

Within the report, he also provided background on the cost of owning a farm tractor, with the first table illustrating cash flow implications, and the second demonstrating the tax impact of the purchase with the Section 179 depreciation allowance.

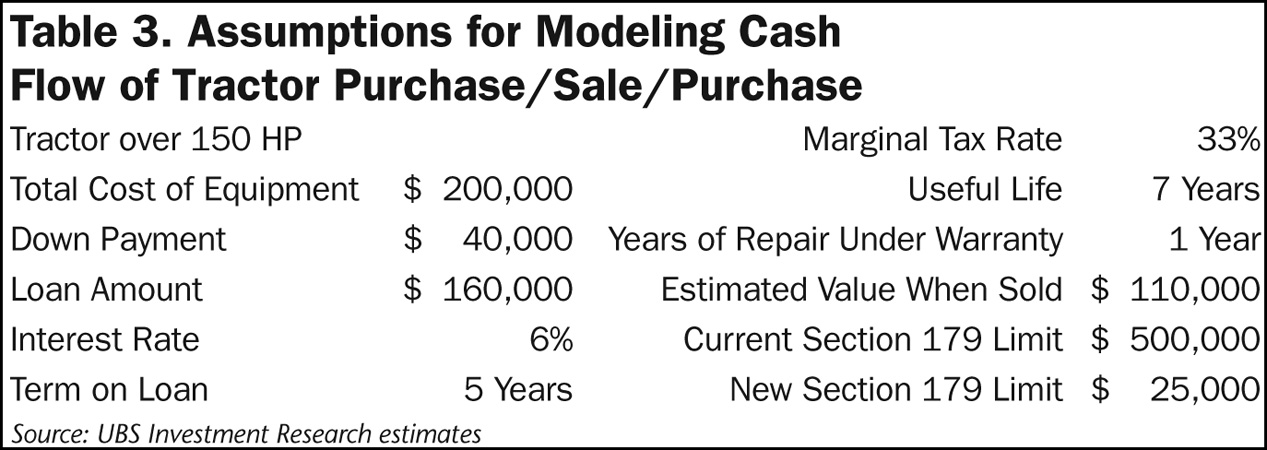

UBS and the Iowa State Univ. Extension Service developed the assumptions used in calculating the costs. These include:

Tractor over 150 HP

Marginal Tax Rate: 33%

Total Cost of Equipment: $200,000

Useful Life: 7 years

Down Payment: $40,000

Years of Repair Under Warranty: 1

Loan Amount: $160,000

Est. Value when Sold: $90,000

Interest Rate: 6%

Current Sect. 179 Limit: $500,000

Term on Loan: 5 years

(Click to Enlarge)

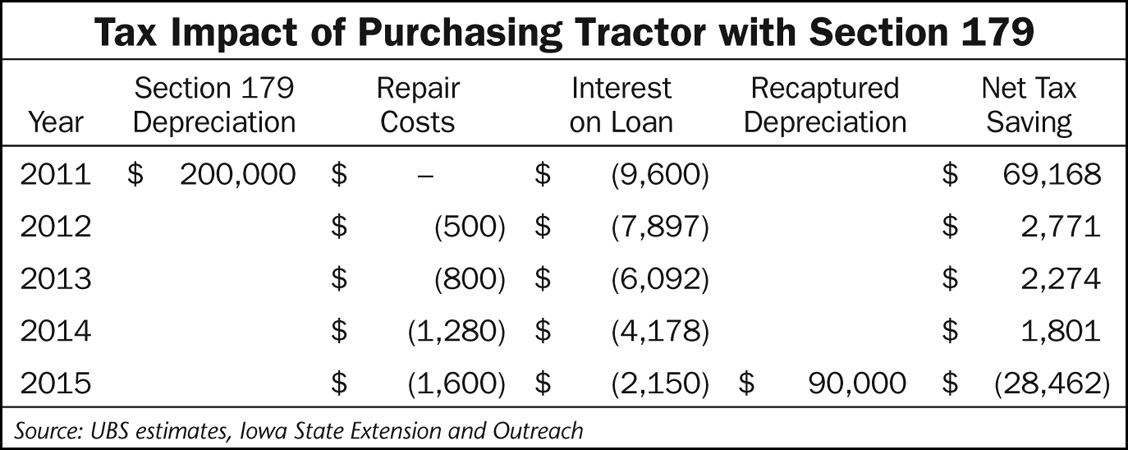

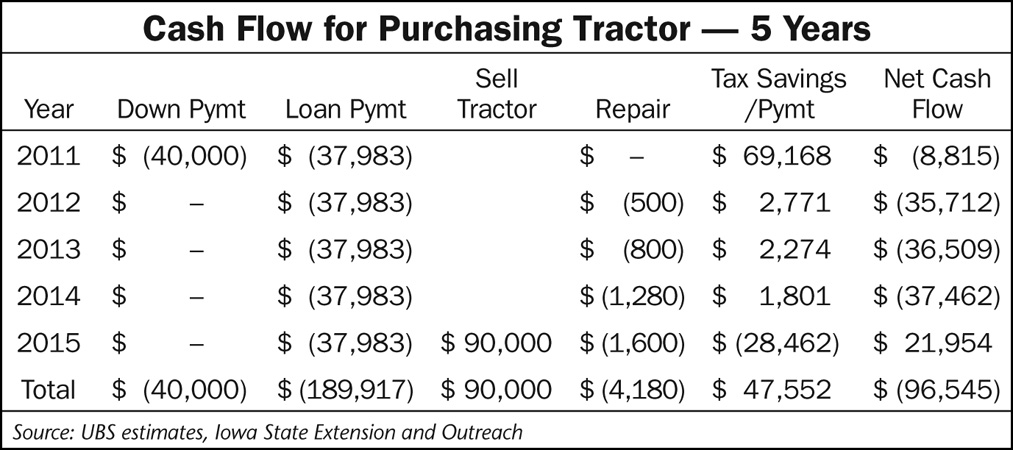

The first table shows the annual ownership costs associated with purchasing a $200,000 tractor and holding it for 5 years. According to Fisher, this example can be applied to a wide range of farm machinery.

The second table shows the cash flow benefit/payment attributable to taxes. Section 179 currently allows for a full deduction of farm equipment under $500,000 in its first year in service, producing a significant cash benefit from taxes in the first year.

The main takeaway, says Fisher, is "Section 179 plays a significant role in offsetting the initial cash cost in purchasing new equipment, largely offsetting - and sometimes completely offsetting - the amount of the down payment."

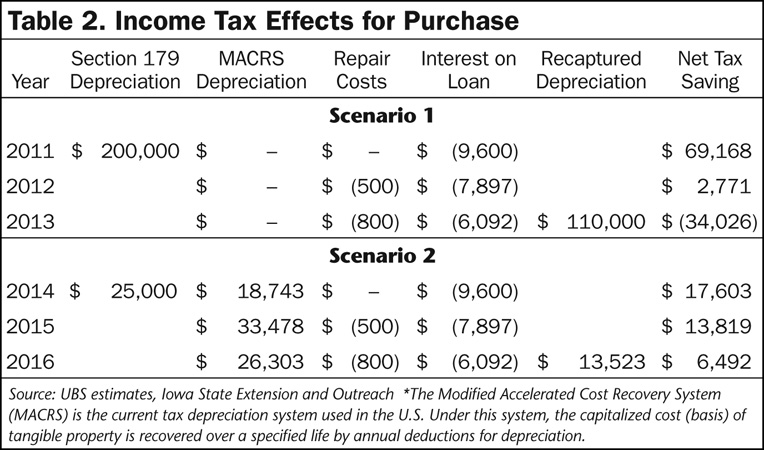

In Table 2, UBS analysts lay out two scenarios: one shows the impact of the Section 179 depreciation as it currently stands. The second scenario illustrates the same purchase decision, but with a much lower deduction limit.

In the first scenario, a $200,000 tractor is purchased on January 1, 2011 and held for 3 years, before being sold for $110,000. As the $200,000 is below the $500,000 deduction limit for Section 179, the entire cost of the tractor can be deducted in year 1. Fisher explains that, in this case, the excess of the sale price over the book value of the asset is "recaptured" at the marginal tax rate, 33% in UBS's simplified assumptions. As the book value is $0, the recaptured tax liability is significant.

In the second scenario, a much lower Section 179 deduction limit is applied ($25,000 in this example) and no bonus depreciation allowance is available. A $200,000 tractor is purchased on January 1, 2014, and held for 3 years before being sold for $110,000. As only $25,000 of the total $200,000 purchase price can be deducted immediately, the remaining cost basis is depreciated using MACRS 150% declining balance methodology. The excess of the sale price over the book value of the asset is "recaptured" at the marginal tax rate of 33%.

Fisher notes the total net tax savings for Tractor 1 between 2011 through 2013, and Tractor 2 from 2014 through 2016, are identical at $37,913.

The benefit of Section 179, he says, is it significantly reduces the total cash outflow in 2011, the year in which the down payment is made. It also has a time value of money component, as cash flows under Section 179 are front-end loaded.

Cash Flow & Section 179

ext/resources

(Click to Enlarge)

Table 3 shows the UBS assumptions for modeling the purchase of a new tractor on January 1, 2011, which is sold 3 years later, followed by a new tractor purchase on January 1, 2014. This analysis assumes the $500,000 Section 179 limit through 2013, but only a $25,000 Section 179 limit starting in 2014.

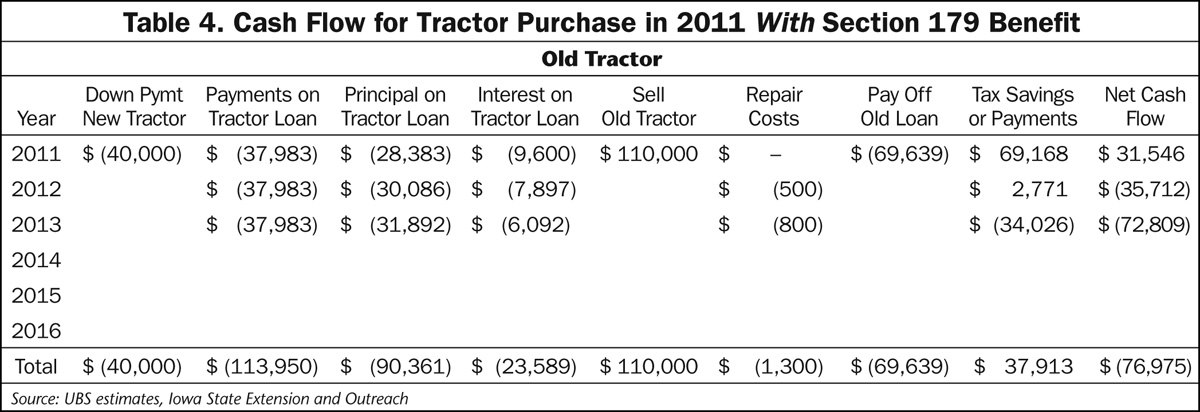

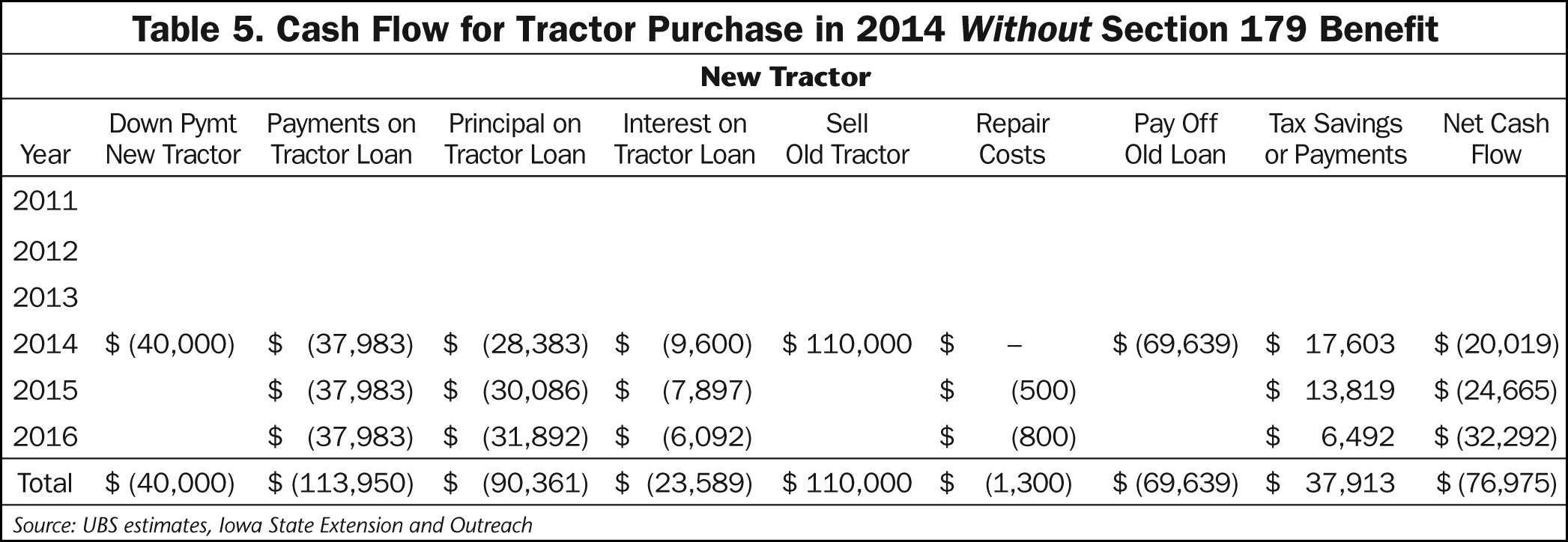

In addition to the tax advantages available with the Section 179 depreciation, UBS also illustrates its positive effects on cash flow in Table 4. On the flipside, Table 5 shows the impact on cash flow without the current depreciation levels afforded by Section 179.

"As our example shows (Table 4), the total cash outflows in 2011 are actually positive as the benefit of selling the old tractor," says Fisher. "In this example, we assume a $110,000 tractor is sold to purchase the new one and the Section 179 tax benefit offset the purchase price, loan payment and cost of paying off the old tractor loan. For our purposes, we assume there's a remaining balance of $69,639 on the old tractor loan."

On the other hand, Table 5 shows the cash flow impact of buying a new tractor on January 1, 2014 in an environment without a significant Section 179 tax benefit. In this example, UBS uses $25,000. Fisher points out that dealers should note that the year 1 cash flow is over $50,000 lower in an environment without a significant Section 179 tax benefit.

At the same time, he notes the total 3-year cash flows shown in Table 4 and Table 5 are identical. "The depreciation methodology does not impact cash flows over the total life of the asset. That said, we see that Section 179 provides a significant benefit in offsetting the purchase cost of a new tractor, as well as a meaningful time value of money benefit by front-loading tax deductions."

The Bonus Depreciation Effect

Much like the scenario where Section 179 depreciation benefits were significantly reduced, the elimination of bonus depreciation could also complicate a farmer's decision to purchase new machinery. It's important for dealers to note this because without new legislation, bonus depreciation will not be available for 2014.

According to Fisher, eliminating bonus depreciation would require a considerably higher upfront payment to purchase equipment. "In percentage terms, this impact is less than the scenario of eliminating Section 179, where the upfront cash requirement increased by over $50,000 for a $200,000 tractor, or more than 25%.

"This is higher than the $442,000 year 1 cash headwind on a $3 million purchase without bonus depreciation, or less than 15% of the purchase price."

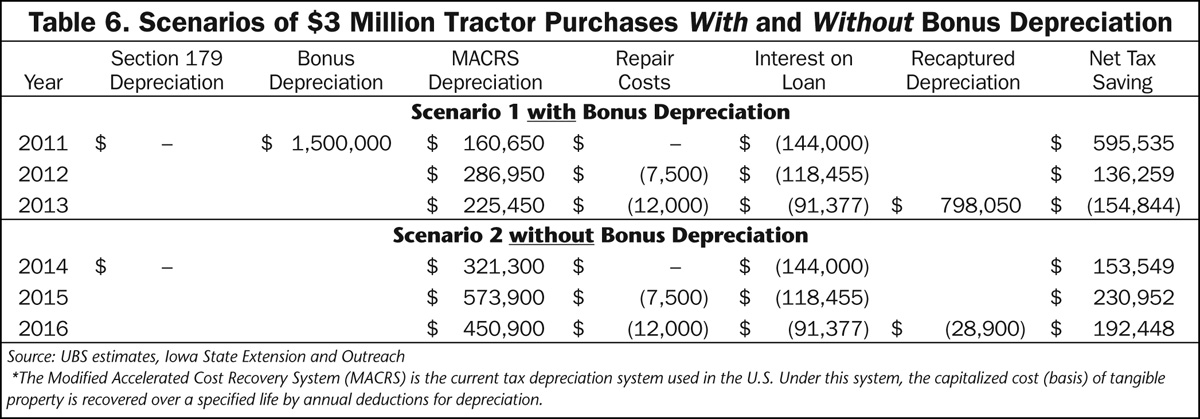

To illustrate why bonus depreciation is more meaningful for larger transactions, UBS provides two scenarios in Table 6 where a farmer purchases $3 million of new machinery in an environment with and without bonus depreciation.

"As was the case with Section 179, the total cash flow impact is inconsequential not considering the time value of money," says Fisher. "However, the initial payment required from the farmer is more significant as the upfront tax savings cannot be applied against a down payment."

In Scenario 1, with the purchase of $3 million in machinery, it is assumed that $1.5 million in bonus depreciation can be applied under the current rules.

When combined with additional MACRS depreciation and other deductions, a total net tax savings of $595,000 is realized assuming a 33% marginal tax rate.

Scenario 2 shows the impact of a purchase without the benefit of bonus depreciation. The farmer would need to pay $442,000 more in year 1 as he will no longer receive the benefit of accelerated depreciation. In both scenarios it is assumed the machinery is sold for $162,500 at the end of year 3.

According to Fisher, The 'cost' of bonus depreciation is essentially the opposite of the savings realized by the farmers; bonus depreciation creates an up-front tax loss that is offset with higher tax collections over time, the UBS analyst explains.

"As an example, in October 2010, President Obama suggested expanding bonus depreciation from 50% to 100%. The White House estimated that the total tax loss over the 2 year proposed period would total $150 billion in addition to other existing accelerated depreciation methods, but the total net cost over time was expected to be less than $30 billion."