Results from the most recent Dealer Sentiment & Business Conditions Update survey shows that North American farm equipment dealers are feeling a bit better about their business prospects these days. At the same time, commentary from the survey indicates that dealers are still gun shy about making big plans for 2013.

The survey conducted by Ag Equipment Intelligence and Cleveland Research Co. (previously called Dealer Trends & Business Outlook) revealed a significant jump in the Dealer Optimism Index (DOI) after three months of negative scores.

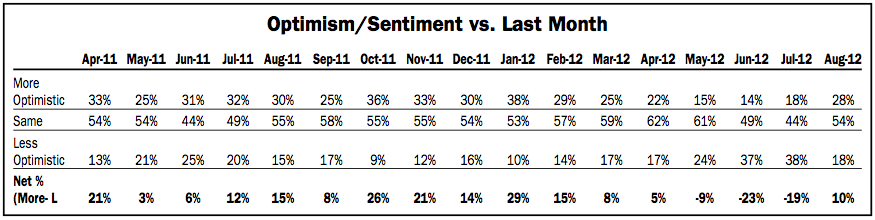

The DOI, a measure of sentiment among dealers compared to the prior month, showed strong improvement to a net 10% of dealers reporting they have a more optimistic outlook now vs. a net 19% last month reporting they were less optimistic about the next year. The latest DOI scored out as 28% are more optimistic; 54% same; 18% are less optimistic.

Ag equipment dealers also reported year-over-year sales grew 4% on average in August, flat from 4% in July. “Other” and Kubota dealers saw sequential growth of 8% and 6% respectively, while Shortline and New Holland dealers say business declined 3% sequentially.

Optimism/Sentiment vs. Last Month

For 2012, dealers slightly increased their sales forecast and expect 4% sales growth for the full year vs. 3% in July. John Deere, Kubota and “Other” dealers are the most optimistic this month while New Holland and Case IH dealers report the least optimistic outlook.

Another encouraging note from the survey is, after several months of slightly softer used values, tractor values in August moved higher in both under 100 horsepower tractors and tractors over 100 horsepower as drought concerns appear to have abated to some degree.

Dealer comments on the positive side included:

• Prices are up and harvested yields are good.

• Farmer demand is holding steady because of yields and Section 179 status.

• Decent rain in our area and hay equipment sales went up significantly.

From the other side of the table:

• Drought is still on everyone’s mind here.

• Continued hot and dry weather are hurting us.

• Concerns with drought and crop quality are at the top. Also growers aren’t ready to spend until cash is in hand.

Several dealers mentioned that early orders have taken a beating and equipment delivery continues to be a problem.

• We’re seeing fewer pre-sells this month.

• We’re seeing a general slowing over last few months.

• I don’t have many commitments for next year … and don’t expect many.

• We’re having trouble getting product.

• Some European built products have been on order for almost 18 months, several which were converted from stock orders to retail orders seven months ago.