Powered by IRON Solutions Gold Standard Data

This installment of Trade Values & Trends looks at the reported monthly sales of used four-wheel drive and large row-crop tractors over a three-year period.

There is a strong market for late-model, low-hour used tractors. As the price of new tractors rise, it follows that values of used tractors would also increase. Plus, farmers are doing well financially and are willing to spend more money for the technology found in newer used tractors.

Rising Tractor Values

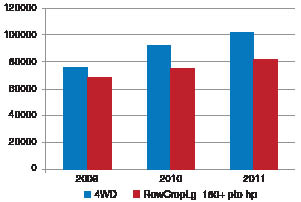

Figure 1 looks at the average sale price reported to IRON Solutions of four-wheel drive and large row-crop (more than 180 PTO horsepower) tractors for 2009, 2010 and 2011. The average price of four-wheel drive tractors in 2009 was $76,203. That climbed to $92,694 for 2010, and by last year they were selling for an average of $102,563. Row crop tractors follow the same trend line, going from $68,595 in 2009 and climbing to $81,937 in 2011.

Avg. Selling Price of Used 2WD & 4WD Tractors

Figure 1. The average sale price for used four-wheel drive and large row-crop tractors has risen dramatically between 2009 and 2011.

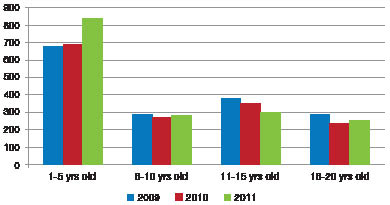

Figure 2 and 3 chart the volume of machines reported sold, broken down by four-wheel drive and row-crop tractors. In 2011, the data shows that sales of 1-5 year-old four-wheel drive tractors increased 24% over 2009 numbers. The rising sales volumes are attributed to farmers buying for tax reasons and building their fleets as they expand their operations.

Reported Unit Sales of Used 4WD Tractors

Figure 2. Reported sales of late-model used four-wheel drive tractors spiked in 2011, partly as a result of farmers who were flush with cash from high commodity prices.

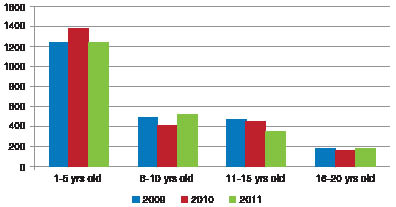

Sales volumes for both tractor types were steady among 6-10 year-old machines over the three-year period, while the volume of tractors sold goes up for 11-15 year-old machines. The best sales year for the latter category was 2009, when 384 four-wheel drive and 463 row-crop tractors were reported sold. That number decreases by nearly 100 units in 2011. The number of 16-20 year-old machines reported sold also drops off quickly, particularly for row-crop tractors.

Reported Unit Sales of Used Row-Crop Tractors

Figure 3. Reported sales of 11-15 year-old large row-crop tractors are trending downward, which may indicate they’re still too expensive for small acreage farmers.

Newer Tractors Move Quickly

The fact that more 1-5 year-old four-wheel drive tractors were sold in 2011 could indicate there were more of those machines on the market. As a greater number of well-financed farmers buy new tractors, they’re trading in newer used machines.

These trends are also representative of the buyers themselves. When it comes to buying equipment, there are several tiers of customers. Farmers with smaller acreage may be shrinking in number, but they’re still buying 6-10 year-old machines. For others, the value of 16-20 year-old machines is coming down to where they’re affordable. These farmers won’t put that many hours on the units and price is a driving factor in the purchases.

IRON Solution’s data says the number of 11-15 year-old machines reported sold is trending downward, which may indicate they’re still too expensive for the lower tiered buyer. Plus, the technological leap between tractors built in 1992 vs. 1997 may not be significant enough for lower-tier farmers to justify the additional cost.

Dealer Takeaways

Dealers taking in four-wheel drive or row-crop tractors on trades can expect a better turn on a 1-5 year-old machine. Although dealers will pay more money on the trade-in, it will not sit on the lot for long. This is particularly true with four-wheel drive tractors. Dealers are selling a greater number of late-model machines than they did in 2009, which is lifting the average price.

While adopting the latest tractor technology is an incentive for farmers who can afford to buy the newest tractor on the lot, there is another factor to consider. Concern over the long-term reliability of the advanced electronics may be a reason farmers are trading up more frequently.

With Tier 4 interim engines making their way into the marketplace in order to meet U.S. Environmental Protection Agency (EPA) regulations, there’s always talk of a “prebuy,” where customers rush out to purchase machinery before significant design changes are implemented. IRON Solutions’ data reveals this is not occurring to any great extent. One of the reasons could be that farmers are not sure which emissions solution to adopt. The EGR/SCR debate may likely become a modern version of the Beta/VHS videotape scenario from the 1980s, and farmers are not rushing to place their bets just yet.

As publishers of the Equipment Industry’s Official Guides based on gold standard equipment data, IRON Solutions gathers data on used machinery transactions from dealers, auctions and other sources. For information on the Official Guide, the gold standard data and other dealer solutions provided by IRON Solutions, visit www.ironsolutions.com.