This installment of Trade Values & Trends looks at reported monthly sales for used farm tractors from the start of 2008 through early 2011.

Used tractor prices are rebounding from the lows of 2008. Last year, the market for late-model used tractors was strong, and recent sales figures from dealers reveal that the trend is continuing into 2011.

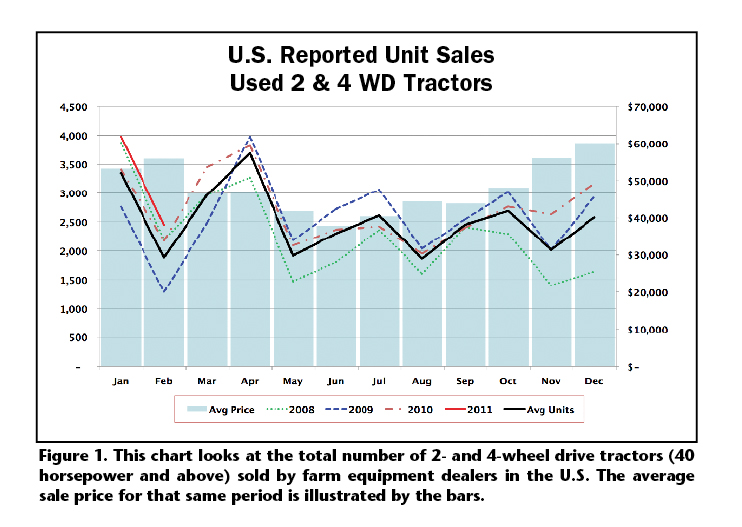

Figure 1 illustrates the total number of 2- and 4-wheel drive tractors (40 horsepower and up) that were reported sold by farm equipment dealers in the U.S. That data has been placed on top of a bar graph that shows the average sale price for that same period.

As shown, the sale price for used farm tractors is considerably higher in the winter months than during the growing season. This trend may be due to fact that the majority of tractors purchased between November-February are trade-ins that have been pre-sold by the dealer. These are typically late-model tractors in good condition. When a farmer’s equipment requirements changes suddenly in the middle of the busy season, he may have to settle for well-used, lower-priced tractors that are still sitting on the lot.

The solid black line in Figure 1 is the average number of units sold for the years covered by the data. During the time represented, the only year when prices and the number of units sold were lower than the average was in 2008 and 2009.

In the first two months of 2011, the number of used tractors sold and the value they commanded have been well above the 3-year average. While this year’s pattern already mirrors previous years — with higher volumes and better prices realized in the winter — the average price is 15% higher compared to 2010 pricing for same or similar equipment. This bodes well for sales for the remainder of 2011 — thanks to high commodity prices and the demand for good used tractors. Concerns about new Tier 4 interim engine technology being introduced this year may also be a factor.

Figure 2 shows a closer look at the monthly average sale price for used 2- and 4-wheel drive tractors for 2010, and how that compared to the average prices for the previous combined months of 2008-09.

Note to Dealers: Report Often

In compiling its quarterly Official Guide of equipment prices, IRON Solutions uses the actual transaction prices of used farm equipment as provided by participating dealers. While more than 60% of the reports arrive electronically within a week after the equipment is sold, other reports are received toward the end of each quarterly publishing cycle, which contributes to some of the quarterly peaks and valleys shown in Figure 1. Data shown on the chart represents actual used tractor sales. The extreme highs and lows may be slightly exaggerated because of the timing of when some reports are submitted to IRON Solutions. For dealers, this highlights the value of reporting sales as soon as they are completed.

Over the years, IRON Solutions has streamlined reporting equipment sales for many dealers, providing prompt reporting methods through numerous products and services, including IRONsearch.com, IRON HQ, Enterprise xSellerator and more. If you are one of the few dealerships currently not reporting to the IRON Solutions Official Guides, or want to learn about one of the electronic services to automatically report to the guides, contact IRON Solutions at 877-266-4766.

Dealer Takeaways

For farm equipment dealers, the data shown in Figure 1 is a reminder that pre-selling trade-in units or striving to sell good used tractors early in the year is best to get the highest price. If a dealer accepts a trade-in as the growing season gets under way and buyers become busy, he may have to accept a lower price in order to move the tractor.

Dealers should also be aware that the market for older tractors is diminishing. Dealers sitting on units that are 10 years old or older may have a difficult time finding a home for them without significant price reductions. Tractors have seen so many advances in efficiency and comfort in recent years that farmers aren’t as apt to purchase older models as they were a few years ago.

These days, sales are strong for both new and used tractors. How the higher prices of new emissions-reducing tractors will affect used equipment values depends on whether farmers put off the purchase of a Tier 4 interim tractor and opt for a low-hour used machine. If that happens, new sales could fall while used equipment sales remain strong. With growers flush with cash, they may not be as price-conscious. Thus, higher prices for new tractors may not have a significant impact on new equipment sales.

The information is provided by IRON SOLUTIONS, publishers of the Equipment Industry’s Official Guides based on gold standard equipment data. IRON SOLUTIONS gathers data on used machinery transactions from dealers, auctions and other sources and provides real-time equipment valuation information needed to make the best pricing decisions. For information on IRON Guides and other dealer solutions provided by IRON SOLUTIONS to price right and sell faster, visit www.ironsolutions.com. FE