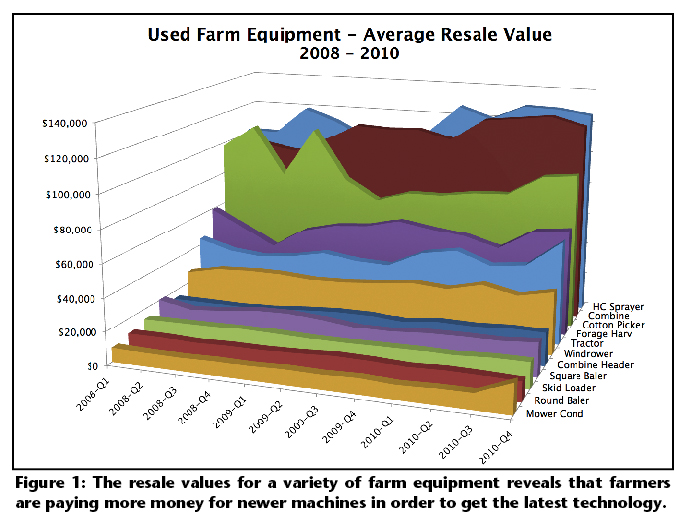

This installment of Trade Values & Trends takes a look at resale values of various types of farm machinery over a 3-year period. The data includes several machinery types, ranging from mower conditioners at the low end to high-clearance sprayers in the upper price range. The resale values for 7 tractor sizes have also been given a close look.

There was a lot of volatility in the farm market in 2008, which is illustrated in the peaks and valleys for high-priced machines in Fig. 1. Two years ago, an oversupply of large farm equipment, such as combines, gave farmers more leverage when it came to negotiating a purchase price.

The relatively stable or upward-trending prices shown in these charts supports Farm Equipment’s “2011 Dealer Business Outlook & Trends” report, which found that more than half of the dealers surveyed expected to see increased revenues from used equipment in 2011. That’s up from 28.5% last year.

Look for the value of equipment in several categories to remain steady or increase throughout 2011. The number of quality machines on the market is limited, helping maintain healthy resale prices.

Trading Up

It’s the larger, more expensive machines that have benefitted greatly from advanced technology introduced in the past few years. Commodity prices also were strong for most of 2010, giving many farmers the opportunity to upgrade their equipment. When doing so, they bought newer tractors, sprayers and combines that were equipped with the latest in precision farming technology. This is keeping resale prices of 2-3 year-old machines steady.

New technology has the opposite effect on the lower end of the price scale, where equipment such as skid-steer loaders and round balers were flat for the past 2 years. While technological advances have been made in these machines, it hasn’t been to the degree found on other equipment. As a result, there’s little or no incentive to pay more for the newest machinery, so farmers tend to buy older models.

Growers buying mower conditioners, windrowers and balers have remained steady over the past few years. Most of these buyers are handling the same amount of material over the same acreage as they did then, resulting in equipment values that have remained stagnant.

On the other hand, farmers who bought equipment such as high-clearance sprayers and track tractors have expanded their operations, with some doubling their acreage. This expansion has made modernizing and enlarging their fleets important.

It’s also made it possible for them to invest more money to do so. They can afford to buy newer used machines.

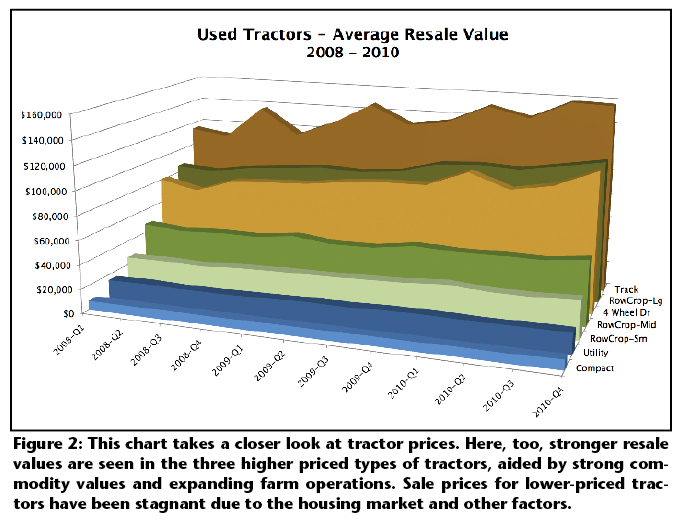

Tractor Prices

In Fig. 2, tractor sale prices are examined in more detail. Here, too, the data shows strength at the higher end of the dollar scale where average resale values continue to grow. Buyers of these tractors are commercial farmers with increasingly more acreage.

On the flipside, growth in compact and utility tractors is steady, albeit not high. Equipment utilization remains constant. There was a jump in the fourth quarter, which could indicate renewed vigor in this segment. It’s important to remember when looking at Fig. 2 that the graph is showing the resale price, not unit sales.

Rural consumers who buy compact tractors are more concerned with comfort. Technology doesn’t hold as much sway on compact units.

Takeaways

Dealers should understand that there is a fairly level market in the smaller tractors and lower-price equipment. Because of this, they should be conservative when taking trades. However, the upward trend for larger tractors means if a dealer needs to get aggressive on the deal, chances are resale prices will support his position.

Looking at overall data and trends shows a solid market in terms of resale value for equipment. Farmers have confidence and are aggressively buying high-end used equipment. In some cases, they make these purchases to delay buying machinery with Tier 4 Interim engines. They are also buying newer used machinery than they have in the past, driven by strong commodity pricing and a desire to benefit from the latest technology.

The information is provided by IRON SOLUTIONS, publishers of the Equipment Industry’s Official Guides based on gold standard equipment data. IRON SOLUTIONS gathers data on used machinery transactions from dealers, auctions and other sources and provides real-time equipment valuation information needed to make the best pricing decisions. For information on IRON Guides and other dealer solutions provided by IRON SOLUTIONS to price right and sell faster, visit www.ironsolutions.com.