George Russell & George Keen, Currie Management Consultants

For full list of articles from the Oct./Nov. Issue, click here.

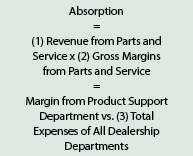

Absorption is the most important financial measure for successful farm equipment dealerships. Some may argue with “most important,” but all will agree that higher absorption rates are a good thing and that 100% absorption should be the objective.

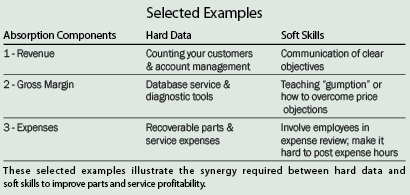

The top dealers also recognize that achieving high absorption rates requires a combination of hard data and soft skills. This column examines how information technology and people management can improve parts and service profits.

“Hard” data is defined as those things that can be easily counted, measured and tracked. Financial results are the most obvious, but you must also count customers, machines, inventory, time and energy use.

“Hard” data is defined as those things that can be easily counted, measured and tracked. Financial results are the most obvious, but you must also count customers, machines, inventory, time and energy use.

“Soft” skills are those that involve people, leadership, morale, influence, behavior and psychology. These are difficult to measure but absolutely vital in the people-oriented business of salesmen, service technicians and parts counter people who sell and service your customers daily.

We’ll focus on the three major components of absorption.

1. Revenue from Parts & Service: Account Management, Clear Communications

Hard Data. The quickest way to increase top-line revenue in an equipment dealership is to actively manage who calls on which customers, to schedule calls, follow up with discipline, and use a different strategy by type of customer. The approach is called “Account Management,“ which depends on having and using the hard data for all customers and prospects. Account Management is as important to increasing parts and service revenue as it is for wholegood sales.

Our clients who utilize Account Management define customers who generate the top 40% of farm revenue as A-Type Customers, the customers in the next 30% of descending revenue are B-Type Customers, the next 20% are C-Type customers and the last 10% are D-Type Customers.

In the North American farm equipment industry, A-Type customers represent less than 1% of the farmers yet, by definition, they generate 40% of all farm revenue. Clearly one sells differently to these “Super Farmers” than one does to the over 2 million C- and D-Type customers.

Classifying customers allows for matching parts and service growth strategy to each customer type.

- A-Type customers tend to buy new equipment regularly. They don’t consume a lot of parts per machine because their machines are newer.

- B-Type customers buy new, but not as frequently, so their parts usage is higher.

- C- and D-Type customers, if and when they buy, tend to buy used equipment. They also buy more parts and service per hour of use because of the age of their machines.

Dealers who want to increase service revenues, should approach C- and D-Type customers even if they don’t buy new or used equipment. Because of the large numbers of these prospects compared to A- and B-Type, “hard” data is needed to know who they are and where they are located.

Soft Skills. “Soft” skills are equally important to improving parts and service revenue. Recent business research reveals that what drives productivity for employees is not just pay or recognition but, more importantly, communication of clear goals and visible comparisons of how the organization is progressing toward its goals. Employees who see how they’re doing vs. an objective will improve their productivity, with or without more supervision.

Parts and service departments typically have the most revenue-producing employees. Increasing their productivity in selling or servicing more per hour means more revenue. We showed the benefits of setting goals and charting progress in an earlier “Planning for Profits” column. (See “Using Service Scorecards to Improve Absorption,” Farm Equipment, Oct./Nov. 2009.)

2. Gross Margin for Parts & Service: “Teaching Gumption”

Hard Data. Troubleshooting and diagnosing machine problems is always a challenge. Dealers who invest in diagnostic tools and specialized training are able to lower their expenses for these tasks. If your best people, with the right tools and training, are able to “best” the flat rate, then there is no reason to charge less for service. If you can fix faster, you should not reduce your profits — especially to compensate for those times when your people cannot beat the flat rate.

Soft Skills. Top-notch sales people, like top-notch companies, are able to command a higher price and therefore higher gross margins. These successful sales people get a higher price because they ask for it, and then are better able to resist the temptation to reduce margins. They know how to overcome their customer’s price objections and have the confidence to get the price they want. Some call this “gumption.”

Parts and service people have the same challenge. When pricing products and services, they need target gross margins and work to achieve them.

Your challenge is teaching your front-line parts and service people to have the gumption to overcome customer concerns. They need to be taught how the gross margins they generate contribute to the success of the dealership. They must develop the confidence to resist the temptation to reduce their margins.

3. Expense Control: Cost Recovery, Employee Involvement

Hard Data. Many expenses can be recovered by charging them back to customers. More and more farm equipment dealers are now identifying and charging for shop supplies (towels, etc.), deadhead travel time and expedited parts. Doing so can reduce your expense ratio by 1-2 points.

But it requires recognizing these expenses in the first place, which calls for hard data. Soft skills are then required to implement the changes.

Many parts and service people resist charging for things that formerly were “thrown in the deal.” Employees can be taught not to cave in to objections and to implement the changes needed to recoup these expenses.

Soft Skills. For cost recovery and overall expense control, you need to involve all employees. For parts freight recovery, the start of the process can be as simple as having your controller determine the monthly freight expenses vs. the amounts that are recovered, and then to post the portion that is recovered. Just posting number will make the percentage recovered go up.

To really reduce expenses, top dealers involve their employees. Department managers regularly meet with all their employees for the purpose of reviewing all expenses, evaluating which vendors were paid and how much, and then determining how best to reduce costs.

A more directive way to reduce expenses is to implement policies that make it difficult to spend time or money. Ways to do this include requiring the dealer-principal’s approval on all hours (vehicle repair, building maintenance, etc.). A service technician or manager may choose not to spend time on a non-revenue activity if they’re held accountable.

In addressing improved absorption, think about how you manage as well as the styles of your department managers. Are you focused on numbers or are you more comfortable managing and leading people? Most dealer managers, like most people, are best at one or the other. A combination of hard data and soft skills is needed. We hope that we have stimulated ideas for both.

For full list of articles from the Oct./Nov. Issue, click here or choose from the list below:

To the Point: A Customer Lost at the Hands of the Major

Dealers’ Sentiments Turn Sharply Positive for 2011

Dealer Profile: Kern Machinery Learning to Adapt on the ‘Go’

Farm Progress Show 2010: Efficiency & Precision Mark New Products

Grain Augers: Stock ’Em to Sell ’Em

Trade Values & Trends: Resale Values for Seeding Equipment

Ahead of the Curve: The Growing Trend Toward Vertical Tillage

The Business of Selling: Fresh Perspectives on the Art of Selling