The intense, diverse agriculture of central California requires equipment dealers like Kern Machinery to be ready to change directions — on a dime.

For full list of articles from the Oct./Nov. Issue, click here.

Kern Machinery

Bakersfield, Buttonwillow, Lancaster & Delano, Calif.

Year Founded: 1969

Number of Locations: 4 (3 Ag, 1 C&CE)

Major Equipment Lines: John Deere

Shortlines: Rears, Flory, Air-o-Fan, Orchard-Rite, Weiss McNair Exact, Wilcox, AutoFarm, Freeman, Jackrabbit, Trioliet, Progressive Ag

Total Employment: 105

Sales: 22

Service: 46

Parts: 25

Administrative: 12

Key Staff: Clayton Camp, president & GM; Marty Buck, CFO; Jared Knudson, aftermarket manager; Larry Sitzman, Tom Schneider & Matt Godinho, sales managers; Don Zajac & Jim Boel, service managers; Marc Leonard & Paula Abbott, accounting; and Elaine Wakelin, human resources.

Ask Clayton Camp to describe agriculture in the area of central California where he sells John Deere farm equipment and he uses the words “diverse” and “intensive.” Ask him to characterize his customers and he simply says, “They’re businessmen.”

From the equipment it carries to its customer base, everything about Kern Machinery is diverse. And with a nearly year-round growing season, you know that the business of the dealership is intensive.

That’s because this 4-store dealership’s area of responsibility (AOR) includes all of Kern and part of Tulare counties, which are located at the southern end of the San Joaquin Valley. It’s an area that some refer to as the “Food basket of the world” since it accounts for an estimated 10-15% of all U.S. agricultural production dollars. It’s an area where labor is expensive and water is scarce; where environmental regulatory pressures are constant and farmers are all business.

In other words, California is both a challenging and difficult place to farm and to be a farm equipment dealer. While diversity adds to the already challenging arena in which farm equipment dealerships operate, it’s also a blessing, says Camp, the president & GM of Kern Machinery.

“California is a hard state to do business in, and our customers are forced to comply with government regulations regarding air and water quality. California agriculture is in a glass bowl as far as being watched, criticized and penalized,” Camp says.

“Our saving grace is the high-value crop diversity available here in California because it allows our growers to make a decent return, in most years, without being dependent on government subsidies.”

With the highly specialized farming in Central California, nearly 40% of Kern Machinery’s 2009 wholegoods revenues came from specialized shortlines.

A History in Ag

While there are days when he wishes he could just pack up his business and move it to friendlier climes, his family’s long history in agriculture has showed Camp how to continuously adapt to the changing ag and political climates — on the go.

The Camp family has been involved in agriculture since 1917, and selling machinery since 1969. They were a multi-store John Deere dealer before multi-stores were fashionable.

Camp’s grandfather moved from South Carolina to California while working for USDA and eventually started his own farming operations in 1936. When the central California aqueduct brought water to the west side of Kern County in 1969, Camp’s father and a partner opened a Deere dealership in Buttonwillow, which they called West Kern Machinery. Shortly thereafter, they acquired another Deere location in Bakersfield, South Kern Machinery, and then another in Delano in 1972, North Kern.

After getting his degree in crop science, Clayton went to work on the family farm and 5 years later began working at the Buttonwillow location. Today, he manages all of the dealerships, including one in Lancaster, Calif., that specializes in equipment for LPOs. His brother Don oversees the family’s Western Power operations (John Deere and Yanmar engines and Funk Drivetrain components). Another brother, Edwin, manages the family farm.

After 25 years of selling farm equipment, Camp says the business isn’t anything like it was when he started out. More changes have taken place in the past 5 or 10 years than occurred during the first 15. There’s no time to sit back and take it all in anymore or think about making changes.

“We used go out there and sell and take care of customers, and it was more laid back. It’s far more intense now. If a piece of equipment breaks down, the customer is all over you. We can’t sit and wait for back-ordered parts to be delivered. We call someone to locate it, get in the truck and go get it. It’s a far more intense business than it used to be, which actually makes it fun when you’re performing,” Camp says.

It’s easier when you have a good manufacturer with a good parts and service backup system, he says. “I’d hate to be with a poor manufacturer because you won’t stay in business out here selling on price. If we could, we’d like to sell only Deere equipment, but they don’t make all of the specialty equipment we need for this area.”

Which leads to another of Kern Machinery’s biggest challenges — carrying a ton of shortlines.

Changing Ag Base

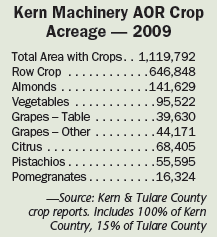

Like the other major farming regions of North America, California farms are getting bigger. But unlike other regions where the types of crops grown may shift gradually, in Central California the crop base has changed rapidly and continues to evolve.

“We used to be all row crops and had little in the way of permanent crops,” says Camp. “We used to sell cotton pickers, combines and large 4-wheel drive tractors. We existed on the higher horsepower equipment, but it’s not like that any more. We had to change and we made the change, and it’s not been a bad thing.”

Today, tractors in the 50-110-horsepower range are the dealership’s bread and butter, with 80-90-horsepower units as its best sellers.

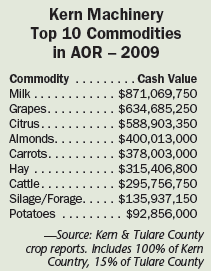

Of the top 10 agricultural commodities grown in Kern Machinery’s AOR (all of Kern County and 15% of Tulare Country), milk, grapes, citrus fruits, almonds and carrots occupy the top five spots. Of those, only carrots fall into the category of row crops.

“We didn’t used to be this big in milk even 5 years ago,” Camp says. “The large dairies from down south sold their property and moved here, and they’ve gotten even larger. We have operations that are milking 3,000 to 8,000 cows.”

The influx of large dairy herds has brought other changes, namely hay and silage to feed the herds. Hay is ranked as the sixth, and silage and forage the ninth largest commodities in the area based on cash value. “There’s a lot of alfalfa and hay grown around here, but with our water cost, it might be cheaper to truck it in than to grow it,” he says.

A combination of table, wine and raisin grapes has also become huge cash crops in the area, along with Clementine oranges.

“We also have the two largest carrot growers in the world based out of Bakersfield,” Camp says. “And this is where the intensity comes in. They’re already double cropping carrots and potatoes in the fall and the spring.”

Pomegranates have recently become another major high-value crop at the south end of the valley. Some 16,000 acres have been planted so far, and many aren’t even fruit bearing yet.

“We like to say we’re covering the entire spectrum of health foods here. You drink pomegranate or orange juice in the morning and wine at night, and you’ll live forever.”

Transforming the Business

The changing landscape of Kern Machinery’s AOR is transforming how the dealership looks at and conducts business, and it’s made the dealership’s business more complicated.

As growers get larger, they’ve become more sophisticated and demanding. As they’ve switched to higher value, specialized crops, they require very specialized machinery and shortline manufacturers have become a vital part of the Kern’s business.

For dairy customers, they handle feed wagons and different types of rakes and harrows that Deere doesn’t make and probably never will. Specialized sprayers, tillage tools, tree pruners for citrus, almond and pistachios, as well as almond harvest equipment are examples of shortline products that have become a significant part of the dealership’s business base in the last decade.

“For the most part, the only thing Deere makes for a lot of the farmers in our AOR is tractors. We would be a much smaller dealer if we weren’t heavily involved in shortlines,” he says.

Adding Shortlines to the Mix

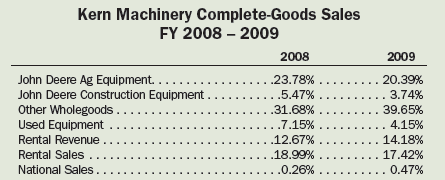

In recent years, 30-40% of Kern Machinery’s revenues came from the sales of “other” wholegoods, or non-Deere equipment. About a quarter of its sales revenues have come from John Deere ag equipment and 4-6.5% from construction products.

Camp says finding the right product from the right supplier adds to the complexity of running the dealership. He admits he’s not a big fan of “pioneering” new shortline products. He’d much rather pick up a well-established line from a well-established supplier that isn’t sold by other dealerships in the area. Of course, the first criteria is that it must also fill the grower’s need.

“The product has to be available from a manufacturer that we’re sure will back it up. But if it’s already taken by another dealer, we’ll most likely look elsewhere,” he says.

“There are a lot of good shortline products out there, but having to pioneer a new line isn’t easy. We love it when we can mate shortline equipment to a Deere tractor because it operates well with the tractor’s hydraulic capacity. That’s a big plus for us to carry a particular line of equipment. Most times we can save the customer money when we can match the implement to the features of the tractor. We don’t want to sell equipment that will jeopardize the sale of a tractor. So, if we can’t match it up to Deere equipment, that might be a pretty good reason for us not to carry it,” says Camp.

Specialized tillage tools are another example where there is a rising grower need. The dealership has had to look to local vendors, especially as conservation tillage takes hold in the state. While farmers are interested in maximizing water use and minimizing erosion and dust, Camp says the sale of conservation tillage equipment is growing because farmers’ number one priority is lowering input costs per acre.

Despite shying away from being the first on the block to carry a new product, he points to Wilcox Agri-Products as a good example of a local supplier meeting a local need that made the dealership one of the first in line to try it out. The company recently introduced the “Eliminator,” that Camp calls a “reduced-pass” tillage tool.

“It’s a product we helped pioneer because when you put it on paper and run the numbers, our farmers need this equipment. It’s going to save them money. It’s going to make them money. And it takes our biggest tractor to pull it, so we like it for that reason.”

Besides the fact that he believes the product meets a big need for his customers, Camp adds that Alan Wilcox, who developed and built the Eliminator, “is a wonderful guy to have with you on a demo. He has a wealth of knowledge and probably has the most passion I’ve seen in any of our suppliers.” One thing he won’t let happen when it comes to shortlines is to let a poor manufacturer endanger the dealership’s reputation. “We live here and when we sell someone something, we’re going to live with it. We have to honor our promises, we expect the same from our suppliers.”

Growing Rental Business

The changing agricultural scene in Central California has resulted in another significant shift in the way Kern Machinery does business. More growers want to rent equipment and a third or more of the dealership’s complete good revenues are derived from rental revenues or the sale of rental equipment.

“This is something that differentiates the farm equipment business here from that in the Midwest.” Camp says. “I see the numbers nationwide, and in a lot of areas rental income in non-existent. For us it’s big.

“But the end game is to sell. We wish we didn’t have to rent, but it helps us maintain market share and our salesmen are out there pushing it because customers demand it. It’s either rent or give the business to another dealer.”

Reorganizing on the Go

Rapid and continuous changes in the business environment in central California caused Camp to rethink how the dealership is organized. A prime example is the parts and service side of the business where Kern Machinery found itself competing with its own customers.

“Many of the corporate farms have their own shops. With aftermarket being so competitive, if we don’t deliver some added value, we’re not going to get the sale,” Camp says.

He adds that parts delivery service, competitive pricing and the knowledge of his parts sales people are the additional value the dealership offers, and what sets Kern Machinery apart.

“Our guys are good and they know they have to make the farmer money or he’s not going to use us.”

They’re on the road actively calling on customers and focused solely on the sale of parts. “Deere wanted its dealers to have someone on the road pushing parts and service, but we never made that work. What works for us are salesmen in the truck calling on customers and pushing parts only. There’s enough parts business out there to keep them busy. They really don’t have time to sell service, so recently we hired outside an service salesman to focus on that.”

In some cases, the salesmen will deliver the parts themselves, but they’d prefer their deliveryman do that. “Our parts salesmen are too expensive to be a delivery guy, but they’ll do it when it’s absolutely critical.”

To ensure that the parts and service departments get the management attention they need, Camp hired Jared Knudson 3 years ago as the company’s aftermarket manager, and reorganized the departments. Today, two service managers and three parts managers report directly to Knudson, while the wholegoods sales managers report to Camp.

He made another unusual move that has worked out very well for the company. Previously, each store had its own accounting department and kept its own set of books. He relocated his chief financial officer, accounting department and IT staff to a central office that’s equidistant between the three ag dealerships.

He also hired two human resource people to handle personnel issues, which Camp calls “a godsend.”

This has helped the dealership get the right people in the right positions, he says. “We’ve gotten more stringent in our hiring practices and that’s been a huge help. For one thing, it’s reduced the pool of people we talk to.”

More of a Business

The biggest change the dealership has made is how it views its sales and customers. It reflects how their customers view their livelihoods.

In a few words, Camp describes how agriculture in the southern valley has changed: “It’s more of a business than a lifestyle.” With this and continuing pressure from their major supplier, Camp says Kern Machinery has refocused on how they philosophically look at the farm equipment business.

“What we tell our sales people is their sales territories are not their sales territories. They’re assets of the business and we have to manage those assets. Just as Deere is holding us accountable, we must hold ourselves accountable for taking good care of and growing those assets.”

For the 40-plus years of success that Kern Machinery has experienced, Camp says it would be a mistake on his part if he didn’t reinforce the message that the dealership must get better. It must be able to change quickly and adapt to customer needs.

“We have meetings bi-weekly and talk to each other so we know what’s happening. But what we really need is input from our sales people. We need them talking to customers, letting us know what’s going on. That’s part of thinking of their sales territory as a company asset,” Camp says.

The dealership recently installed new customer contact software aimed at facilitating communications between sales and management.

“We may find we need to change hours of operation, or how we sell. We may have to change our service department, where we put everyone in trucks and send them to the field. We may need a drive-through parts window. None of us have all the answers, but we need to keep looking,” says Camp.

The biggest challenge is to keep changing for the better and doing it quickly. This may be the biggest one of all because dealers have gotten better at taking care of customers, says Camp. “It’s not just us — everybody’s getting better.”

Dealer Takeaways

- Think of sales territories as assets of the business that need to be managed like other assets.

- Someone must be responsible for growing aftermarket — parts and service — sales.

- Customers can go anywhere to “buy” something. You have to make your customers money if you want to set your dealership apar t from the competition.

Check out the web exclusive extras below to learn more about Kern Machinery!

Not Much Used Equipment

Another characteristic of the farm equipment business that sets Kern Machinery’s territory apart from many other agricultural areas is used machinery.

Stay on Top of Farm Issues

California stands alone when it comes to environmental issues and the impact on agriculture

For full list of articles from the Oct./Nov. Issue, click here or choose from the list below:

To the Point: A Customer Lost at the Hands of the Major

Dealers’ Sentiments Turn Sharply Positive for 2011

Farm Progress Show 2010: Efficiency & Precision Mark New Products

Grain Augers: Stock ’Em to Sell ’Em

Trade Values & Trends: Resale Values for Seeding Equipment

Ahead of the Curve: The Growing Trend Toward Vertical Tillage

Planning for Profits: Hard Data + Soft Skills=Improved Absorption

The Business of Selling: Fresh Perspectives on the Art of Selling