In this episode of On the Record, brought to you by Associated Equipment Distributors, we dive into John Deere's annual report, including what it spent on dealer sales incentives in 2023. In the Technology Corner, Noah Newman showcases the ag spray tech being developed at XAG. Also in this episode, Bourgault and Buhler Industries have been acquired, dealers likely won't add equipment lines next year, self-propelled sprayer inventories and Claas' 2023 earnings.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Year-End Acquisitions: Buhler & Bourgault

- Deere Spends More on Dealer Sales Incentives, R&D in 2023

- Top 5 Features of the “Fastest & Largest” Drone on the Market

- 25% of Dealers Considering Adding New Lines in 2024

- Claas Reports $6.7 Billion Net Sales

- Self-Propelled Sprayer Supplies & Prices Up Year-Over-Year in November

- DataPoint: AGCO’s Dealer Network

Year-End Acquisitions: Buhler & Bourgault

This week saw 2 notable acquisitions in the ag equipment industry. First, Linamar Corp. announced on Dec. 20 its intent to acquire implement manufacturer Bourgault for $480 million. This follows Linamar’s 2017 acquisition of MacDon and its 2022 acquisition of Salford Group. During a webcast following the announcement, Linamar Executive Chair & CEO Linda Hasenfratz stated, “We doubled MacDon's business in 5 years, we hope to do the same with Bourgault.”

Also on Dec. 20, Buhler Industries, which manufactures the Versatile and Farm King equipment lines, announced that Turkish ag equipment manufacturer Başak Traktör would acquire all the common shares of the company owned by Russian combine manufacturer Rostselmash Ltd. The aggregate cash purchase price to be paid by Başak Traktör’s parent company ASKO Holding is $45 million.

Deere Spends More on Dealer Sales Incentives, R&D in 2023

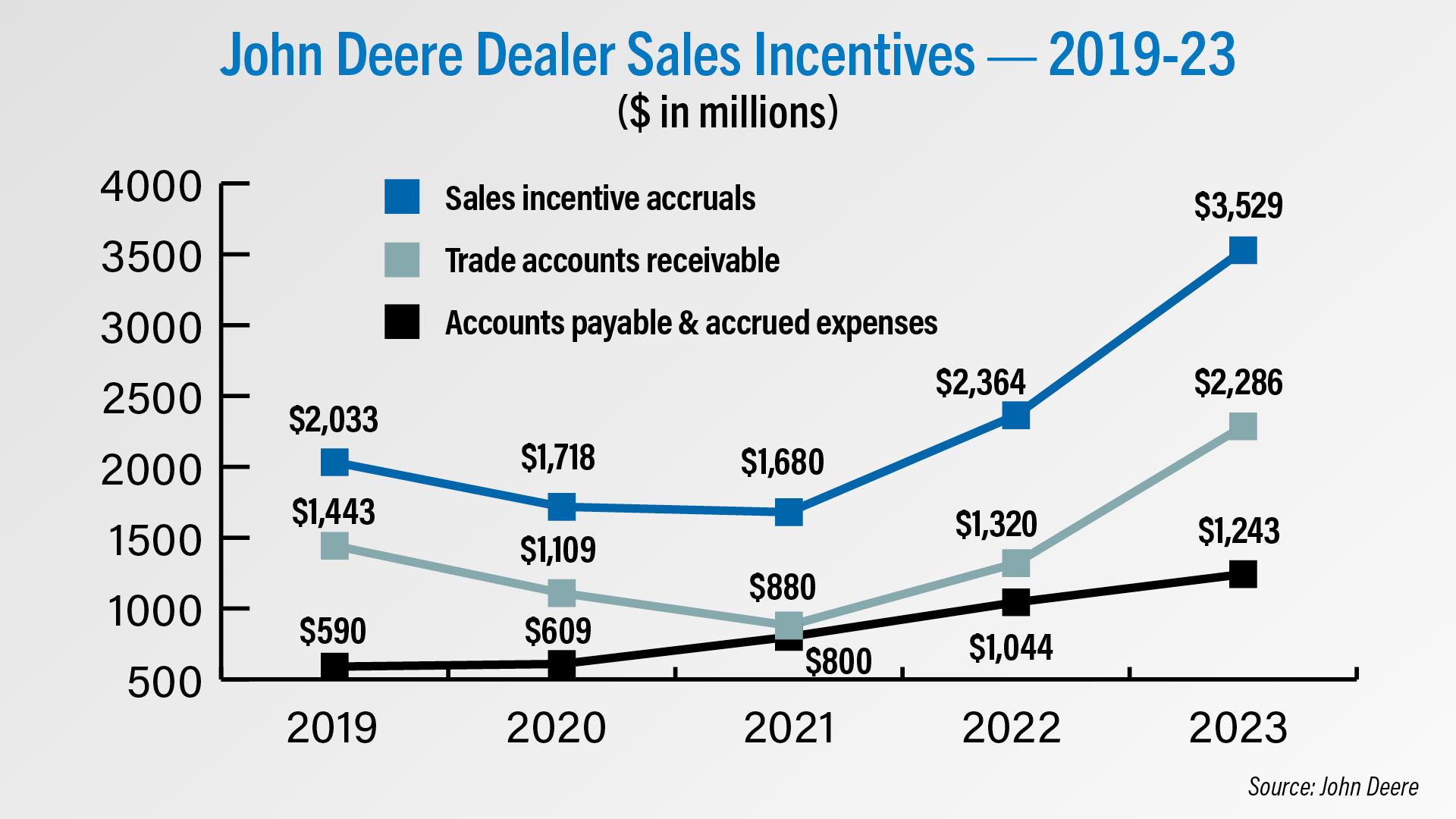

According to John Deere’s annual report filed with the SEC on Dec. 15, the company spent just over $3.5 billion on dealer sales incentives in its fiscal year 2023.

Total sales incentive accruals were up 49% year-over-year from $2.4 billion in 2022. Most of this increase came from accruals in trade accounts receivable, which was up 73% year-over-year to $2.3 billion in 2023.

The company stated some factors impacting accruals recorded against receivables in 2023 were higher incentives for dealer market share and incentives provided to offset elevated interest rates.

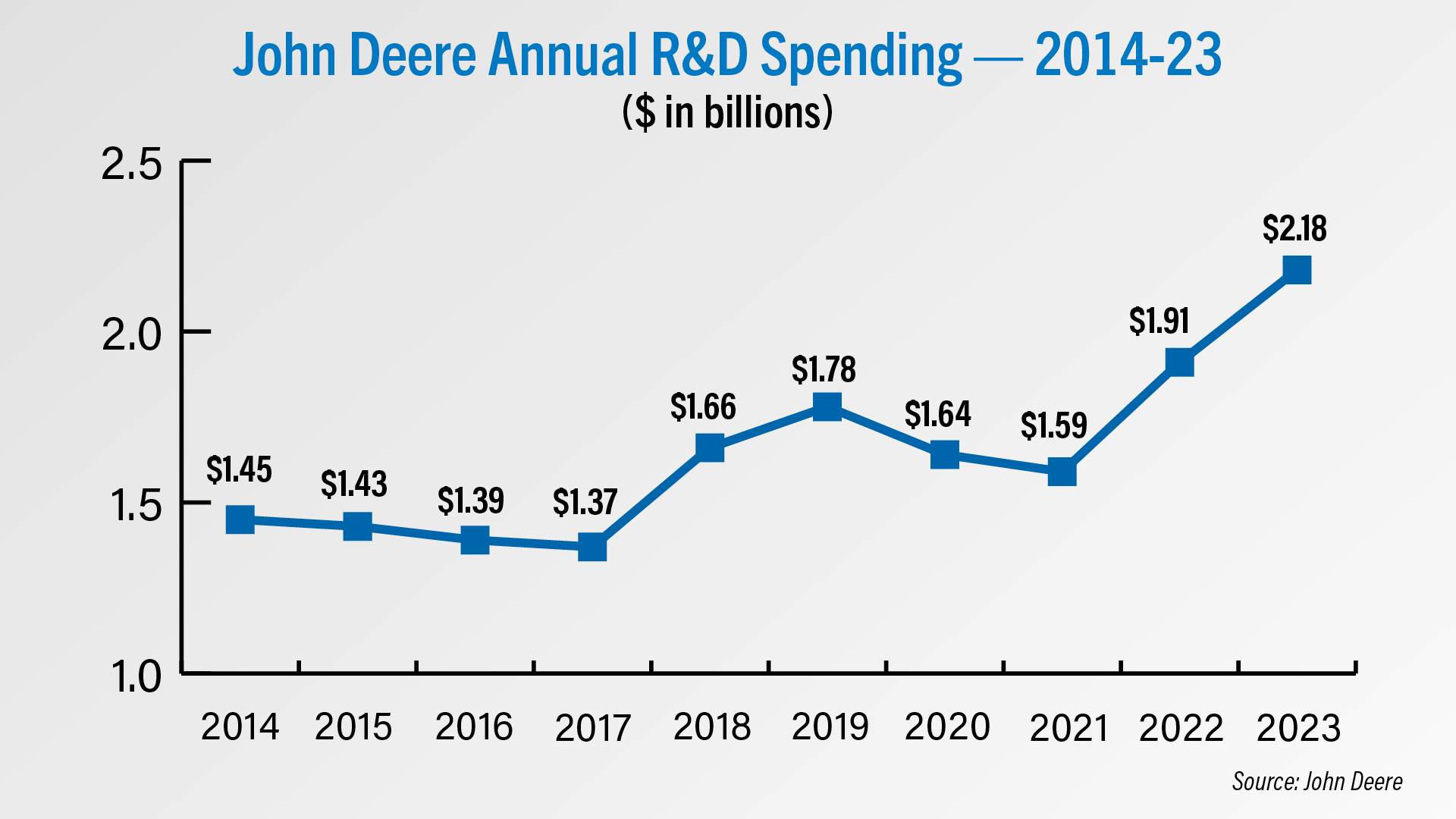

Deere’s annual spending on research & development rose again in 2023, up 14% to $2.2 billion. Deere said in the filing that R&D expenditures were higher due to the company’s continued focus on developing new technology solutions and new product introductions.

Deere also gave details on 2 acquisitions it made in 2023 in its annual report. In March, Deere acquired SparkAI, a New York-based startup with applications in agriculture that support functions like obstacle detection and avoidance. Along with Deere’s July acquisition of precision spraying equipment company SmartApply, the combined cost of these 2 acquisitions was $82 million. In 2022, the total cost of Deere’s ag-related acquisitions was $410 million.

Top 5 Features of the “Fastest & Largest” Drone on the Market

This week we’re getting an up-close look at the Pegasus Robotics XAG P100 drone, billed as the fastest and largest drone on the market. It can hold up to 14 gallons and go 31 mph while spraying. Danielle Helland shares 5 features that set it apart from other drones.

“The speed and size for one. Another thing is the blades being constructed like this to give it relief on the motors. I like the cord management. Another huge difference is the spray and spreader tank actually attaches to the bottom of the drone by these latches. You can easily unlatch the drone and pull it off to switch out a tank if you need to. It’s super simple in my opinion, and it makes it really easy to change out things. Another thing that sets it apart from its competitors is its batteries charge in water. It helps them cool down a lot faster when you’re outside on hot days and they don’t overheat. It’s also something really unique, you wouldn’t think about putting a battery in a tub of water to charge it.”

The XAG P100 Pro with battery kit is listed at just under $35,000 on the Pegasus website.

25% of Dealers Considering Adding New Lines in 2024

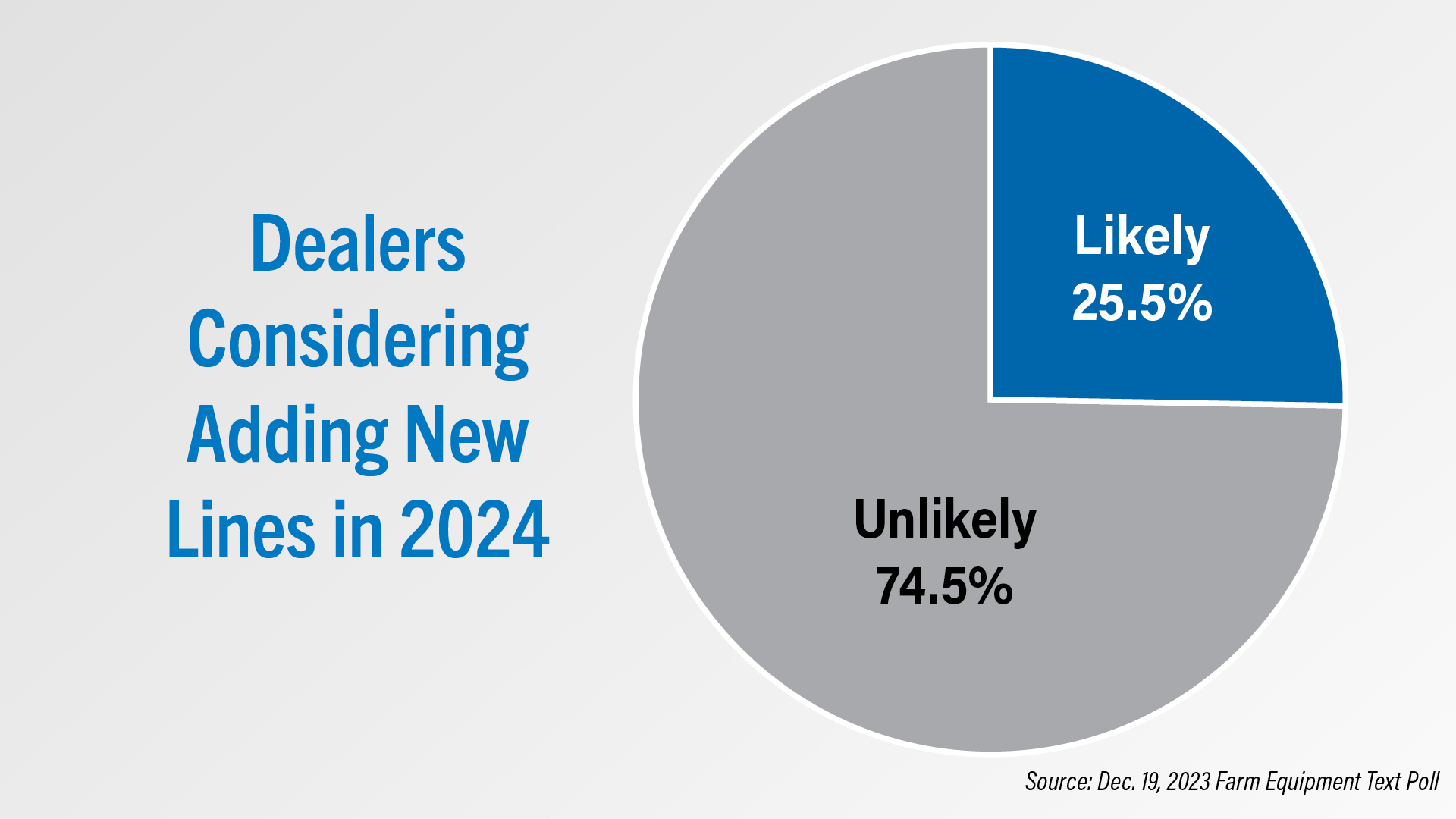

The results of the latest Farm Equipment text poll suggests a quarter of dealers are likely to add additional product lines in the new year.

The Dec. 19 poll asked dealers how likely they are to take on a new equipment line in 2024. 25.5% of dealers said they were likely to add a new line, while 74.5% said it was unlikely that they would expand their product offerings in the year ahead.

To be a part of future text polls, text FARM to 833-413-2175 to sign up.

Claas Reports $6.7 Billion Net Sales

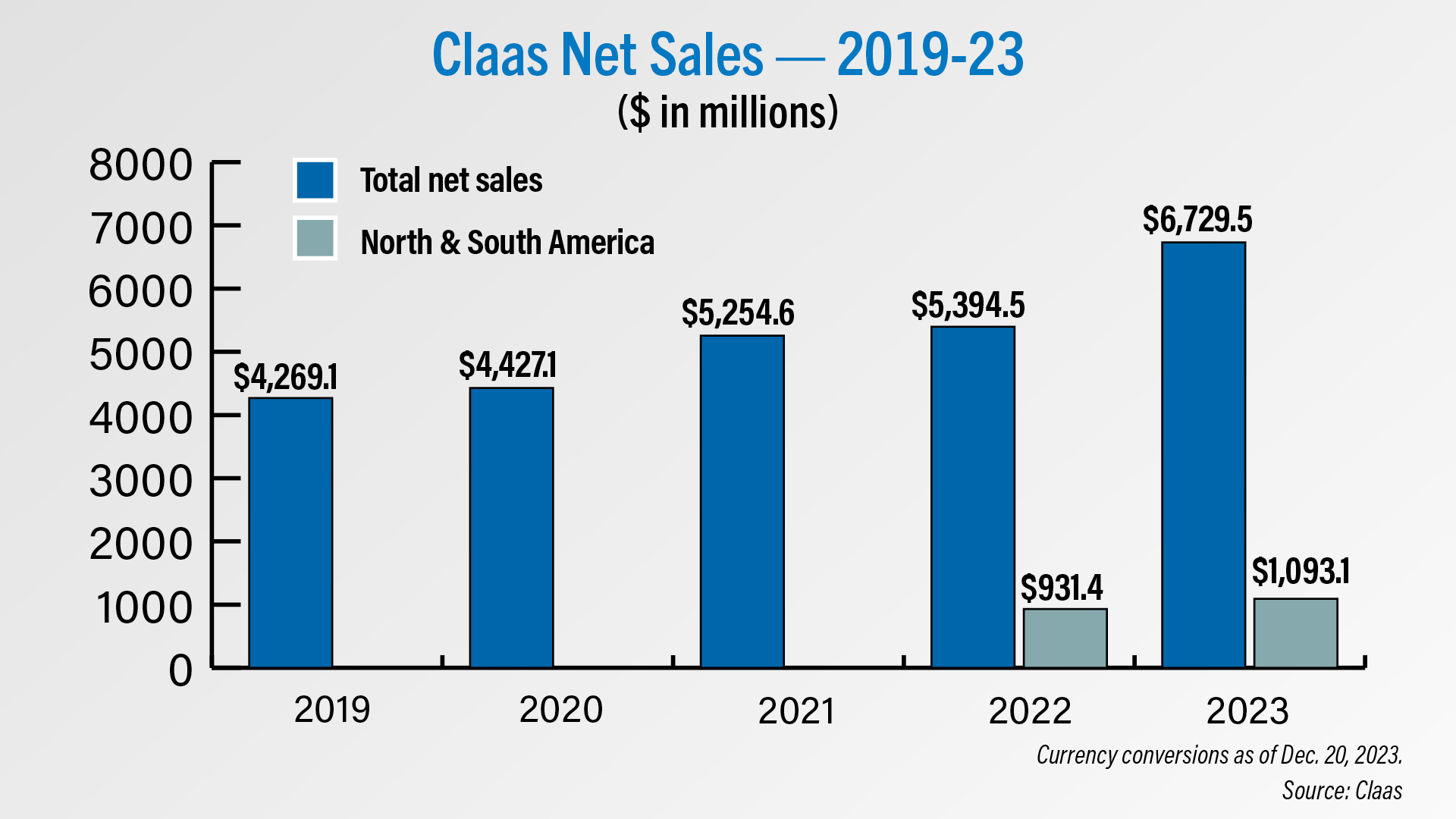

In Claas’ recently released annual report, the company reported $6.7 billion in 2023 revenue, a 25% year-over-year increase from $5.4 billion in 2022.

Claas’s total annual net sales have increased every year for the past 4 years. Total net sales for the North and South America region came in at $1.1 billion in 2023, up 17% year-over-year. Prior to 2022, Claas did not break out its revenue for the North and South America region. The company said significant growth was generated in North America through new machine sales of combine harvesters and forage harvesters.

Claas also said in the report that it expects demand for ag equipment to decline overall in Central and Western Europe, as well as in North America, in fiscal year 2024. The company said that amid normalizing inventories, and without the effects associated with the supply chain-related deliveries of prior-year orders that had a positive influence on the past fiscal year, it expects a moderate year-over-year decrease in sales in its fiscal year 2024.

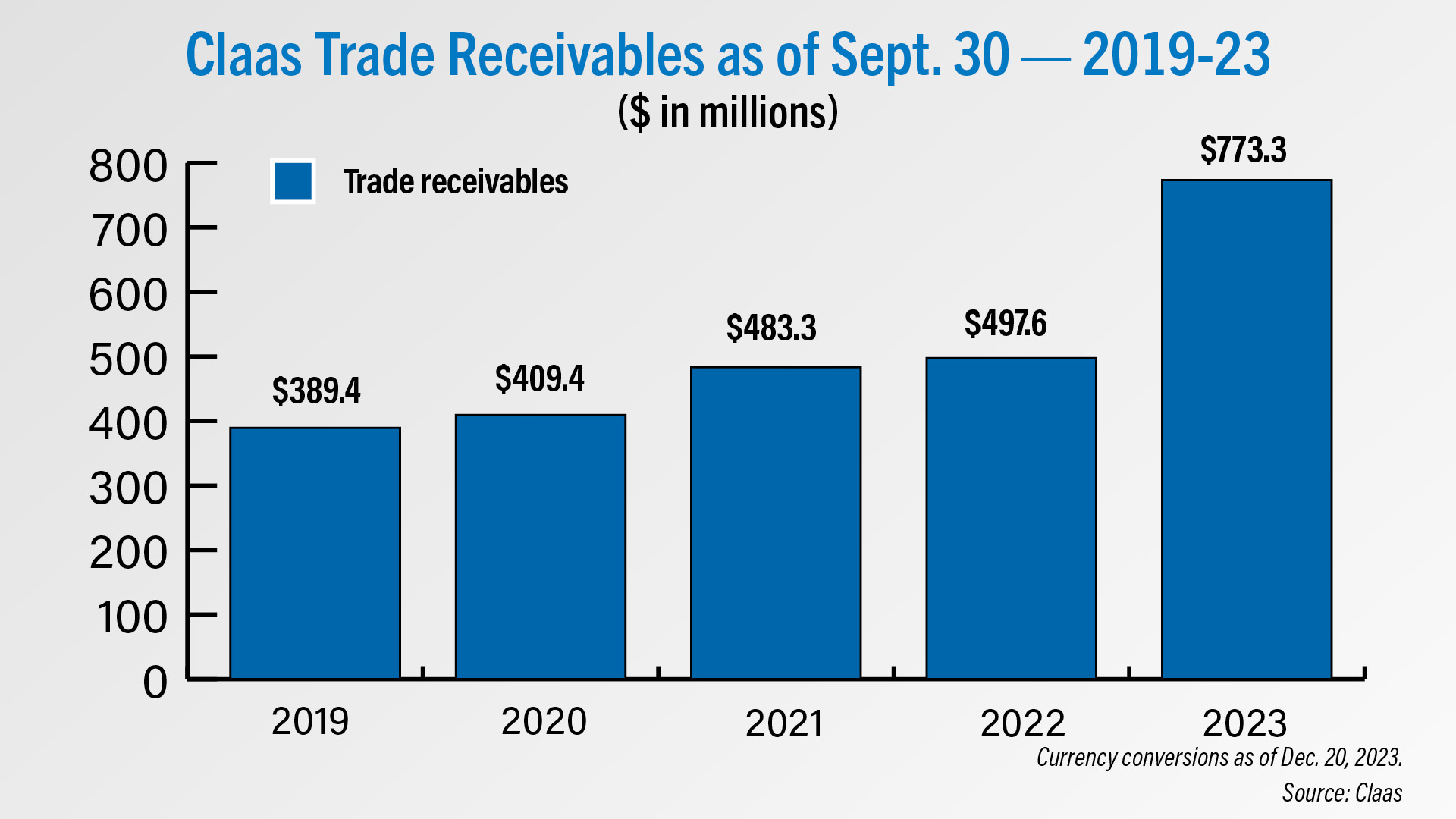

Claas’ total trade receivables were valued $773 million as of Sept. 30 of this year, up 55% year-over-year. Claas described this increase as significant and said that it was due in part to a substantial rise in sales.

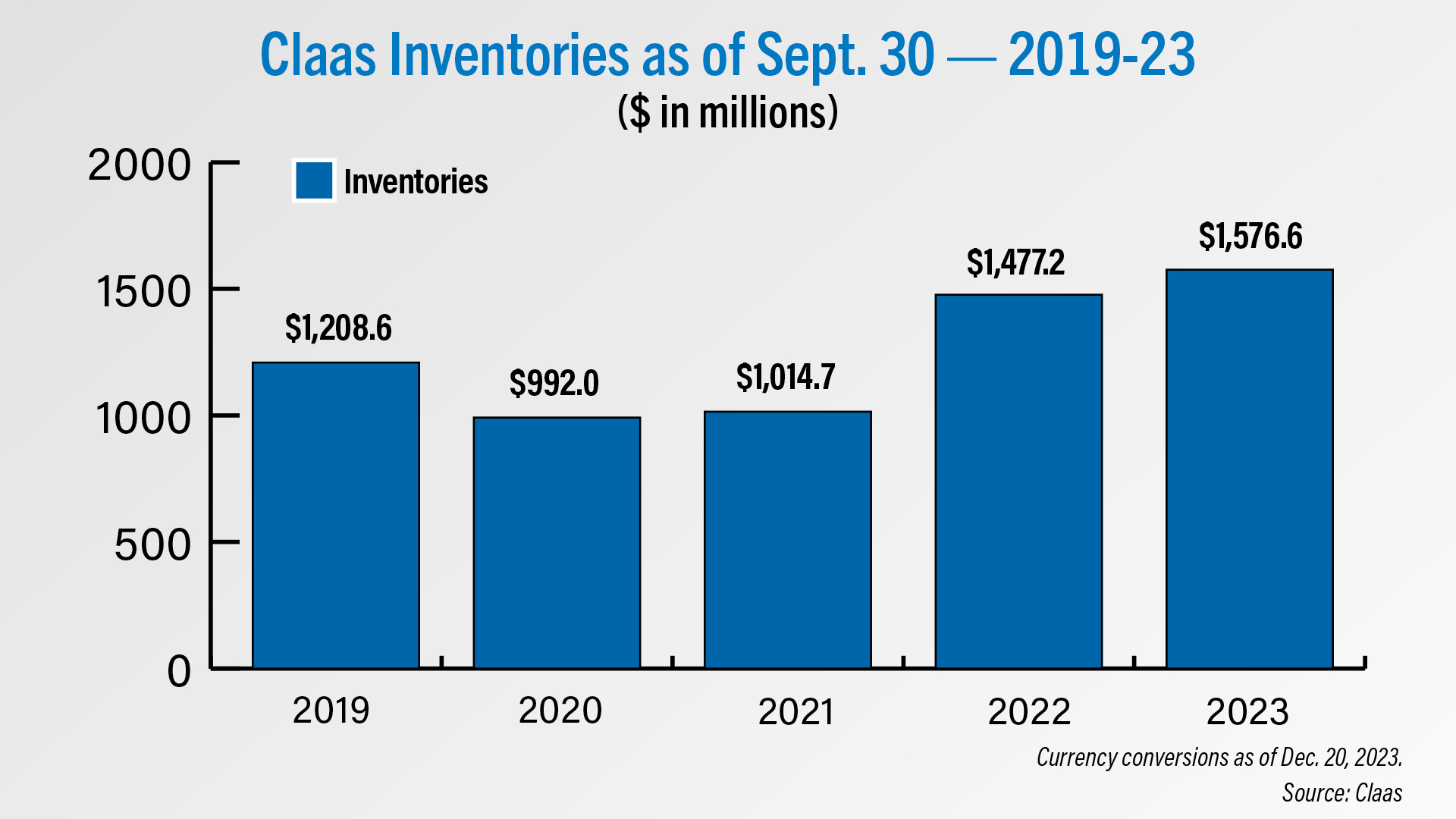

Claas’ inventories were valued at $1.6 billion as of Sept 30., a 7% year-over-year increase. Claas’ reported inventory has increased in value every year for the last 3 years.

Self-Propelled Sprayer Supplies & Prices Up Year-Over-Year in November

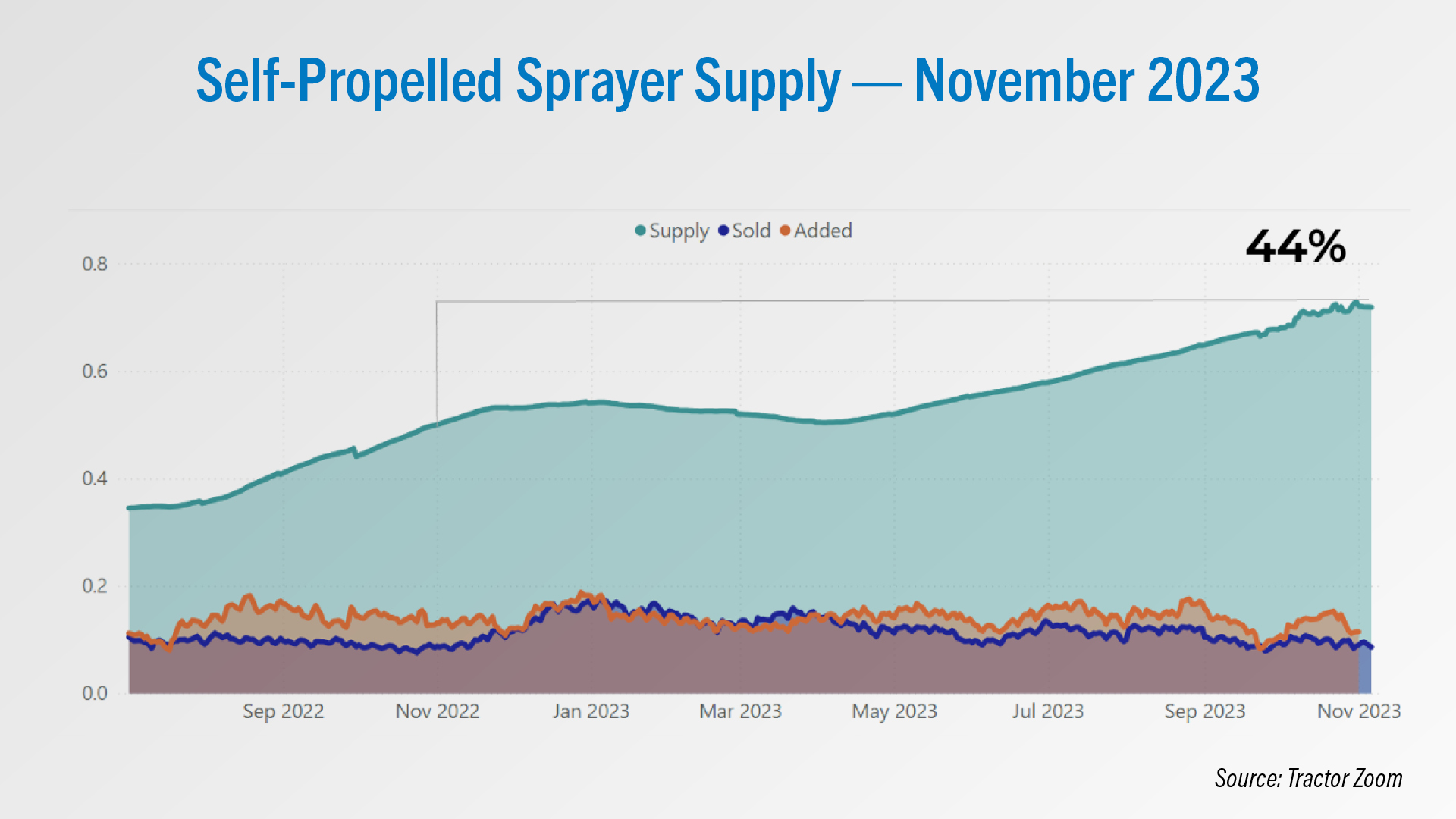

During a presentation for the Ag Equipment Intelligence 2024 Executive Briefing on Dec. 7th and 8th, Tractor Zoom Director of Insights Andy Campbell reported industry supplies of self-propelled sprayers were up 44% in November compared to one year ago. At the same time, pricing was up 12% at the dealership level year-over-year.

“So even despite those increases in supply, we're still seeing really strong price increases year-over-year both at auction at 20%, roughly 12% at dealership lots,” said Campbell. “I've got the asterisk in there for the auction just to remind myself that at the time of taking this, there was only about 7 legitimate sales in November that I could pull data from. And so, since though there had been a lot more and was just talking with a couple other dealers whose initiative is to really move sprayers yet this year. And so I think we're going to see some aggressive moves on sprayers, and it's just a matter of a question of what is that going to do to the valuation that we see in the auction market.”

Campbell noted there was only a brief period between January and April of this year when sales of self-propelled sprayers out-paced the rate at which sprayers were being added to dealers’ lots.

“An interesting trend, obviously there’s seasonality with selling sprayers that only for a brief period for a little bit in 2023 did sales outpace what was being added to the lot,” said Campbell. “And then obviously in your off seasons that's not the case. So we'll see as we go into 2024 if sales are able to outpace what's coming to the market, because remember that November through March timeframe was a really good time. It was a great buying season for farmers, things sold at a premium, and that's likely not going to persist into 2024. And so I think that time is of the essence right now with sprays and that their heyday is limited.”

Campbell presented similar market analysis on combines and row-crop tractors as well as gave his market predictions for 2024 at this year’s Executive Briefing, you can purchase access to replays of this year’s session in the link in the description.

DataPoint: AGCO’s Dealer Network

This week’s DataPoint is brought to you by the 2024 Precision Farming Dealer Summit.

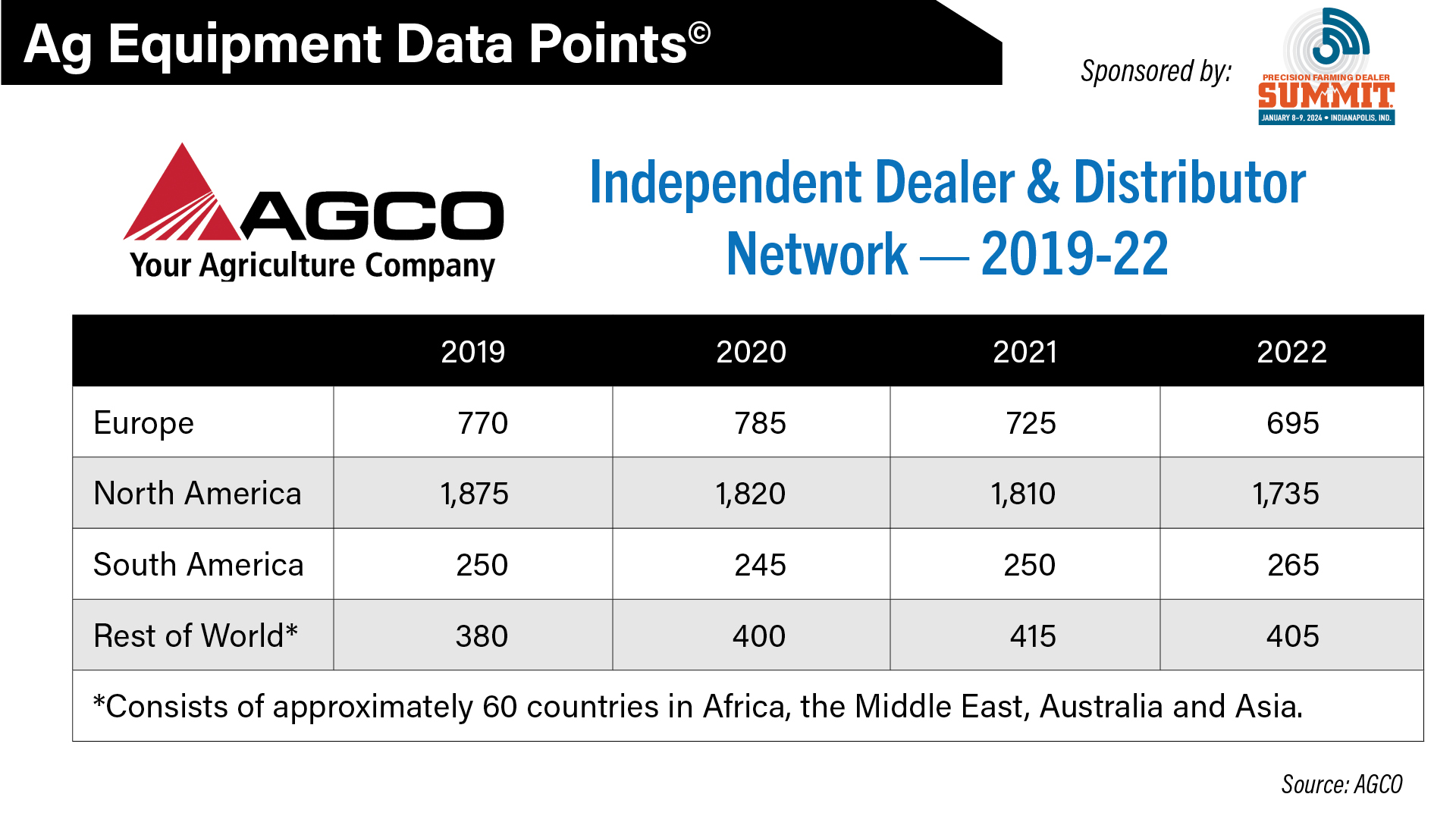

According to AGCO’s SEC filings, the company’s number of North American dealers and distributors has declined for the last 3 years, coming in at 1,735 for its 2022 annual report filed March 1 of this year. This represents a 7.5% decline from 1,875 dealers and distributors in 2019. The only region to see year-over-year growth in the number of dealers and distributors for 2022 was South America, which rose to 265.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.