With interest rates topping the list of major concerns dealers have these days, Zach Hetterick, CEO of executive coaching firm Harvesting Potential and member of the Machinery Advisors Consortium (MAC) as well as a former dealer executive, says dealers will have to develop their sales teams to be successful in that environment. In his presentation at the 2023 Dealership Minds Summit, he offered 3 areas of focus in coaching a sales team to excel in a high-interest-rate environment: the information they need to gather about prospects, creative financing options and cost-of-ownership pricing.

This article will address the third of those 3 focus areas: cost-of-production pricing.

Creative financing works best when considering the notion that the real value of the equipment is when it's operating, not just because the customer owns it, Hetterick says. He calls it “cost-of-production” pricing.

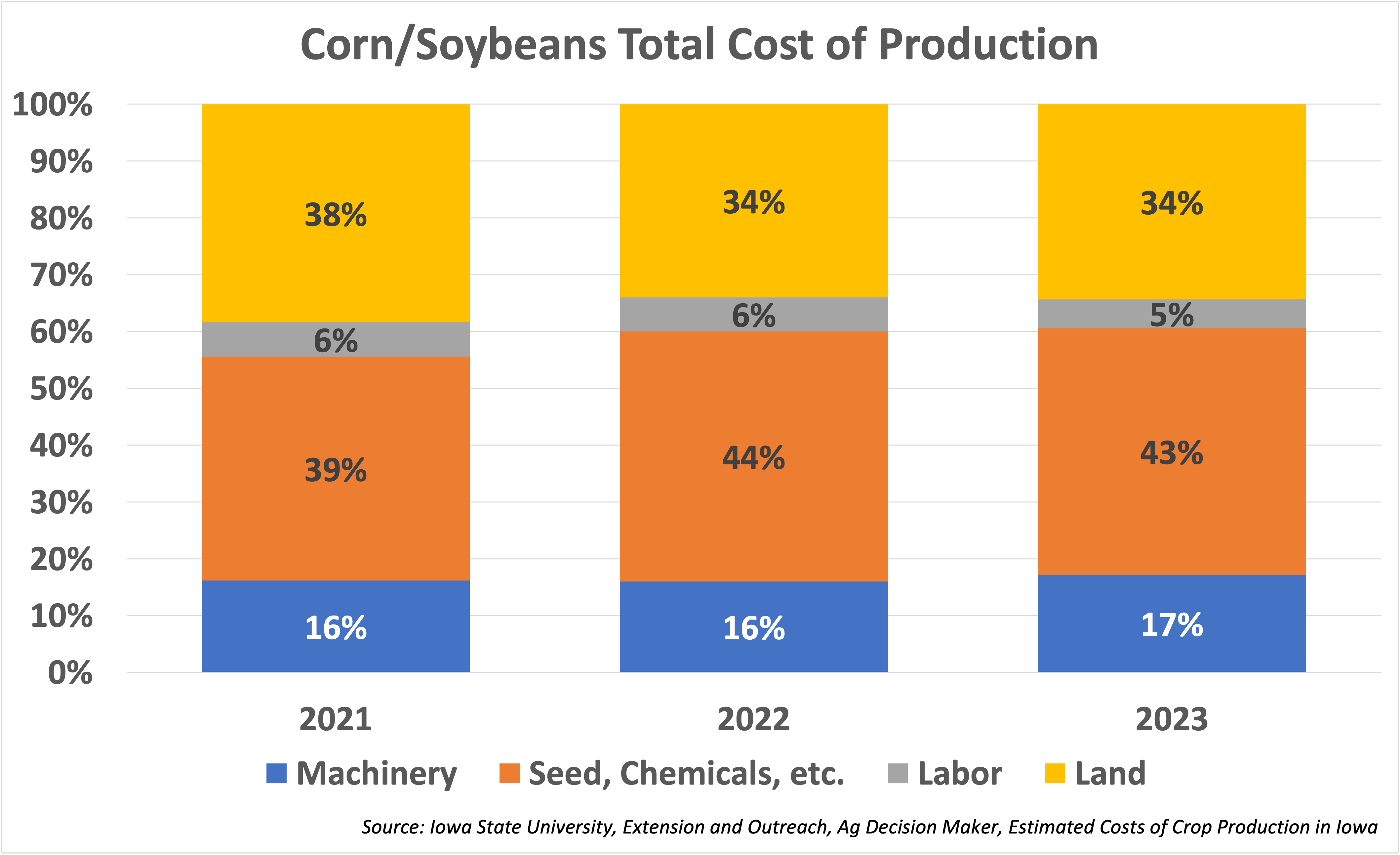

To explain this, Hetterick looks at the total cost of production for corn and soybeans in Iowa from 2021-23, based upon data from Iowa State University. Looking at the costs of machinery, inputs such as seed, chemicals, etc., labor and land, the cost per acre of corn and soybeans produced in a 50/50 rotation hasn’t changed in that time, he says, although the percentage contribution of each cost has changed. The machinery input, for instance, has gone from 16% to 17% while input costs have gone from 39% in 2021 to 43% in 2023.

“As we think about how we apply that, the other people sitting at the table are having the same discussions with these producers, it's not just us,” he says. “And we need to stay out of that sympathy discussion and state the facts.”

Those facts, Hetterick says, are that this year it's going to cost the average producer about $35 per acre more in machinery cost, while input costs are about $62 per acre more and land costs are $53 per acre more. This gives salespeople the opportunity to tell producers it’s possible to fix equipment costs for multiple years, whereas inputs are variable and they change, he says.

To address total cost of ownership, Hetterick says once you find financing to match the customer's needs, it’s time to work on other aspects to help the customer fix their costs. “Then you're going to fix their risk with either an insurance product or an extended warranty in some form or fashion that can mitigate their risk for the period of ownership or their intended period of ownership.”

Next is building a maintenance package. “I know some of you don't have those built out,” Hetterick says, “but it's not a hard discussion to have your service department calculate a 300 or 600 hour service, or 1,000 hour plan — whatever they are for the products you sell — and build that in.”

A new item that Hetterick is seeing dealers include is the precision subscription. “What’s it going to cost that customer for 3 years and can we build some of those into the total cost of ownership of that unit.”

Finally, as Hetterick noted before, it’s important to break the total cost into a cost per acre, cost per hour or cost per bushel basis for the customer that the salesperson can explain and lay out for multiple years.