In this episode of On The Record, we ask Oxbo what we can expect from their acquisition of H&S Manufacturing. In the Technology Corner, Noah Newman covers Versatile's recently announced collaborative autonomy project. Also in this episode: farmers' interest rates concerns and declining used equipment price trends.

This episode of On the Record is brought to you by Weasler Engineering.

Deliver a seamless transfer of power between a tractor and its attached machinery with one of Weasler’s three ASABE-compliant drive shaft product lines; the Standard, the Classic and the Professional. Weasler’s Newest product line – the Standard- offers a selection of pre-configured driveshafts. The Classic and Professional lines offer variety of standard components to choose from, allowing you to customize your PTO drive shaft to meet the specifications of your job. Learn more about what Weasler can do for you by visiting Weasler.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Oxbo Expands Forage, Manure Equipment Offerings with H&S Acquisition

- Dealers on the Move

- Versatile Enters Autonomy Arena with Mojow Partnership

- Interest Rates Remain a Concern for Growers

- Used Equipment Prices Decline, Inventories Tighten

- DataPoint: Canadian Combine Deliveries

Oxbo Expands Forage, Manure Equipment Offerings with H&S Acquisition

Oxbo announced June 22 that it is acquiring hay and forage equipment manufacturer H&S manufacturing out of Marshfield, Wis.

Viewers may recall back in 2015, Oxbo brought a patent infringement lawsuit against H&S Manufacturing surrounding its triple head windrow merger technology. Oxbo won the case in 2017.

Roel Zeevat said in an interview with Ag Equipment Intelligence that the acquisition is designed to boost Oxbo’s hay and forage equipment offerings, which had previously been limited to mergers, as well as increase its manure equipment presence.

“Oxbo has been active in forage and hay business for a long time but with a very limited number of products. We produce mergers, and mergers only. So we’ve looked at becoming more attractive to our customer base by putting more substance to our hay and forage business. And we looked at paths to develop more products ourselves in that industry. But when the possibility came up and we got informed that family wanted to sell the business, we immediately got interested. Because this gives us the substance, and hay and forage business that we were looking for.”

Zeevat said the company is currently addressing how to best merge the 2 companies’ dealer networks, though he adds there’s no near-term plan to take all Oxbo’s product to all H&S dealers.

“We’re currently in discussion [about] how we can best merge that together. Because the philosophy was a bit different, because the product lines of Oxbo were more limited. So we did a careful selection of dealers to carry the Oxbo product, where H&S had the philosophy of having a very condensed dealer network through the east and the mid part of the U.S, while working with distributors more in the West of the U.S. There is overlap in dealers. So, we have the first talks with several dealers that have both brands, how we can best approach this.”

Zeevat said acquisition talks with H&S began in mid-2022 and that Oxbo has no rebranding plans in the short-term.

Dealers on the Move

This week’s Dealers on the Move include Agri-Service, Highway Equipment & Tractor, Truland Equipment and True Ag & Turf.

AGCO dealer Agri-Service announced July 11 it has acquired Washington and Idaho dealer Deer Park Farm Center, Diesel & Machine and Walla Walla Farm Center. The acquisition was finalized on June 29.

The North Carolina-based Kubota dealers Charlotte Tractor and Lake Norman Tractor announced that the two are merging to become Highway Equipment & Tractor, a division of Highway Equipment Company.

Nebraska AGCO dealer True Ag & Turf will be formed by the merger of Manzer Equipment, Merz Farm Equipment and West Point Implement of Columbus.

Versatile Enters Autonomy Arena with Mojow Partnership

Versatile announced a partnership with Mojow Autonomous Solutions — the two companies are teaming up on the development of Mojow’s EYEBOX autonomous navigation controller.

Engineers from both companies have been working together over the past 6 months, to integrate the system on Versatile tractors. Mojow founder and president Owen Kinch was involved in the original development of the autonomous DOT platform, which was purchased by Raven a couple years ago. So, when Versatile started looking for someone to team up with on autonomy, they identified Mojow as the perfect partner.

EYEBOX utilizes sensors and computer vision techniques to enable autonomous operations within broad-acre applications. A Versatile high horsepower, four-wheel drive tractor has been running with the EYEBOX controller in Alberta this spring and summer, completing several in-field tests and applications with promising results. I just caught up with Adam Reid, who’s the Vice President of Sales & Marketing for Versatile. He says this partnership opens the door for Versatile’s entry into the autonomy arena.

“Our involvement in autonomy is really in the infancy stages. It’s obviously a feature that we will incorporate into the tractors at some point. I don’t think it’s a secret that’s where the industry is going. For us and our customer base it’s going to be a slow lead up to that, and we wanted to find a partner that would work with us with that understanding, knowing that we’re not necessarily going to be the first company to be running tractors in the market without people in the cab. We’ll be at the table when the time is right, and we’ll have a slow progress to it. Based on our roadmap now there will be a leader follower scenario before we get to full autonomy. Its just important that we are part of that evolution as of course technology advances and continues to evolve.”

Reid says the company doesn’t necessarily have a commercial plan for EYEBOX at this point. Right now they’re focusing on an advanced engineering study. They know customers will be asking for it at some point, and they want to be ready when that time comes.

Interest Rates Remain a Concern for Growers

Farmer sentiment rebounded in June, according to Purdue’s Ag Economy Barometer. The Barometer rose 17 points in June to a reading of 121. According to James Mintert and Michael Langemeier, who compile the report, “The swing in sentiment was driven by producers’ more optimistic view of the future as the Index of Future Expectations rose 25 points to 123, while their perception of the current situation was unchanged.”

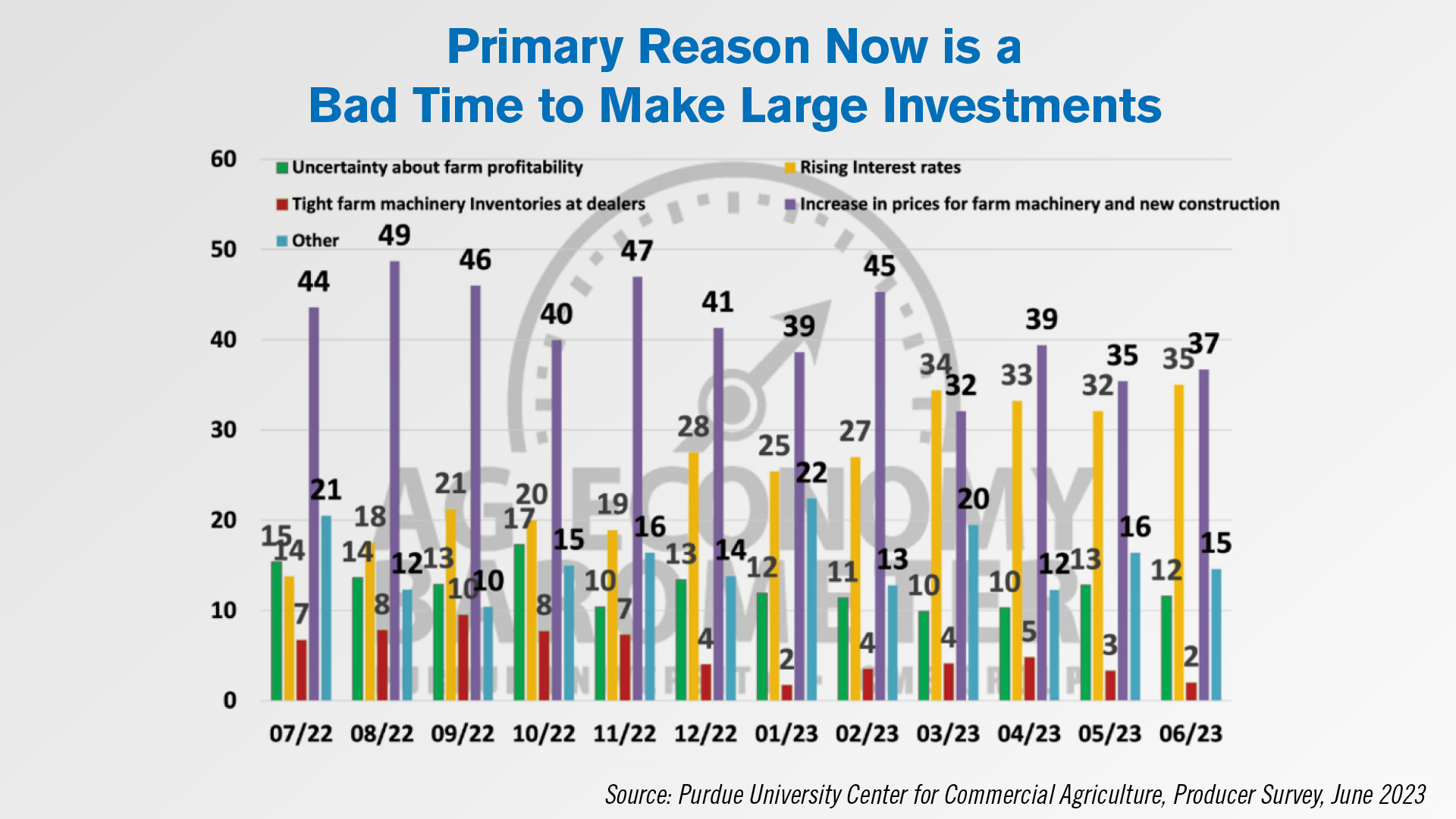

Almost 75% of respondents said they view this as a bad time to make large investments in their farm operation, and 16% said it’s a good time to make investments. For 37% of respondents, the rising prices of farm machinery and new construction was the primary reason they consider now a bad time to make large investments. This was followed by rising interest rates at 35%, its highest percentage since July 2022.

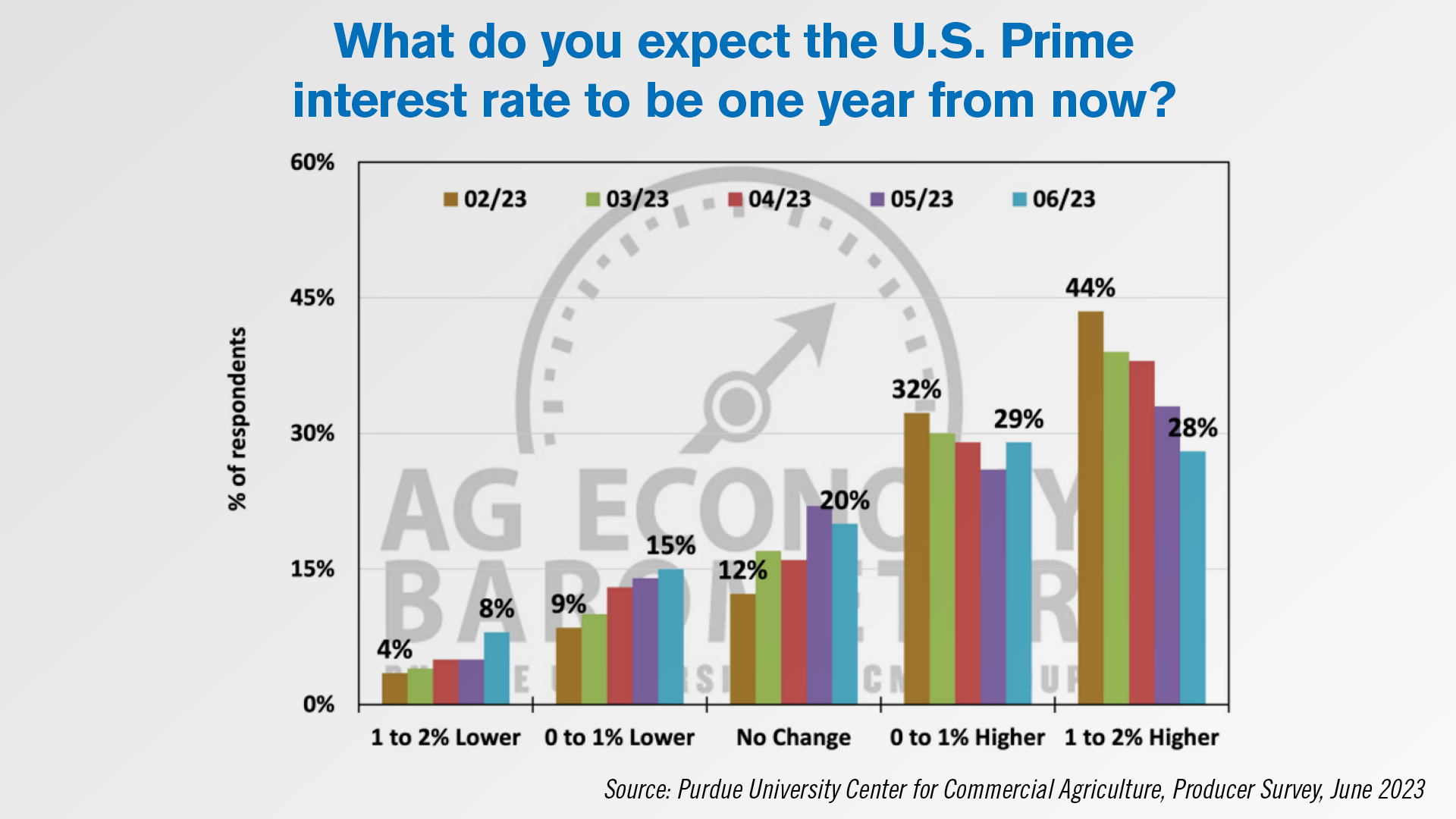

Since February, the survey has asked farmers about their expectations for U.S. Prime interest rates in the next year. Here is Mintert with a look at what farmers are expecting to happen with interest rates over the next 12 months.

Overall, almost a quarter of respondents expect U.S Prime interest rates to be up to 2% lower in one year. The percentage of growers expecting interest rates to be lower has been steadily increasing over the last 5 months. However, 57% of surveyed farmers still say they expect interest rates to be up to 2% higher in one year from where they are now. This is down from 76% who said the same back in February.

Used Equipment Prices Decline, Inventories Tighten

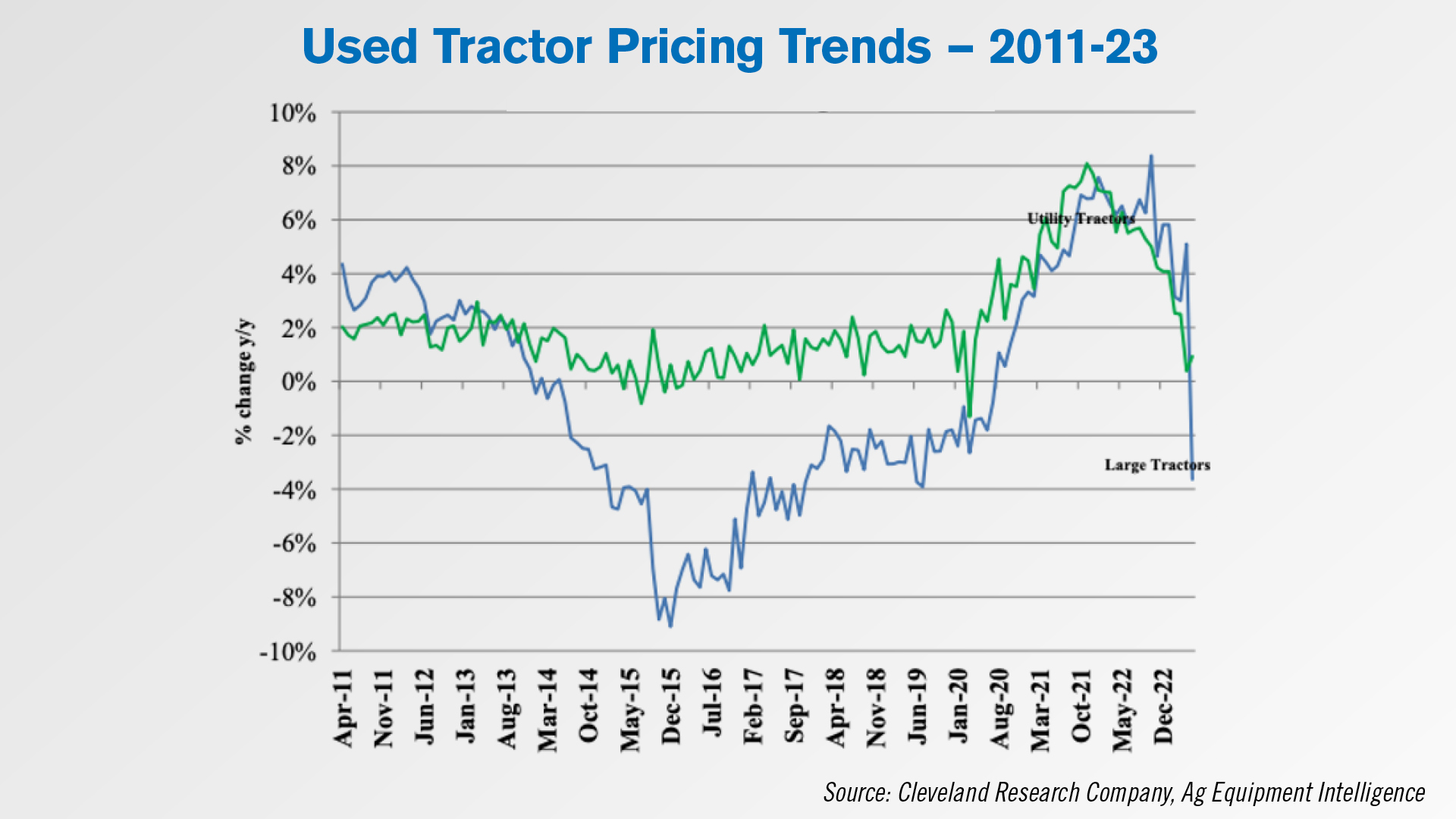

Ag Equipment Intelligence’s June Dealer Sentiment & Business Conditions Update showed used equipment pricing down by 4% year over year.

This was the first drop in price since July 2020. Used large tractor pricing was down notably, declining 4% year-over-year. Used 4WD tractors specifically showed the largest year-over-year drop at 9%. New equipment prices, by contrast, were up about 2.5% year-over-year in May.

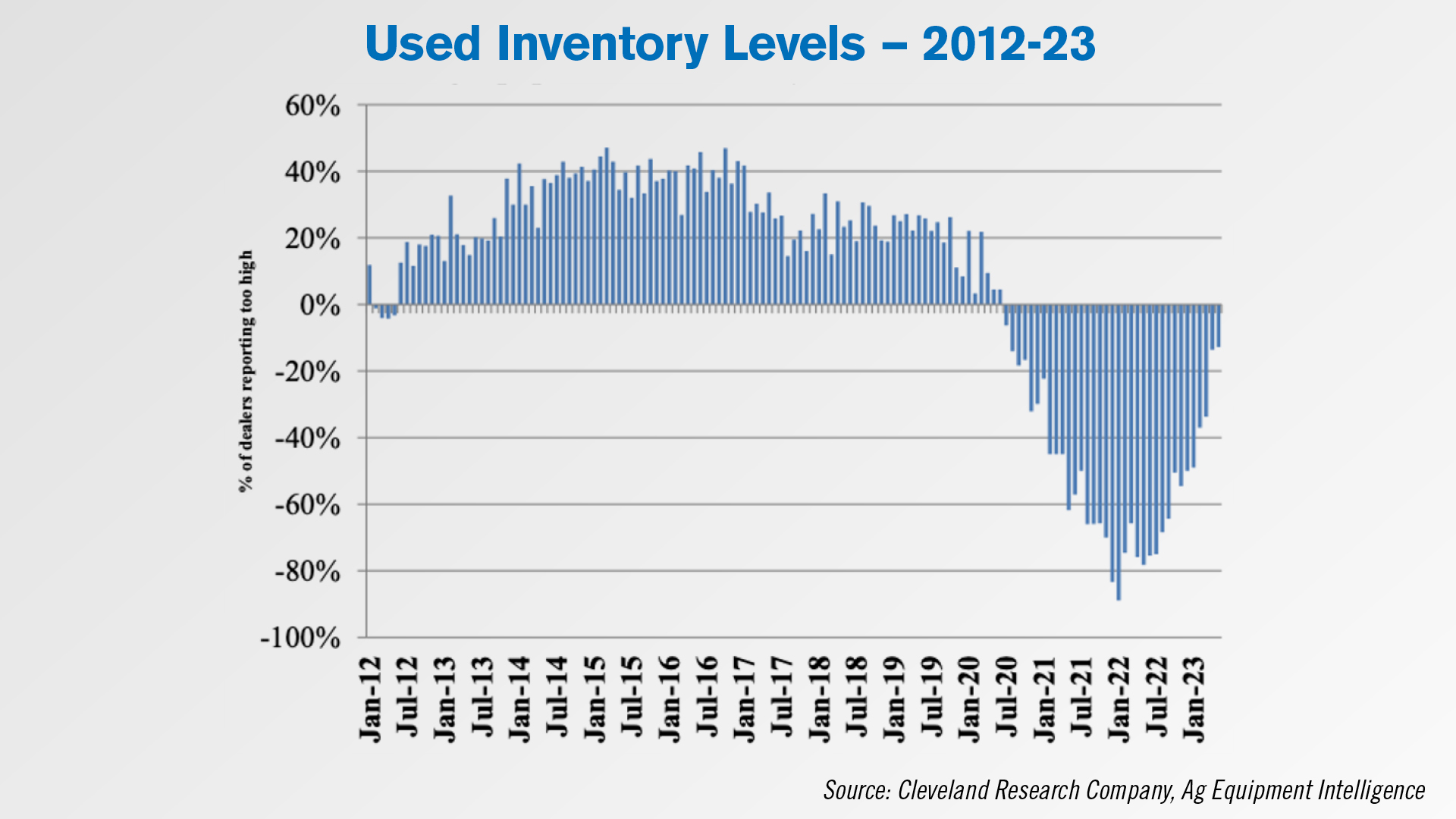

A net 13% of dealers said used equipment inventories were too low in May, the lowest net percentage seen since mid-2020. New inventory levels have recovered less, with a net 34% of dealers reporting them too low vs. 5% saying the same in April.

Andy Campbell, an analyst with Tractor Zoom and a farmer himself, said the lack of farmer optimism in the latest Ag Economy Barometer was not a surprise to him. He cites the fact that the survey for the barometer was deployed in early June when the commodity markets were also on the rise. He adds that farmers may have been showing recency bias in forecasting improved future conditions in what he calls a “rare moment of optimism.”

From the standpoint of equipment dealers, however, he believes they are much more rooted, saying they are not tied to those commodity markets. Instead, they are seeing what he is calling a return to normalcy.

“It’s just a bit of a shock because now we’re actually having to carry inventory and manage business differently. So, I can understand why the dealer’s sentiment is down because they’re seeing a little bit more of reality of the — the holding cost and having to really focus on turning inventory, which we’ve been noticing. The turns metrics have been slowing down a little bit more recently.”

He says farmers being cognizant of rising interest rates and equipment values as well as uncertainty around profitability has them pulling back on their purchase plans, meaning certain dealer inventories will start to rise.

“I can see why farmers are pairing back their intent to purchase, which is already being shown in the mounting supply that are showing up on dealers’ lots. Lots of those high ticket value items. I think the equipment categories that are going to be affected the most are your low-hour, late model pieces, not necessarily the new purchases or the leases. Those will still happen, but I think it’s those first trade ins and those inventory supply levels that are going to mount the most.”

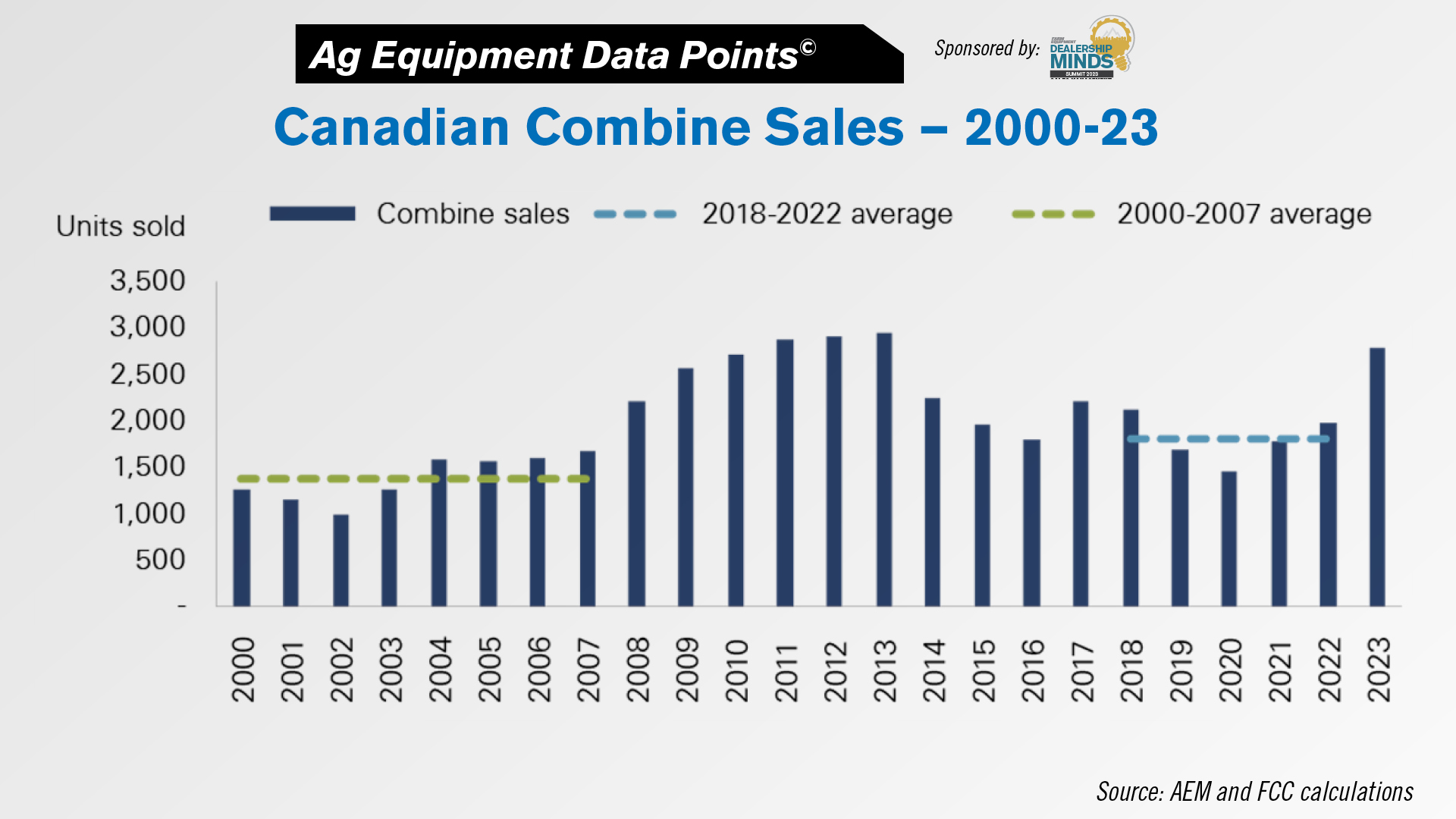

DataPoint: Canadian Combine Deliveries

This week’s DataPoint is brought to you by the Dealership Minds Summit.

In a July 11 report, Farm Credit Canada forecast a notable increase in Canadian new combine sales for 2023, around the 2,700 mark. FCC stated in the report that, “Combine manufacturers’ deliveries year-to-date have increased year-over-year by over 100%. The high manufacturer deliveries of new combines to dealers (mainly pre-sold) result in our projection of combine sales rising 40% in 2023.”

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.