Editor’s Note: This Q&A originally appeared in AG Tire Talk to provide answers that farm equipment dealers have about farm tire technology. This series features a trending question followed by an abridged version of the answers. For the complete answers, check out www.agtiretalk.com.

We posed the following questions to tire manufacturers. Why are agricultural tires so difficult to find, why are prices increasing, how long will this continue, and what steps do you recommend producers take to make sure they have the tires they need?

AG TIRE TALK KEY TAKEAWAYS

- MAXAM

“The agricultural tire market is facing an unparalleled demand for 2021 and is up significantly by +35% factor versus the same period last year. The primary factor for this incredible leap in demand is core crop prices for 2021.” - BKT

“Although agricultural tires have been in demand, as farmers have received government subsidies and invested in farming equipment, manufacturers are challenged to keep up with demand.” - YOKOHAMA

“Many farm tires have been hard to find over the past year or so due to supply chain constraints at every level, from sourcing raw materials to shipping finished tires to dealers.” - CONTINENTAL

“The pandemic shut down many key operations and material supply for tires. Steel, natural rubber, carbon black, silica; the list goes on…” - TRELLEBORG

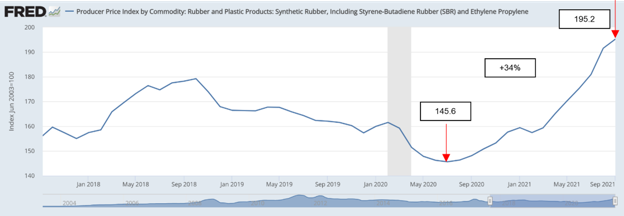

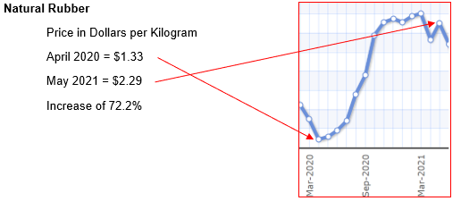

“Natural and Synthetic rubber account for over 51% of a tire’s cost.” “…since March 2020, Natural Rubber Cost +72%. …since August 2020 Synthetic Rubber Cost +34%.” - MICHELIN

“We are beginning to see some relief around the late second half of 2022. Pricing will still be high and campaigns will be few and far between, but supply is improving.”

Trelleborg Wheel Systems

Norberto Herbener: OE Applications Engineer

AG TIRES HAVE BEEN DIFFICULT TO FIND, BACKORDERED, SHORT SUPPLY WHATEVER TERM YOU WANT TO USE BECAUSE OF SEVERAL FACTORS:

Customer Buying Cycle hit at the right time and/or Pent-Up demand

With the pandemic in full swing in early 2020 customers hesitated in any kind of tire purchase because of the uncertainty of what was to happen. Tractor production stopped and some tire production stopped for some time creating future pent-up demand. The AG market does go in cycles and 2021 caught the up cycle.

Tire Manufacturing Labor Shortage

The tire industry is suffering similar problems to other industries – Labor shortage. Many people are not working and because tire building and tire manufacturing is a skilled service skilled laborers are difficult to find. With less people making tires the factory output is lower. Hence supply is lower.

Crop Yield was Good

I am going to just use corn as an example. According to the report, over 14.18 billion bushels of corn for grain were produced in the U.S. in 2020.

The total production of corn in the US for the year 2019 is reported to be 13.016 billion bushels.

That’s a 9% increase which turned into 1.17 billion more bushels of corn harvested.

Commodity Prices High

I will again use just corn, prices have rose since last year. Windfall for farmers.

- US $ amount per metric ton on Sept 2020 = $166.08 this equates to $4.22/bu

- US $ amount per metric ton on May 2021 = $305.31 this equates to $7.77/bu

That’s a whopping 84.1% INCREASE.

As of Oct. 19, 2021, corn was selling at $5.37/bushel.

Check out this example – If a corn producer farms 1,500 acres and we will use the above cost – 1,500 ac x 166 bu/ac yield x $3.88/bushel cost = $966,120. He will sell corn at $5.37/bu = 1500 x 166 = 249,000 bushels x $5.37/bu = $1,337,130 – his cost of $966,120 = $371,010 profit. This is a simple example, but you can see the producers had a good year. He needs to spend that money.

CFAP Payments

The Secretary of Agriculture is issuing this rule to implement the Coronavirus Food Assistance Program (CFAP). CFAP provides assistance to agricultural producers impacted by the effects of the COVID–19 outbreak. This rule establishes provisions for direct payments to producers of eligible commodities.

Dealers Procrastinated

As we tried to solicit distributors and dealers to place fall orders for spring shipments – they didn’t. The sudden influx of business from producers to dealers created the immediate demand. This immediate demand has put us in the situation right now.

Farmer Money Triggered Tractor Orders

Because of the aforementioned comments producers realized a large windfall from 2020 triggering spending. Tractor manufacturers could not keep up with the sudden influx of tractor orders consequently tire manufacturers could not keep up with the sudden influx of tire orders from tractor manufacturers.

WHY ARE PRICES INCREASING

Raw Materials Increase Costs

“Natural and Synthetic rubber account for over 51% of a tire’s cost.” “…since March 2020, Natural Rubber Cost +72%. …since August 2020 Synthetic Rubber Cost +34%.”

Synthetic Rubber

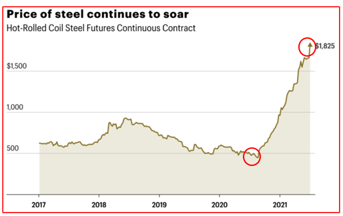

Steel

Steel is used in tire production with the beads and some tires having steel belts.

You can see what has happened to the price of steel.

What steps do you recommend producers take to make sure they have the tires they need?

Producers should place tire orders right now with their tire dealers. We suggest the tire dealers place the order with the manufacturers to get in line when tires become available.

Michelin Ag

David Graden: Operational Market Manager – Agriculture

Since 2018, Michelin Agriculture has seen record growth year over year. Throughout 2020 and 2021, that growth has really gone through the roof! As many of us know, replacement tire demand can be driven by many different factors. If I were to prioritize those factors, I would say seasonal weather, net farm income and global agricultural economics would be at the very top.

To explain what is occurring today, we need to look back to the beginning of COVID. Farmers that were negatively affected tended to rely heavily upon manual/migrant workers and/or grow and supply foods to our schools, restaurants, and businesses. All other farmers and producers were affected very little and still received COVID financial relief. This, in addition to low input costs, are a big piece of the net farm income equation that led to more spending.

Unfortunately, from a manufacturing perspective, the entire world almost completely shut down for 4-8 weeks, while we all continued to feed ourselves and others. In a normal year, Ag tire plants have to build constantly in order to keep up with demand. By Q3 – Q4 2020, all Ag tire manufacturers were playing catch up, while demand continued to increase.

From a producer’s perspective, it has really been business as usual, but with more advanced planning and strategy to get the supplies they need in time to fertilize, plant, harvest, store, etc. If a producer needs new Ag tires, well good luck getting the brand you want without waiting months in the sea of back orders. To get around this, producers will need to order their tires well in advance. When they finally arrive, I recommend storing them until needed or replace and sell the used tires for a premium.

The light at the end of the tunnel is dim, however, it’s there. We are beginning to see some relief around the late second half of 2022. Pricing will still be high and campaigns will be few and far between, but supply is improving.

BKT USA, Inc.

Dave Paulk: Manager Field Technical Services

The tire industry, as well as many other companies, have been faced with many difficulties over the last 18 months during COVID. Although agricultural tires have been in demand, as farmers have received government subsidies and invested in farming equipment, manufacturers are challenged to keep up with demand.

There have been many complications getting the raw materials needed to produce tires because of restrictions imposed during and after the shutdowns from the pandemic. Rubber and other raw material prices continue to increase month over month.

Getting tires to customers is also a challenge. For the logistics industry, there has been a shortage of containers with estimated 12.5% of the global capacity being unavailable. Shipping and freight costs are escalating almost daily. There is a shortage of laborers at the ports as well as truck drivers for transportation. Containers of tires that have already arrived at the ports are many times held up for several extra weeks before reaching the customers.

Producers need to work closely with their suppliers of raw materials and customers of their finished products, to forecast their needs to better keep up with their demand. BKT is working closely with our distributors and dealers to ensure that they receive the tires they need to cover current demand and order effectively for future needs.

Continental Agriculture North America

Dana Berger, Ag Business Development Manager at Continental Commercial Specialty Tires

We have all seen the affects of the COVID-19 pandemic in one way, or another. As if the toilet paper crisis wasn’t enough; I am sure there are meme’s coming for the shortage on farm tires, too. The pandemic shut down many key operations and material supply for tires.

Keep in mind, farmers are considered essential workers. Even when many were working from home, farmers were out using their tires. Plant shutdowns don’t happen on a farm because their plants keep growing.

As with any commodity, the law of supply and demand comes to play. When there is high demand and a low supply, price always goes up. The only challenge with this; the market demand hasn’t decreased despite price increases. Enter Demand-Pull Inflation – where demand for tires exceeds the manufacturer’s capacity.

We certainly don’t want to see this demand-pull affect be the norm, but it’s very hard to say when this situation will level out. Farmers will need to plan ahead as much as possible. If they find the right size tire in stock and expect to need a replacement, they should jump on it. OEM’s have also struggled with a shortage in resources and getting new equipment to the farmers. This will keep the demand for replacement tires at a high level, at least into 2023, with brand loyalty not carrying much weight until some relief can be seen on the horizon.

Yokohama Off-Highway Tires America, Inc.

Blaine Cox, National Product Manager–Agriculture, Golf & Turf

Many farm tires have been hard to find over the past year or so due to supply chain constraints at every level, from sourcing raw materials to shipping finished tires to dealers. Supply chain challenges have also contributed to high raw material prices, which have been a major factor in driving up tire costs. The bad news is that economists say it will be months or longer before today’s constraints let up.

When supplies are tight and costs are increasing, it really pays off for customers to know their tire dealer and trust that he or she is going to be able to get them the tires they need for the job they’re doing.

This is not the time to skimp on tires and figure there will be a replacement around if something goes wrong. It’s the time when investing in a quality tire that’s purpose-built and application specific for your equipment and conditions is the best way to ensure long, reliable service. This is the time when trust, expertise and relationships really pay off more than ever.

Maxam Tire International

Greg W. Gilland: Business Development & Ag Segment Manager

The agricultural tire market is facing an unparalleled demand for 2021 and is up significantly by +35% factor versus the same period last year. The primary factor for this incredible leap in demand is core crop prices for 2021. Despite the economic impacts of the Covid Pandemic of 2020, we have experienced almost a doubling of crop prices in less than 15 months beginning in the second half of 2020. This explosion of demand is primarily centered on global need for wheat, soybeans, corn, and cotton.

The below table captures the market evolution of cash crop prices through the end of November 2021.

Improved profits for farmers and growers due to the above crop prices have fueled unprecedented global demand for new equipment and/or tires for their vehicles. This has accelerated new equipment demand from the OEMs which has severely strained the global tire supply as manufacturers are reacting to the combined tire surge in both original equipment and after-market needs.

As we close 2021, and look at both 2022 and beyond…the below appears to be the trends we are observing:

- OEM demands for tires will remain high as tire manufacturers react to their factory needs well into 2022.

- Farmers and growers will need to purchase equipment and tires to amortize their 2021 profits earned.

- Cash crop prices are forecasted/expected to remain high well into Q1 of 2023 which will allow more farmers to purchase equipment or tires into the first half of 2023.

- Global population continues to grow which will create a permanent strain on food supply for the years to come.

- In addition, the current global delays caused by container or port distribution and/or ground freight problems with no end in sight will artificially continue to drive tire demand, and as well sustain the current crop prices.

Farmers and Growers need to remain proactive and monitor all their equipment needs to include tires. In this case, proactive means farmers and growers must be placing order’s now for what they think they may need in the next three to six months to a year away.

The surge in radial tires that we are seeing in the market is also being fueled by the need for proven tire solutions that will allow farmers and growers to plant, service, and harvest their crops more efficiently to meet global demand. As agricultural machinery continues to grow in weight and engine horsepower, we are seeing not only an explosion in market demand, but as well an evolution towards high load IF and VF technology tires with steel casings or belts that can deliver the flotation, traction, and/or stability they need for their equipment and crop management.

Post a comment

Report Abusive Comment