Workforce development has become an increasingly important topic for the farm equipment industry in recent years. While a lot of attention has been given to the challenge of finding and retaining qualified service technicians, the workforce development issue is much larger than that. Developing employees to fill future senior and mid-level management and leadership roles is a challenge for dealers.

WEDA conducted a survey of dealership CEOs, extending the invite to 70 dealer organizations, to benchmark the industry’s employee development needs. Of those 70 dealerships, 63 responded and represented 549 locations across the U.S. and Canada. The average number of locations per dealership was 8.7. By brand, 38.1% were Deere dealers, 23.8% were Case IH, 15.9% were Kubota, 11.1% carried New Holland, 7.9% were AGCO and 3.2% replied with “other.”

“As we look across the landscape of our dealer channels, we see because of consolidation, as well as growth, retirement, the evolution of the business, new customer demands and a variety of other things, having the right people doing the right job is vital to our success,” says Michael Piercy, vice president of dealer development with WEDA’s Dealer Institute. “And I would go a little further and say today, it’s not just having the right person doing the right job, it’s also making sure the right person has access to the right training to do the job right.”

Summarizing what the survey results showed, WEDA CEO John Schmeiser says, “In the end, dealers feel they need to do more, they need a better plan but they do not have a strategy except to fill a hole when it becomes open. And that this challenge, this necessary requirement of your business is harder today than it ever was.”

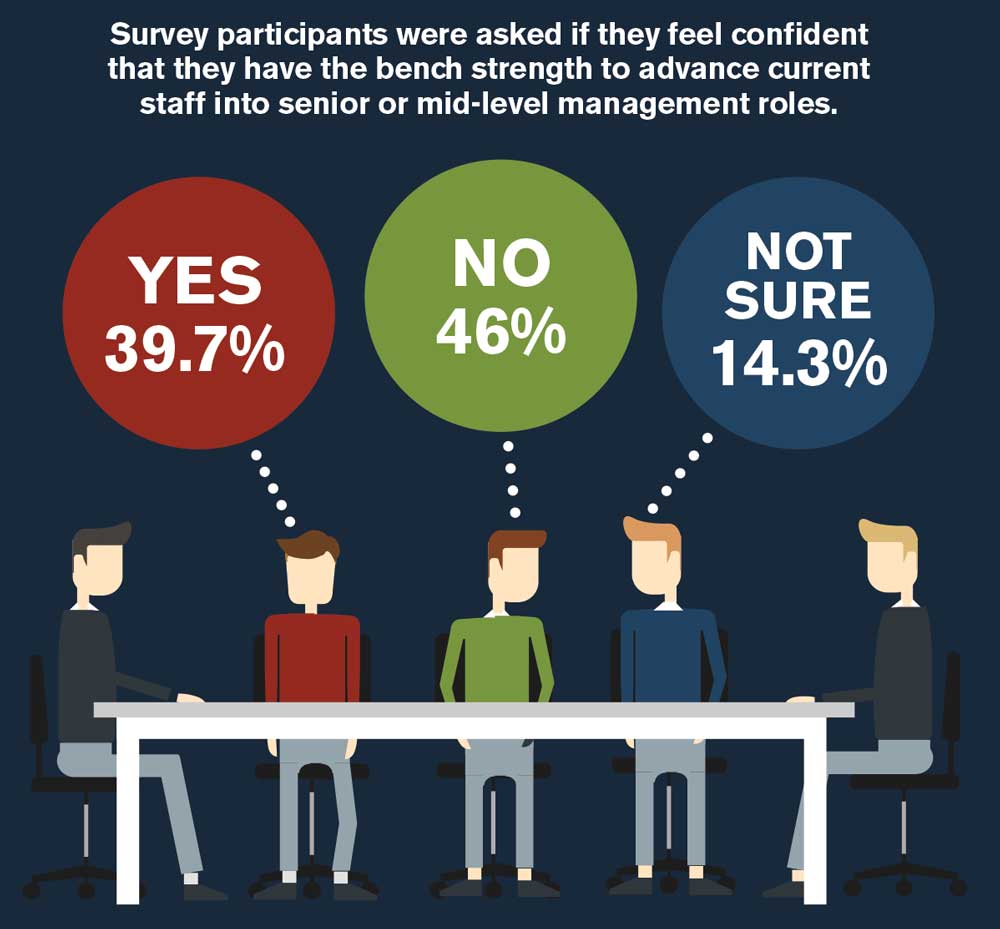

How’s Your Bench Strength?

Bench strength refers to the capability of an organization’s staff to move into positions of greater responsibility when required. Michael Piercy, vice president of dealer development with WEDA’s Dealer Institute says, “We know and understand that bench strength has always been an issue, but it’s growing more vital to the viability of an organization’s success.”

Dealer comments included:

“There’s a gap in experience, maturity and accountability. The ability to take the next steps. Most managers are not qualified to train.”

“We’ve had a shortage of bench strength for 20 plus years, it has and continues to be an area of concern.”

“Our bench is way too empty. We have great employees, but not too many who can advance their careers into high-level management positions, unfortunately. They lack management leadership skills.”

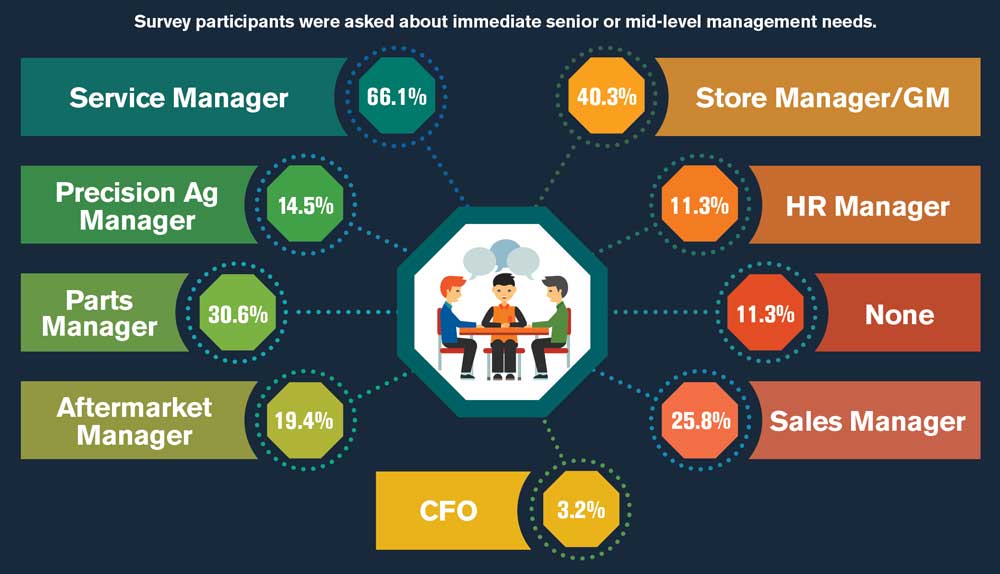

Where’s the Biggest Immediate Need?

Unsurprising, when asked where their immediate needs were for senior or mid-level managers, 66.1% of dealers listed service managers as their top need. This was followed closely by store manager/general manager (40.3%),

parts manager (30.6%) and sales manager (25.8%).

Dealer comments included:

“We need more training at the top levels.”

“Precision is still a difficult role to fill, it takes a long time to train people to be effective in this role.”

“Service management continues to stay at the top of the list, we feel the service manager role is the most challenging role in the organization and the most difficult to fill effectively. We have also found it challenging to replace sales leadership roles in an effective manner.”

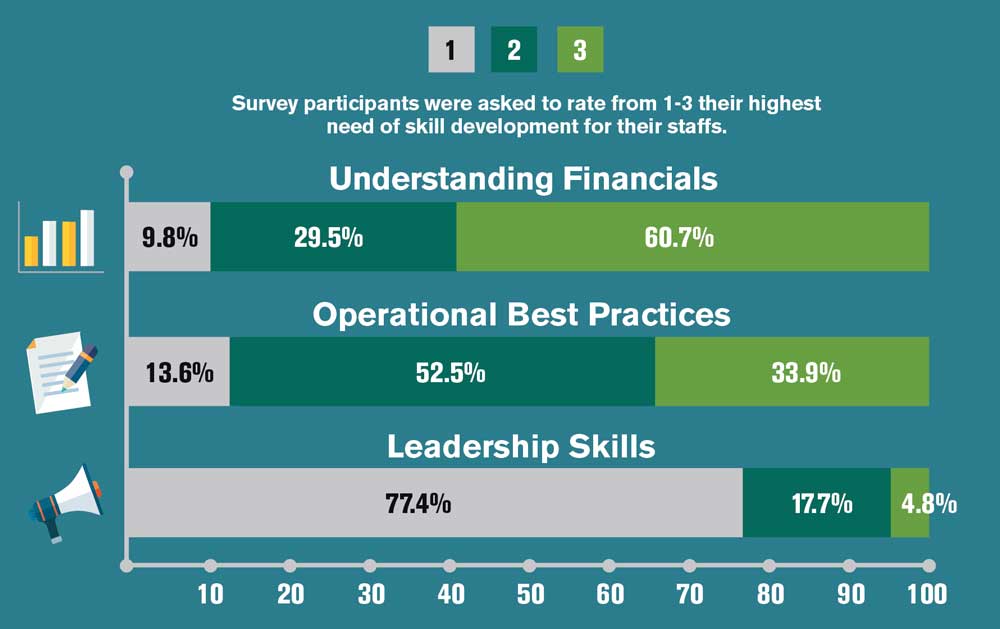

Top Skill Development Needs

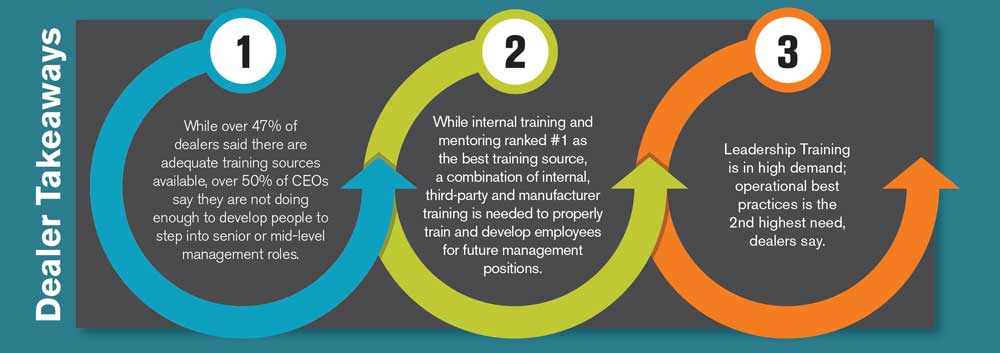

When looking at dealerships of all brands, leadership skills was ranked as the #1 need for skill development by 77.4% of dealers. Operational best practices ranked second at 52.5% and financial understanding was third at 60.7% of dealers.

Best Training Sources

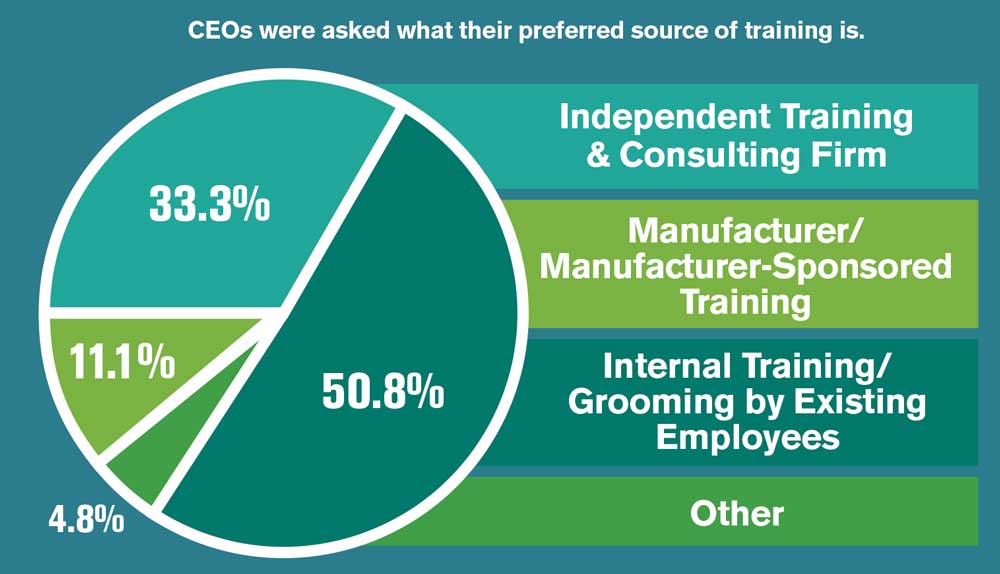

Just over 47% of dealership CEOs say there are adequate training sources available. When asked what their preferred source of training was, 50.8% said internal training/grooming by existing employees was their top choice. A third of CEOs said they preferred independent training and consulting firms. Comments suggested, however, that a blend of internal, third party and manufacturer training is needed for a successful employee development.

Want to Learn More?

- View the webinar — Workforce Development, Identifying Today’s Challenges for the Next Generation of Leadership — on Farm-Equipment.com

- If you’d like a copy of the survey as well as breakouts by individual lines — AGCO, Case IH, John Deere, Kubota and New Holland results compared to the industry averages are available from the Western Equipment Dealers Assn. Contact Michael Piercy (mpiercy@westerneda.com) or John Schmeiser (jschmeiser@westerneda.com) for more information.

Where’s the Biggest Long-Term Need?

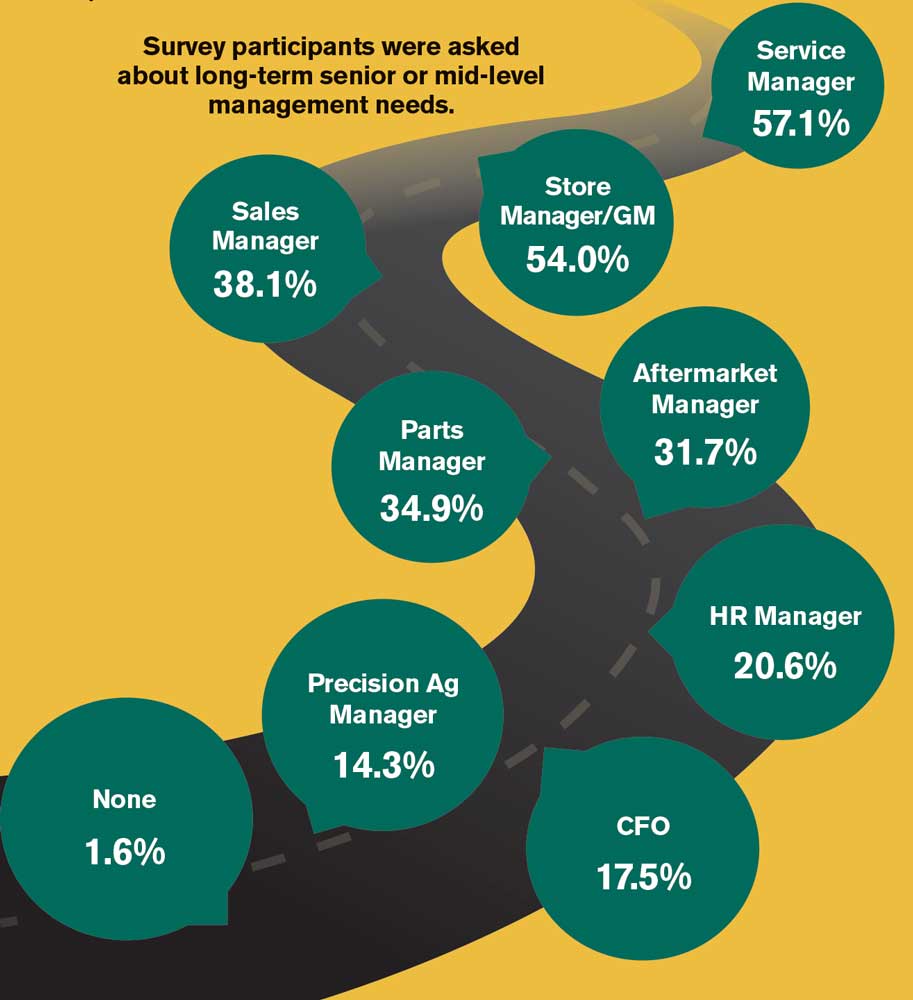

Similar to the short-term needs, service managers ranked No. 1 (57.1%) followed by store manager/general manager (54%), sales manager (38.1%), parts manager (34.9%) and aftermarket manager (31.7%). “We also saw some differences where human resources managers registered higher on the long-term. Precision ag manager also registered higher in the long-term, and the other would be CFO also registered higher on the long-term needs,” notes John Schmeiser, WEDA CEO.

Dealer comments included:

“Training at the top level will be our long-term need. What we need will be the most challenging positions to fill. Expectations for these types of jobs have increased. And then it’s becoming more difficult to promote from within because of the lack of skill sets.”

Self-Check — How Are You Doing?

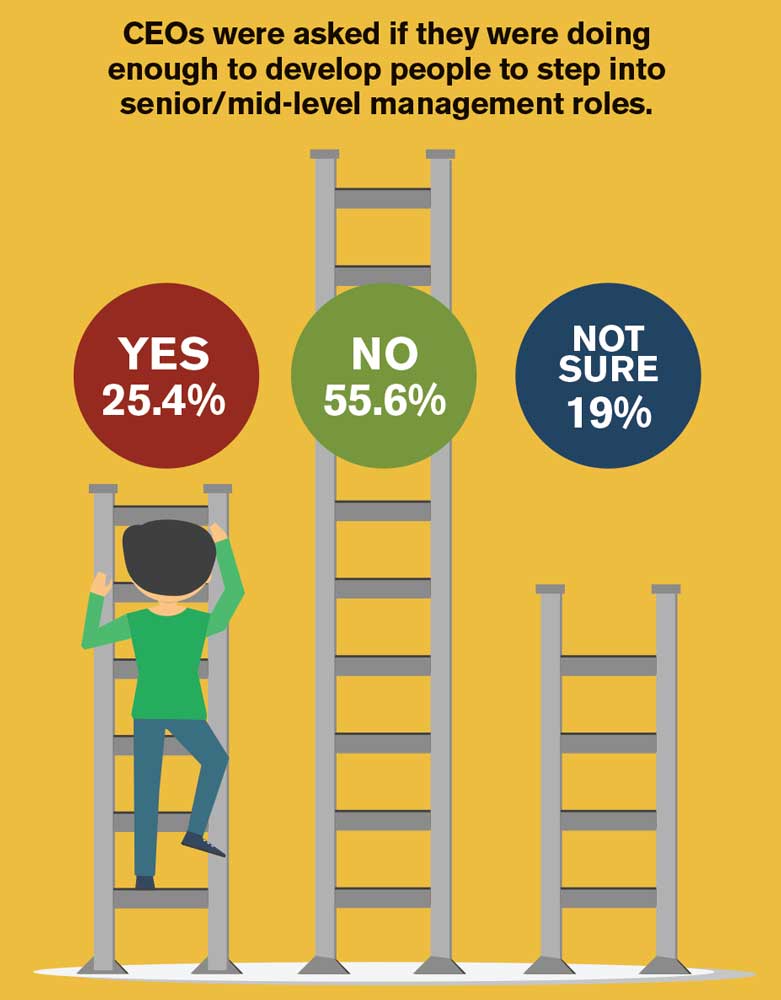

CEOs were asked if they were doing enough to develop people to step into senior or mid-level management roles. Over half (55.6%) said no and just a quarter said they were doing enough. Another 19% weren’t sure if they were or not. “The accountability piece on following through on the development and training that people are receiving seems to be a real point of difficulty,” notes Piercy.

Dealer comments included:

“It seems that less people are interested in developing their skills unless the dealership continues to pay them for the time they’re learning. I believe in the past, many people would invest in their own time to improve skills.”

“We do a lot to try and grow, but accountability is a big challenge.”

Training Investments

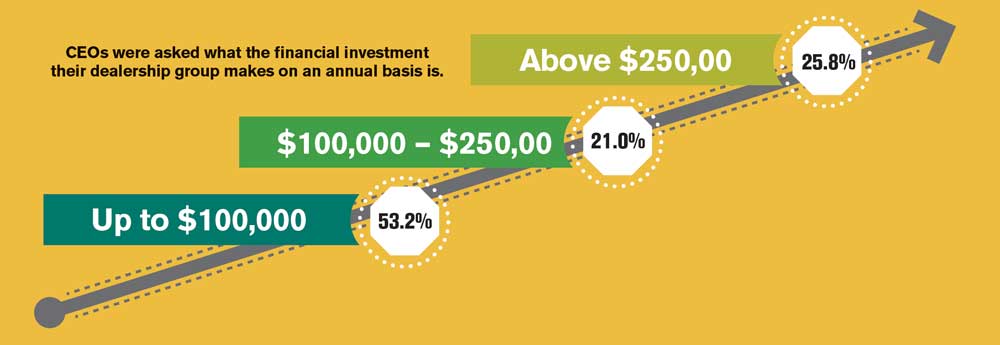

“One of the most interesting questions we asked was the financial investment that their dealership group was making on an annual basis on training. This question was very telling when we did the break down line by line. But overall, we have just over one quarter of the survey participants investing over $250,000 in training, but over 50% are investing under $100,000,” says Schmeiser. Dealers were asked to answer based on pre-COVID levels of investment.