Titan Machinery Inc. (Nasdaq: TITN), a leading network of full-service agricultural and construction equipment stores, today reported financial results for the fiscal third quarter ended Oct. 31, 2020.

David Meyer, Titan Machinery's Chairman and chief executive officer, stated, "We exceeded our third quarter top-line expectations due to strong parts and service performance in our Agriculture segment and better than anticipated equipment sales in our Construction and International segments. The stronger revenue, combined with continued success controlling operating expenses and driving down interest expense, resulted in a significant improvement to our pre-tax income. Due to our strong third quarter results and solid agriculture market fundamentals that are supporting our fourth quarter, including improved corn and soybean prices, we are raising our earnings per share guidance for fiscal year 2021. COVID-19 continues to challenge our team and our customer's end markets, however, I'm proud of how our team has responded to the new operating environment as they continue to deliver the high level of support our customers have come to expect."

Fiscal 2021 Third Quarter Results

Consolidated Results

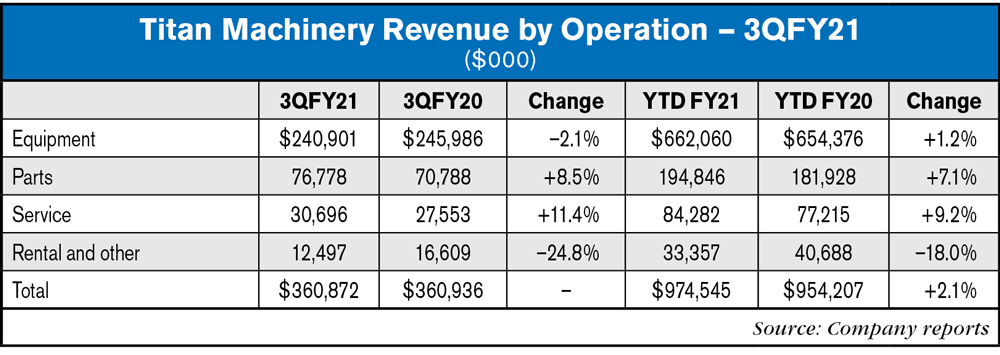

For the third quarter of fiscal 2021, revenue was flat versus prior year at $360.9 million. Equipment sales were $240.9 million for the third quarter of fiscal 2021, compared to $246 million in the third quarter last year. Parts sales were $76.8 million for the third quarter of fiscal 2021, compared to $70.8 million in the third quarter last year. Revenue generated from service was $30.7 million for the third quarter of fiscal 2021, compared to $27.6 million in the third quarter last year. Revenue from rental and other was $12.5 million for the third quarter of fiscal 2021, compared to $16.6 million in the third quarter last year.

Gross profit for the third quarter of fiscal 2021 was $72.6 million, compared to $71.8 million in the third quarter last year. Gross profit margin increased 20 basis points to 20.1% versus the comparable period last year. The increase in gross profit margin was primarily due to an increased mix of higher margin parts and service business, as compared to the third quarter of last year.

Operating expenses decreased by $4.1 million to $54.1 million for the third quarter of fiscal 2021, compared to $58.2 million in the third quarter last year due to managed expense reductions in our Construction and International segments and lower expenses caused by COVID-19, such as travel and fuel expenses. Operating expenses as a percentage of sales decreased 110 basis points to 15% for the third quarter of fiscal 2021, compared to 16.1% of revenue in the prior year period. The Company recognized $2.6 million in goodwill, intangibles and long-lived asset impairment in the quarter compared to $0.1 million in the prior year. Nearly all of the impairment in the current quarter related to certain goodwill and other intangible assets in our International segment.

Floorplan and other interest expense was $1.7 million in the third quarter of fiscal 2021, compared to $2.4 million for the same period last year. The decrease was due to a lower interest rate environment, a lower interest rate spread under our new five-year Amended and Restated Credit Agreement that was finalized in April 2020, and lower borrowings on our line of credit.

In the third quarter of fiscal 2021, net income was $9.9 million, or earnings per diluted share of $0.44, compared to net income of $8.2 million, or earnings per diluted share of $0.37, for the third quarter of last year.

On an adjusted basis, net income for the third quarter of fiscal 2021 was $13 million, or adjusted earnings per diluted share of $0.58, compared to adjusted net income of $10.7 million, or adjusted earnings per diluted share of $0.48, for the third quarter of last year.

Adjusted EBITDA was $24.8 million in the third quarter of fiscal 2021, compared to $21.4 million in the third quarter of last year.

Segment Results

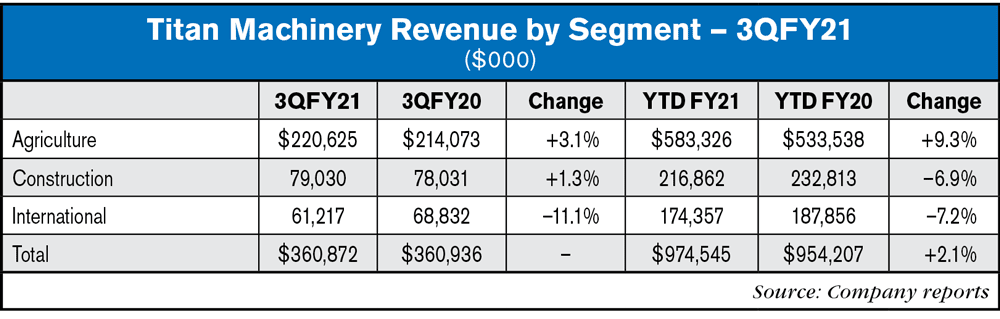

Agriculture Segment - Revenue for the third quarter of fiscal 2021 was $220.6 million, compared to $214.1 million in the third quarter last year. The increase in revenue was driven by on-going strength in the parts and service business. Pre-tax income for the third quarter of fiscal 2021 was $13.6 million, compared to $10.3 million of pre-tax income in the third quarter last year.

Construction Segment - Revenue for the third quarter of fiscal 2021 was $79 million, compared to $78 million in the third quarter last year. The increase in revenue was driven by an increase in equipment sales that was partially offset by lower rental revenue. Pre-tax income for the third quarter of fiscal 2021 was $1.4 million, compared to a pre-tax income of $0.3 million in the third quarter last year.

International Segment - Revenue for the third quarter of fiscal 2021 was $61.2 million, compared to $68.8 million in the third quarter last year. Lower revenue was driven by decreased customer demand due to below average yields in certain areas of our International footprint as well as overall challenging economic and business conditions due to COVID-19. Pre-tax loss for the third quarter of fiscal 2021 was $2.4 million, compared to pre-tax income of $2.1 million in the third quarter last year. The lower results were the result of decreased revenues and a $2.3 million impairment of goodwill and other intangibles in this segment. Adjusted pre-tax income for the third quarter of fiscal 2021 was $0.2 million, compared to adjusted pre-tax income of $1.6 million in the third quarter last year.

Fiscal 2021 First Nine Months Results

Revenue was $974.5 million for the first nine months of fiscal 2021, compared to $954.2 million for the same period last year. Net income for the first nine months of fiscal 2021 was $18.6 million, or $0.83 per diluted share, compared to a net income of $13.3 million, or $0.60 per diluted share, for the same period last year. On an adjusted basis, net income for the first nine months of fiscal 2021 was $23 million, or $1.02 per diluted share, compared to an adjusted net income of $18.1 million, or $0.81 per diluted share, in the same period last year. Adjusted EBITDA was $51.7 million in the first nine months of fiscal 2021, compared to $44.4 million in the same period last year.

Balance Sheet and Cash Flow

Cash at the end of the third quarter of fiscal 2021 was $41.8 million. Inventories decreased to $532.7 million as of Oct. 31, 2020, compared to $597.4 million as of Jan. 31, 2020. This inventory decrease includes a $66.1 million decrease in equipment inventory, which reflects a decrease in new equipment inventory of $36.1 million and a $29.9 million decrease in used equipment inventory. Outstanding floorplan payables were $287.8 million on $765 million total available floorplan lines of credit as of Oct. 31, 2020, compared to $371.8 million outstanding floorplan payables as of Jan. 31, 2020.

In the first nine months of fiscal 2021, net cash provided by operating activities was $60.8 million, compared to net cash used for operating activities of $8.3 million in the first nine months of fiscal 2020. The Company evaluates its cash flow from operating activities net of all floorplan payable activity and maintaining a constant level of equity in its equipment inventory. Taking these adjustments into account, adjusted net cash provided by operating activities was $56.5 million in the first nine months of fiscal 2021, compared to adjusted net cash used for operating activities of $35 million in the first nine months of fiscal 2020.

Mr. Meyer concluded, "Our financial position continues to improve due to strong year-to-date performance and prudent management of our inventory position, which is driving significant increases in cash provided by operating activities. Due to the strong third quarter performance and our outlook for the remainder of fiscal 2021, we are increasing our revenue expectations for all three of our operating segments and raising our earnings per share guidance. We are actively monitoring the current environment and the associated impacts that it may have on our customers, the commodities markets, and our business. We remain focused on keeping our business in a sound condition while we pursue our long-term growth initiatives."

Fiscal 2021 Modeling Assumptions

The following are the Company's current expectations for fiscal 2021 modeling assumptions. We believe modeling assumptions will continue to be impacted by the challenging global economy due to the COVID-19 pandemic, creating a higher degree of uncertainty in these assumptions compared to a normal environment.