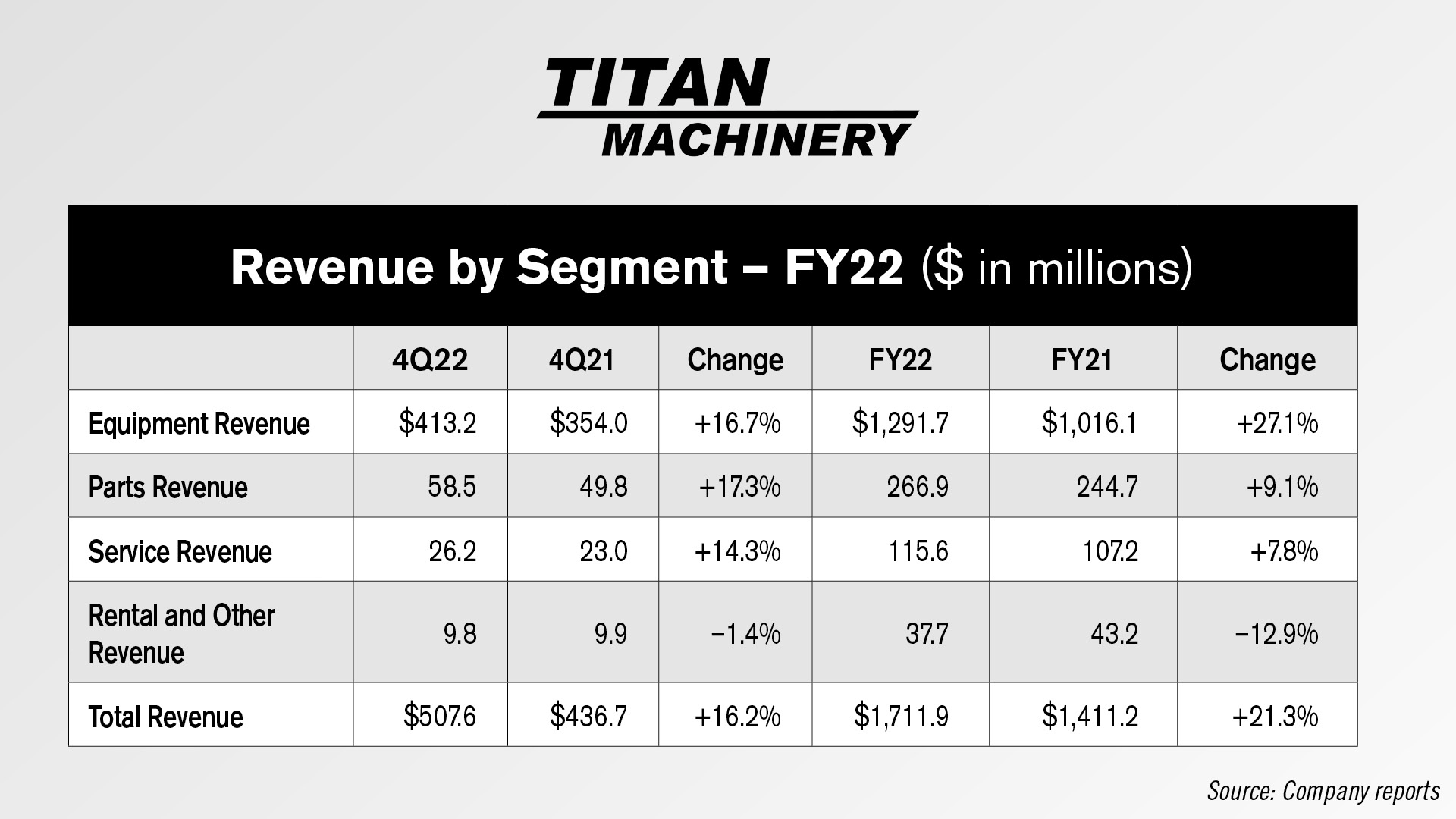

For the fourth quarter of fiscal 2022, revenue was $507.6 million, compared to revenue of $436.7 million in the fourth quarter last year. Equipment revenue was $413.2 million for the fourth quarter of fiscal 2022, compared to $354 million in the fourth quarter last year. Parts revenue was $58.5 million for the fourth quarter of fiscal 2022, compared to $49.8 million in the fourth quarter last year. Revenue generated from service was $26.2 million for the fourth quarter of fiscal 2022, compared to $22.9 million in the fourth quarter last year. Revenue from rental and other was $9.8 million for the fourth quarter of fiscal 2022, compared to $9.9 million in the fourth quarter last year.

Gross profit for the fourth quarter of fiscal 2022 increased to $94.2 million compared to $67.7 million in the fourth quarter last year. The Company's gross profit margin increased to 18.6% in the fourth quarter of fiscal 2022, compared to 15.5% in the fourth quarter last year. The stronger current quarter gross profit margin was primarily due to robust equipment margins, which were enhanced by increased amounts earned from manufacturer incentives.

Operating expenses were $64.6 million for the fourth quarter of fiscal 2022, compared to $60.5 million in the fourth quarter last year. Operating expenses as a percentage of revenue improved 120 basis points to 12.7% for the fourth quarter of fiscal 2022, compared to 13.9% of revenue in the prior year period, and benefited from the recognition of a $5.7 million pre-tax gain on the sale of the Company's Montana and Wyoming construction equipment store locations.

Floorplan and other interest expense was $1.4 million for the fourth quarter of fiscal 2022, compared to $1.5 million for the same period last year.

In the fourth quarter of fiscal 2022, net income was $22.4 million, or earnings per diluted share of $0.99, which includes approximately $0.47 of benefits associated with increased manufacturer incentive plans, gain on sale of Montana and Wyoming construction store locations, and a partial release of an income tax valuation allowance. This compares to fiscal 2021 fourth quarter net income of $0.8 million and earnings per diluted share of $0.03, and adjusted net income of $1.9 million and adjusted earnings per diluted share of $0.09.

The Company generated $35.9 million in adjusted EBITDA in the fourth quarter of fiscal 2022, compared to $13.7 million for the fourth quarter of fiscal 2021.

Segment Results

Agriculture Segment

Revenue for the fourth quarter of fiscal 2022 was $346.3 million, compared to $303.2 million in the fourth quarter last year. Pre-tax income and adjusted pre-tax income for the fourth quarter of fiscal 2022 was $17.7 million, and included a $5.1 million benefit earned through manufacturer incentives. This compared to a pre-tax income of $7.9 million and adjusted pre-tax income of $8 million in the fourth quarter last year.

Construction Segment

Revenue for the fourth quarter of fiscal 2022 was $87.9 million, compared to $88.9 million in the fourth quarter last year. While revenue was essentially flat versus the prior year period, same-store sales increased 7.2% primarily due to increased equipment demand, but was offset by the lost sales contributions from the Company's Arizona stores following the January 2021 divestiture. Pre-tax income and adjusted pre-tax income for the fourth quarter of fiscal 2022 was $9 million, and included a $5.7 million gain associated with the sale of the Montana and Wyoming construction store locations. This compared to a pre-tax income of $0.2 million and adjusted pre-tax income of $0.6 million in the fourth quarter last year.

International Segment

Revenue for the fourth quarter of fiscal 2022 was $73.4 million, compared to $44.6 million in the fourth quarter last year. Pre-tax income for the fourth quarter of fiscal 2022 was $3.1 million, and included a $1.3 million benefit earned through manufacturer incentives. This compared to a pre-tax loss of $2.9 million in the fourth quarter last year. Adjusted pre-tax income for the fourth quarter of fiscal 2022 was $3.1 million, compared to an adjusted pre-tax loss of $2.7 million in the fourth quarter last year.

Fiscal 2022 Full Year Results

Revenue increased 21.3% to $1.7 billion for fiscal 2022. Net income for fiscal 2022 was $66.0 million, or $2.92 per diluted share, compared to $19.4 million, or $0.86 per diluted share, for the prior year. Adjusted net income for fiscal 2022 was $67.3 million, or $2.98 per diluted share, compared to an adjusted net income of $24.5 million, or $1.09 per diluted share, for the prior year. The Company generated adjusted EBITDA of $114.5 million in fiscal 2022, representing an increase of 75.1% compared to adjusted EBITDA of $65.4 million in fiscal 2021.

Balance Sheet and Cash Flow

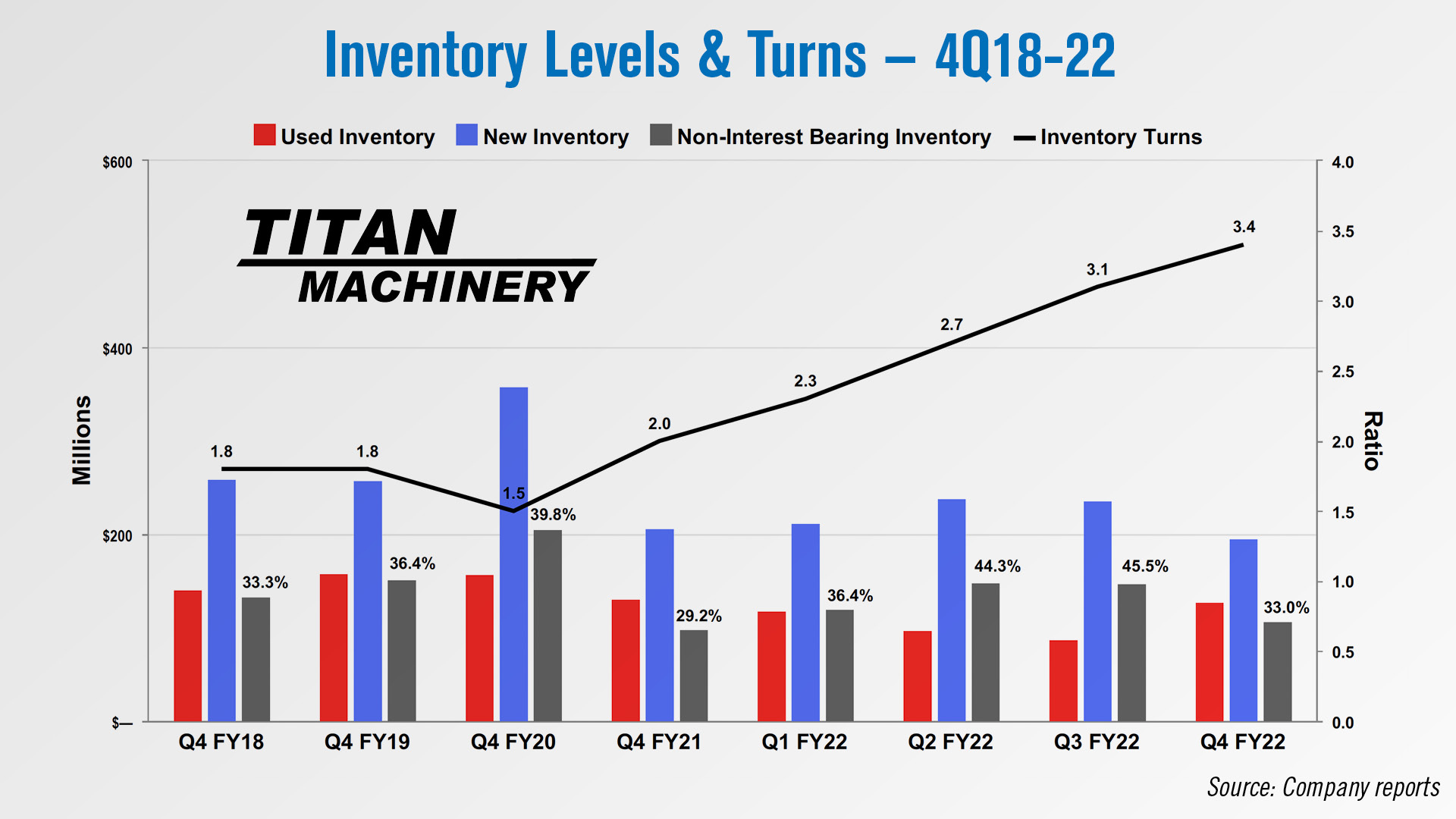

Cash at the end of the fourth quarter of fiscal 2022 was $146.1 million. Inventories increased to $421.8 million as of January 31, 2022, compared to $418.5 million as of January 31, 2021. This inventory increase reflects a $16.9 million increase in parts inventory, a decrease in new equipment inventory of $10.9 million and a $3.3 million decrease in used equipment inventory. Outstanding floorplan payables were $135.4 million on $752.0 million total available floorplan lines of credit as of January 31, 2022, compared to $161.8 million outstanding floorplan payables as of January 31, 2021.

For the fiscal year ended January 31, 2022, the Company's net cash provided by operating activities was $158.9 million, compared to $173.0 million for the fiscal year ended January 31, 2021.

Fiscal 2023 Modeling Assumptions

Titan Machinery assumes the following for its fiscal year 2023:

- Agriculture revenue — Up 22-27%

- Construction revenue — Down 12-17%

- International revenue — Down 8-13%

Ukrainian Geopolitical Conflict

Meyer added, "The entire Titan Machinery organization is focused on the well-being of our employees and customers in Ukraine. Our primary concern is our employee's safety as we are providing support where we can to help them through this difficult situation."

On Feb. 24, 2022, the ongoing Russia/Ukraine conflict significantly intensified and the Company is actively monitoring the evolving geopolitical situation between Ukraine and Russia and supporting its employees located in the region.

For the full year ended Jan. 31, 2022, revenues and assets of Titan Machinery Ukraine, its wholly owned Ukrainian subsidiary, accounted for less than 5% of the Company's total revenues and assets and less than 25% of revenues of our International segment. Recent in-country inventories and fixed assets (primarily vehicles) as well as customer receivables total about $28 million and represent the higher risk assets of this subsidiary. Given the unknown duration of the conflict, the Company currently assumes very little revenue contribution from its Ukraine operation and as a result is estimating approximately $0.25 per share of losses due to unabsorbed expenses in fiscal 2023, exclusive of any possible asset impairments that may arise.

Analyst Commentary

RW Baird Analyst Mircea (Mig) Dobre said in a March 24 note to investors that the fundamentals of Titan's business remain solid, with the obvious exception of Ukraine.

"The quarter came in slightly below expectations (excluding one-time items) as some shipments slipped into FY23 given OEM supply chain challenges," he said. "Fundamentals across TITN’s business are solid (Ukraine the obvious exception) with a demand upcycle that will likely extend into CY24. That said, with inventories running unusually lean relative to demand and new equipment volume growth remaining constrained, we see limited potential for upside relative to prior expectations.

" ... The operating environment remains supportive across both ag and construction verticals, we also see continued pruning of lower margin construction stores as a long-term positive along with ongoing acquisitions in the U.S. ag space."