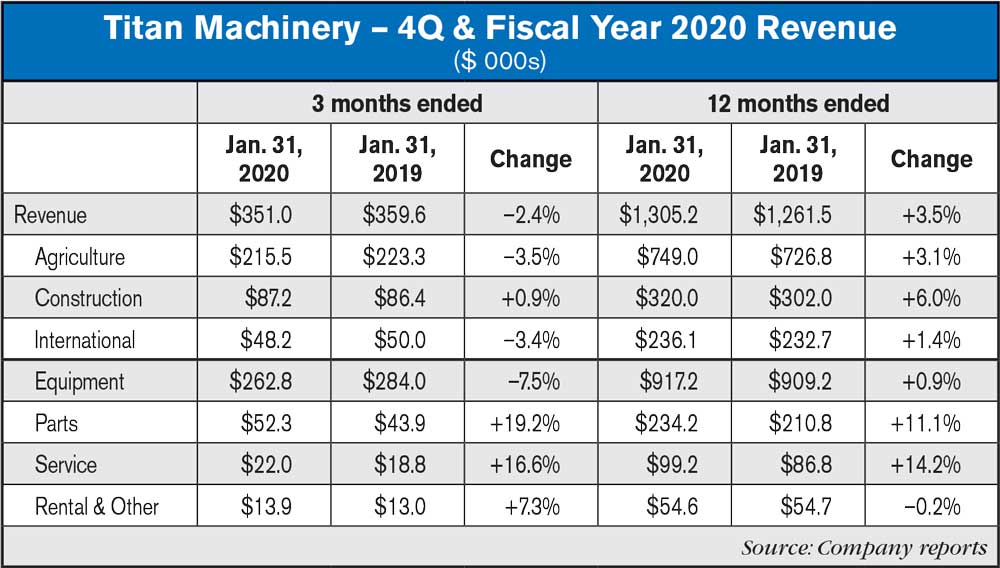

Despite seeing a slowdown in the fourth quarter of its fiscal 2020 period, annual revenues were up 3.5% on strong aftermarket results, as parts sales rose 11.1% and service grew by 14.2%. Overall, equipment sales increased by about slightly under 1%.

In the fourth quarter, total revenues declined by 2.4%, with equipment sales dropping 7.5%. In the period ended Jan. 31, 2020. The falloff in equipment sales was offset somewhat by strong parts and service, which rose 19.2% and 16.6%, respectively.

On January 31, 2020, Titan Machinery acquired 3 Case IH store locations from HorizonWest located in Nebraska and Wyoming. In its most recent fiscal year, HorizonWest generated revenues of about $26 million. The acquisition is expected to close in May 2020.

David Meyer, Titan Machinery’s chairman and CEO, said, "The acquisition of HorizonWest's three store dealership complex in western Nebraska and eastern Wyoming is contiguous to Titan Machinery's footprint and a great fit for our business. We continue to work toward strategic acquisitions in our existing markets.”

Fiscal Year 2020 Results

Revenue increased 3.5% to $1.3 billion for fiscal 2020. Net income for fiscal 2020 was $14 million compared to $12.2 million for the prior year. Adjusted net income for fiscal 2020 was $17.7 million compared to an adjusted net income of $14.7 million for the prior year. The Company generated adjusted EBITDA of $53.1 million in fiscal 2020, representing an increase of 6.7% compared to adjusted EBITDA of $49.8 million in fiscal 2019.

Titan Machinery ended the fourth quarter of fiscal 2020 with $43.7 million of cash. The company's equipment inventory level increased to $515.9 million as of Jan. 31, 2020, compared to $417 million as of Jan. 31, 2019.

Fourth Quarter FY2020 Results

Consolidated results for the fourth quarter of fiscal 2020, revenue was $351 million, compared to revenue of $359.6 million in the fourth quarter last year. Equipment revenue was $262.8 million during the most recent reporting period compared to $284 million in the fourth quarter last year. Parts revenue was $52.3 million for the fourth quarter of fiscal 2020, compared to $43.9 million in the fourth quarter last year. Revenue generated from service was $22 million for the fourth quarter of fiscal 2020, compared to $18.8 million in the fourth quarter last year. Revenue from rental and other was $13.9 million for the fourth quarter of fiscal 2020, compared to $13 million in the fourth quarter last year.

Gross profit for the fourth quarter of fiscal 2020 increased to $61.1 million compared to $55.6 million in the fourth quarter last year. The Titan Machinery's gross profit margin increased to 17.4% in the fourth quarter of fiscal 2020, compared to 15.5% in the fourth quarter last year. Gross profit margin increased primarily due to mix, with a greater proportion of higher margin parts and service revenue compared to equipment revenue, which was further supported by strong equipment margin performance vs. the prior year.

4QFY20 Segment Results

Agriculture Segment: Revenue for the fourth quarter of fiscal 2020 was $215.5 million, compared to $223.3 million in the fourth quarter last year. Pre-tax loss for the fourth quarter of fiscal 2020 was $0.3 million, compared to pre-tax income of $1.1 million in the fourth quarter last year. Adjusted pre-tax income for the fourth quarter of fiscal 2020 was $2.5 million, compared to $1.7 million in the fourth quarter last year.

Construction Segment: Revenue for the fourth quarter of fiscal 2020 was $87.2 million, compared to $86.4 million in the fourth quarter last year. Pre-tax loss for the fourth quarter of fiscal 2020 was $1.8 million, compared to $2.6 million in the fourth quarter last year. Adjusted pre-tax loss for the fourth quarter of fiscal 2020 was $1 million, compared to $1.5 million in the fourth quarter last year.

International Segment: Revenue for the fourth quarter of fiscal 2020 was $48.2 million, compared to $50 million in the fourth quarter last year. Pre-tax loss for the fourth quarter of fiscal 2020 was $2.3 million, compared to $1.1 million in the fourth quarter last year.

No FY2021 Guidance

“As we look to fiscal 2021, we remain focused on providing exceptional uninterrupted customer service, safeguarding our employees and managing the controllable aspects of the

business as we carefully navigate the COVID-19 global health crisis,” said Meyer. “We believe the strength of our balance sheet and business model will enable us to achieve long term top line growth, both organically as well as through acquisitions. Due to the uncertainty surrounding COVID-19, we believe it is prudent to not provide specific full year fiscal 2021 guidance at this time."

Post a comment

Report Abusive Comment