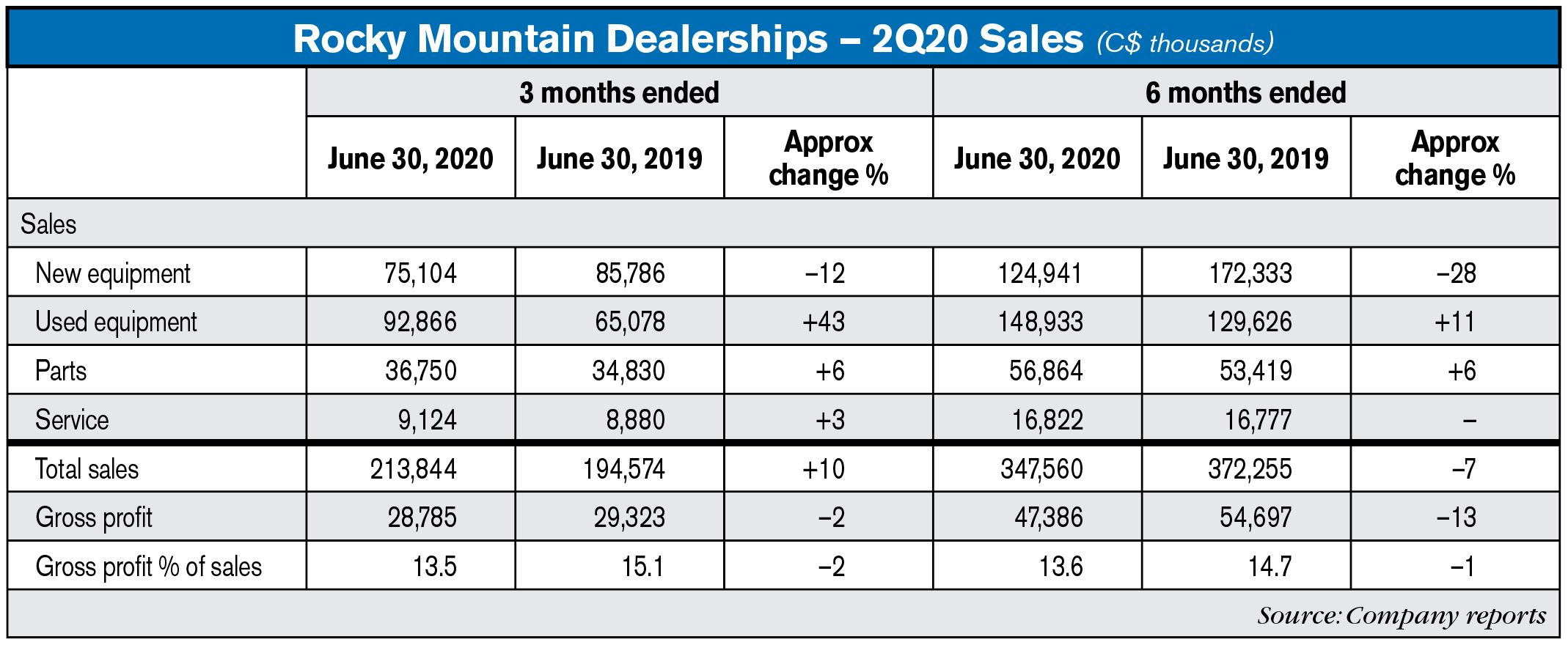

Improving sales of used ag equipment for the period ended June 30, 2020, helped push Rocky Mountain Dealerships (RME) to a year-over-year gain of 9.9%, according to the company. Based in Calgary, Alta., RME is Case IH’s largest Canadian dealership group.

Overall, revenues improved by $19.3 million during the quarter to $213.8 million vs. the $194.6 million in same period of 2019. The company said the uptick in revenues was largely due to higher sales of used equipment, combined with greater parts and service sales.

Gross profit as a percent of sales decreased to 13.5% from 15.1% in the same period in 2019 as the increase in used equipment sales volume was outweighed by the typical thinner margins of this category.

“During the quarter, we continued working to reposition RME within our current operating environment,” the company said. “Through a concerted effort to focus on used equipment sales we have achieved a methodical and orderly reduction of equipment inventory. This is highlighted in the year-over-year equipment inventory reduction of $114,842.”

Total equipment inventories, including new and used, decreased by $77.1 million and $37.7 million. From Dec. 31, 2019 to June 30, 2020, equipment inventory levels declined by $78.5 million.

Gross profit decreased slightly, from $29.3 to $28.8 million. Gross profit as a percent of sales decreased to 13.5% from 15.1% in the same period in 2019. The company said these slimmer margins were the result of its focus on used equipment sales. Adjusted EBITDA for the quarter ended June 30, 2020, increased by nearly $2.3 million to $8.2 million compared with nearly $6 million for the same period in 2019, excluding the CEWS noted below.

RME commented on income received from the Canadian Emergency Wage Subsidy (CEWS) program. CEWS was brought into law on April 11, 2020, and introduced a wage subsidy of up to 75% for qualifying businesses, retroactive to March 15, 2020. The subsidy covers employers of all sizes and across all sectors who had suffered a drop in revenue of at least 15% in March and 30% the preceding months. RME qualified for CEWS in March and April 2020 and received about $4.6 million.

Product Support Revenues

Second quarter 2020 product support (parts and service) revenues increased by 5% or $2.2 million to $45.9 million compared to $43.7 million in the same period of 2019. The increase was driven by continued aftermarket promotions and initiatives, according to the company.

Year-to-date product support revenues increased by 4.8% or $3.4 million to $73.8 million compared with $70.3 million in the same period of 2019, due to strength in our parts sales.

Ongoing Headwinds

RME said that trade disputes and impact of COVID-19 continue to affect the dealership group’s revenues. “Unresolved trade disputes between Canada and several of its agriculture commodity trading partners continues to add uncertainty to farmer sentiment and consequently, demand for agriculture equipment. As a result, while second quarter 2020 equipment sales have increased year-over-year, they remain depressed relative to historical norms.”

On the coronavirus situation, the company said the COVID-19 pandemic has been pervasive in its global impacts. While our business has been impacted, agriculture equipment distribution has been classified as an essential service by provincial governments where we operate. “As a result, all of our Canadian branch locations remained open for business during the quarter. The volatility and unknown duration of this pandemic has created a great deal of uncertainty and the future is very difficult to predict.”

Commenting on Canadian ag equipment sales, The company reported that the cumulative impact of these headwinds is reflected in AEM’s June 2020 Ag Tractor & Combine Report for Canada. AEM reported “year-to-date sales declines in major product categories including 4WD tractors (down 17%) and self-propelled combines (down 31%). These 2020 declines are a continuation of market trends which commenced subsequent to 2018.”