Sales management in farm equipment dealerships is undergoing major changes in which measuring the performance of the salesforce is becoming increasingly critical. These changes are being forced by the growing size and demands of farming operations that require more attention from the sales team, as well as the expansion of dealership operations via industry consolidation. Effectively managing and measuring the dealership’s efforts and subsequent results is essential for increasing profits.

While close attention to internal metrics and comparing these to past performance remains important, determining where the dealership stands compared to similar operations and its competition is an essential component in determining overall sales performance. One of the methods for doing so is through benchmarking.

To make these comparisons, this Farm Equipment 2019 Confidential Sales Survey was compiled by the editors of Farm Equipment to help dealerships evaluate the performance of their salesforce compared to an industry baseline.

This report is based on results of an April 2019 survey of sales managers, sales directors, general managers and dealer-principals for farm equipment dealers in the U.S. and Canada. Nearly 200 responses were collected for the report.

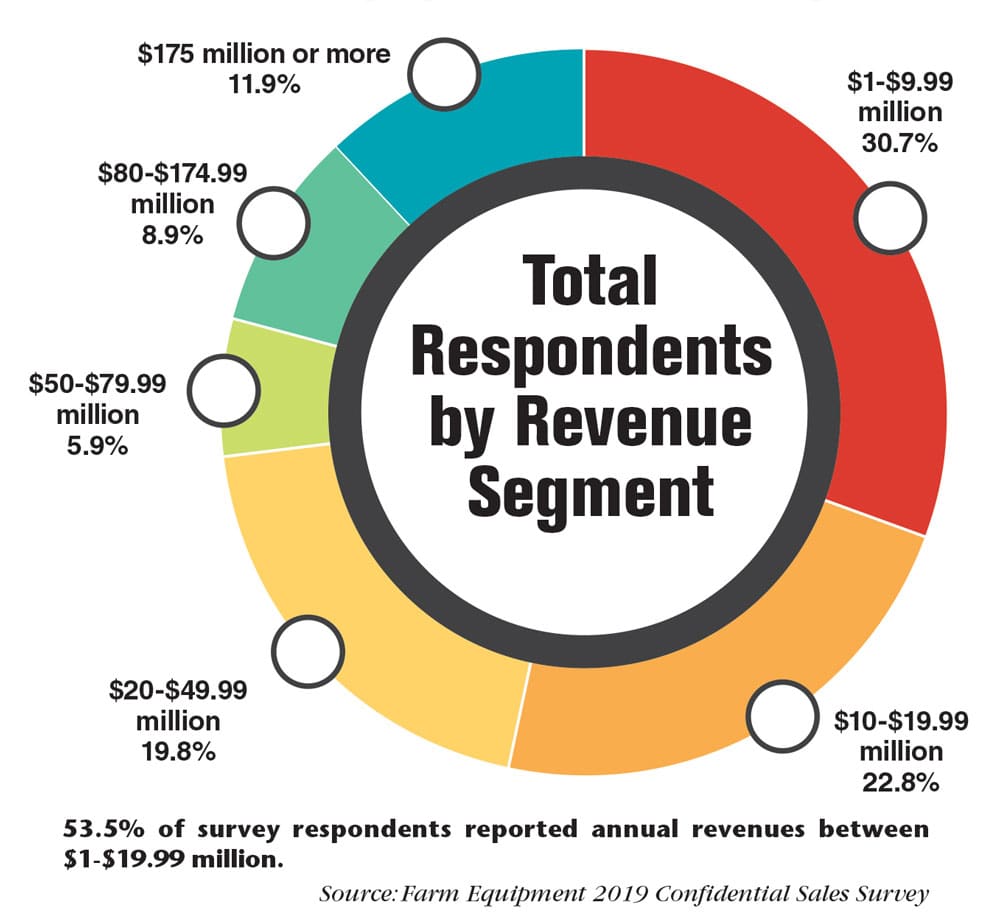

This report breaks respondents out based on annual revenue:

- Annual Revenue: $1-$9.99 million

- Annual Revenue: $10-$19.99 million

- Annual Revenue: $20-$49.99 million

- Annual Revenue: $50-$79.99 million

- Annual Revenue: $80-$174.99 million

- Annual Revenue: $175 million or more

Out of the responses to this survey, over 53% of respondents were operating dealerships with annual revenue under $20 million. The most common revenue range of respondents was $1-$9.99 million with 30.7%. The annual revenue range with the lowest number of respondents was $50-$79.99 million.

It is important to note that the results of this survey are representative of the survey respondents and not necessarily a perfect representation of the market as a whole. These results serve as a window for what the market looks like for some.

Results of Farm Equipment’s survey of sales managers, directors and general managers also provided a review of dealership sales staff and how differing compensation plans and commission programs are being used for junior and senior salespeople.

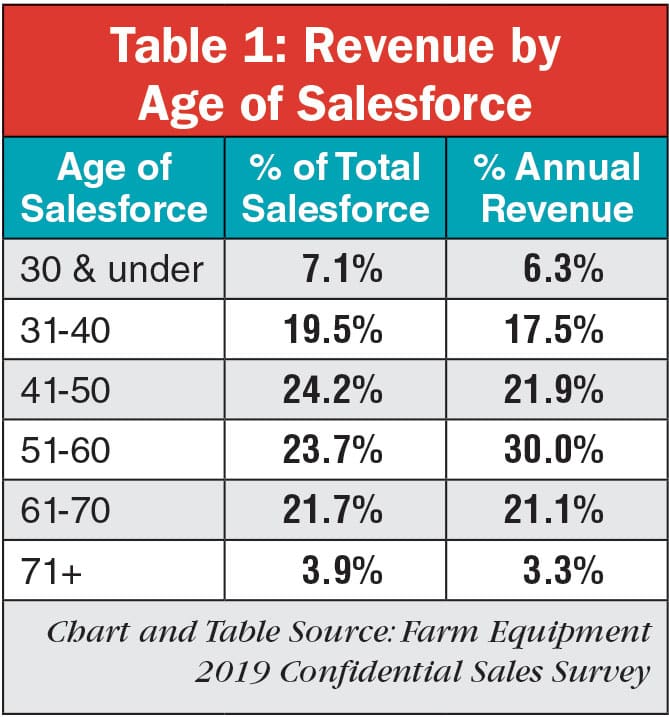

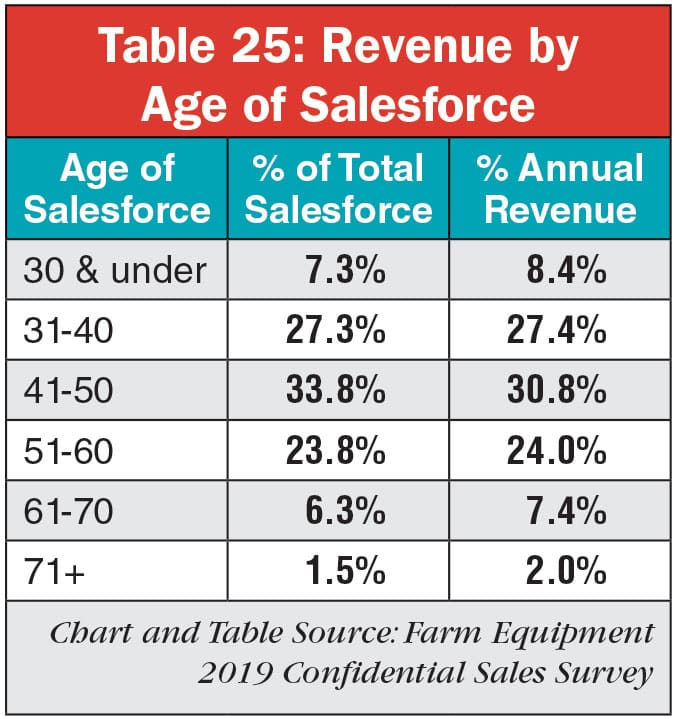

When it comes to the age of the salesforce, data indicates that the largest percentage of salespeople fall into the 31-60 year old age group. On average, more than 91% of their sales teams are over 30 years old.

The largest group by a small margin are those at age 51-60, accounting for 27.4% of the salesforce. The bulk of the average dealer’s sales revenue falls with ages 41-50 years old (26.4%) and 51-60 years old (28.6%).

“What this shows is that age is not a determinant for how many sales one can make or their productivity,” says George Russell, Machinery Advisors Consortium. “My theory is that there are older salespeople who actually aren’t doing a very good job. They aren’t generating a lot of business.

“We think that seniority is a good thing but the fact is, older salespeople continue working on their existing customer base and often aren’t going out and talking to somebody new. I also believe that younger salespeople can be taught how to sell relatively quickly. In other words, I don’t think you have to spend x number of years on the job in order to be successful. Sales ability is not limited to age or experience. Young people can learn the trade quickly and be productive.”

Annual Revenue $1-$9.99 Million

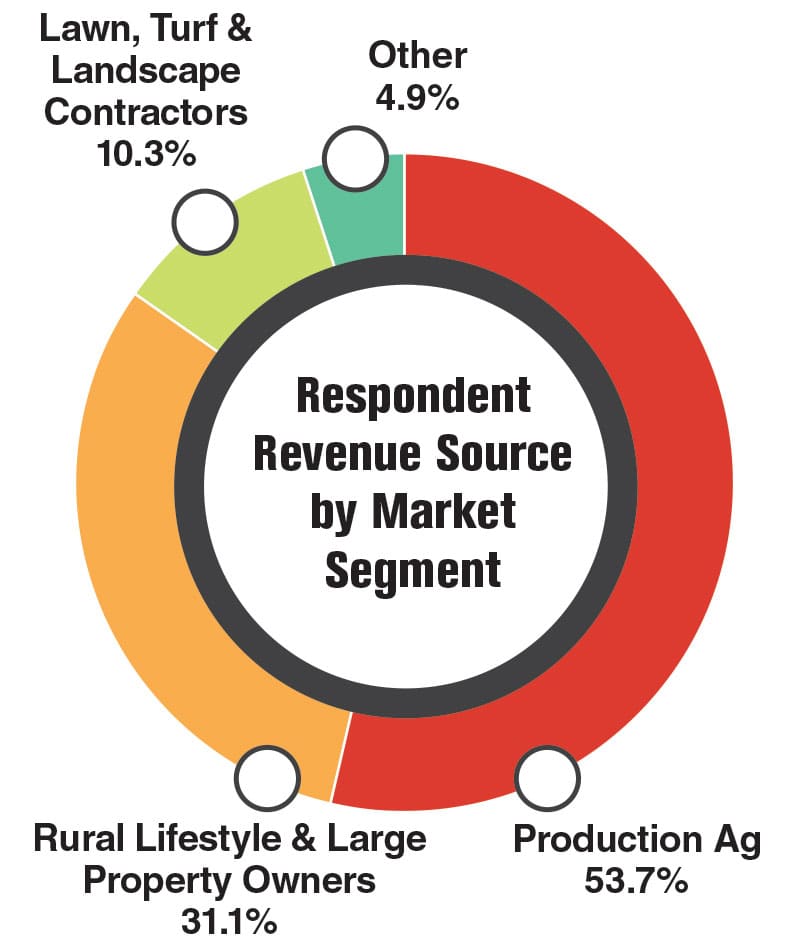

In this revenue segment, $1-$9.99 million, production ag makes up 53.7% of revenue. Rural lifestyle customers account for 31.1% and landscape contractors 10.3%.

Commission Structures

“Percentage of net profit.” … “10% commission on net profit plus salary.” … “25% gross profit on new and 30% on used.” … “Weekly draw.” … “3% used and 2% new of gross difference plus draw salary.” … “Base set wage plus 15% sales profit.” …

“Bonus at the end of year.” … “20% net profit on new, 25% net profit on used, fixed base salary to keep them from starving in the winter.” … “Commission from the manufacturer.” … “25% gross profit on new and 30% on used.” … “No commission until trade in is sold for profit.”

Salesforce Characteristics

It was more likely that respondents indicated the salesforce to be over 40 years old (Table 1). Those aged 51-60 years old accounted for most of the dealership revenue at 30%. The average age of a salesperson in this revenue segment is 43 years old.

When asked where they would find new salespeople, most respondents in this revenue segment said they would either hire salespeople from another agribusiness or develop and promote existing staff (Table 2).

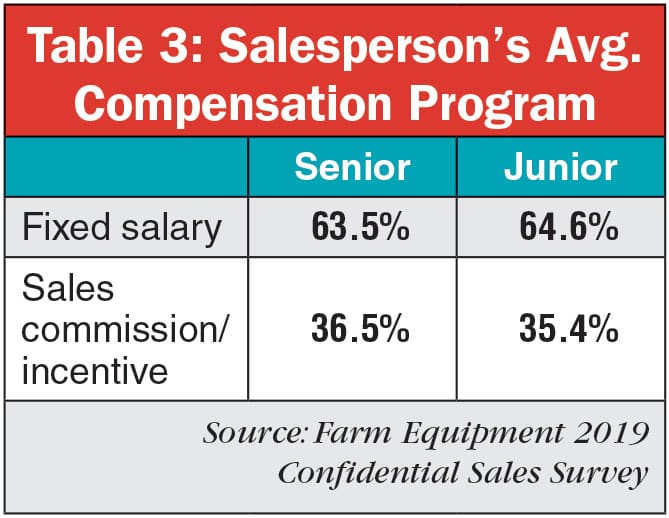

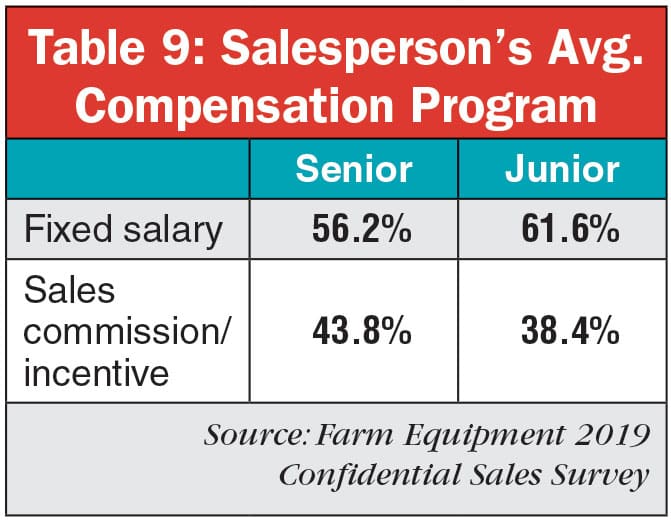

In this revenue segment, it was more likely to have senior salespeople working on a fixed salary (Table 3). Junior salespeople in this revenue segment were also more likely to work with a fixed salary, 64.6%.

Expectations & Priorities for the Salesforce

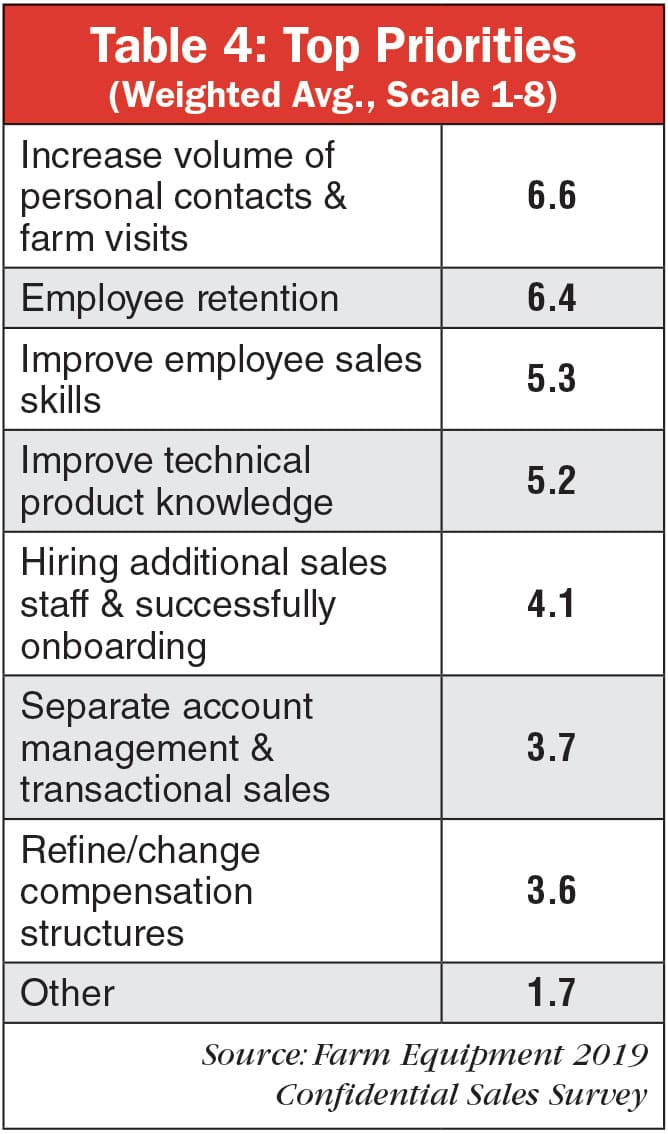

Increasing the volume of personal contacts and farm visits and employee retention were top priorities for respondents in this revenue segment (Table 4). Increasing personal contacts and farm visits averaged 6.6 and employee retention had an average of 6.4, an increase from the 5.8 average in the overall survey results.

In six of the eight scenarios respondents could rank their salesforce in, most in this revenue segment (52.3%) stated that their salesforce sometimes met expectations (Table 5). The only areas that did not receive this ranking were tracking and logging contacts in their management system and recruiting additional talent.

With tracking and logging contacts into the management system/CRM, many say that their salesforce did not “exceed expectations” (8.1%), with 29.7% “sometimes meets expectations” and 21.6% “rarely meets expectations” (Table 5). Just over 5% said the salesforce “never meets expectations.”

Recruiting additional talent had similar results with only 5.4% of respondents indicating that the salesforce “exceeded expectations.”

Expectations by Sales Management Structure

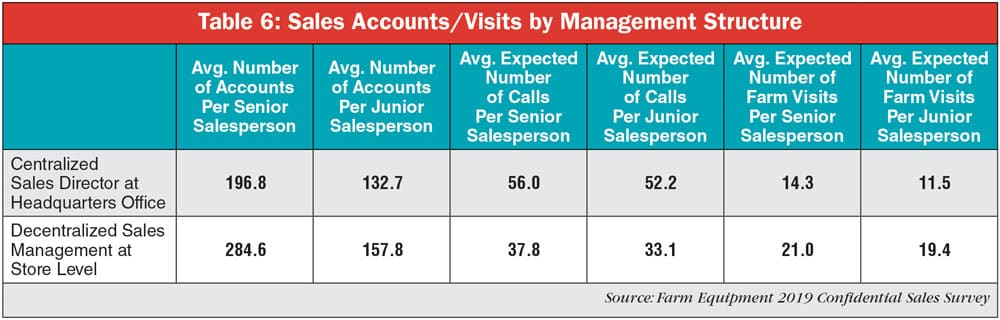

Respondents here either operated under centralized management with a sales director at headquarters office or decentralized management with sales management at the store level (Table 6). While there were respondents who reported running a centralized structure with a regional sales director, there was not sufficient data for expectations of senior and junior salespeople.

Both the number of calls expected and the expected number of farm visits were close to one another regardless of salesperson experience. There is a significant difference between accounts assigned to junior and senior salespeople for this revenue segment under the decentralized management system. Here, senior salespeople are reportedly assigned 284.6 accounts vs. junior salespeople’s 157.8 (Table 6).

Respondents running a centralized structure with the sales director at headquarters office reported senior salespeople being assigned 197 accounts vs. juniors with 132.

Annual Revenue: $10-$19.99 Million

Respondents operating dealerships with annual revenues between $10-$19.99 million reported that production ag makes up 60% of annual revenue while rural lifestyle customers make up 24.8% and landscape contractors 11.4%.

Commission Structures

“Base pay and commission on profit after expenses.” … “Percentage of net profit.” … “Commission is the salesman bonus from OEM. Also have small bonuses for total dollars of sales such as $2,000 for every million dollars sold.” … “Company programs.” … “Senior is salaried with a 10% commission on total dealership profit. Junior is salary plus 10% commission monthly on sales profit.” … “Gross margin of sales; 25% no trade and 20% with trade.” … “Salesperson keeps any manufacturer or lender incentives. They are paid a year end bonus based on profitability.”

Salesforce Characteristics

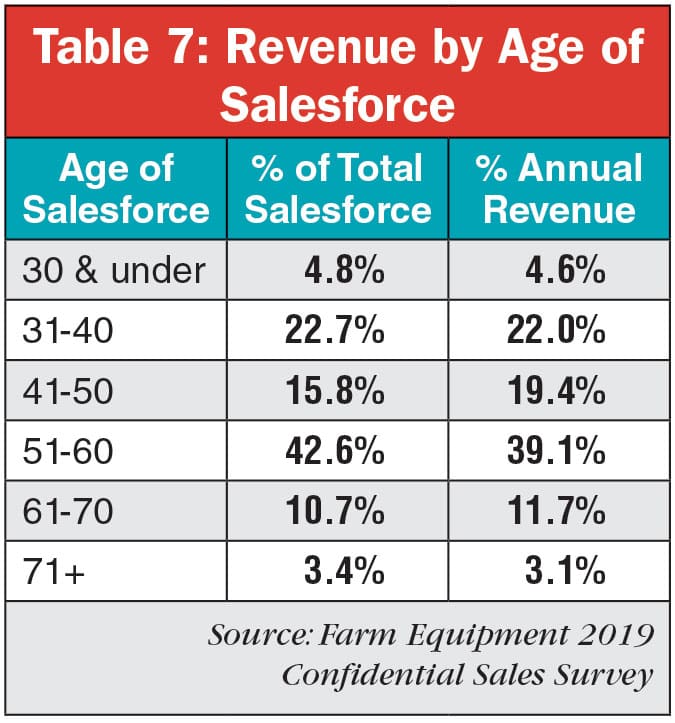

A large portion, 42.6%, of the respondents in this revenue segment reported that their salesforce consists of people between 51-60 years old (Table 7). This same age group accounts for 39.1% of company revenue. Salespeople aged 31-40 years old make up the second largest portion of the salesforce at 22.7% and accounting for 22% of company revenue. The average age of a salesperson in this segment is around 43 years old.

Salespeople aged 41-50 years old make up only 15.8% of the salesforce is in this segment. Despite making up a smaller portion of the salesforce, this group does account for 19.4% of company sales revenue (Table 7).

When asked where they will look for future salespeople, respondents in this revenue segment listed the top area as hiring from other agribusinesses (Table 8). The next two areas were developing and promoting existing staff and hiring from outside of ag.

Looking at compensation in dealerships with revenue between $10-$19.99 million, 56.2% of senior salespeople and 61.6% of juniors were reported to have a fixed salary (Table 9).

Expectations & Priorities for the Salesforce

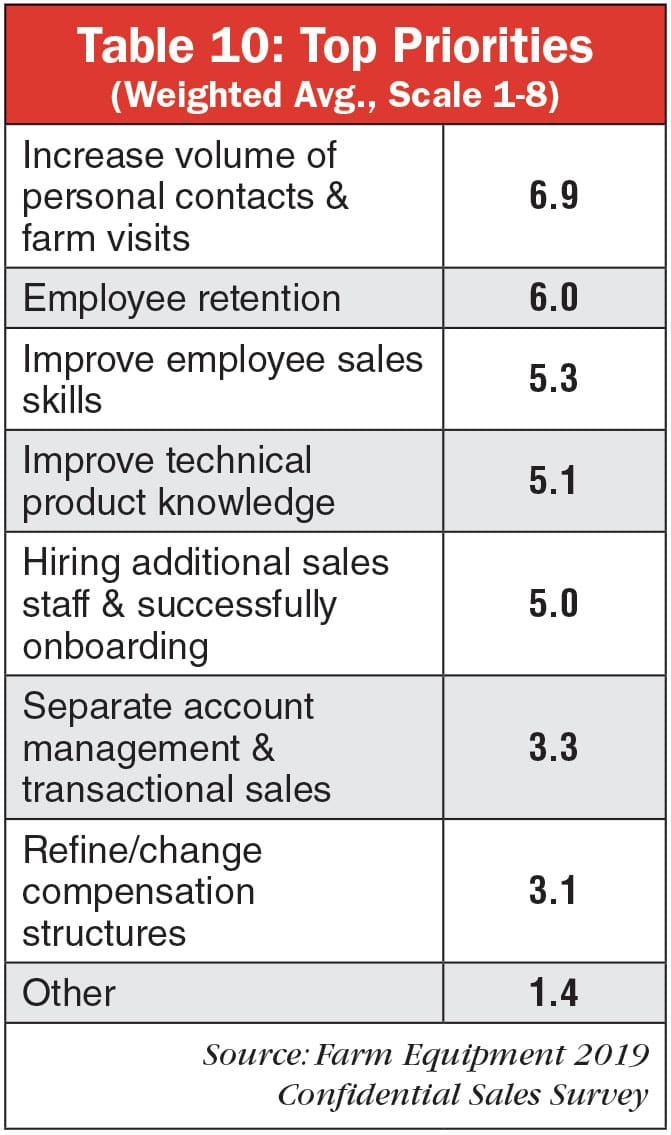

In this revenue breakdown, the top two priorities were increasing the volume of personal contacts and farm visits with a weighted average of 6.9 and employee retention with a weighted average of 6 (Table 10).

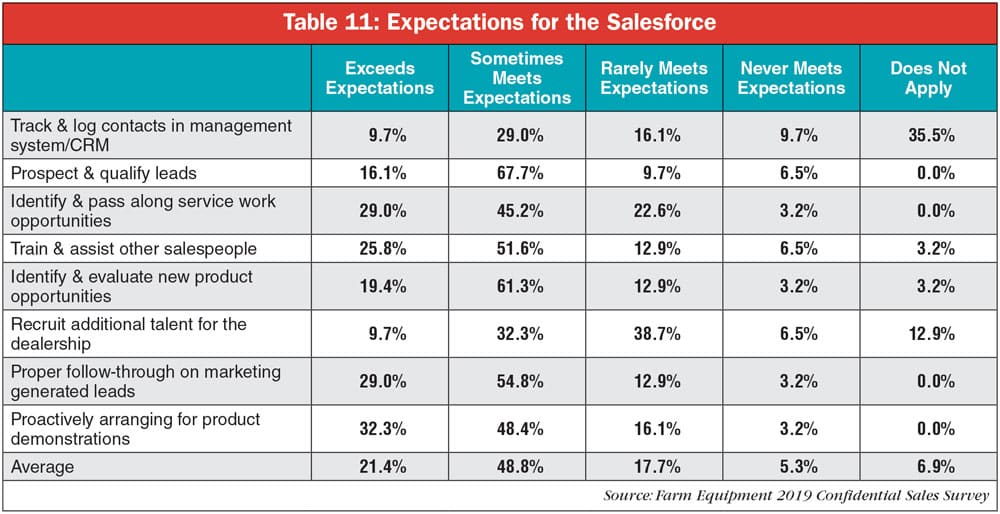

In six of the eight scenarios respondents could rank their salesforce in, most, 48.8%, stated that their salesforce sometimes met expectations (Table 11). The only areas that did not receive this ranking were tracking and logging contacts in their management system and recruiting additional talent.

Tracking and logging contacts into the management system/CRM was not an area in which the salesforce shined according to survey respondents with less than 10% reporting exceeds expectations (Table 11). Outside of reporting that the question did not apply to their dealership, 29% of respondents said sometimes and 16.1% said rarely meets expectations.

Recruiting additional talent also did not fair well with less than 10% reporting that the salesforce exceeded expectations.

It is worth noting that the salesforce did fairly well in meeting expectations for other categories. For instance, 32.3% of respondents said that their salesforce exceeded expectations when it comes to proactively arranging for product demonstrations (Table 11). The salesforce also had a nice percentage exceeding expectations in identifying and passing along service work opportunities (29%).

Expectations by Sales Management Structure

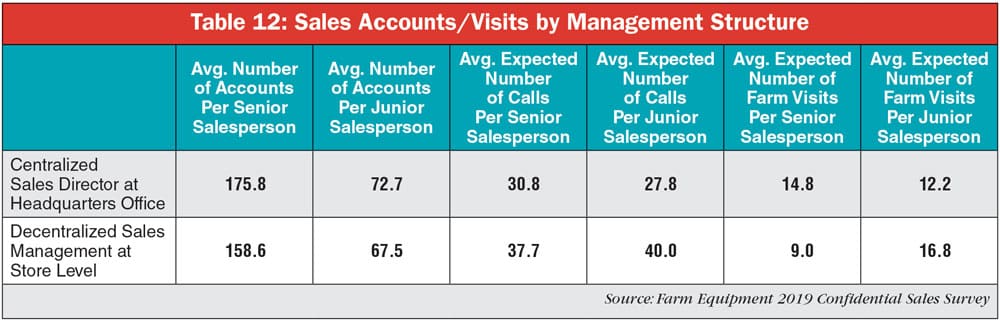

With dealerships making $10-$19.99 million in annual revenue, the management structure was decentralized with sales management at the store level or centralized with a sales director at headquarters office (Table 12).

In this revenue segment, there are a few standout points when comparing senior and junior salespeople.

For both centralized management with the sales director at headquarters office and decentralized management, senior salespeople have a far higher number of accounts assigned than juniors do (Table 12). Also notable is that in the decentralized system for this revenue segment, junior salespeople are expected to make more calls and farm visits than senior salespeople.

Annual Revenue: $20-$49.99 Million

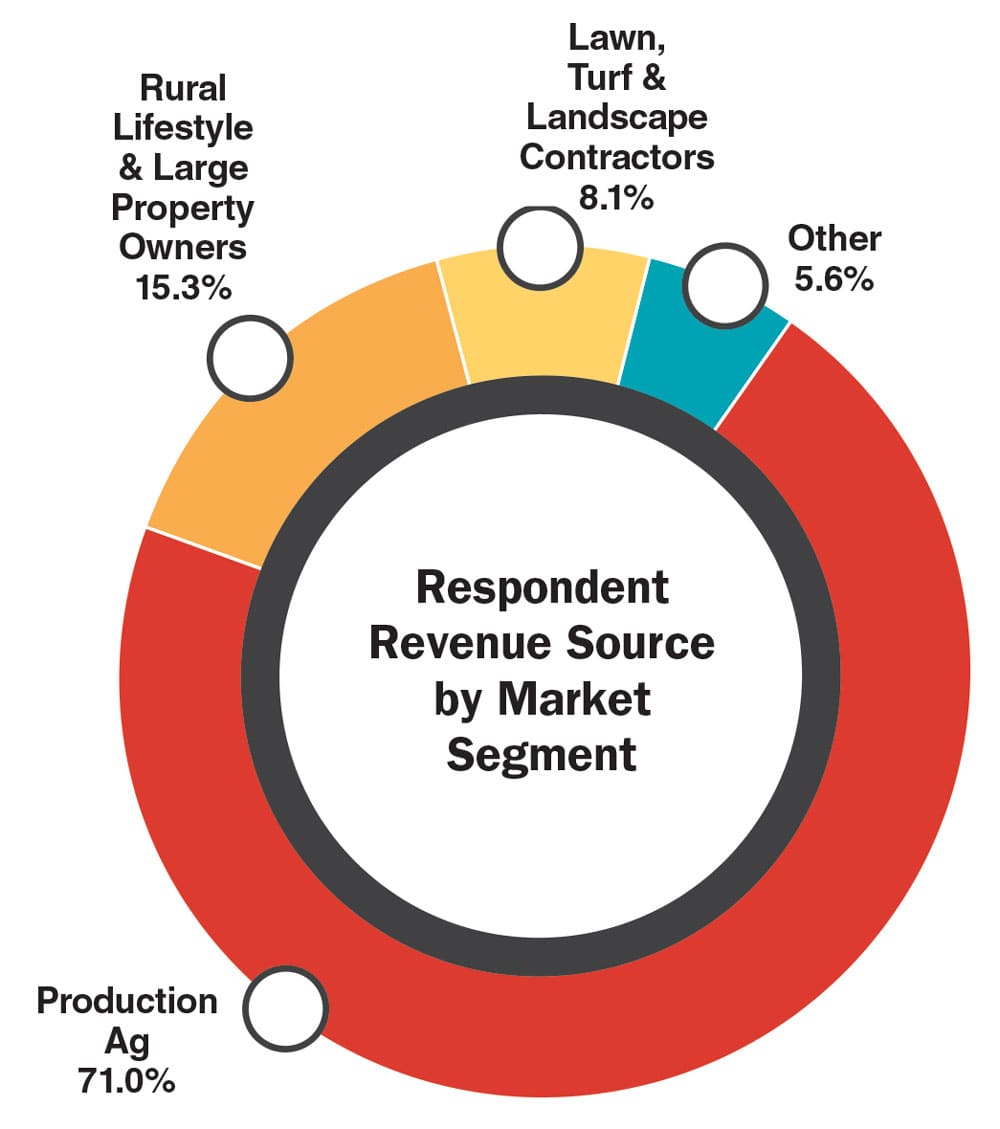

Respondents running dealerships reporting annual revenues with $20-$49.99 million reported that 71% of their revenue comes from production ag.

Commission Structures

“$20,000 base salary and 20% of gross margin.” … “Percentage of net profit with a hold back on a portion if a trade is taken. Balance paid when trade sells.” … “1% of trade difference.” … “Percentage of gross profit for new and used.” … “Salary plus 5-10% commission.” … “Anything below $15,000, the salesperson gets 2.5% of the total sale. Anything above $15,000, the salesperson gets 20% of the total profit of the sale.” … “$45,000 base salary with 10% commission.”

Salesforce Characteristics

In this revenue segment, the top age groups of the salesforce were 41-50 years old and 31-40 years old (Table 13). Here, the 41-50 year olds account for 34.4% of company revenue and the 31-40 year olds make up 22.3%. On average, a salesperson in this revenue segment was 39 years old.

When asked where they would find future salespeople, survey respondents stated they would either develop and promote existing staff or hire from another agribusiness (Table 14). Hiring from outside of agriculture also was an area of interest for finding news salespeople with 24.6% of respondents choosing that as an option.

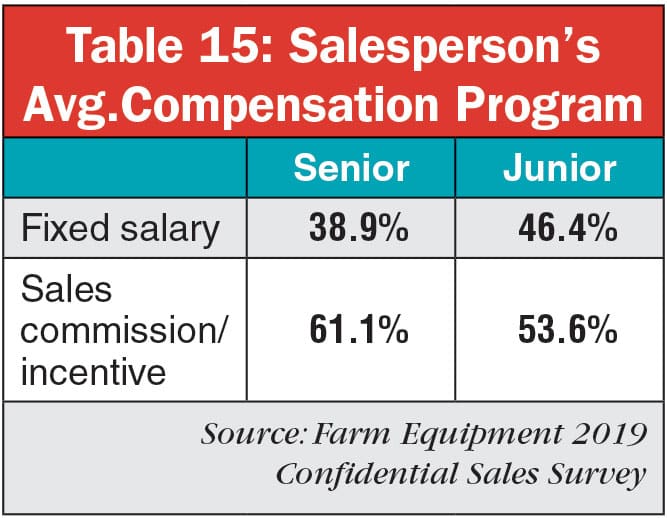

For compensation programs, dealerships making $20-$49.99 million, indicated that senior salespeople were far more likely to work off of sales commissions/incentives (61.1%) rather than a fixed salary (Table 15). For junior salespeople, it was more common for them to work on sales commission.

Expectations & Priorities for the Salesforce

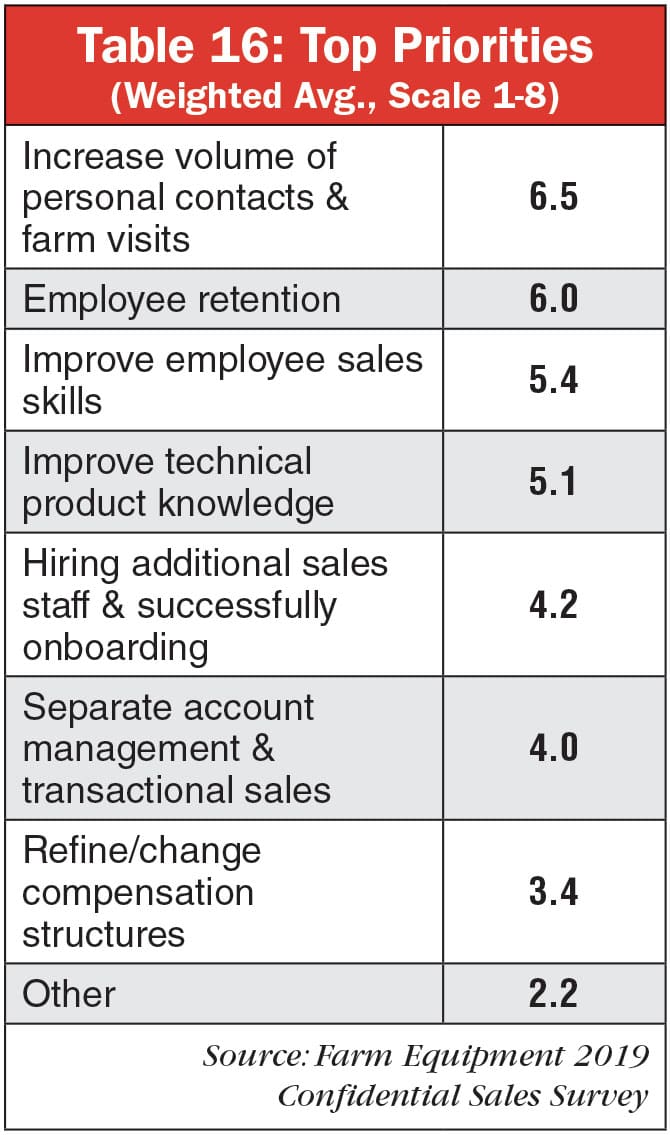

In this revenue segment, the top priority was increasing the volume of personal contacts and farm visits (Table 16). Employee retention is second on the list with improving sales skills following.

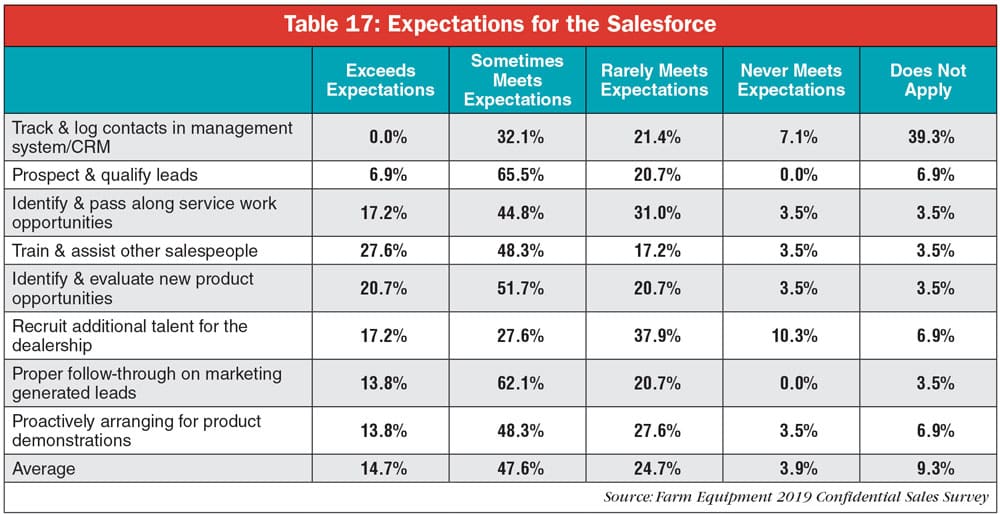

When rating the salesforce, respondents running dealerships with this annual revenue range were most likely (47.6%) to say their salesforce only “sometimes meet expectations” (Table 17). Recruiting additional talent had most respondents, 37.9%, report salespeople as rarely meeting expectations.

Tracking and logging contacts had most respondents indicating this scenario does not apply to their dealership (39.3%) or that their staff only meets expectations sometimes (32.1%). It is worth noting there was not a single respondent who stated the salesforce exceeded expectations for this scenario.

Expectations by Sales Management Structure

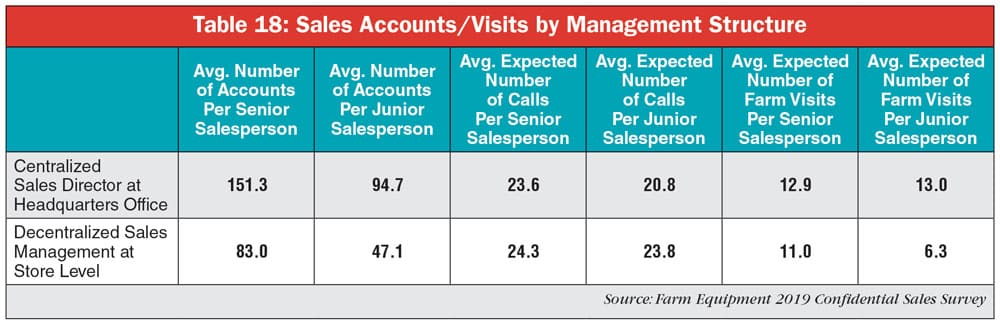

In dealerships making $20-$49.99 million, respondents reported their dealerships ran on a centralized management structure with a sales director at headquarters office or a decentralized structure with sales management at the store level (Table 18).

With the expectations for senior and junior salespeople, there are a few areas that stand out (Table 18). In the centralized structure, senior salespeople are assigned a far higher number of accounts than juniors (151.3 vs. 94.7).

Also worth noting in the decentralized structure is that junior salespeople are expected to make fewer farm visits than juniors in the centralized structure.

Annual Revenue: $50-$79.99 Million

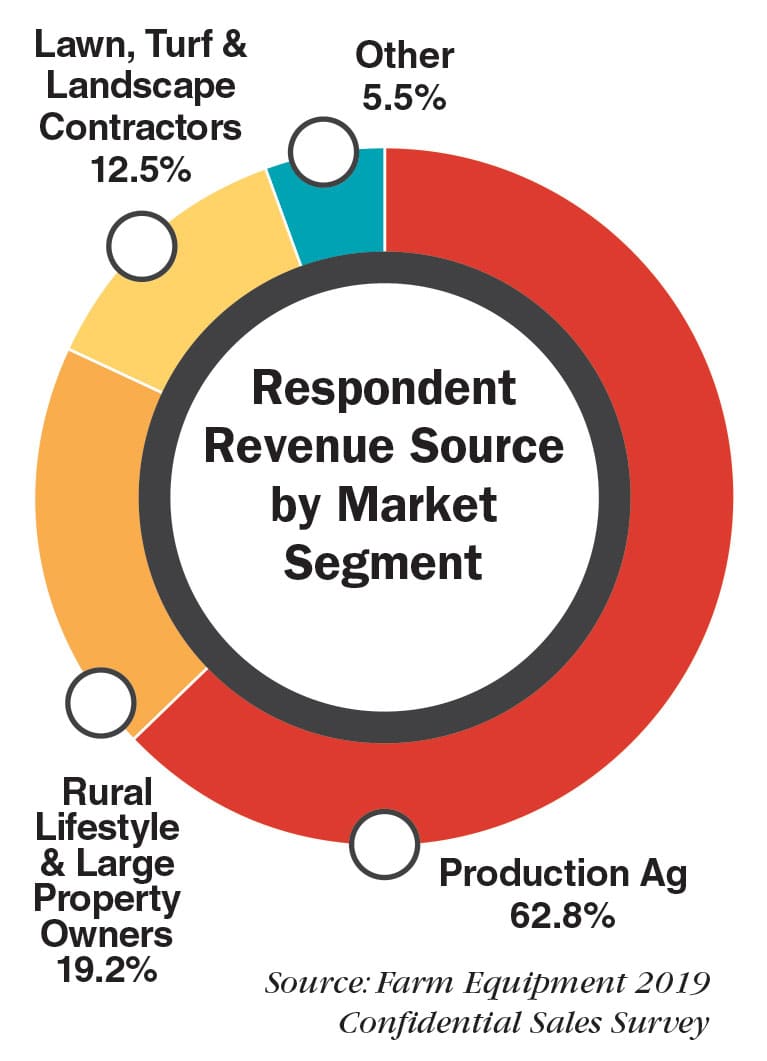

In the survey, dealerships with annual revenues with $50-$79.99 million, respondents reported that production ag accounts for 62.8% of their revenue. Rural lifestyle customers account for 19.2% and landscape contractors make up 12.5%.

Commission Structures

“Percent of gross margin.” … “Salary plus 25% gross profit.” … “30% of net profit after a 2 year training period.” … “Percentage of cash difference.” … “30% of net profit after a 2 year training period.” … “Base salary plus 10% of gross margin with a 50% hold back for trade-ins that is not paid until the trade-in is sold.”

Salesforce Characteristics

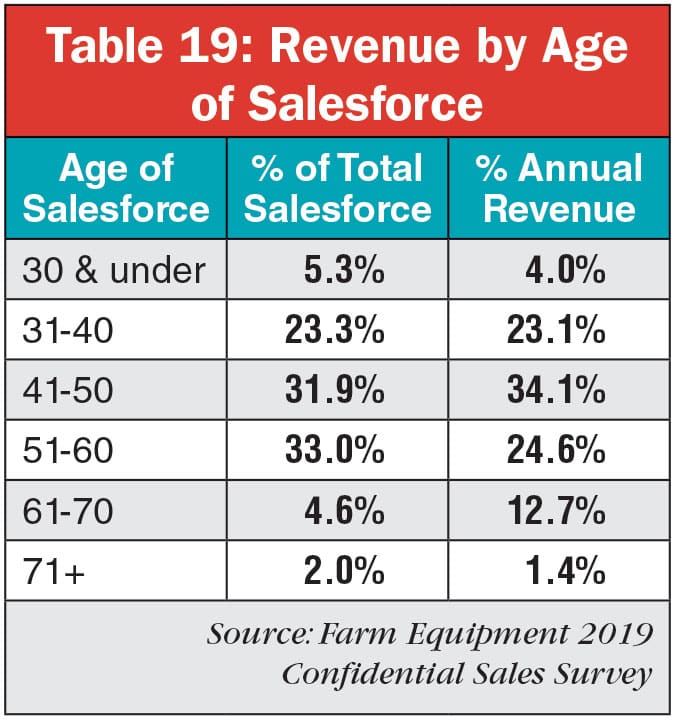

The top two age groups in this revenue segment are 51-60 years old and 41-50 years old (Table 19). For those aged 51-60 years old, they account for only 24.6% of the revenue while those aged 41-50 years old make up 34.1% of company dealership revenue. The average age of a salesperson in this revenue segment is 40 years old.

Another age group to look at in this revenue segment is the 61-70 year old salespeople. Although they reportedly make up less than 5% of the salesforce here, they do account for 12.7% of the revenue.

In this revenue segment, the two most common answers to where future salespeople could be found were through hiring from other agribusinesses or through developing and promoting existing staff (Table 20).

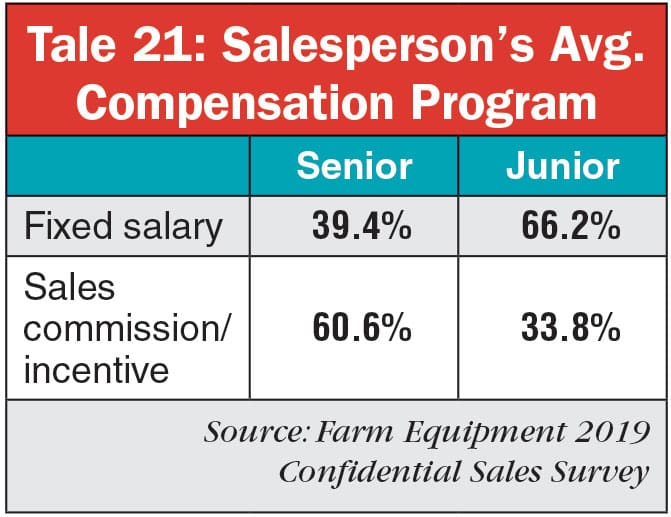

With compensation programs, a high percentage of senior salespeople (60.6%) worked on sales commissions/incentives (Table 21). For junior salespeople working in dealerships making $50-$79.99 million in annual revenue, it was reported that 66.2% worked off of a fixed salary.

Expectations & Priorities for the Salesforce

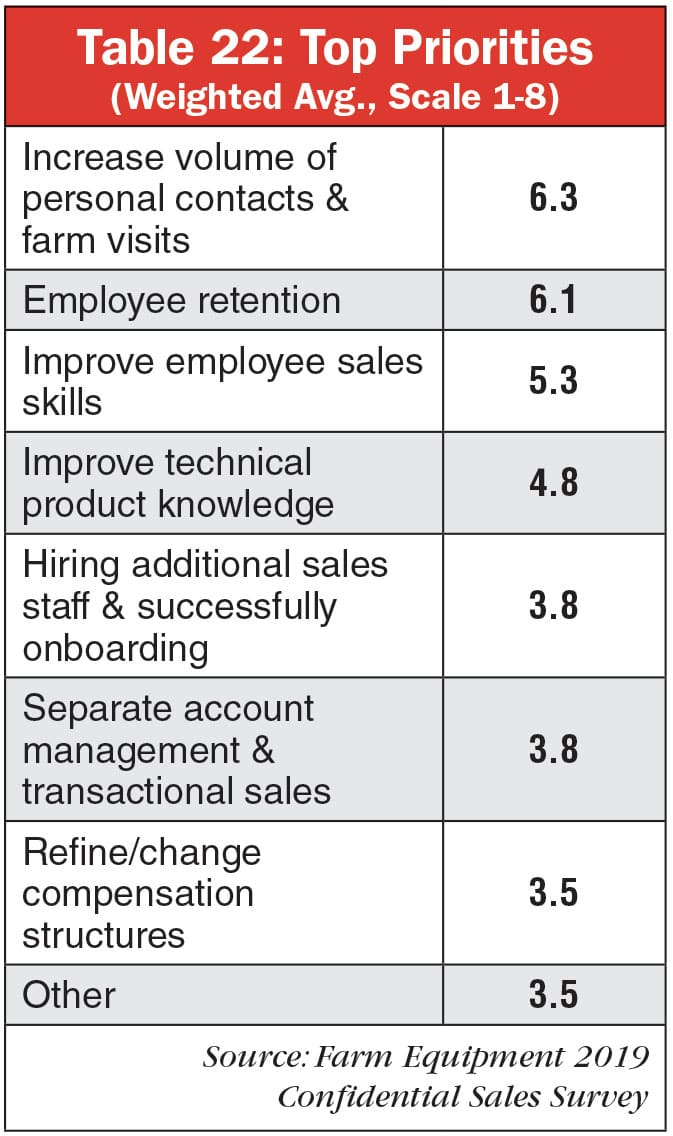

When looking at the top priorities for respondents in this segment, increasing the volume of personal contacts and farm visits and employee retention were at the top (Table 22). Worth noting, the bottom half of the list has the final four options having similar levels of importance.

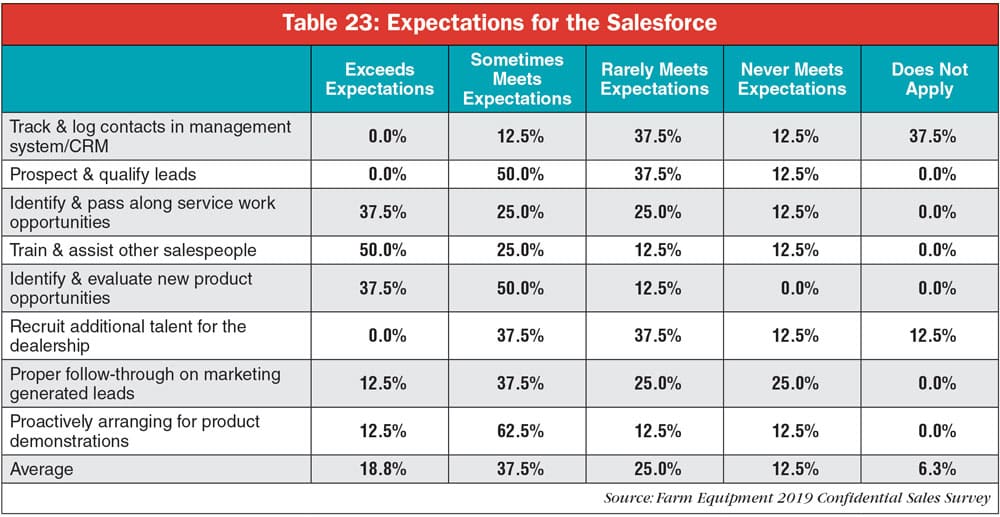

When rating the salesforce, respondents running dealerships with this annual revenue range were most likely (37.5%) to say their salesforce only “sometimes met expectations” (Table 23).There were a few scenarios in which most respondents reported the sales exceed expectations.

The best results came in the category for training and assisting other salespeople. This scenario saw respondents say that the salesforce “exceeded expectations” 50% of the time. With identifying and passing along service work opportunities and identifying and evaluating new product opportunities, the salesforce exceeded expectations 37.5% of the time (Table 23).

Only two scenarios had most respondents indicate the salesforce did worse than meeting expectations some of the time: tracking and logging contacts into a management system and recruiting additional talent. With tracking and logging contacts, respondents either reported the salesforce to “rarely meet expectations” or it did not apply to their operation. Recruiting additional talent also had a tie between sometimes and rarely meeting expectations.

Expectations by Sales Management Structure

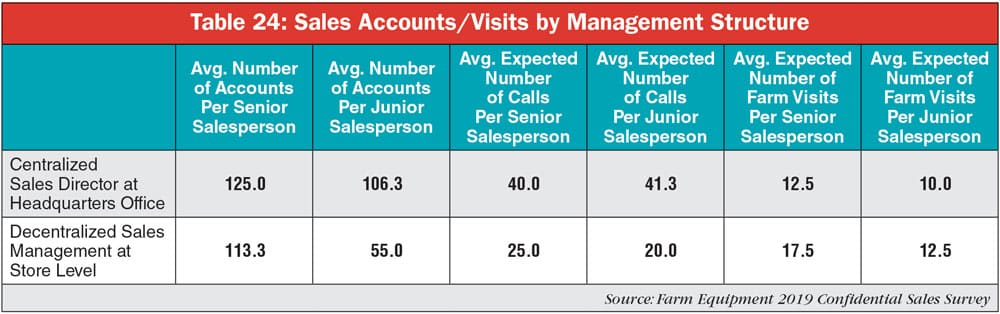

For dealerships with revenue between $50-$79.99 million, respondents reported to either run a centralized structure with the sales director at headquarters office or a decentralized structure with sales management at the store level (Table 24).

While most of the expectations for these management structures are similar to one another, it is worth noting that in the decentralized structure, junior salespeople have a far lower number of accounts assigned to them than senior salespeople.

Annual Revenue: $80-$174.99 Million

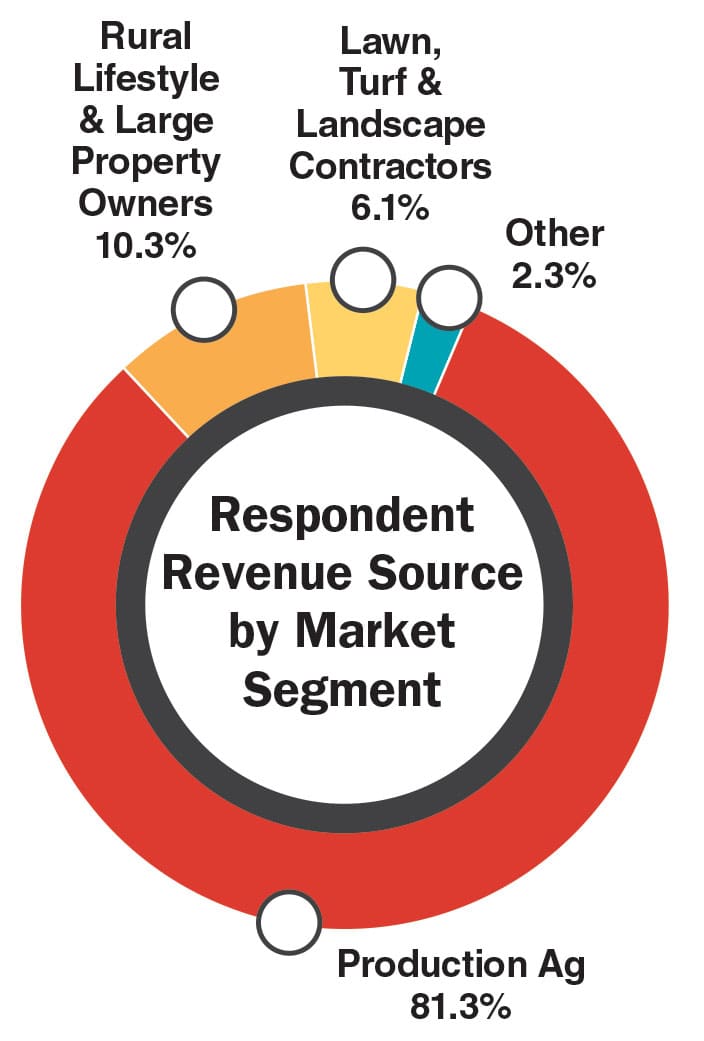

Dealerships reporting annual revenues with $80-$174.99 million had respondents stating that 81.3% of their revenue came from production ag, 10.3% from rural lifestyle customers and 6.1% from landscape contractors.

Commission Structures

“Base plus commission.” … “Percentage of gross profit on each sale. Higher percentage for used equipment.” … “20% on new and 30% on used.” … “Straight commission of 25% profit.” … “Percentage of gross margin that varies depending on new or used and is tiered by gross margin percentage.”

Salesforce Characteristics

The two main age groups for the salesforce in this revenue segment were 41-50 years old and 31-40 years old (Table 25). When it comes to the amount of revenue these age groups accounted for, the salesforce in the 41-50 years old range made up 30.8% and those aged 31-40 years old made up 27.4%. On average, a salesperson in this revenue segment is 39 years old.

The top two areas that respondents intend to look for additional staff include hiring from another agribusiness and developing and promoting current staff (Table 26). Finding additional staff through part-time salespeople was not an area respondents intend to look.

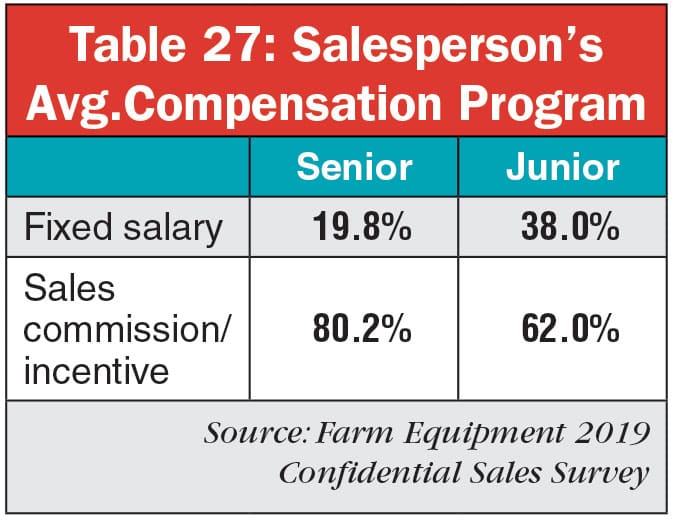

With compensation programs, senior salespeople were far more likely to work with sales commissions/incentives (Table 27). Compensation programs for junior salespeople in this segment also had junior salespeople working off of sales commission/incentives.

Expectations & Priorities for the Salesforce

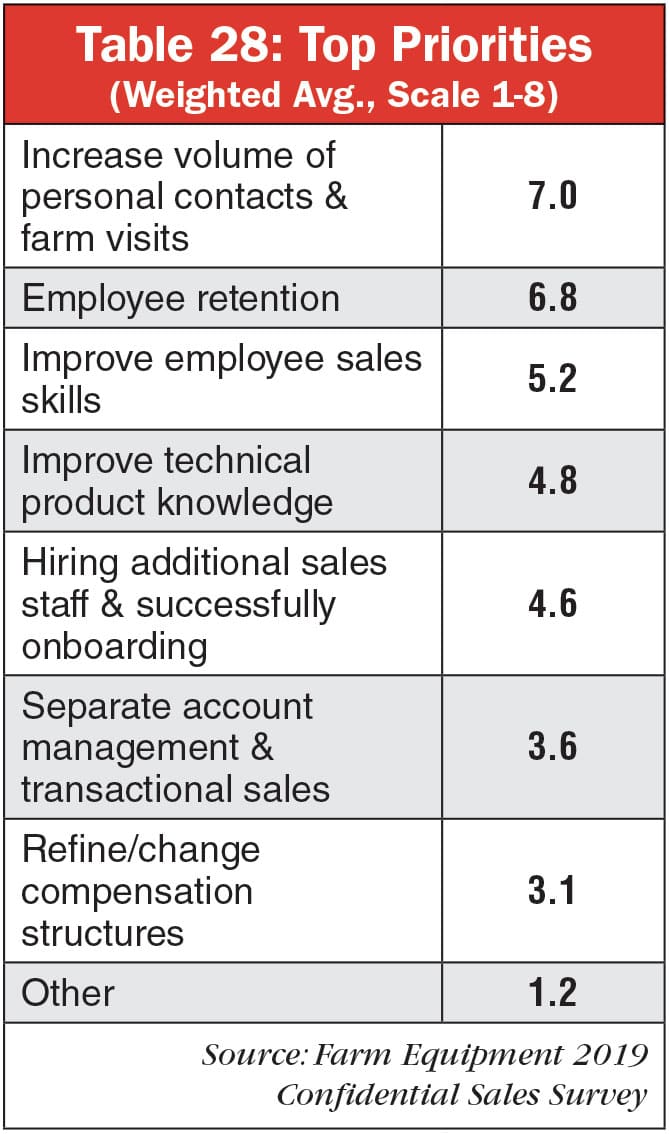

Increasing personal contacts and farm visits and employee retention were the top two priorities for respondents (Table 28). Increasing contacts and visits had a weighted average of 7 and employee retention had an average of 6.8.

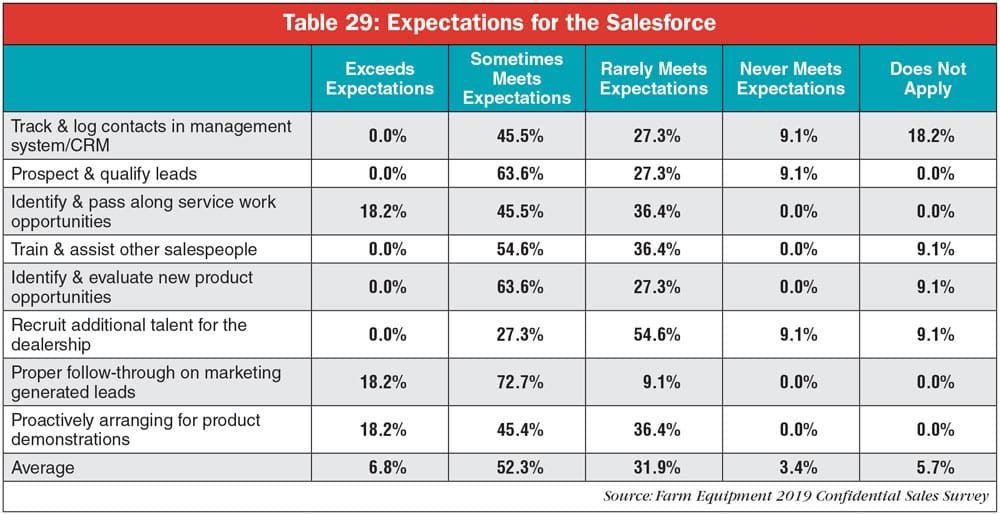

On average, respondents found that their salesforce sometimes met expectations 52.3% of the time in this revenue segment (Table 29). The only scenario in which most of the salesforce did not meet expectations some of the time was in recruiting additional talent. Here, 63.7% of the time, the salesforce either rarely or never met expectations.

Expectations by Sales Management Structure

In this revenue segment, respondents reported operating dealerships in one of three management structures: centralized with a regional sales director, centralized with a sales director at headquarters office or decentralized with sales management at the store level.

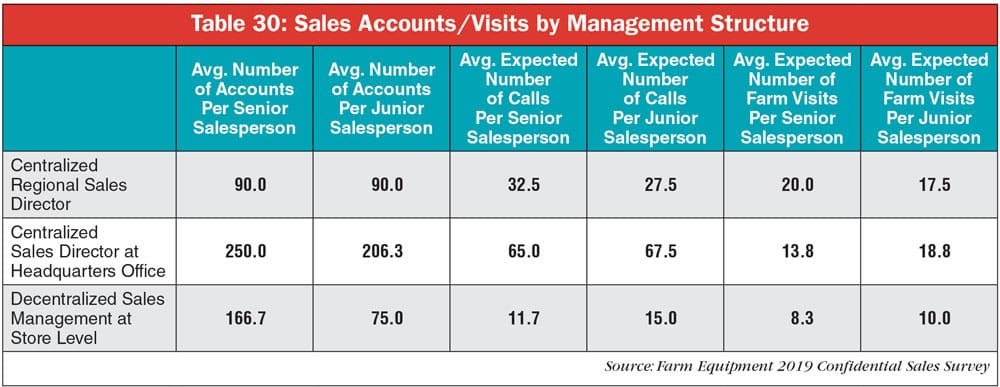

With these management structures, the number of accounts assigned, expected calls and expected farm visits varied greatly from each other (Table 30).

For instance, in the centralized structure with a regional sales director, the senior and junior salesperson are reportedly assigned the same number of accounts, 90. The other sales management structures, particularly centralized with the sales director at headquarters office, have far higher numbers of accounts assigned to senior and junior salespeople.

With the centralized structure with the sales director at headquarters office has a higher expectation for calls made by junior and senior salespeople compared to the other structures in this revenue segment (Table 30).

Also worth noting is the expected calls and farm visits for junior salespeople in both centralized structures with the sales director at headquarters and decentralized structures. In both, juniors are expected to make more calls and go on more farm visits than their senior counterparts.

Annual Revenue: $175 Million or More

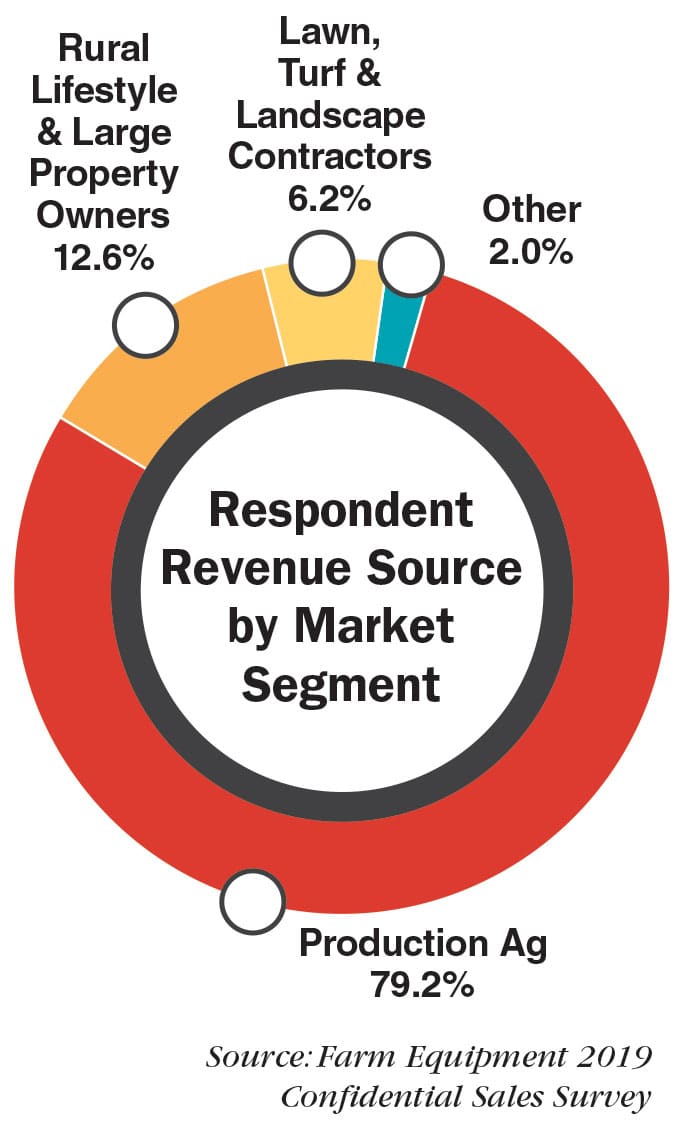

Respondents operating dealerships reporting annual revenues with $175 million or more stated that production ag makes up a large part of dealership revenue at 79.2%. The remaining sources of revenue are rural lifestyle customers at 12.6%, landscape contractors at 6.2% and other at 2%.

Commission Structures

“Quarterly pool incentives divided equally among qualifying salesmen. All manufacturer and outside financial spiffs go to the salesmen.” … “New equipment incentive plus a percentage of new equipment margin and a percentage of trade-in sales margins.” … “Gross margin with bonus for hitting certain metrics.” … “Percentage of gross margin with a reserve held back and paid on the salesman’s used turn of equipment.” … “10% margin on new and 15% on used.”

Salesforce Characteristics

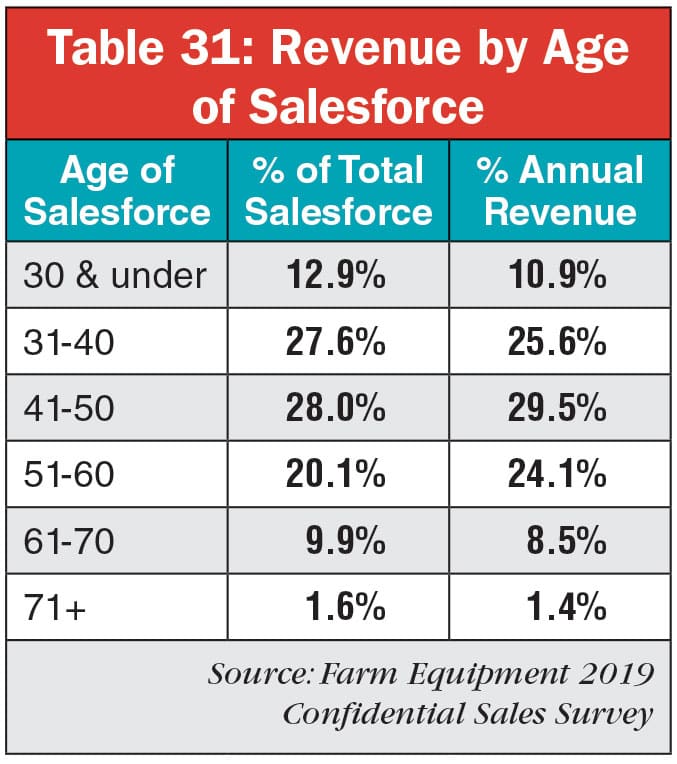

Most of the salesforce in this revenue segment is either aged 31-50 years old or 31-40 years old (Table 31). These two age groups combined account for 55.1% of dealership revenue. Worth noting is the 51-60 year old age group which is 20.1% of the salesforce and accounts for 24.1% of revenue. The average salesperson in this revenue segment is around 39 years old.

The main areas that respondents in this revenue segment intend to look for additional sales staff include developing and promoting current staff and through hiring from other agribusiness (Table 32). Hiring from outside of ag and through internships/fresh out of school were also popular options.

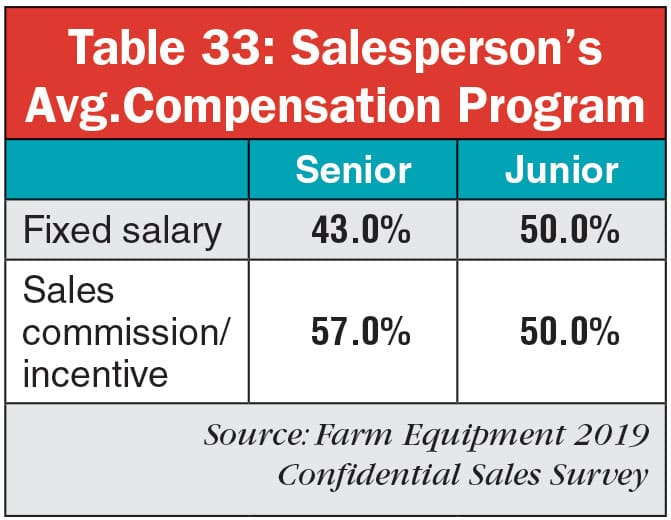

With compensation programs, senior salespeople were more likely to work off of commissions/incentives. For junior salespeople, it was an even split between working off of commissions and fixed salaries (Table 33).

Expectations & Priorities for the Salesforce

Among the top priorities of respondents, increasing the volume of personal contacts and farm visits was clearly at the top, with a weighted average of 6.9 (Table 34). Sitting below this was employee retention with a 5.7.

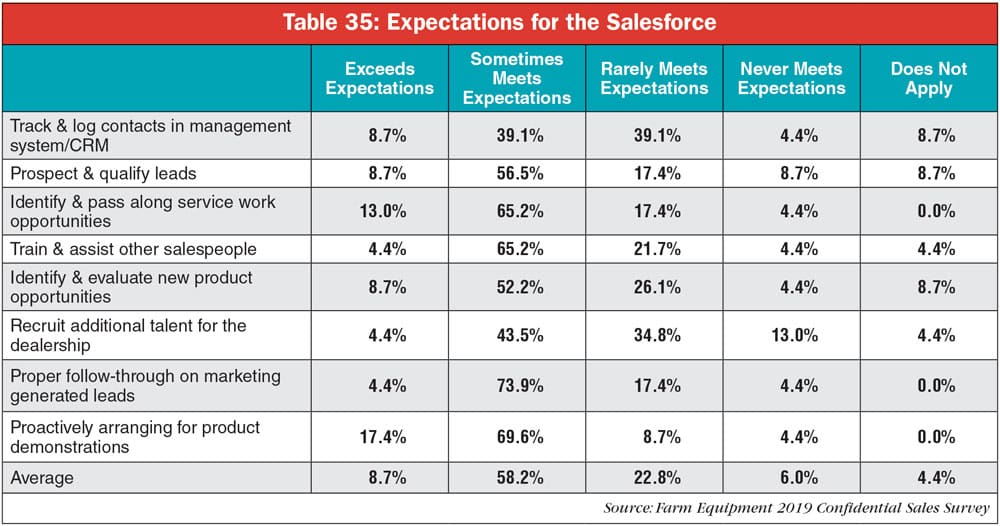

When tracking whether or not the salesforce is meeting expectations, respondents in this revenue segment said that their teams sometimes meet expectations 58.2% of the time (Table 35). On average, the salesforce in this revenue segment exceeds expectations less than 9% of the time.

Expectations by Sales Management Structure

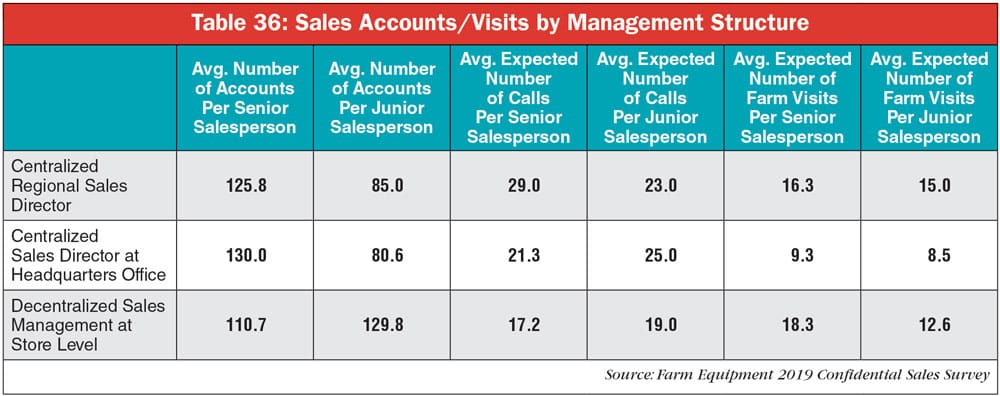

Within this revenue segment, it was reported that respondents were operating dealerships under centralized structures with a regional sales director, centralized with the sales director at headquarters office or decentralized structure with sales management at store level (Table 36).

For dealerships running a centralized structure with a regional sales director and those with centralized and the sales director at headquarters office, the number of accounts assigned and expected calls for junior and senior salespeople was similar (Table 36).

Dealerships running a decentralized structure had junior salespeople being assigned more accounts than seniors in this structure (129.8 for juniors and 110.7 for seniors) and more than junior salespeople in other management structures.

In both the decentralized structure and the centralized with sales director at headquarters office, junior salespeople were expected to make more calls than senior salespeople. The expected number of farm visits for salespeople in the centralized structure with sales director at headquarters office was lower compared to other management structures in this revenue segment (Table 36).

Special Report: 2019 Confidential Sales Survey, Parts 1 and 2