Over the last two decades, the agricultural equipment market has seen dramatic change — change that has had a huge impact on farm equipment manufacturers, dealers and customers. In this special report, Farm Equipment takes an in-depth look at the many factors that have been driving industry consolidation through the decades, and what to expect in the years ahead.

For nearly 100 years, consolidation has been taking place in the farm equipment industry: as farming became increasingly mechanized, farms grew larger in size and smaller in number. In the first half of the last century, fewer farmers working more land spurred growth in farm equipment, and by 1940, some 1.6 million farm tractors were in use — almost double the 1930 total, according to John Deere.

In the early 1900s, more than 160 tractor companies, with names like Agrimotor, Ajax, Big Bud, Dragon, John Blue and Kitten, sold their machines around the world to meet the growing demand for mechanization. Hundreds more sold plows, pickers and other farm implements.

As early as 1930, through attrition and industry consolidation, only 7 full-line farm equipment companies remained: John Deere, International Harvester, Case, Oliver, Allis-Chalmers, Minneapolis-Moline and Massey-Harris. Of those only John Deere remains intact today: Case and International Harvester joined forces in the mid-1980s, around the same time that New Holland and Ford merged to become Ford New Holland. Then those companies all came together in 1999 to become CNH. Meanwhile AGCO emerged in 1990 and went on to absorb Allis-Chalmers, Minneapolis-Moline and Massey-Ferguson.

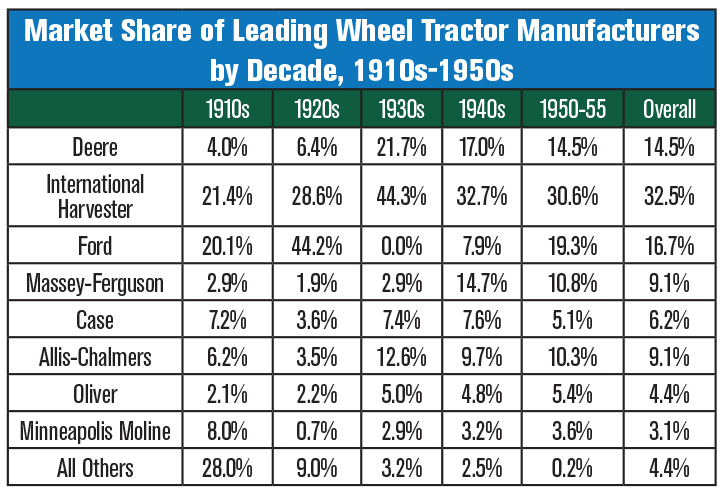

By the mid 1950s, Case, IH and Ford — who today comprise CNH Industrial — represented a combined market share of nearly 55%; Massey-Ferguson, Allis-Chalmers, Oliver and Minneapolis Moline — today’s AGCO brands — represented nearly 26%; Deere’s share was 14.5%.

In the second half of the last century, the farm equipment market continued to see periods of robust growth, followed by contractions influenced by factors such as low commodity prices and farm income. The manufacturing sector responded to these business cycles with rapid expansion, followed by consolidation.

By the 1950s, Case, International Harvester and Ford, which today make up CNH Industrial, had 55% market share for tractors. Source: White (2000)

Note: Totals include production of predecessor companies

2000 – Present

Today, the total number of U.S. farms is about 2.2 million, down from 6.8 million in 1935. Yet the industry saw a long rise in farm equipment sales from the mid-2000s to 2013. This rise in sales was influenced by a number of factors, including strong farm incomes, federal tax incentives that encouraged capital investment, low interest rates and abundant credit.

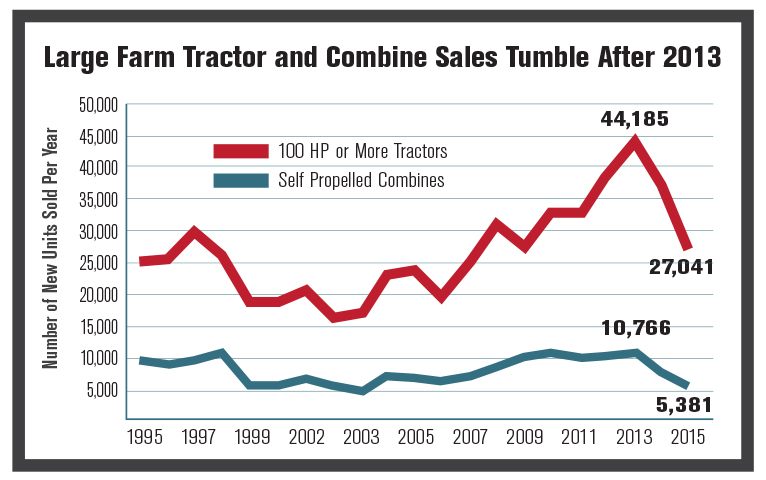

Then, from 2013-2015, a sharp decline in annual unit sales of larger row-crop tractors (those with at least 100 horsepower engines) and combine sales occurred. The decline in combines was particularly steep, with 2015 sales just half of the 2013 peak and at the lowest level since 2003. For larger farm tractors, sales fell 39% over the same period.

Not surprisingly, equipment manufacturers responded quickly to this rapid erosion in their markets — all while keeping an eye on the longer-term growth opportunities. Operations became more efficient, assets were sold and investments were made in new companies and business opportunities. In many cases, farm equipment manufacturers have filled key product gaps in their equipment lineup through acquisitions. For example, Kubota’s acquisitions of Kvernland and Great Plains.

An in-depth look at the major industry players reveals how they’ve achieved market share and revenue growth through the years.

Deere & Co.

John Deere founded the company in 1837 and today Deere & Co. is still based in Moline, Ill. By 1963, Deere had surpassed IH to become the world’s largest producer and seller of farm and industrial tractors and equipment. In the decades that followed, the company kept its focus on growth and innovation, quality and improving its cost structure and asset management capabilities. In 1999 — as Case IH is being acquired by New Holland and Fiat Group — the company recorded a meaningful profit in the face of a major downturn in the farm economy. The company attributed its success on its efforts to create a more resilient enterprise.

A Special Technologies Group, formed in 1999, confirmed the company’s focus on technology. That same year, Deere purchased the assets of NavCon technologies, a provider of advanced GNSS products.

Since the start of this century, Deere has acquired several farm equipment and ag-related companies:

“I don’t think we’ve ever seen as much innovation — there’s an absolute explosion of entrepreneurs working in ag tech. This space is moving very quickly; the big guys will have trouble keeping up and acquisitions is one of the ways they can do so…”

–Robert Saik, Founder, Agri-Trend & Agri-Data Solutions

2005 - United Green Mark, a wholesale distributor of irrigation, nursery, lighting and landscape materials in the U.S.

2006 - Robera Irrigation Products, which provides a wide variety of water-based systems used in farming

2007 - Ningbo Benye Tractor & Automobile Manufacture Co. Ltd., which engages in the research and development, manufacture and marketing of tractors in south China

2008 - Plastro Irrigation Systems Ltd., a maker of mostly plastic irrigation equipment and supplies

2009 - T-Systems, a security system provider for big data management and analysis

2009 - ReGen Technologies, which remanufactures engines for John Deere products in the U.S. and Canada

2013 - Bauer Built Manufacturing Inc., an Iowa company that manufactures and assembles planters, bars and pulling sleds

2016 - Hagie, a U.S.-based manufacturer of high clearance sprayers

2016 - Monosem, a European market leader in precision planters

2017 - California-based Blue River Technology, a precision technology company that’s shifted the focus of farm-management decisions from the field level to the plant level

2018 - King Agro, with headquarters at Valencia, Spain, manufacturers carbon fiber technology products, including sprayer booms that are versatile, strong and durable

2018 – Pla, an Argentinian-based manufacturer of sprayers, planters and specialty products.

In general, tractor sales are considered a good barometer of other farm equipment sales by the industry. The single biggest factor in the recent rise and then the collapse in farm equipment was farm profitability: sales of large farm equipment fell as net cash farm incomes fell.

Source: Assn. of Equipment Manufacturers

CNH Industrial

CNH Industrial is a true conglomerate, the result of multiple mergers and acquisitions of some of the most noteworthy farm machinery businesses through the years. Today, CNH Industrial represents Case IH, which acquired the ag assets of International Harvester in the mid-1980s, and New Holland.

Wisconsin-based J. I. Case Corp.’s entry into the farm equipment business began in earnest in 1957, when Case bought the American Tractor Corp. (ATC). Then in 1964, Case acquired Colt Garden Tractors, the first garden tractor powered by “Hy-Drive,” a form of hydraulic propulsion that allowed for various heavy duty attachments.

The company was acquired in 1972 by Tenneco Inc., an oil company based in Houston, Texas; in 1984 Tenneco bought selected assets of the International Harvester agriculture division and merged it with J. I. Case, creating Case IH. Case IH’s first tractor was the Magnum, introduced in 1985. One year later, Case IH purchased Steiger, the Fargo, N.D., tractor company known for its 4WD tractors. They continued the Steiger branding, and still do today.

Meanwhile, in 1986, Ford acquired New Holland, based in New Holland, Pa., and formed Ford New Holland. Then, in 1991, Fiat of Italy purchased 80% of Ford New Holland and the New Holland brand to become a global full liner producer. Then in November 1999, Fiat acquired Case Corp. and the Case IH brand and merged it with New Holland to become CNH.

The combined companies now held the No. 1 position in tractors and combines built around the world. The rationale was that both companies had complementary product lines and markets: New Holland was strong in the low-horsepower tractors that were popular with livestock producers in the Northeast and Southeast, whereas Case IH was strong in high-horsepower tractors and well known to large cash grain farmers in the heartland. The bottom line impact on operational efficiencies — up to $500 million annually by combining functions like purchasing and logistics, R&D, manufacturing, sales and marketing.

Today’s CNH Industrial is the result of the company’s de-merger from Fiat Group in 2013. With corporate offices in London, CNH Industrial is present in all major markets worldwide.

Since the de-merger, CNH Industrial has acquired Miller-St. Nazianz, a Wisconsin-based sprayer manufacturer that gave New Holland a new line of self-propelled sprayers, and the tillage, seeding and hay and forage business of Danish farm equipment maker Kongskilde Industries.

AGCO

Formed in 1990 with the buyout of Deutz Allis (formerly Allis-Chalmers), AGCO, based in Duluth, Ga., has grown rapidly from multiple acquisitions of select farm machinery businesses. Its first acquisition in 1991 was the Hesston hay and forage line from Fiat, which included a 50% participation in a manufacturing joint venture with Case IH, known as Hay and Forage Industries, or HFI. That same year, the company purchased the White tractor business from Allied Products, expanding its dealer network.

One year later, AGCO went public and by the close of its first decade as a company, AGCO had purchased the worldwide holdings of Massey Ferguson, including the North American distribution rights to Massey Ferguson products, expanding its dealer network in North America by over 1,000 dealers. Other notable acquisitions included McConnell tractors, leading to the development of the AGCOSTAR articulated tractor line and Black Machine; the White-New Idea business of planters, hay tools and spreaders; Tye and Farmhand ag implements and tillage equipment, and Spra-Coupe and Willmar, two leaders in the agricultural sprayer market.

In 2002, AGCO acquired Caterpillar’s agricultural equipment business, including its Challenger brand, which opened up new opportunities to for AGCO dealers to approach large scale farming operations, and Sunflower Manufacturing Co., a leading producer of tillage, seeding and specialty harvesting equipment.

AGCO has also expanded its global reach through acquisitions:

1996 - Brazilian company Iochpe-Maxion, the No. 1 market leader in tractors with the Massey Ferguson brand; Deutz Argentina S.A., the market share leader in tractors in Argentina, and Western Combine Corp. and Portage Manufacturing of Canada, which further expanded the Massey Ferguson combine business

1997 - Fendt GmbH, a leading German tractor business, and Dronningborg Industries, a leader in European precision farming technology

2005 - Valtra, a leading tractor manufacturer in the Nordic countries and Latin America

2010 - Sparex Holdings, a leading independent, global distributor of accessories and tractor replacement parts serving the agricultural aftermarket

2011 - ARGO group, a German manufacturer of grass and hay machinery

Today, Massey Ferguson is AGCO’s flagship brand and remains a major seller around the world. Last year, the company acquired Precision Planting from The Climate Corp., a subsidiary of Monsanto Co. (after Deere’s deal to acquire the company was abandoned) that has played a key role in the adoption of precision ag practices. In late May of this year, AGCO announced a partnership with AgIntegrated (AGI) to deliver ag information management systems and services to AGCO customers, so they can connect more easily with their agronomy service providers. The new services are scheduled to launch in North America yet this year.

Source: Wong, B. (2015); Farm Machinery Market Share Estimates; Piper Jaffray Companies.

Kubota

Kubota Corp., based in Osaka, Japan, was established in 1890, and started in metal casting and pipe making. It developed and marketed its first Japanese farm tractor in 1960, introduced its first tractor in the U.S. in 1969, and established Kubota USA in 1972. The company went public in 1999, and today manufactures and sells tractors and agricultural equipment, engines, construction equipment, vending machines, pipe, valves, cast metal, pumps and equipment for water purification, sewage treatment and air conditioning.

Best known for its lower horsepower equipment, over the last 6 years, Kubota has taken steps to build a full line of broadacre equipment. In 2012, the manufacturer acquired the European-based implement manufacturer Kverneland. With that acquisition, the company said it was “taking its first major step toward becoming a comprehensive manufacturer of agricultural machinery.”

In North America, Kubota acquired Salina, Kan.-based equipment-maker Great Plains Manufacturing in 2016, which expanded the company’s long-time partnership with Land Pride and included all 5 Great Plains divisions with multiple facilities in Kansas and a manufacturing plant in Sleaford, England. Since 2007, Kubota has worked closely with Land Pride to produce quality, performance-matched implements for Kubota dealers and customers across the U.S. and Canada.

Alamo Group Inc.

Shortline manufacturer Alamo Group has also been in acquisition mode in recent years. Founded in 1969, the company’s first products were based on rotary cutting technology; over the years it has added flail cutting and sickle-bar technology.

In 1986, the company entered the agricultural mowing markets with the acquisition of Rhino Products and embarked on a strategy to increase the Rhino dealer distribution network during a period of industry contraction.

Today, the company’s products include tractor-mounted mowing and vegetation maintenance equipment, street sweepers and snow removal equipment, agricultural implements and related aftermarket parts and services. The company’s agricultural products are sold through Alamo Group’s marketing organizations and independent dealer networks under various trade names, including Bush Hog, CT Farm & Country, Earthmaster, Herschel and RhinoAg.

Alamo Group went public in 1993 and 2 years later, expanded its business in the agricultural market with the acquisition of Herschel Corp., a manufacturer and distributor of aftermarket farm equipment replacement and wear parts. Ten years later, it acquired key assets of Valu-Bilt Tractor Parts, a parts distributor that sold directly to customers through its catalog and the internet and on a wholesale basis to dealers.

In 2009, Alamo acquired Bush Hog, which manufactures rotary cutters, finishing mowers, zero turn radius mowers, front-end loaders, backhoes, landscape equipment and other implements. This acquisition, combined with the company’s existing range of agricultural mowers, created one of the largest manufacturers of agricultural mowers in the world.

Alamo’s acquisition strategy has helped the company grow sales by 52% between 2008 and 2016, while increasing headcount by only 14%. Acquisitions can be divided into three groups: market share consolidation, complimentary products for existing markets, and international expansion of existing products. The company attributes this growth to its consistent focus on meeting customer needs through geographic market expansion, product development and refinement, and select acquisitions.

See also: Looking Back at What Happened to Equipment Manufacturers in the Early 1980s Farm Crisis.

Consolidation & Growth

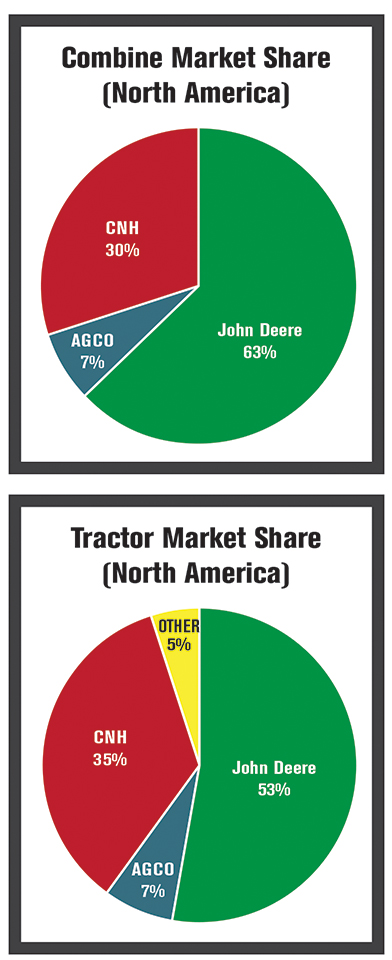

Today, 3 major manufactures still dominate the market for in North America, with Deere claiming 53% of large farm tractors, followed by CNH Industrial at 35% and AGCO at 7%. Deere’s lead is even more commanding in the combine segment, with 60% of the market, followed by CNH Industrial at 30% and AGCO at 7%, according to “The Voice of the Farmer,” a 2017 report by the Farmers Business Network (see chart).

That’s quite a reversal from the mid 1900s, when Deere’s share stood at 14.5%, compared with 26% for AGCO’s combined businesses and 55% for CNH Industrial’s combined businesses (see chart).

How Industry Consolidation Impacts Shortlines

When larger companies acquire smaller ones, the competitive landscape is forever altered. For the companies getting acquired, there are clear benefits: “Sometimes it’s a troubled company whose innovations made it attractive for a larger company to pick them up,” says Vernon Schmidt, executive vice president of the Farm Equipment Manufacturers Assn. “Or it’s a small family-owned company that can’t keep the business going. For these companies, it’s a blessing that the buyout opportunities are there.”

However, the loss of specialized product lines can be negative for dealers and the farmers they serve. “For the dealer that’s now covering a larger area with multiple stores, there’s operational efficiencies and the ability to sell more,” he says. “But what you gain there you’ve lost in competition. For the farmer, it’s good to have a lot of dealers who sell specialized equipment and who all want his business.”

Schmidt believes that when the majors rule out shortlines, it affects innovation and the dealers’ ability to serve the needs of farmers in their local markets. And competition: the majors want one model that can be sold anywhere in the world.

“Pressure from the majors is huge, but dealers have incredible flexibility,” he notes. “If the dealer doesn’t like the terms, they don’t have to accept them. But the reluctance on the part of dealers not to have shortlines on their lot, I believe hurts their sales. It’s difficult to sell equipment that you don’t have sitting on your lot, and dealers are missing out on incredible opportunities to sell shortline equipment.”

To avoid the pitfalls of industry consolidation, Schmidt advises dealers to take a diversified approach that includes shortlines. “Dealers have told me that the profit margins are much better on shortline products,” he says. “Plus, it gives the consumer that opportunity to choose the level of quality for their operation, and the dealer the ability to meet that specific need for that specific customer.”

“Shortlines play a key role in keeping the environment competitive,” says Schmidt. “We all want the same thing: many strong dealers who are independent and able to make decisions at a local level, with the ability to choose the best products for their market, without influence from outside forces. That’s what works best for the dealers, the customers and the manufacturers.”

Changes in Industry Consolidation

Robert Saik, founder Agri-Trend and Agri-Data Solutions, cites several trends that are impacting the industry today and will continue to do so in the decades to come: the rapid emergence and influence of technology on the industry as a whole, and the keen interest in agribusiness on the part of the investment community.

“The investment community is attracted to agriculture because of the scope of the numbers and the feeling that agriculture is ripe for the integration of new technologies,” says Saik. “So some of the mergers going on right now are to signal to the investment community that we’re playing in the high-tech world of agriculture. These acquisitions are not iron-based, they’re tech-based.”

Take, for example, the Blue River Technology acquisition by John Deere. “Blue River caught the eye of the investment community as an up-and-coming company, a go-getter,” he says.

“There’s also a great team inside of Blue River, and one of the best ways of finding talent is to acquire. Now that team is John Deere. John Deere just signaled to the world that they are a player in the machine learning, artificial intelligence space.”

That’s a big change from the mergers of the 1990s, which were largely driven by iron. “The types of acquisitions are changing to try to give those organizations a faster leap into the new technology arena and let’s face it, the technology startups are happening faster,” says Saik. “It’s faster and easier to do a technology startup than it is to do an iron startup.

“There are a lot of startups in the tech space that need a home for what they are building. And if the acquisition is done properly, the acquired technology will go globally within the larger company because the larger company has global reach, and that’s exciting.”

Another trend that’s starting to emerge is the need for farmers to make better use of — or stretch the use of — crop inputs. “Whether it’s crop protection or seed, farmers need to be more judicious with crop protection products,” says Saik.

“So this is an area where iron and technology can displace some of the things were doing with chemistry: using tech and iron to weed out and cultivate a crop. Whether it’s the pressure to reduce inputs or the opportunity to farm organically, that opens up other opportunities to reduce crop inputs.

“The industry is consolidating, and we know who the big players are,” says Saik. “There’s going to be another whole round of mergers and acquisitions involving these emerging companies.

“In fact, I don’t think we’ve ever seen as much innovation — there’s an absolute explosion of entrepreneurs working in ag tech. This space is moving very quickly; the big guys will have trouble keeping up and acquisitions is one of the ways they can do so.”

Key Takeaways

Consolidation in the farm equipment industry has been taking place for nearly 100 years, as fewer people farm more acreage. To meet the changing needs of growers, farm equipment is getting bigger and more productive, but the market overall is shrinking.

“As the farm population continues to age, that continues to drive consolidation among farmers,” says Curt Blades, senior vice president of Ag Services for the Assn. of Equipment Manufacturers. “Farms are growing in size, with fewer family members to operate them. So it starts with the customers who are consolidating. It’s simple math.”

Success is about understanding how to thrive with a shrinking customer base that operates on razor-thin margins. “With fewer people in growth mode to sell to, there is an economic need to consolidate,” says David Parker, executive vice president at FLM Harvest.

Within this context, we’ve seen what’s working for farm equipment companies focused on profitable growth:

Mergers & Acquisitions. M&As have proven to be one of the most effective ways for manufacturers, and dealers, to gain quick entry into new markets, or gain a competitive edge in markets already served. Parker cites the advantages:

• More R&D dollars to bring new products to the market that, in the end help everybody — especially the producer.

• More job opportunities for people at every level in the organization.

• The ability to hire and retain the best talent as companies and dealers become more attractive to highly skilled employees.

• Improved access to capital for companies that suddenly look more attractive to finance providers.

• New markets, as companies and dealers expand territories to cover new geographic regions.

Operating Efficiencies. In this highly competitive environment, running an efficient business — from production and marketing to logistics and supply chain management — is as critically important to manufacturers and dealers as it is to the farmers they serve.

But Parker cautions that one of the downsides is, as a company gets bigger, it tends to turn inward and focus more on processes, often times at the expense of the customer.

“There are ripple effects as companies work to drive efficiencies,” adds Blades.

“It’s easy to look at a community that has a plant closure and see the impact. But if you look at the company as a whole, business operations just move around. And ultimately the end customers benefit. When you have technology that’s undercapitalized and can get a major investment that allows that technology to live up to its potential, the farmer wins.”

So, whether companies are looking inward to improve processes, or outward to expand into new markets — the need to stay focused on their overall strategy and the customers they serve is vital.

“Keep the sales organization focused on the right customer,” advises Parker. “Those who have a plan, who intend to stay in business — whatever your business — make it work. At the end of the day, it’s about customer focus and understanding where the market is headed, not where you would like it to be. You have to position yourself for where is it headed, and then do something about it.”

Technology. In today’s fast-changing farm equipment landscape, a company’s ability to stay ahead of technology will determine its future success. It’s no wonder so many recent acquisitions by the majors have had strong tech focus.

“In farming, we have been masters in innovation, and these acquisitions point to where folks in the industry think it’s going,” says Blades. “It has everything to do with technology. We see innovation happening all the time and it’s moving fast. So a lot of times interesting technology is picked up by a more established company and they commercialize it across the market.

“It’s exciting when we see these products live up to their hopes and dreams. If you’ve got a good plan and a good product, innovation wins. Those who have good products and management will get stronger,” he says.

“It’s a paradigm shift for the farm customer and the dealer,” says Blades. “But those that have good plans and leadership in place, they absolutely thrive.”

Looking back over the last 5 years, a number of acquisitions have taken place in the farm equipment industry, among the majors and shortlines alike, as well as with technology companies, tire manufacturers and farm equipment auction companies.

For an extended list of mergers and acquisitions, visit www.Farm-Equipment.com/0918

2014

February - Jacobsen, a turf maintenance company owned by Textron, acquired Dixie Chopper.

Alamo Group acquired the operating units of Specialized Industries. This includes the businesses of Super Products, Wausau-Everest LP and Howard P. Fairfield.

Ag Growth International entered into an agreement to acquire the REM GrainVac product line from REM Enterprises Inc.

Luigi Blasi and Carlo Tonutti have entered into an agreement that binds their respective companies, Progroup with brands Bargam, Projet, Oma, Rimeco, Agricom, Protek and Tonutti Wolagri with the same name brand. The deal ended up being a "nightmare" that after a number of years resulted in Tonutti regaining possession of the company in June 2017.

April - Hexagon AB acquired Arvus.

May - Raven Industries’ Applied Technology Division (ATD) acquired SBG Innovatie BV and its affiliate, Navtronics BVBA.

AGCO acquired Intersystems Holdings.

Alamo Group completed the acquisition of the operating units of Specialized Industries LP, a portfolio company of ELB Capital Management.

August - Valmont Industries Inc. acquired a majority interest AgSense.

October - Dexter Axle acquired the North American assets of AL-KO Axis Inc.

Anderson Industries acquired 100% of the shares of Dakota Foundry.

November - Ag Growth International Inc. announced that AGI, Vicwest Inc. and Kingspan Group plc entered into an arrangement where Kingspan will acquire all of the issued and outstanding shares of Vicwest and AGI will acquire substantially all of the assets of Vicwest’s Westeel Division.

Topcon Positioning Group announced the complete acquisition of Wachendorff Elektronik GmbH and Wachendorff Electronics.

December - IronPlanet and Associated Auction Services, an alliance of Caterpillar and several of its independent Cat dealers, that operates under the name of Cat Auction Services confirmed merger of the two companies.

CNH Industrial completed the acquisition of precision spraying equipment manufacturer Miller-St. Nazianz.

The Climate Corp. announced the acquisition of 640 Labs, an agricultural technology startup based in Chicago.

Trimble Navigation purchased privately held Iron Solutions.

2015

February - Novariant and Arag announced their partnership.

March - Alamo Group completed the acquisition of Herder Implementos e Maquinas Agricolas Ltda. in Brazil.

Paladin Attachments announced the acquisition of Kodiak Manufacturing.

AgJunction acquired Novariant.

April - Sukup Manufacturing acquired DanCorn.

Trelleborg Wheel Systems acquired Armstrong Tyre in Australia.

EFC Systems purchased AgJunction Inc.’s Cloud Services division.

May - Sukup Manufacturing sold its implement line to Remlinger Manufacturing.

Salford Group acquired Valmar Airflo.

July - T.G. Schmeiser acquired the Smart-Till product line from HCC.

November - Trimble acquired the assets of privately held Agri-Trend.

Trelleborg acquired CGS Holding.

RENN Mill Center Inc. purchased the manufacturing and distribution rights to the Jiffy brand of agriculture equipment.

December - Topcon acquired Wachendorff, Digi-Star, RDS Technology and NORAC.

2016

January - A local private investor group, including two Bestway Management Team members, announced the acquisition of Bestway Inc. from Rick and Debbie Heiniger.

February - Ritchie Bros. Auctioneers Inc acquired Mascus International Holding BV, a leading global online equipment listing service.

March - Ag Growth International announced the acquisition of Entringer S.A.

Wells Fargo & Co. completed the purchase of the North American portions of GE Capital’s Commercial Distribution Finance and Vendor Finance businesses as well as a portion of its Corporate Finance.

June - AGCO acquired Cimbria Holdings.

Trelleborg finalized the acquisition of CGS Holding.

October - Kongskilde Industries’ owner, DLG Group has entered into an agreement to sell the Grass and Soil activities of Kongskilde Industries to CNH Industrial N.V.

November - Ritchie Bros. acquired Kramer Auctions.

December - Ag Growth International Inc. closed its acquisition of Yargus Manufacturing.

SMA completed acquisition of TISCO.

2017

February - AGCO announced its intention to launch a tender offer for the outstanding shares of Kepler Weber S.A.

Valley Industries completed the acquisition of A1 Mist Sprayers

Deere & Co. completed its acquisition of Monosem, the European market leader in precision planters.

Curtis Industries finalized the acquisition of Artillian.

March - Textron Inc. acquired Arctic Cat.

April - Constellation Software, through its Perseus division, purchased 100% of the shares of Dealer Information Systems Corp.

Ag Growth International Inc. acquired 100% of the outstanding shares of Global Industries Inc.

Jaylor has purchased controlling interest in MMI International.

May - Alamo Group acquired 100% of the outstanding capital shares of Santa Izabel Agro Industria, a privately held company owned by Soufer Industria.

Trimble acquired German company Müller-Elektronik.

June - Northpoint Commercial Finance announced LBC Capital, a subsidiary of Laurentian Bank of Canada, is expected to acquire Northpoint.

John Deere purchased Mazzotti, a privately held sprayer manufacturer based in Ravenna, Italy.

Deere & Co., announced it would be expanding the reach of its Construction & Forestry division by acquiring the German construction equipment maker Wirtgen Group.

July - AGCO acquired the Precision Planting equipment business.

August - DuPont acquired San Francisco-based Granular Inc.

Alamo Group Inc. acquired R.P.M. Tech Inc.

September - Deere & Co. acquired Blue River Technology.

Mahindra & Mahindra acquired Turkish manufacturer Erkunt Traktor Sanayii.

HCC Inc. assumed 100% ownership of HCC Methal Co. The company will now be recognized by the name HCC, Curitiba and will continue to be managed locally by Thecio Pelanda.

2018

March – John Deere acquired King Agro, a privately held manufacturer of carbon fiber technology products with headquarters in Valencia, Spain and a production facility in Campana, Argentina.

Venapri Group’s Agrisolutions division (Ingersoll and Bellota) acquired Trinity Logisitcs Corp.

April – Elmer’s Mfg. acquired Dynamic Ditchers Inc., maker of the Wolverine Extreme Rotary Ditcher.

May – AGROdeviate acquired W&A Manufacturing Co.

June - John Deere partnered with Norwood Sales Inc. to manufacture a John Deere-branded Kwik-Till machine.

Italian manufacturer Annovi Reverberi Group acquired 95% stake in Ace Pump Corp.

July – Green Park Partners (GPP) acquired what’s left of Kongsklide after CNH Industrial acquired its tillage, hay tools and forage feeders in 2017.

Michelin acquired Camso

Clean Seed Capital acquired Harvest International.

August - John Deere acquired Argentinian manufacturer Pla.

Part 1: Number of U.S. Farms Declines While Size of Farms Increases

Part 2: Manufacturer Consolidation Reshaping the Farm Equipment Marketplace

Part 3: What’s Driving Consolidation Among Farm Equipment Dealers?

Post a comment

Report Abusive Comment