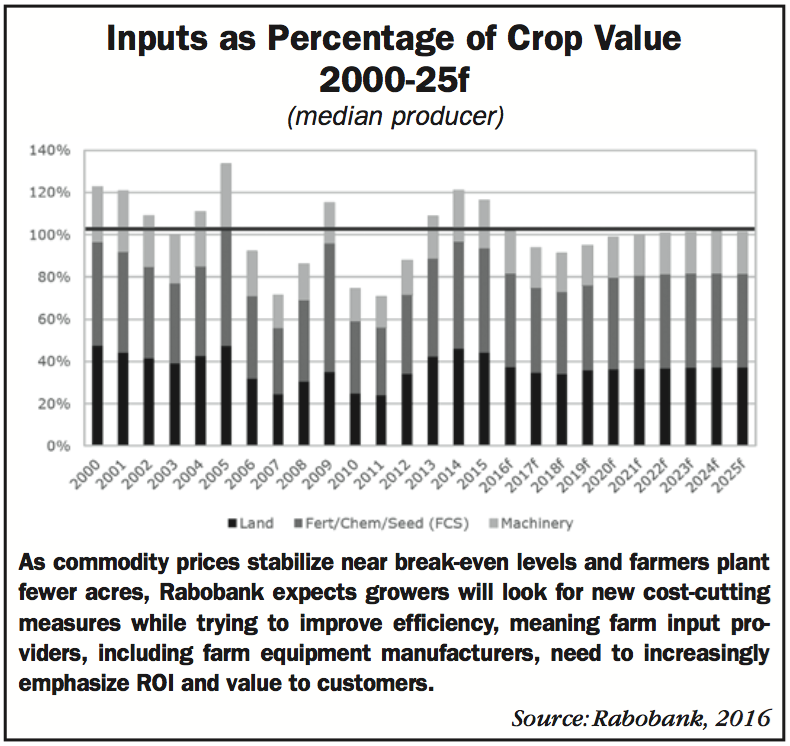

When commodity prices fall, farm equipment purchasing is the first area in which farmers reduce spending. In their February report, Rabobank analysts Kenneth Zuckerberg and Sterling Liddell anticipate that commodity prices will stabilize over the next 5 years to near break-even levels. As a result, the report predicts large crop farmers will continue looking to conserve cash, and farm input providers, including fertilizer, chemical, seed and equipment manufacturers, will need to deliver more value to increasingly cost-conscious customers. At the same time, smaller farmers may be forced to merge.

From 2000-05, commodity prices shifted as a result of increased use of corn for ethanol and increased imports of soybeans by China. But recently, more regular yields and lower export demand have been driving commodity prices closer to break-even levels, Zuckerberg and Liddell explain. With prices fluctuating around break-even, farmers will be looking to cut input costs in the next few years. These costs are largely established prior to planting and therefore changes tend to lag behind those in commodity prices, so the report suggests input costs will level out over the coming years.

In a typical row-crop cycle, as prices decline, farmers reduce equipment purchases for the first year or two, which was the case in 2014-15. For 2016, Rabobank expects farmers to minimize fertilizer applications, switch to cheaper seed and negotiate for lower land costs before we hit the trough of the crop cycle. In 2017, the crop cycle is anticipated to rise out of the trough and farmers will begin to reestablish planting disciplines and optimize yield, leading to a return of profitability and equipment purchasing.

For farmers, this means planting fewer acres to reduce supply to match the diminished demand. “To reach long-term equilibrium with supply, we argue that acreage utilized for the three major row crops needs to decrease by 2% (3-4 million acres) from peak levels for the next 5 years,” say Zuckerberg and Liddell.

With farmers planting fewer acres, the analysts anticipate growers will be more focused on cost cutting and making yield efficiency improvements relative to input usage. This will lead to increased competition among fertilizer, chemical and seed companies for a portion of growers’ average gross crop value, driving integration between these industries. “Fertilizer, chemical and seed will represent approximately 40% of the crop value, with machinery averaging 15-20% and the balance being claimed by land,” says Rabobank.

“Machinery is the only input cost category in which ‘current-year’ changes in ag commodity prices is a statistically significant driver. We would argue that farmers have more direct control over expenditures on farm machinery than on other categories, and this is the very first category in which farmers reduce purchases during a downturn.”

Over the last 2 years, growers have already reduced spending on farm equipment purchases and Rabobank anticipates that for the next few years seed companies will gain the most traction as farmers continue to seek ways to cut costs while increasing yields year-over-year. Along this vein, successful farm equipment manufacturers should emphasize equipment’s ability to improve efficiency and demonstrate clear ROI on the equipment purchase, according to the report.

Post a comment

Report Abusive Comment