Few things are guaranteed, but many things are taken for granted. My career in the equipment business has been filled with guarantees that are dressed-up things taken for granted. A couple of examples come to mind. Late model and low-hour equipment will always sell, and used equipment values always reflect the most current price increases. My favorite is, without a doubt, that tractors always sell no matter what.

I was looking at the marketplace, and it is hard to ignore the number of tractors, especially row-crop tractors. Supply shortages starting in 2020 and ending in 2023 caused a significant problem. A scarcity premium was added to everything. It did not matter if it was toilet paper or farm equipment; prices increased dramatically over the 3 years. Because of various COVID relief programs, good crops and high commodity prices, on-farm income was at record highs, and upgrading an aging fleet was a significant priority. With the hangover of 2012 and a contracted commodity market, the average age of the on-farm equipment fleet was 7-10 years old. The oldest the fleet had been in since the 1940s.

With on-farm income at all time highs and high commodity prices, the equipment order writing periods filled quickly, within minutes, to be exact. Lack of supply and screaming demand drove prices up. The most updated machine was the row-crop tractor. During this time, orders were written, and few machines were delivered. Machines were pushed out and, in many cases, canceled and re-ordered later. The orders were there, and tractor builds were in the queue.

Inventory Shifts

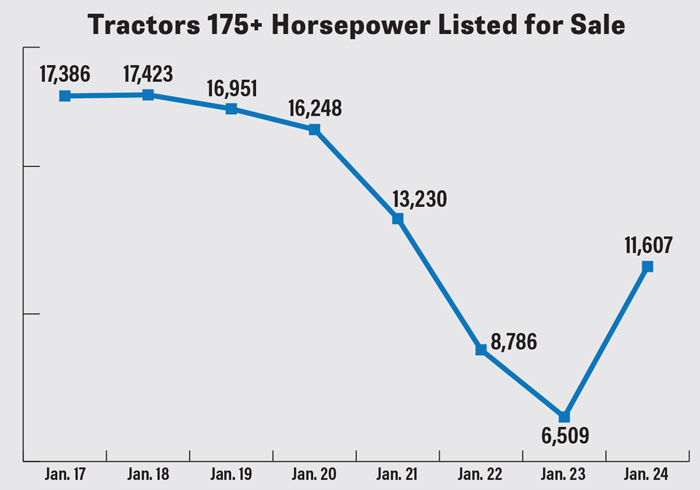

According to TractorHouse.com, as of Jan. 1, 2024, 11,607 tractors 175 horsepower and greater are listed for sale. The graph shows the number of machines listed Jan. 1 of each year since 2017-2023

When looking at the graph from 2017-20, roughly 1,000 tractors were taken off the market, and from 2017-20 and 2020-23, 10,000 tractors were taken off the market, and a year later, half of the 10,000 tractors depleted in 3 years were added back in 2023. I fully expect current inventory levels to equal or exceed 2017-18. The number of used tractors on the market isn’t the issue alone. The highest number of used tractors I recorded was a 3-month stint starting in March 2015 through May 2015. During those months, the number of tractors on the market was March – 20,358, April – 20,455, and May – 20,012. Since then, the number of used tractors has not exceeded 20,000.

The other issue facing the used tractor market is the number of late-model and low-hour machines. Not only is the subset of machines the largest, but they also have record-high pricing. Between 2020 and 2023, equipment manufacturers increased their prices by 40%. Like everything else, supply chain disruptions and lack of materials cause factory delays, increasing the scarcity premium dividend. In 2017, the new tractor had an average price of $328,600; in 2020, the price was $363,700; in 2023, the price was $491,800 — an increase from 2017 to 2023 of $163,200 or 49.7% increase. To add further disruption to the market, the prime interest rate in 2017 peaked at 4.5%, and in 2023, the current rate is 8.5%, an increase of 188%.

All these factors set up the used tractor markets for a fall. Looking at 2024, I see nothing but a significant crop production issue where used row-crop tractors do not struggle. I am expecting a decrease in value of 15%-25%. The auction market will continue to have row-crop tractors listed, further feeding the decline in value. This will be a year where tractors cannot save themselves. I want to be clear that the decline is not because of a bad economy. The decline is caused by supply catching up with demand and the erosion of the scarcity premium on pricing. Like any bubble, there is a correction when it pops, which resets the market to the “New Normal.” This is not the first, and it will not be the last.