While we’ve come to expect dealers to report used equipment levels as “too high,” for the fourth consecutive month, dealers are now also reporting their new equipment inventories as “too high.”

According to the December release of the “Dealers Sentiments & Business Conditions Update” report, a net 24% of dealers categorize their new inventory as “too high” (31% too high; 62% about right; 7% too low), vs. 8% of dealers last month who categorized their new inventory as “too high.” This marks the fourth consecutive month in which more dealers reported that new inventories are “too high” vs. “too low” and the highest net percentage since Ag Equipment Intelligence and Cleveland Research Co. began this survey in April 2011.

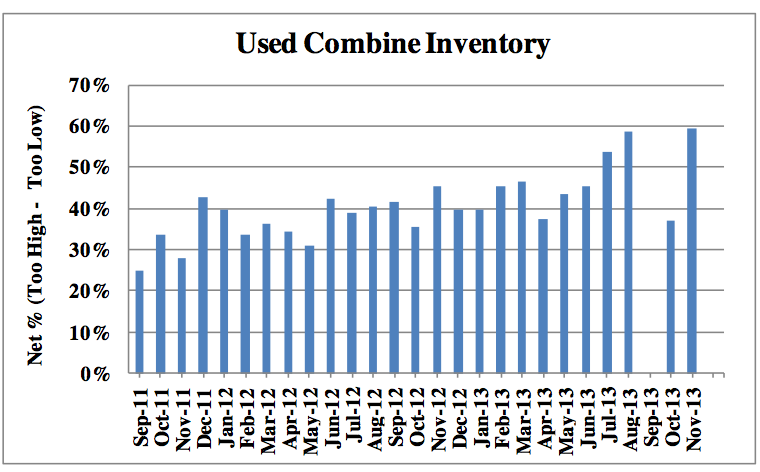

Used Equipment Levels

At the same time, used equipment inventory continues to build as it has during the past year. Overall, dealers report that used machinery backlog also rose to the highest level in the history of the survey with a net 38% of dealers reporting used inventories as “too high” (48% too high; 43% about right; 10% too low), well above the net 20% reporting “too high” in the previous month.

Also, continuing the trend, dealers say used combines remain the big problem. A net 59% of dealers reported used combines inventories were “too high” (59% too high, 41% comfortable, 0% too low) vs. a net 37% during the previous month.