Farm equipment dealers are putting as much or more emphasis on the used segment of their business as they do new equipment.

In November 2010, Robert Werthheimer, then the machinery analyst for the global financial services firm Morgan Stanley, downgraded shares of Deere & Co. to “equal-weight” or to a hold position from “overweight” or a buy position. In a note to investors, Werthheimer said he made the move because he believed the industry and investors were “too focused on corn and missing other factors that make the cycle more stable.” The major factor he was pointing to was used farm equipment.

What’s interesting about Werthheimer’s comments is that a financial analyst sitting in New York was picking up on a growing concern about a segment of the farm equipment business that seldom makes news, let alone headlines.

SIDEBAR:

Recent Trends in

Used Equipment Pricing

But with the growth of combine roll programs, high commodity prices allowing grain farmers to speed up the equipment replacement cycle, and the increasing number of multi-unit equipment trades taking place, how dealers’ manage used equipment inventories is one of the most critical factors in determing a dealers’ success — or failure.

Earlier this year in an interview with Farm Equipment, the top executives of Cervus Equipment Corp., one of John Deere’s largest North American dealership groups, emphasized the growing importance of managing this segment of the business. “Our used equipment sales have grown probably faster than any other part of our business over the last three years,” said Graham Drake, president and CEO of Cervus. “It’s the biggest financial risk out there.”

“It’s a big challenge for the industry,” says Peter Lacey, executive chairman of Cervus. “There’s been a bit of overzealousness by the manufacturers to get new product out the door. So there are lots of very, very competitive, multi-unit discounts and strong financial incentives to encourage new sales. We’re seeing a definite trend toward multi-unit deals, lots of trades and flips done every year. We don’t think flipping every year is a good strategy. The industry can’t absorb that much used, so you’re really stealing sales from the future and it’s going to come in one big crash if the industry doesn’t sort it out. Unfortunately, we all can talk about it and agree that it’s not sustainable, but it still happens.

“Our preference would be for farmers to trade every two or three years where the owners make full use of the warranty period and gets some hours on the equipment, especially combines. By rotating equipment every two or three years, the industry can absorb that; there are enough buyers of used for that.”

At the same time, Lacey and Drake acknowledge the company needs to compete in the current environment. “The reality is, if a customer wants to flip his units every year, we’re not going to say no,” Lacey says. “Usually there are a number of buyers for that first- year flip. It’s becoming more challenging after that because of the consolidation of farms. There’s very little market for that 15-year-old combine, other than overseas. So, how do you find a home for that 15 year-old combine?”

Combines & Old Equipment

Lacey’s reference to a 15-year old combine capsulizes the sentiments of most dealers Farm Equipment surveyed in preparing this report. Most dealers seem to agree that as new sales have ramped up during the past few years, they’ve generally been able to manage the growth in the volume of most used machines, except for combines.

“The biggest area of concern is obviously used combines,” says Mark Foster, ag division manager for Birkey’s Farm Stores in Illinois and Indiana. “While other segments require attention, the used combine glut is a time bomb. All of us want increased market share, however that comes with risk and the risk of used combines is the most glaring area that will cause the greatest harm to dealers.”

Richard Dorris, Wright Implement, Owenboro, Ky., adds he also sees used combine inventory to be the major problem. He says he’s afraid crop sprayers could be headed in the same direction.

To stay on top of his used inventory, he says the dealership is more proactive than ever and isn’t hesitating to reduce prices “or move the equipment to wholesale a lot quicker.”

But the buildup of older, used machines is as big of a concerns as the glut of combines. While the value of the newer, low-hour used row-crop equipment has actually grown in value, older equipment of all types that just a few years ago could still produce a fair margin, has become almost worthless.

In the case of “older” equipment, dealers have implemented one or more of three basic strategies:

- Make sure there’s an outlet for used before taking it in trade by either preselling or using a wholesaler.

- Set a prescribed timeframe in which the used equipment “must be moved.”

- Don’t take trades if at all possible.

Darryl Buttar of Bob Mark New Holland Sales, Lindsay, Ontario, says, “Older, high-hour used equipment is not in great demand anymore and is worth very little, although a lot of customers still believe it’s worth a lot. Tillage and planting equipment is changing so quickly that it’s creating a very soft market for pieces that are not in demand anymore. On the positive side, it’s hard to get some new equipment and this has helped us move our used equipment.”

This was a common theme among dealers who responded to our survey.

Butch Heitzman of Barnett Implement of Yakima, Wash., adds, “Older machines — 1960-70s vintage — are not worth anything. We are attempting to not take any trades if at all possible.”

Like many dealers, Lance Carlson, Quincy Tractor, Quincy, Ill., combines are the big issue, but he’s also being careful on the tractor side, as well. “Used combine inventory is slow turning and the market is flooded. At the same time, we make sure we know where the tractors being traded in are coming from. There are numerous southern tractors with unknown hours and new paint jobs out in the market.”

In any case, Carlson says the dealership is has set a 90-120 day maximum for used equipment. “We’re receiving bids from jockeys and making sure we have an outlet for the used,” he adds.

Similar sentiments came from Joe Wallace of Somerset Farm Equipment, Somerset, Ky. “Used equipment is getting older and more used up before customers trade, making it more difficult to get rid of. We are backing off of taking such aged inventory in on trade.”

Paul Huber, Central Equipment, Lexington, Ky., explains, “We’re selling more equipment to wholesalers. Manufactures have eliminated interest-free floor planning on equipment taken in trade. When applying the daily interest acquired on the used piece of equipment and the not spending money on repairs, we feel wholesaling it is actually much more profitable.

“The only pressure we will at times feel is from customers wanting more for their trade, but we believe it’s better not to be stuck with a slow or non-selling piece of used equipment. We generally will have the unit sold within two months or less,” says Huber.

With the push to increase new sales, Jed Bengston, corporate sales manager of Torgerson’s LLC, a dealer group in Montana, says older, used equipment can get lost in the shuffle.

“As new equipment becomes more and more productive, its cost is growing. We are very focused on solution based selling to our core clients, and this takes away time from selling trades that are 10 years old and older.

“Because this is our lower dollar used pieces have the tendency to begin to pile up. They’re easy to overlook because the capital allocated is low. We’ve focused on only buying these pieces at a level where we can always turn them in a variety of ways — or not taking them at all.”

Tricky & Rising Values

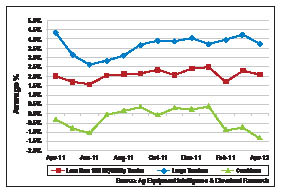

Maybe the most perplexing issue surrounding used equipment is trying to value it competitively. Several dealers mentioned that, especially with row-crop tractors, the demand for good used equipment is pushing prices up to a point where there’s not a lot of difference between new and used machine. Then again, there’s the sheer value of newer used equipment that’s adding to inventory management issues.

“The most significant change is the dollar value of the trades,” says Foster. “It was not that long ago that the price of a used combine rarely topped $150,000. Now, that number quite often is over $200,000. The sheer dollar value of our trades is the biggest change we’ve seen the past three years.”

This and the steadily higher prices for new farm machinery, he says, is keeping the pressure on dealers. “While new prices continue to climb, used values follow along. This is causing all of us to work harder on turning the used equipment at a reasonable rate.”

Turn, Turn, Turn

For most of the dealers surveyed, used equipment inventory turns is at the heart of the matter. Few say they will accept anything less than three turns annually, and several have their sights set on four or more turns.

“In our mind, three turns doesn’t equate with being a dealer of tomorrow,” says Bengston. “We’ve dialed up our target to 3.5-4 turns. “We have been forced to be aggressive with this metric, and we believe it’s the key to keeping a ‘real’ balance sheet.”

A few dealers are reaching turn beyond the generally accepted norm. “Our used inventory turn in 2011 was 6x and we’re trying to hold this,” says Todd Channell of Farmers Equipment, Urbana, Ohio.

“We watch what we allow for units and work very hard with the salesman at all four of our stores to presell used just as hard as we do new. We keep good prospect lists and we communicate,” he says.

“If the market is saturated, we need to look at reducing margins,” says Randy Randy Amosson, general manager of Precision Equipment, a John Deere dealer group in Iowa.

“We’ll also continue looking outside of our normal channel to make these sales. We need to look at the overall country to where we can possibly sell these units. We must get it transitioned at the customer level. As we buy this equipment, we must hold the line and buy it for what we can sell it, not for the price customers pressure to give them.”

Not all dealers are hung up on rapidly turning their used inventories. For example, Kevin Heisterkamp of Vetter Equipment, Storm Lake, Iowa, says, “I still look at a two turns. Many customers from 60 miles out like to see an assortment and have commented on our larger inventories.”

He also gives his used machine one year or “at least a full season before reducing the price. Being too hasty with reducing price ruins margins and profits that you could use to pay a little interest. You must include a carrying cost in this seasonal business,” he adds.

Dealer Strategies

In addition to closely monitoring used equipment inventories, dealers also revealed various strategies they’ve undertaken to keep used machines in clear view of their sales staffs.

For example, Heisterkamp says Vetter Equipment makes sure their sales staff has some skin in the game. “We do not pay commissions until the first trade is sold. We also pay a higher percentage on used than new, and limit the number of like trades — same year, same model, same options. You can only sell so many of the same thing.”

“Our organization places a huge amount of emphasis on accurately assigning trade values by holding sales accountable for their trades and staying focused on our inventory turns ratio,” says Jerad Geisler of Birkey’s Farm Store in Macomb, Ill.

Brion Torgerson, CEO of Torgerson’s in Montana, says in addition to making it mandatory that management sign off on any trade-ins, his dealership is also focusing on having its salespeople “think like a customer” when negotiating price on trade-ins.

“We never used to do this, but we’ve implemented a formal booking method that everybody uses and it has to be signed off by the appropriate managers.”

But more than this, Torgerson says salespeople need to think the process all the way through before closing the deal. “Why would you write a check for a piece of equipment that you know you’re going to take a loss on. It doesn’t make. Our biggest challenge with used is to get our sales people to understand that this is what they’re doing. It affects their job long, their market and their territory long term. That to me the focus our sales consultants need to understand much, much better than they did 10 years ago.”