2011 Dealership of the Year:

Category: Under $50 Million in Annual Revenue

Janson Equipment Co.

Founded: 1939

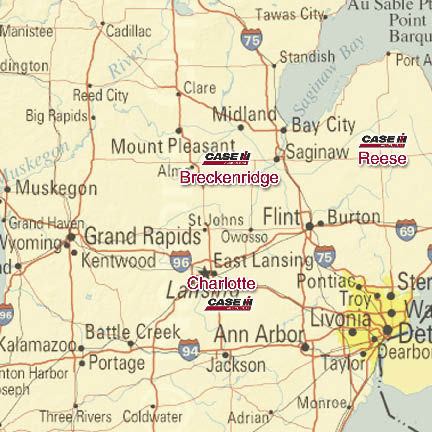

Locations: 3 (Reese, Breckenridge and Charlotte, Mich.)

Major Line: Case IH

ShortLines: Case IH, Krause, Monosem, Kongskilde, Hardi, Amity, Ashland, AWS, Cub Cadet, Degelman, Harvestec, Hiniker, Horst Welding, Kinze, Kuhn Knight, Luck Now, Mandako, Martin Industries, Mauer, Mensch Mfg., MK Martin, Pickett Equipment, Remlinger, Stihl, Sunflower, Unverferth, Westfield, Yetter

2010 Revenues: $40,880,160 ($29,455,021 wholegoods; $8,323.973 parts; $2,766,739 service; $245,427 other)

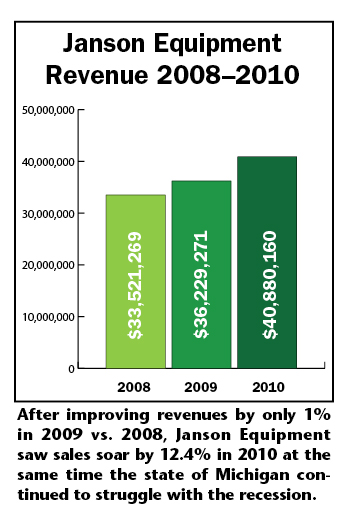

3-Year Revenue Growth:

2008 – $33,521,269 (+1.27%);

2009 – $36,229,271 (+1.08%);

2010 – $40,880,160 (+12.4%)

2010 ROA: 27%

2010 Market Share: 22% (Case IH over 60-horsepower tractors, 4WD tractors, combines)

2010 Parts & Service Absorption: 93.9%

Awards: Farm Equipment’s 2010 “Best-in-Class” Dealership

Founded: 1939

Locations: 3 (Reese, Breckenridge and Charlotte, Mich.)

Major Line: Case IH

ShortLines: Case IH, Krause, Monosem, Kongskilde, Hardi, Amity, Ashland, AWS, Cub Cadet, Degelman, Harvestec, Hiniker, Horst Welding, Kinze, Kuhn Knight, Luck Now, Mandako, Martin Industries, Mauer, Mensch Mfg., MK Martin, Pickett Equipment, Remlinger, Stihl, Sunflower, Unverferth, Westfield, Yetter

2010 Revenues: $40,880,160 ($29,455,021 wholegoods; $8,323.973 parts; $2,766,739 service; $245,427 other)

3-Year Revenue Growth:

2008 – $33,521,269 (+1.27%);

2009 – $36,229,271 (+1.08%);

2010 – $40,880,160 (+12.4%)

2010 ROA: 27%

2010 Market Share: 22% (Case IH over 60-horsepower tractors, 4WD tractors, combines)

2010 Parts & Service Absorption: 93.9%

Awards: Farm Equipment’s 2010 “Best-in-Class” Dealership

Founded: 1939

Locations: 3 (Reese, Breckenridge and Charlotte, Mich.)

Major Line: Case IH

ShortLines: Case IH, Krause, Monosem, Kongskilde, Hardi, Amity, Ashland, AWS, Cub Cadet, Degelman, Harvestec, Hiniker, Horst Welding, Kinze, Kuhn Knight, Luck Now, Mandako, Martin Industries, Mauer, Mensch Mfg., MK Martin, Pickett Equipment, Remlinger, Stihl, Sunflower, Unverferth, Westfield, Yetter

2010 Revenues: $40,880,160 ($29,455,021 wholegoods; $8,323.973 parts; $2,766,739 service; $245,427 other)

3-Year Revenue Growth:

2008 – $33,521,269 (+1.27%);

2009 – $36,229,271 (+1.08%);

2010 – $40,880,160 (+12.4%)

2010 ROA: 27%

2010 Market Share: 22% (Case IH over 60-horsepower tractors, 4WD tractors, combines)

2010 Parts & Service Absorption: 93.9%

Awards: Farm Equipment’s 2010 “Best-in-Class” Dealership

Tom Janson has been selling farm equipment for the dealership founded by his grandfather for more than 30 years. After a 6-year sabbatical, his cousin, Steve Janson, came back into the business in 1993. As much as the farm machinery business has changed during the last decade alone, the influence their grandfather and fathers have had on the way they do business is obvious.

They still rely on many of their mentors’ favorite sayings to keep them focused and pointed in the right direction. Sayings like, “Used equipment usually doesn’t go up in value” or “Some of the best deals I’ve made are the ones I lost.”

But their fathers’ comments that impacted them most involve customer care, like, “The best way to get a new customer is to take care of the old ones” and “If we don’t take care of the customer, someone else will.”

At the same time, they’ll tell you that today’s farm equipment business barely resembles that of their dads’ generation. While the values instilled in them form the bedrock on which they’ve grown the business, it’s the execution of day-to-day business principles engrained in them by Dr. Jim Weber of Weber Consulting, and many of their peers, that has helped them grow profits in an increasingly competitive marketplace.

The Jansons credit all of these influences for the performance that’s resulted in them being named Farm Equipment’s 2011 Dealership of the Year in the “under $50 million in annual revenue” category. Last year, Farm Equipment selected Janson Equipment Co. as a Best-in-Class dealer.

While they recognize the importance of the guidance others have given them, they also know that running a successful dealership comes down to maintaining those values instilled in them by their predecessors and executing best business practices with unwavering fervor.

Benchmark, Benchmark, Benchmark

The Jansons benchmark all key ratios, including new and used equipment inventory turns and gross margins in wholegoods sales. They benchmark billable hours in the service department. They benchmark parts sales. They benchmark gross margins. They measure every factor that can affect the dealership’s bottom line profitability. They believe that anything that can be measured can be benchmarked and managed.Tom and Steve Janson keep it as simple and straightforward as possible in operating their 3-store dealership. They manage by benchmarks. By following the “numbers,” they stay focused on what makes a dealership profitable. “This discipline might be boring,” says Tom, “but it yields results.”

For example, Tom asks, “How can you not track and manage billable hours in the service department? All you’re really selling is time, so you need to measure it. And any way you look at it, there’s no substitute for inventory turns. Either you’re hitting your turns or you’re not. We like to stay at about 4 on used and about 3 on new. Right now our new is a lot higher because of all the presells coming in.”

It’s the numbers that guide the dealership’s actions on a day-to-day basis. All of their managers know what standards they’re aiming at and on which they’re judged. “They like it because they always know where they’re at all of the time,” says Steve.

In fact, not measuring the day-to-day activities that can adversely affect the profitability of the business is a foreign concept to the Jansons. “Working without benchmarks is like playing the game and not looking at the scoreboard. You’re never quite sure where things stand. At the same time, you can’t just stare at the scoreboard either. You need to play the game, too,” says Steve.

Weber recalls an experience with the dealership that he says demonstrates how its determination to measure performance and keep its benchmarks in clear view has paid off.

“It appeared that Janson’s used equipment turnover had fallen below their benchmark, which was nearly twice the national average,” Weber says. “Rather than let it go as many dealers are prone to do, Tom called an emergency meeting of all sales personnel to discuss the unacceptable turnover. Within weeks, the used turnover was back above the benchmark, where it remains today.”

Weber adds that the Jansons “expect and reward performance, which in turn is charted by the individual and by the department. Individual performance is expected, while departmental and dealership teamwork is demanded. In return, compensation and incentive systems are in place for top performers and overachievers.”

Another Side to Benchmarks

Besides the obvious benefits, the Janson’s unwavering commitment to establishing and maintaining benchmarks serves the two partners well in other ways.

Tom and Steve admit that they have two entirely different personalities. Steve says, “Tom absolutely loves the numbers. I like the numbers, but he’s intrigued with the numbers. I’m more intrigued with relationships.”

Tom explains the differences in another way. “His cell phone goes off all the time with customers calling. When I get a call it’s usually from employees or suppliers.” They say their fathers were also as different as night and day.

“When I came back into the business, I thought if our dads, Bill and Howard, could do it, Tom and I could do it, too,” says Steve. “We’re just like them, two different personalities. My dad would order 12 units and Howard would cancel four of them. It turned out that eight units were perfect. That’s just the way it was.”

While they both agree that their different approaches are actually complementary, they sometimes do have differences. It’s the benchmarks that act as an objective third party, the common ground, to keep the partners in sync. If they agree on anything, it’s the benchmarks.

‘Focused Inside These Walls’

The two partners say the host of numbers they use to measure where the business is and where it’s heading, in large part come from the work with their 20 Group, which is headed up by Weber.

Steve explains they’re really not sure how they stack up against national or industry wide benchmarks because they’re not looking at those. “I don’t know what the national average is now for any of the things that we measure,” he says. “It’s immaterial to us.

“With respect to the question of what are we doing differently than the competition or even what our competition is doing, it doesn’t really matter,” Steve says. “We’re fully aware of our competition because we have very good competition. But we maintain our focus on our own insufficiencies and ourselves, rather than what’s going on outside. Our goal is to stay focused inside these walls.”

Steve continues to reiterate this fundamental principal of operating their business. “Our goal is to manage ourselves. Our competitors are always going to be there, they’re always going to be good, but we need to pay attention to what we’re doing, not what they’re doing.”

Without saying as much, if the Jansons measure their business performance against anyone else, it’s against their peers in their 20 Group.

Tom says their 20 Group pushes them a lot in different ways. “We’ve got great dealers in our group and they set the bar pretty high. They bring a high level of professionalism to the table that we’re always working toward.”

Where the influence of the group really shows up is when Tom and Steve have to lay it all out for their peers to see. “Let’s put it this way,” Tom says flatly, “I don’t like going to the 20 Group meetings and being at the bottom of the pile. I’m as competitive as they come.”

Turning Points

Tom identifies two defining moments that changed the course of the dealership. The first came in 2001, when he and Steve made the leap from running a profitable single-store operation to expanding it into a $40 million enterprise. The second was more personal as he came to realize the importance of effective communication.

When two Case IH dealerships owned by a co-op and in serious financial condition came up for sale, the Jansons looked at acquiring them. The one in Breckenridge, Mich., was about 45 miles from their base in Reese, Mich. The other was a little more than 100 miles away in Charlotte, Mich.

Not having the experience of acquiring another location, the partners sought outside counsel from Weber. “After running the numbers, I told them that this purchase was a no brainer, because the additional locations would almost triple existing sales,” says Weber.

Within a year of the purchase, the Jansons transformed these new locations into positive cash flow dealerships. But it didn’t come without some major changes on their part.

“Before we bought those two stores, I managed from the income statement,” says Tom. “We had cash and seldom had to borrow money. I knew exactly when we would run low on cash, when our parts were going to be paid off, all of those things. But when we tripled in size, I had to learn to manage from a balance sheet. That took me to a whole different level of management, and I had to learn to do it quickly.”

Weber says that the Janson’s transformation of their new stores was not a surprise. “Tom is a firm believer in ‘what gets measured is what gets done.’ As a result, he monitors all key ratios on a rolling 12-month basis and prudently shares these results with his employees.”

Expanding to three store locations added urgency to the need to communicate effectively, and was a second turning point for Tom and the company. He discovered communicating involved more than simply sharing numbers with his managers once a month.

“It was about 6 years ago that I started to understand how important communication was. I don’t want to say that I lacked communication skills, but I realized that I needed to take it to another level,” Tom says. “Steve was always a better communicator than me. Any time we had something pop up, instead of reacting, he’d say, ‘Well, let’s figure it out.’ I watched him do this and saw how good he was at it. He knew how to get employees to talk about problems and then get them resolved. He brought that to the table for me.”

Communication is Everything

Today, Tom says, “Communication is everything. It’s amazing how it has evolved in this organization. It’s unbelievable what we’re getting done today just by talking to our people and making sure they’re talking to each other.”

Not overreacting to situations as they occur is one of the communication techniques Steve has learned. “There have been times when I’ve had an issue with a particular employee. That’s when I get the mirror out and say, ‘Maybe we need to communicate better. Maybe this guy isn’t getting the tools he needs. Maybe he doesn’t understand what’s expected of him. Let’s go down this path.’ If that path doesn’t work, then we’ll decide if we have to part.

“We’ve learned to ask questions before reacting. What’s actually stopping this from happening? Is there something we can help the employee with, like purchasing new tools? If we get rid of this fellow and nothing changes, will the next guy fail, too?”

While they manage by the numbers, the Jansons agree that they need to take time to walk in the other guy’s shoes. “We try to put his boots on and figure out where the insufficiencies are, and then try to fix them,” says Steve.

Managing Recovery Rates

In addition to its farm equipment service shop, Janson Equipment’s truck shop also helps support its 94% absorption rate. The Breckenridge store has technicians certified to work on Navistar and Cummins truck engines.

The Jansons point to several examples where all it took was simple conversation to improve dealership operations. One is recovery rate, which Tom says is all about communications because service can’t always estimate how long a repair job will take.

An important reason why a customer chooses a dealership is proper service billing, according to Tom. For example, a big part of managing recovery rates is communication. When a technician sees a job is going to take longer than originally expected, he needs to let the service manager know, who, in turn needs to explain the delay to the customer. When there are no surprises, customers tend to understand why the cost of a repair is higher than originally quoted.

“Recovery rate in the service department is so much about communication. It’s been an ongoing chore to help the techs understand this,” he adds. “We stress to them that Steve and I can’t do it for them. It has to come from the mechanic himself.”

If the dealership gets into a squabble with a customer and ends up reducing the repair bill, the reduction results in charging fewer hours against the job. That’s lost revenue that cannot be recovered, but the dealership still pays their techs for that time.

“It’s the bottom line,” says Tom. “All you have to sell is time and how much of the person’s time you’re selling is directly tied to your gross margins in that department.”

The Jansons say the minimum they’re shooting for in terms of recovery rates is 85% as a shop average. “Anything over 78% is profitable. If you’re getting a 75% or lower recovery, chances are you’re fixing tractors and handling employees for no return on assets.”

One thing they don’t do is include vacations, sick times or holidays into their recovery rate calculations. “We feel that including that time into it is like a penalty to the individual and the entire shop,” Tom says. “There are some individual incentives, but mostly we pay recovery on a shop basis because we have warranty work that’s never fully reimbursed.” In fact, they treat recovery rate as a ‘store effort’ because they believe the parts and sales department play a role in it. As a result, part is kicked back into the profit sharing plan as well.

Monitoring Parts Obsolescence

The Jansons say improved communications is also helping to reduce part obsolescence. Managing that aspect of their parts business takes precedence over part turns.

Janson Equipment runs obsolete parts reports for 12, 24 and 36 months, plots each and manages it on a “rolling 12” to determine if it’s trending up or down. At the same time, they measure parts fill rate.

“We shoot for an 90% fill rate and make sure we minimize obsolescence. If a dealer has an issue with cash flow, then he needs to watch inventory turns more closely,” says Tom.

The Jansons’ premise for how they manage their business starts with the belief that the number one reason a farmer chooses to work with a particular equipment dealership is because the dealer offers excellent parts availability. Even with this, they don’t focus on parts turns. By concentrating on turning parts quickly, it’s difficult to focus on fill rate, which means they need to minimize parts obsolescence.

“If cash flow allows, we’ve found it’s best to closely manage fill rate and parts obsolescence rather than turns because that’s where real losses show up,” says Tom. “Instead of watching how much inventory is stocked, we monitor how much of that inventory goes obsolete — parts that won’t be sold and can’t be returned to the manufacturer. You’ve paid for it, but you’re never paid back.”

This means making full use of the manufacturer’s return policies. “You only do that by constantly monitoring it,” Tom says. “If we have $80,000 worth of obsolete parts, this may be a cost of doing business. We just don’t want to see it go to $85,000.”

Tom adds that a lot of the dealership’s efforts to improve in this area of the business are based on better communication. He gives an example where he was able to help his technicians better understand their role in minimizing the number of non-returnable ordered parts and how it affects profitability.

“One day my parts manager sets four or five boxes of parts on my desk and he’s clearly frustrated. He explained that the service technicians had ordered the parts, opened them up, got grease all over the boxes, but never used them. I asked him how much was sitting there, and he said, ‘About $500. I’m not going to sell them and I can’t return them.’

“What we did was bring the mechanics in and explained the problem,” says Tom. “We made it clear that we weren’t telling them not to order the parts they needed, but to make sure they needed them and be more careful in how they handle them. We explained that Case IH was getting tougher on parts returns. We didn’t need to hold a big meeting to communicate that. We just sat down and talked for a few minutes. The message got through and that was a good day for all of us.”

Managing parts obsolescence and fill rate takes precedence over part turns at Janson Equipment. “We shoot for a 90% fill rate and make sure we minimize obsolescence,” says Tom Janson.

Absorption & Market Share

With an eye toward the future and a firm hand on the present, it’s no surprise that the Jansons believe the successful farm equipment dealerships of the future will be those who consistently achieve higher absorption rates.

“It’s one of those benchmarks that’s just as important today as it was 10 years ago and will be just as important 10 years down the road,” says Tom. “If you look at the 5-year average of wholegoods profit margins, you’re not going to see a lot of growth. They’re up. They’re down. They’re all over the place.

“We need to run our businesses with something that’s more stable and that’s parts and service. Parts give you your highest margins. That’s another reason why we stock so many. It really hurts us if we don’t have parts when customers need them.”

With a grain elevator as the backdrop of their Breckenridge, Mich., store, Tom and Steve Janson say receiving the 2011 Farm Equipment Dealership of the Year award is really a tribute to Janson Equipment employees at all three of its locations.

He adds that any dealership wanting to improve their return on investment or return on assets must start with absorption and the profitability of a dealer’s parts and service business.

“You also have more control of these than you do wholegoods,” Tom adds. “Wholegoods sales tends to be tied to crop yields and commodity prices and we have no control over those at all.”

Of course, the pressure to increase market share of new equipment remains as intense as ever. The Jansons say they’re well aware that their major supplier wants sales volume. At the same time, they believe they can serve their suppliers and customers best by being a stable, profitable force in their market areas.

“We’re clearly in second place with 22% share of our markets in over 60-horsepower tractors, four-wheel drive tractors and combines,” says Tom. “At the same time, we continue to increase our absorption rate. We spend a lot of time preaching our product to the green guys, trying to get them to take a look at red equipment. It’s probably our biggest challenge today.”

Steve adds, “We’re still the new guys on the block in our two newest markets and our competition is good. We both take good care of our customers. We don’t have a choice but to be good with our customers. We still believe our success lies in staying out of the coffee shop and managing our own business.”

What the Judges Say About Janson Equipment

“Janson achieved the highest dollars generated per employee among this year’s nominees in the category at $730,000” … “They have the highest ROA and they have the highest absorption rate of all at 93.9%” … “They had good market share for their area” … “What was most impressive was a 12% growth in volume in a state that still has a distressed economy.”

A Positive Future

On the other hand, the Jansons see changes coming that could lead to increased market share for their stores.

First, they believe farmers are becoming more discerning in how they invest in new equipment. They also like what Case IH has been doing, especially in the last few years, with its equipment and dealer support.

“I’ve never been more convinced that Case equipment is as good as anything in the market today. In fact, many of the new machines they’ve introduced in the last couple of years are superior to other equipment on the market,” says Steve.

In addition, the company has put more boots on the ground providing dealer and customer support. “I really rate them highly on their field staff and product specialists,” says Steve. “I hope having these folks in the field is paying off for them because it’s working for us.”

As farmers become “more prudent” with their equipment investments, Tom says they’re losing some loyalty to color. “They’re more loyal to the color of money and their own bottom line,” he says. “If Case keeps supplying us with productive equipment, we’ve got a better than ever chance to win some new business.”

Adding these things as well as their own attention to customer care, the Janson’s believe they’re in a good position to continue growing their business.

Dr. Weber believes this, as well. In summarizing his work with the dealership, he says, “Long ago, the Jansons realized that customer satisfaction was a manifestation of employee satisfaction. So, rather than invest in the ‘here today, gone tomorrow’ customer satisfaction programs perpetrated by so many, they’ve invested their time, money and energy into developing a goal-oriented team that places equal emphasis on return on assets, while at the same time serving the customer.”