Trade Values & Trends

Powered by IRON Solutions Gold Standard Data

The old adage “bigger is better” is as true for planting equipment as it is throughout agriculture. While sales and prices are strong, large planters are driving the market.

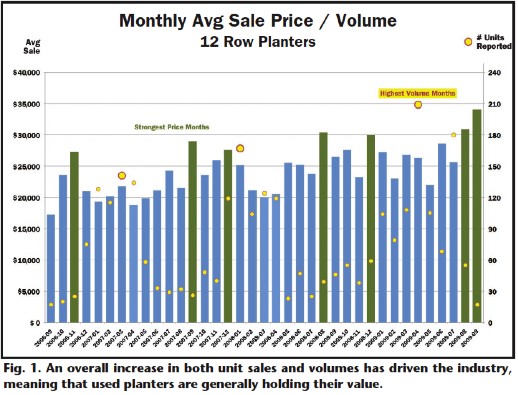

Watch the Fourth Quarter. Historically, planter and seeder unit sales rise, and prices decline, as dealers liquidate inventories and farmers commit to planned purchases. Sales data analysis over the past 3 years, however, shows that both sales volume and price have been improving since mid-2008 (Fig. 1.)

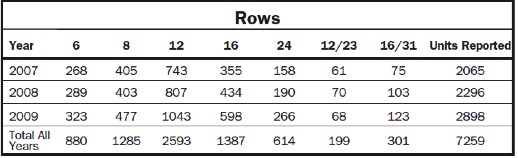

The industry standard remains 12-row planters, with a steady 35% market share (See table on p. 64). Closer analysis of the data shows a pronounced trend toward larger units. As more dealers report sales and prices, it’s becoming increasingly clear that growth is coming from larger units.

While 12-row planters remain the predominant choice, the market share of 6- and 8-row units declined from 33% in 2007 to 27% in 2009, while sales of 16-, 24-, and 16/31-row units have increased from 30% to more than 34% during the same period. The average number of rows per unit sold has steadily increased from 12 rows in 1994-1996 to more than 16 rows since 2004 (Fig. 2).

As more dealers report data, IRON Solutions is providing the information in Report Analyzer and is analyzing these trends in more depth.

Unit Size Drives Pricing. Larger units not only are more complex mechanically, but they also tend to have features that are unavailable on smaller units. The growth of precision agriculture technology has driven demand for narrow-row planters, center hoppers, variable seeding rates and other innovations typically found only on larger units.

The results can be measured by looking at the average value per row for planters in Fig. 2. During the mid- 1990s, when the  typical planter sold had 12 rows, the average price per row was less than $2,000. As units became larger and more sophisticated, the price per row has more than doubled. Of course, the increase in prices for new planters also directly impacts the cost of used equipment.

typical planter sold had 12 rows, the average price per row was less than $2,000. As units became larger and more sophisticated, the price per row has more than doubled. Of course, the increase in prices for new planters also directly impacts the cost of used equipment.

Looking Forward. Examining long-term sales trends suggests that planter sales and sales prices remain relatively consistent across time. For example, planters built in 1997 have sold at relatively consistent levels over the last 3 years, with average sales prices varying along predictable, seasonal patterns.

Contrast this planter sales data with that for hay balers, which was examined on this page in the April/May 2009 Farm Equipment. Sale prices for used large balers tend to peak when the unit is about 5 years old, and decline steadily after that.

Meanwhile, the data suggests that prices for used planters  depend more on the unit size, as farmers tend to add or replace this type of equipment based on expanding or contracting their operations. It also means that, rather than a slow, predictable decline, the value of planters and seeders will drop rapidly as the equipment nears the end of its life.

depend more on the unit size, as farmers tend to add or replace this type of equipment based on expanding or contracting their operations. It also means that, rather than a slow, predictable decline, the value of planters and seeders will drop rapidly as the equipment nears the end of its life.

Dealers and appraisers need to pay careful attention to equipment condition when setting and reporting prices.

|

As publishers of the Equipment Industry’s Official Guides based on gold standard equipment data, IRON Solutions gathers data on used machinery transactions from dealers, auctions and other sources. For information on the Official Guide, the gold standard data and other dealer solutions provided by IRON Solutions, visit www.ironsolutions.com. |