In this episode of On the Record, brought to you by Associated Equipment Distributors, we talk to a Solectrac executive about the company's search for a new investor. In the Technology Corner, Noah Newman talks about the majors' growing presence in the precision retrofit market. Also in this episode, a new partnership between Great Plains and Montag, Canadian ag equipment sales forecast and John Deere's 2023 earnings.

This episode of On the Record is brought to you by Associated Equipment Distributors — the leading association in North America strictly dedicated to the equipment distribution industry. AED offers a wide range of education, events, advocacy and reports for companies of all sizes and all roles within your organization. Learn more about AED by visiting www.aednet.org/agdealers

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Solectrac Exec Talks Search for New Investor, Future of Electric Tractor Market

- Dealers on the Move

- Technology Corner: OEMs Bring More Technology to the Farm with Retrofits

- Great Plains & Montag Partner on Dry Fertilizer Solution

- Canadian Implement Sales Forecast Up for 2023 & 2024

- John Deere Reports $27 Billion in 2023 Large Ag Revenue

- DataPoint: Alternative Ag Financing

Solectrac Exec Talks Search for New Investor, Future of Electric Tractor Market

Solectrac, a manufacturer of electric tractors based out of Santa Rosa, Calif., has been declared as “assets held for sale” by its parent company, Ideanomics. A global electric vehicle company, Ideanomics said in its second quarter earnings filed Aug. 4 that 4 of its subsidiaries, including Solectrac, had met the criteria to be classified as assets held for sale.

Ideanomics acquired a 15% stake in Solectrac in October 2020 and 100% ownership in June 2021, spending a total of $25 million to acquire Solectrac. Solectrac was founded in 2012 and sells 3 models of electric tractors ranging from 25-75 horsepower.

Solectrac Vice President of Sales and Marketing John Grooms said the company is looking for an investor with ag or electric vehicle experience and aims to have the transaction closed by the end of the year. Grooms said at this point, the company won’t rule out any proposals.

“It'll [a new investor] mean a lot more stability. I think it'll mean a lot more capabilities of getting our new products to market faster to help our dealers grow faster and increase sales. So, I think it will also help us in the way that we market our go-to-market strategy. We can expedite that and speed that up a little bit.”

Grooms said Solectrac currently has over 100 stores in its dealer network but is still looking for more dealers. He added, however, that they’re being more selective and looking for dealers who understand their go-to-market strategy is different than it would be for a diesel product.

Grooms said the company always knew there would be challenges with the acceptance of electric tractors in the ag equipment market but that there are still plenty of customers. He said it's possible electric tractors could make up 15% of the under 100 horsepower tractor market in 5 years.

“It's kind of like there was with Tier 4 emissions. It's just something that the government mandated and once everybody got behind it, it became a non-issue. I still think there's plenty of people that are seeking regenerative energy and a green alternative out there that's going to carry us through, while I do think the diesel market is going to continue to shrink.”

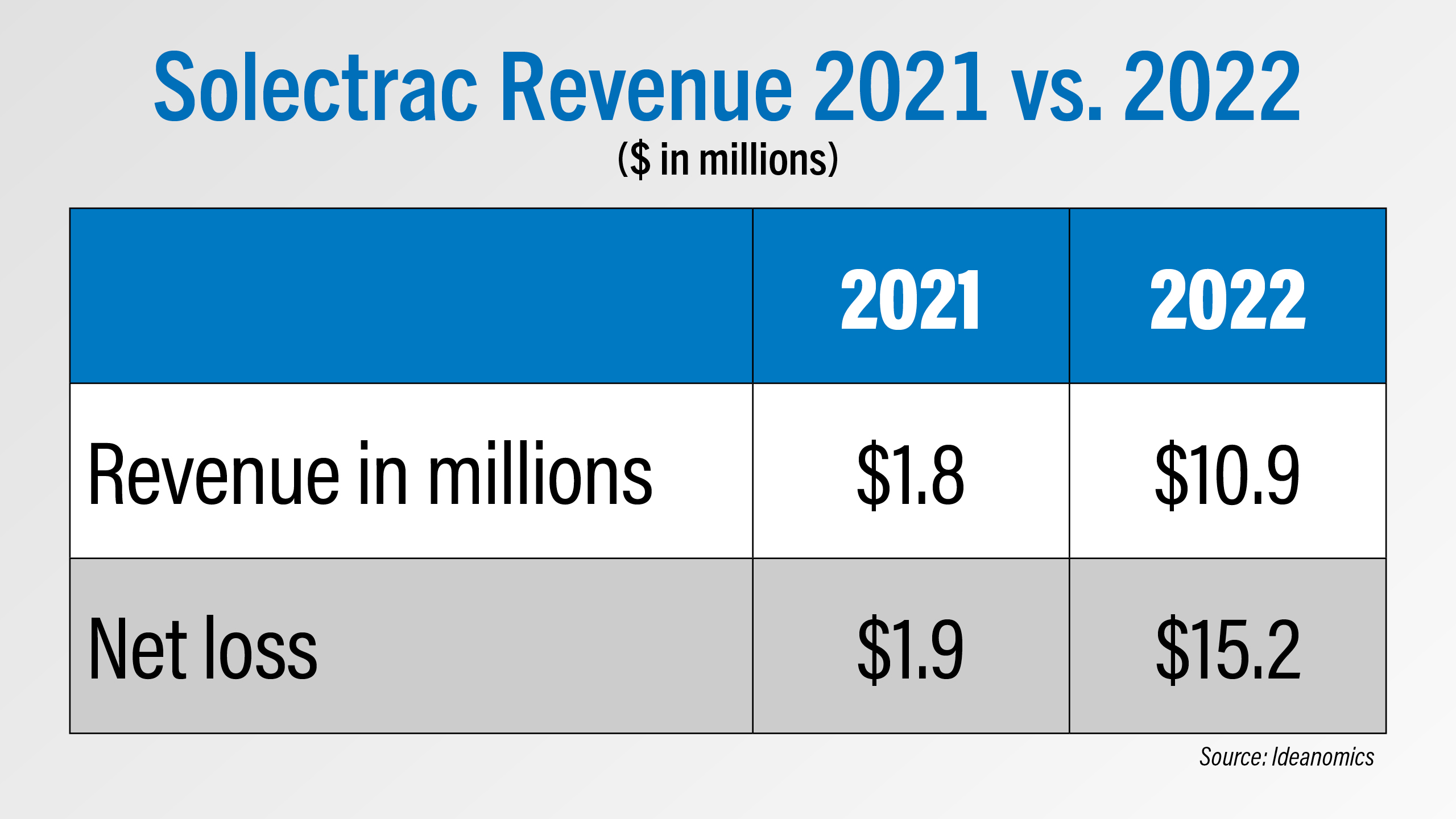

Ideanomics reported total revenue for Solectrac in 2022 was almost $11 million, up from $1.8 million in 2021. However, net loss for 2022 was $15.2 million, also up from a net loss of $1.9 million in 2021. Ideanomics has not reported Solectrac’s revenue thus far for 2023.

Ideanomics said in its second quarter filings that its Solectrac business is in the development stage, is not profitable and is not expected to be profitable and cash generative in the short to medium term.

Dealers on the Move

This week’s Dealers on the Move include Northland Lawn, Sport & Equipment, P&K Midwest and Hoonen Equipment.

Northland Lawn, Sport & Equipment, a 6-store dealership in Michigan, Wisconsin and Minnesota, has acquired Minnesota dealer Moose Lake Implement & Sport.

John Deere dealer P&K Midwest announced it will be opening a new “mega store” location to better serve its DeWitt and Maquoketa customers. It is scheduled to open in early 2024.

11-store Deere dealer Hoonen Equipment announced it is selling its 8 stores in Wyoming, Utah and Idaho to RDO Equipment and its 3 Colorado stores to 4Rivers Equipment. The deal is expected to close on Dec. 11, 2023.

OEMs Bring More Technology to the Farm with Retrofits

How Farmers are Teaching Old Tractors to Think for Themselves — that’s the title of a recent Wall Street Journal article covering how OEMs like AGCO, Deere and CNH are expanding their presence in the retrofit market to ease the transition to more automation.

I saw an example of this ‘retrofit first’ approach from Deere at the Farm Progress Show. The company debuted its new See and Spray Premium package, which can be retrofitted to any sprayer model year 2018 or newer, as opposed to See and Spray Ultimate that can only be purchased from the factory. In their eyes, the retrofit option is easier, faster and will drive more technology to the farm.

“If you’re looking at you just got a 2-year-old sprayer or 4-year-old sprayer, and you’re not ready to upgrade to a brand new one, or you just got that sprayer and you want to get the latest and greatest technology, you can do that with See and Spray Premium. You don’t have to go buy a whole new sprayer. You can get that as a precision upgrade on your sprayer today. So, if you’re looking to get little incremental value on your sprayer and take advantage of this technology, what we’re trying to do is not make you fully commit to a totally different sprayer. You can get that, order it, get it installed on your sprayer today, and get this awesome technology where you can go in the field, spray just weeds, cut down on your costs and look at better yields.”

Farm Equipment editor Mike Lessiter wrote about this trend in his most recent blog, titled Precision Ag’s Multi-Front Blitz. Check it out at PrecisionFarmingDealer.com and Farm-Equipment.com.

Great Plains & Montag Partner on Dry Fertilizer Solution

Thanks, Noah. Great Plains Manufacturing and Montag Manufacturing announced a new dry fertilizer tank partnership last week during Agritechnica.

A project that was borne out of a meeting at a past Farm Progress Show, Tom Bryan, president of Great Plains International, says the two companies realized they could work together with some of their technologies. He says that while liquid fertilizer is dominant in the U.S., about 80% of fertilizer around the world is dry. By working with Montag, now Great Plains can offer a dry fertilizer solution behind a Great Plains planter. Here’s Bryan with more details on the partnership.

“This partnership is a global partnership. It's Great Plains products working with Montag in the development of the technology. It's not limited to any particular country. It is North America, south America, Northern Hemisphere, Southern Hemisphere. It's a global type of partnership. And this is just the first step because on our drawing board, through our discussions together, this is one of four or five projects that we have mapped out to develop and introduce over the next few years.”

While the product was introduced in Europe, Byran says it will be available worldwide.

Canadian Implement Sales Forecast Up for 2023 & 2024

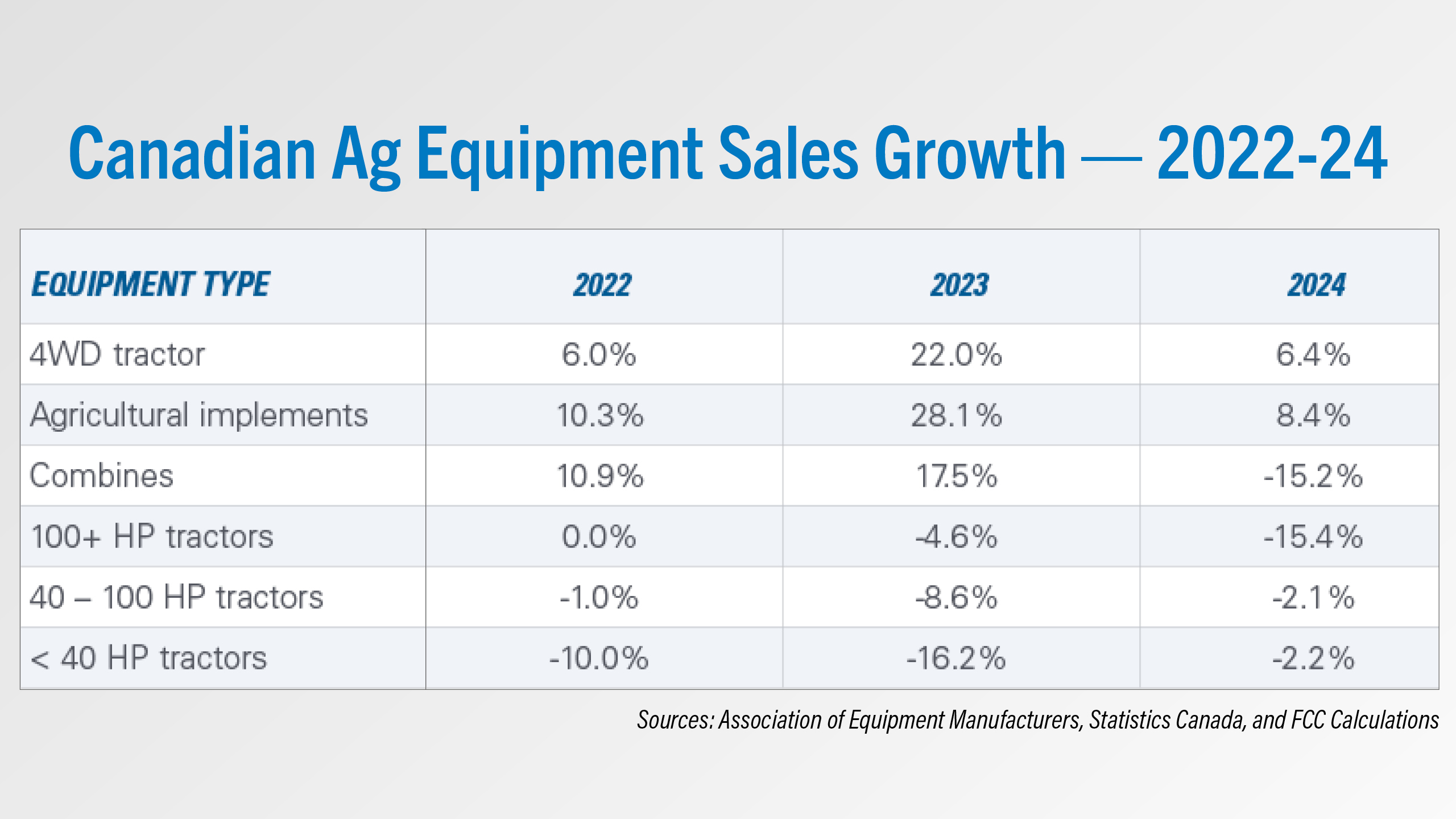

According to a Nov. 15 report from Farm Credit Canada by Senior Economist Leigh Anderson, ag implements is one of 2 equipment categories forecast for sales growth in Canada in 2024.

Implement sales are forecast to be up 28.1% in 2023 and 8.4% in 2024, which would be the highest increases among all equipment categories for those respective years. 4WD tractor sales were the only other category forecast to see improved sales in both 2023 and 2024.

Regarding implement sales, Anderson said in the report that:

“Canadian implement manufacturing dollar sales are expected to finish higher in 2023 due to price inflation on raw materials used in manufacturing. Both 4WD tractors and implement manufacturers (e.g., air drills) faced delivery issues and low inventory levels throughout 2023, which are driving part of the increase in our 2024 projections.”

The report also said used air drill sales continue to be strong, rising 26% in 2023 due to “reduced deliveries of new manufactured units and subsequent trades over the previous few years.”

Over 100 horsepower tractor sales are forecast to decline 15.4% in 2024, the largest drop by category for that year. For 2023, Farm Credit Canada forecast under 40 horsepower tractor sales would see the largest decline, down 16.2%.

John Deere Reports $27 Billion in 2023 Large Ag Revenue

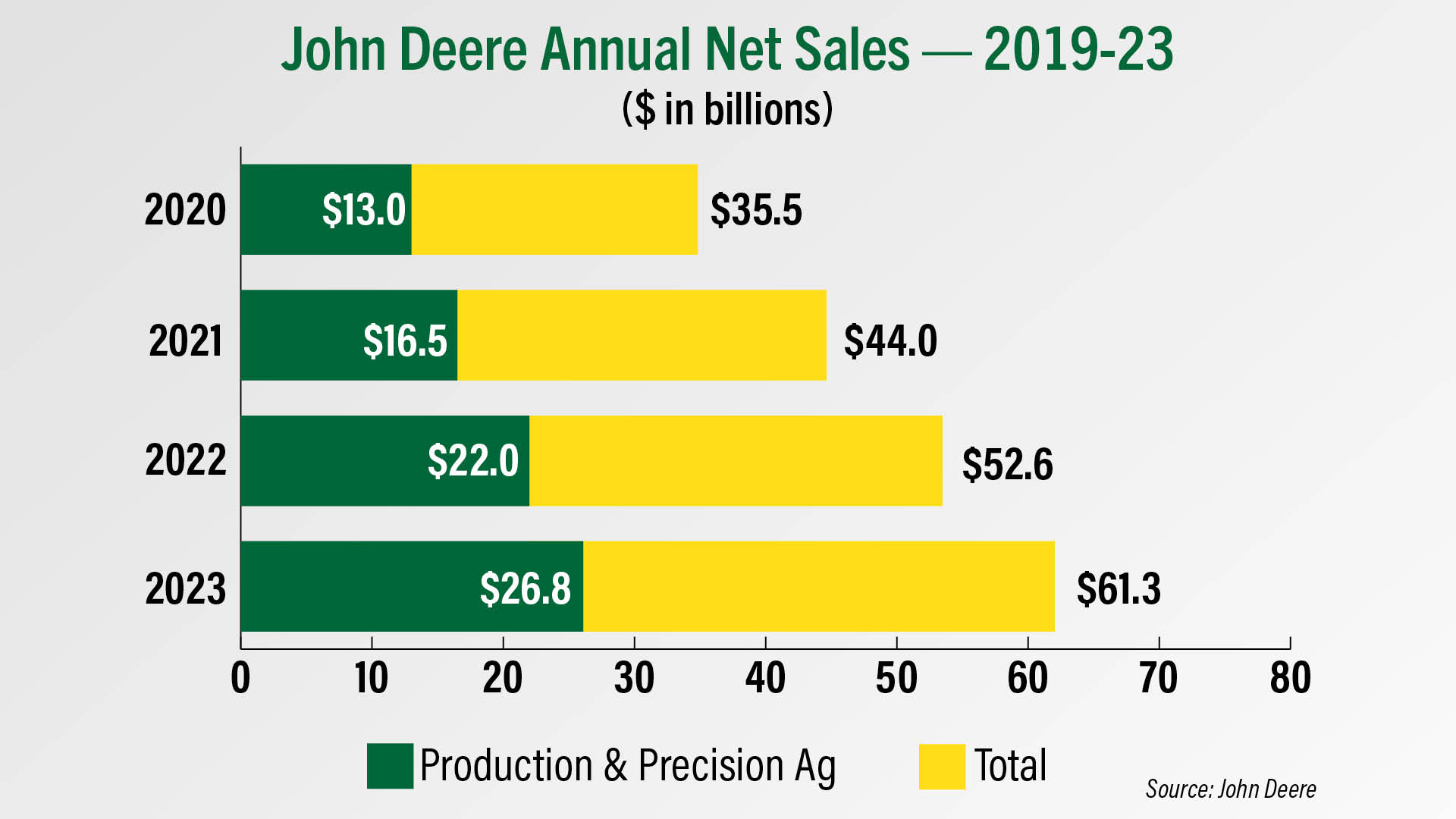

John Deere reported its earnings for the full year 2023 on Nov. 22.

Deere reported $61.3 billion in total revenue for its fiscal year 2023, up 16% year-over-year. In its production & precision agriculture division, total revenue for the year was $26.8 billion, a 22% year-over-year increase. Total revenue in Deere’s fourth quarter was down 1% to $15.4 billion. Production & precision ag revenue in the fourth quarter was also down 6% to $7 billion.

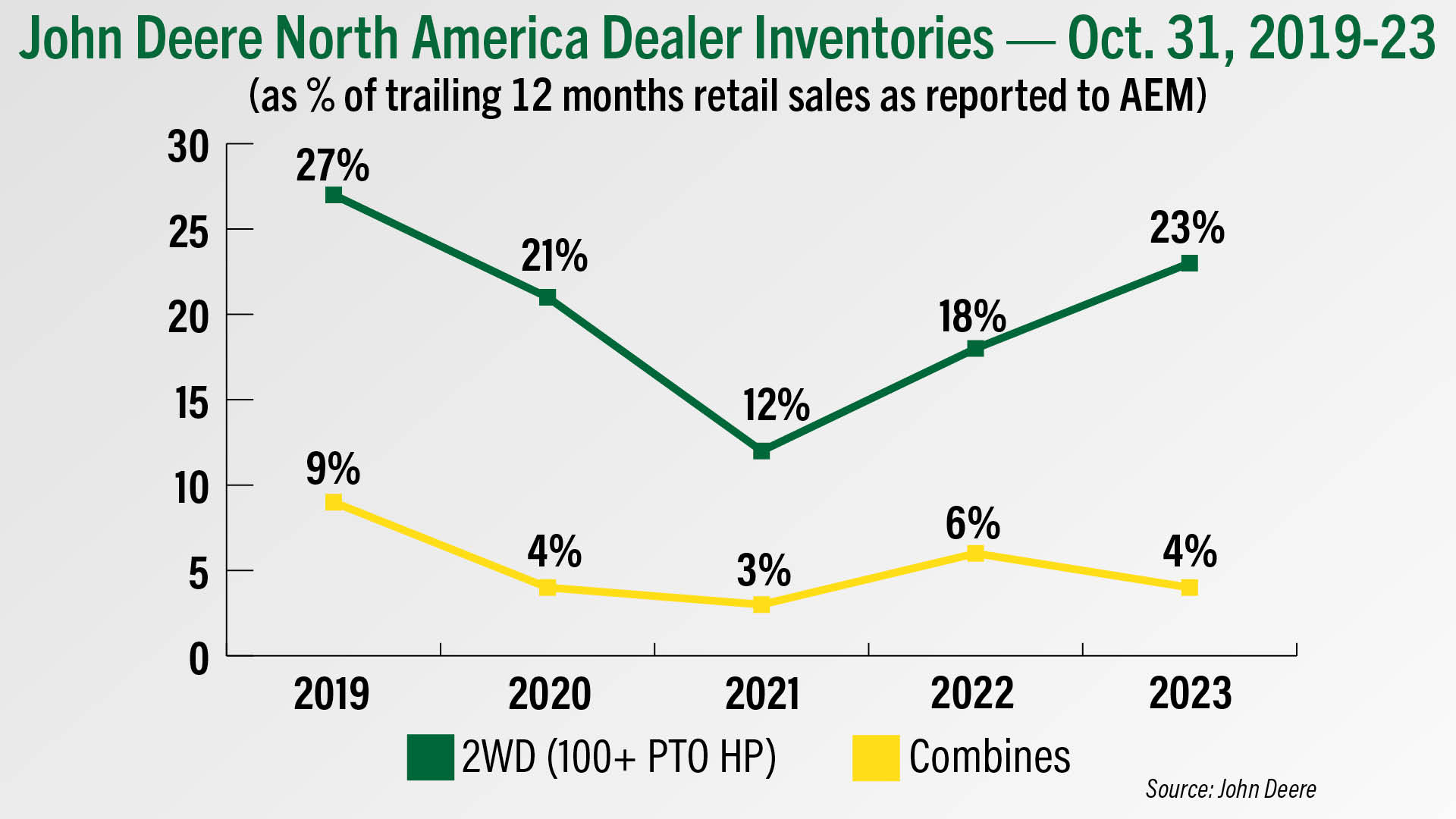

John Deere reported its North American dealers’ combine inventories, as a percent of trailing 12 month sales, dropped to 4% as of Oct. 31 vs. 6% at this point last year. For two wheel drive tractors with 100 or more PTO horsepower, Deere dealers’ inventories were 23% of trailing 12-month sales, up from 18% one year ago.

DataPoint: Alternative Ag Financing

This week’s DataPoint is brought to you by the 2024 Ag Equipment Intelligence Executive Briefing.

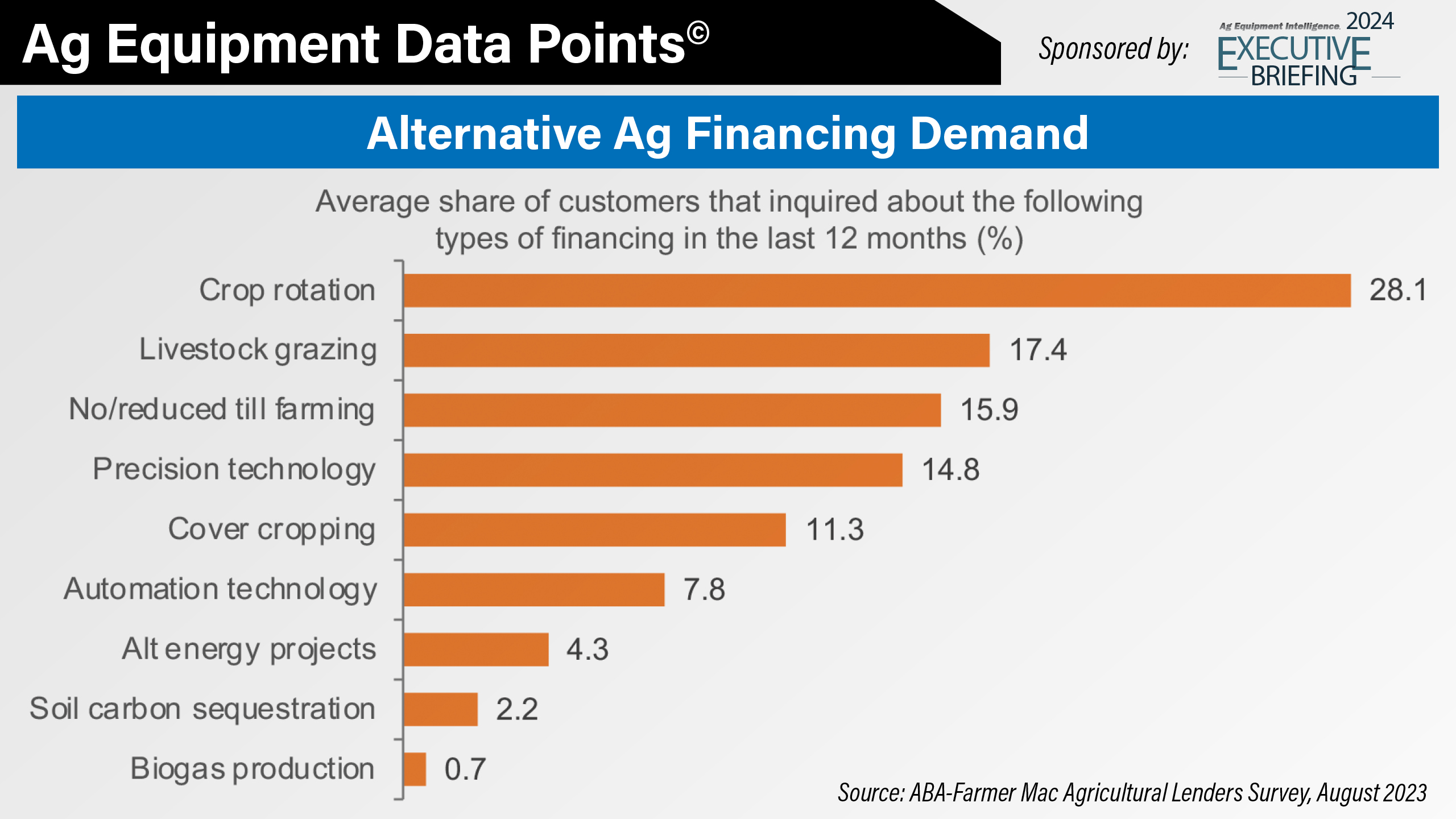

According to the Fall 2023 Agricultural Lender survey results from the American Bankers Assn. and the Federal Agricultural Mortgage Corporation’s, lenders reported that, on average, 28% of borrowers inquired about financing crop rotation over the past 12 months, and nearly 1 in 5 asked about financing livestock grazing. Borrowers also expressed interest in financing reduced till farming, precision farming technology (e.g., field electronic sensors), cover cropping and automation technology (e.g., labor efficiency).

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to kschmidt@lessitermedia.com.