Strip-Till Farmer's 10th annual benchmark study of strip-till practices conducted in early 2023 shows that more strip-tillers plan to use precision technology in 2023 and beyond.

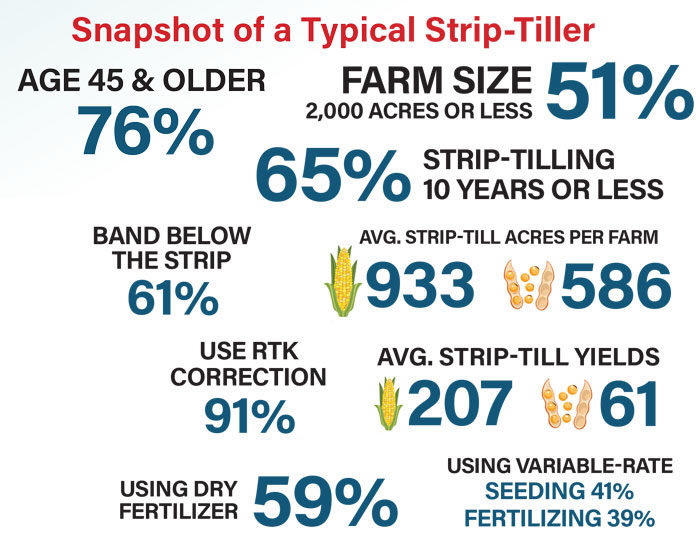

41% of survey respondents currently use variable-rate seeding, while 39% use variable-rate fertilizer. But 55.3% of survey respondents plan to use variable-rate seeding next year, up 5 percentage points from the previous survey in 2022 and 15 percentage points from 2021. Some 53% plan to use variable-rate fertilizer application next year, down nearly 2 percentage points from 2022, but up just over 7 percentage points from 2021.

26.2% utilize remote service/support, up just over 13 percentage points from 2022.

34.6% currently use implement guidance on their strip-till rigs, a 4-point increase from 2022. 43.7% plan to purchase implement guidance technology next year.

WATCH: Strip-till expert Tony Vyn reacts to Strip-Till Benchmark Study

results in recent episode of Conservation Ag Update.

15.9% utilize drones on their strip-till operation, down nearly 7 percentage points from 2022. 17.5% plan to use or purchase drones next year.

75% will use products that claim to increase soil/plant biological activity in 2023, and 24% plan to participate in carbon credit programs in 2023.

Strip-till toolbars with 12 rows were most popular among the 2023 survey respondents, with about 41% running a 12-row bar. About 33% run 16-row bars, and another 14% run 8-row toolbars.

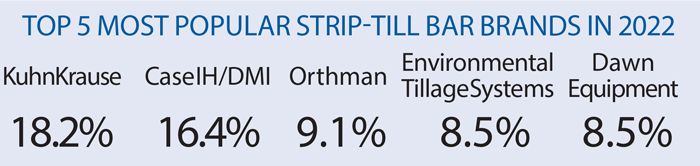

The most popular brand of toolbar was Kuhn Krause (18.2%), followed by Case IH/DMI (16.4%) and Orthman (9.1%).

Curt Davis, Kuhn Krause marketing director, says the strip-till equipment market is becoming more crowded as major manufacturing companies invest in the practice.

“Strip-till has always been more of a side item for major manufacturers than what it’s becoming today,” Davis says. “There have always been a lot of manufacturers in the strip-till industry, but they’ve been the smaller, regional type companies. Now you see several of the major companies focusing more on strip-till. I think that’s being driven by demand from the customers.”

Other popular strip-till equipment included SoilWarrior (8.5%), Dawn Equipment (8.5%), John Deere (7.9%), Yetter (7.3%) and Unverferth/Blu-Jet (6.1%).

Most of this year’s survey respondents farm in the U.S. About 62% operate in the Corn Belt, followed by 21% in the Plains/West. They farm an average of 1,751 total acres.

About 50% have been strip-tilling for 10 years or less, including about 15% who said 2022 was their first year strip-tilling. Total respondents strip-tilled an average of 933 acres of corn and 586 acres of soybeans — the highest total for soybeans and the second highest for corn (trailing only last year’s 1,083 acres) in the 10-year history of the survey.