In this episode of On The Record, we examine Kubota's earnings for the first quarter of the year, including what percentage of its total revenue comes from its ag segment and its North American market. In the Technology Corner, Noah Newman dives into the latest Precision Farming Dealer Day in the Cab visit. Also in this episode: SurePoint Ag's acquisition of some of Dawn Equipment's product lineup and the most recent update to the Ag Economy Barometer.

This episode of On The Record is brought to you by Agrisolutions.

Improve performance and durability with a wide range of premium tillage parts and extended life solutions, with Agrisolutions. As the market leader in wearable parts, components, accessories and solutions for tillage, seeding, planting and fertilizing, Agrisolutions is proud of their purpose - to build and feed the world. To learn more about Agrisolutions and their globally recognized brands, such as Bellota, Ingersoll Tillage and Trinity Logistics, visit Agrisolutionscorp.com.

TRANSCRIPT

Jump to a section or scroll for the full episode...

- Kubota Reports 33% Increase in 1Q23 Ag Revenue

- Dealers on the Move

- Day in the Cab: West Enterprises

- SurePoint Ag Systems Buys Product Lineups from Dawn Equipment

- Farm Capital Investment Index Down in May

- DataPoint: Manufacturing GDP Contribution

Kubota Reports 33% Increase in 1Q23 Ag Revenue

On May 15th, Kubota reported its total revenue for the first quarter of the year increased year-over-year to $5.6 billion. Overseas revenue specifically rose 42% from the prior year to $4.4 billion.

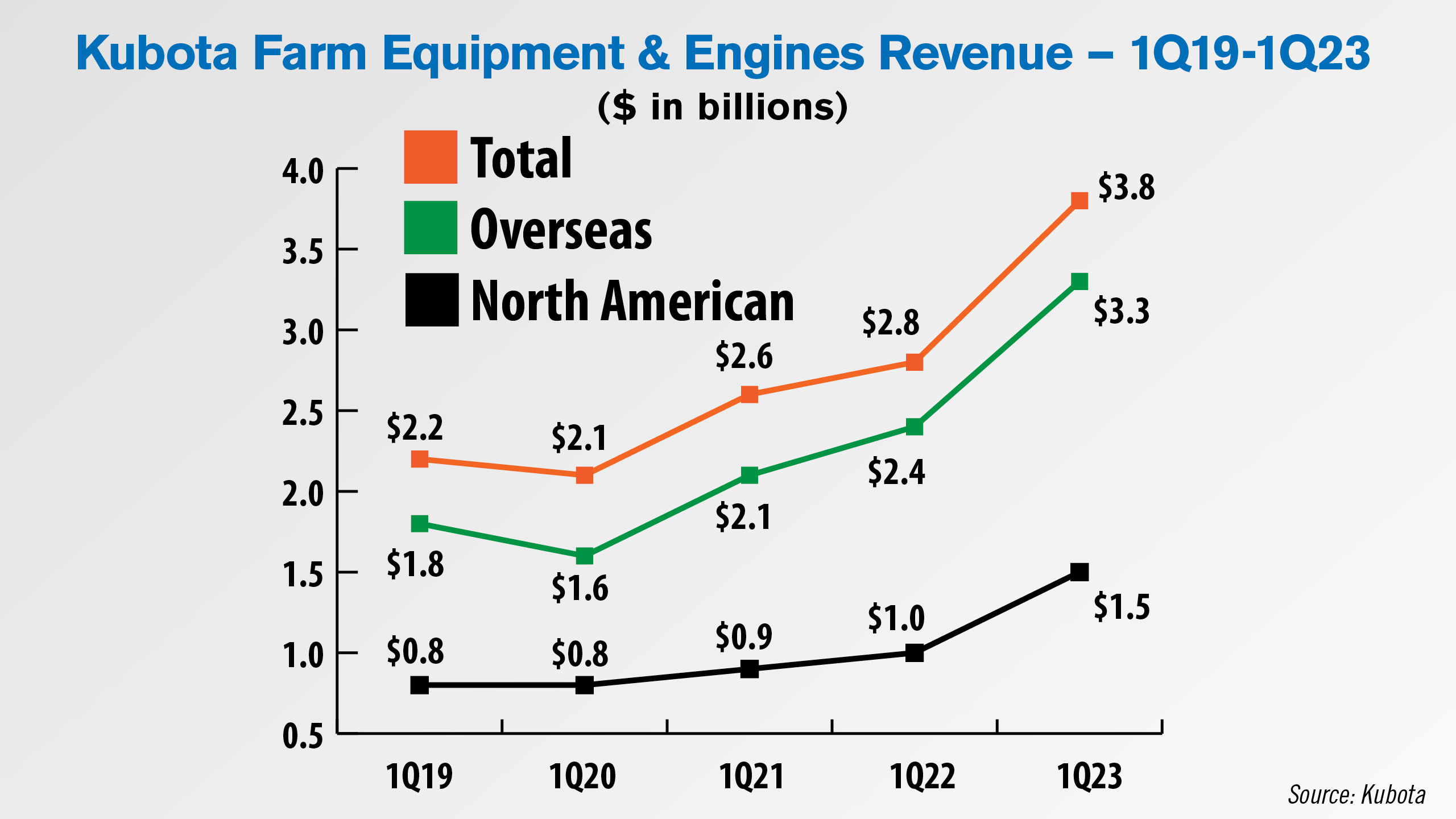

The company does not report farm equipment sales alone and includes engine sales revenue in the segment. So, Kubota’s total Farm Equipment & Engines revenue reached $3.8 billion for the first quarter, an increase of 33% from $2.8 billion in the first quarter of last year. Overseas revenue in the segment totaled $3.3 billion, up 38% year-over-year.

Meanwhile, North American farm equipment and engines revenue totaled $1.5 billion for the quarter, up 41% year-over-year. This puts the percentage of Kubota’s total farm equipment and engine revenue coming from North America at 41%, up from 39% in the first quarter of 2022 and 38% in the first quarter of 2019.

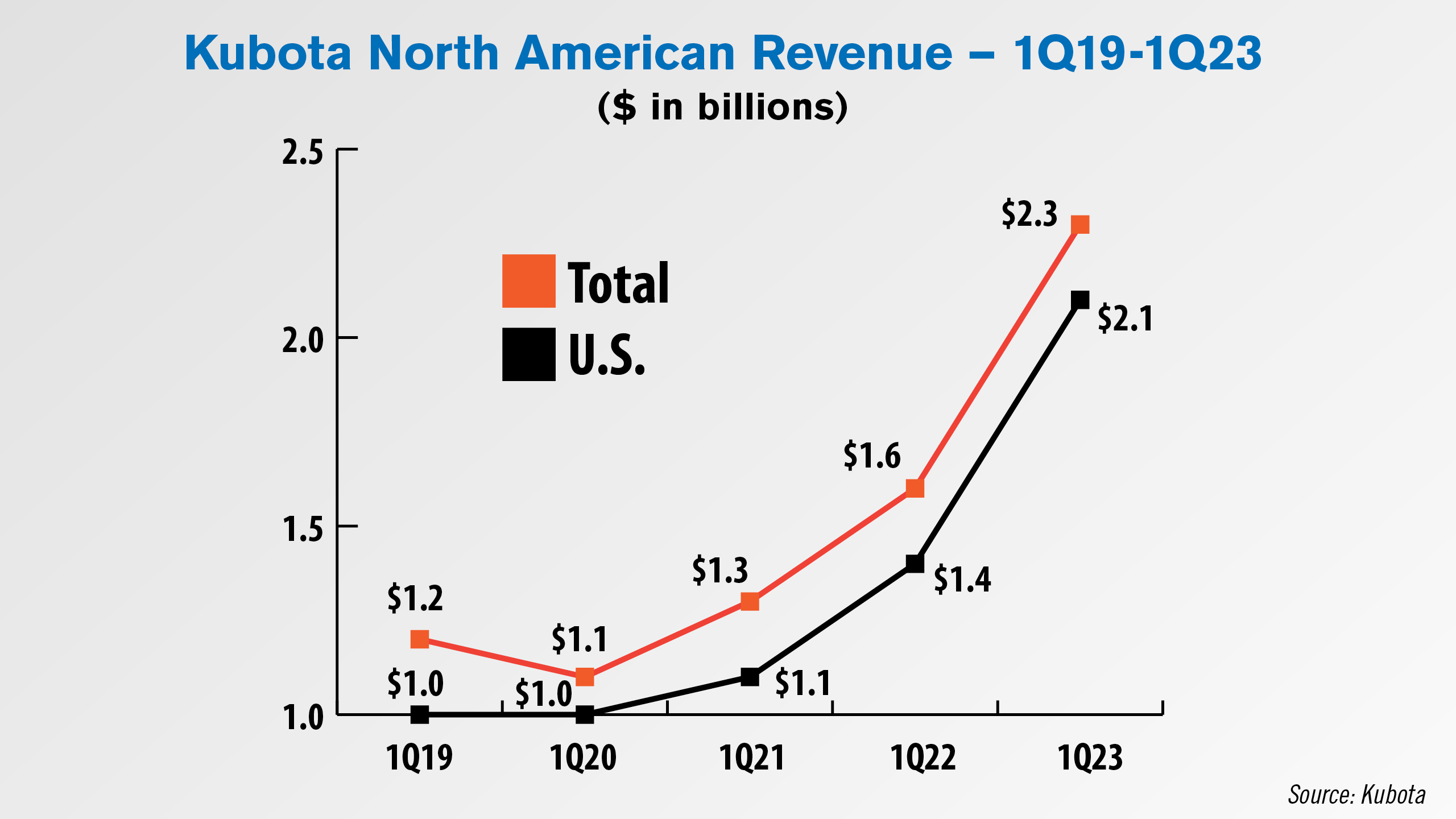

Kubota’s total revenue in North America was $2.3 billion, up 49% from $1.6 billion in the first quarter of 2022. Revenue from the U.S. specifically was $2.1 billion, up 51% year-over-year. Note Kubota’s regional revenue breakdown includes revenue from outside its farm equipment & engines segment.

The percentage of Kubota’s first quarter revenue coming from North America rose to 41% of total revenue vs. 37% last year and 34% in 2019. The percentage coming from the U.S. specifically rose to 37% from 32% in 2022 and 30% in 2019.

Dealers on the Move

This week’s Dealers on the Move are Titan Machinery and Florida Coast Equipment. Case IH and New Holland dealer Titan Machinery recently announced its acquisition of Midwest Truck Parts in Dawson, Minn., and will add the full Case IH lineup to the business. Titan’s Marketing Director Mike Hall said the additional location fills a gap in coverage in that part of Minnesota.

Florida Coast Equipment announced June 6 that it had opened a new location in Mims, Fla. The new facility will serve the communities of Titusville, Oviedo and Melbourne on Florida’s Space Coast with a range of Kubota products.

Day in the Cab: West Enterprises

Precision specialists often wear many hats — technician, salesperson, business owner, farmer. Bruce West barely has enough closet space for all the hats he wears as owner of West Enterprises, an independent dealer in western Illinois.

Bruce was nice enough to give us a peek behind the curtain during one of his busiest weeks of the year.

He drives about 250 miles a day visiting customers across the state. He starts a busy morning off with a visit to an organic farm, to check out a customer’s new Treffler precision tine harrow in action for the first time, killing weeds after soybean planting.

Next up — he stops by some longtime strip-tillers, who are interested in adding Speedtubes to their planter. Bruce checks out their setup and sees what they need so he can build a quote for the order.

Then after a quick stop at Subway…he visits a no-tilling father-son duo, to make sure everything’s going smoothly with their new Ag Leader Right Spot sprayer technology. Bruce is always trying to stay ahead of the curve — I asked him what the next big thing in precision ag will be.

“We all talk about autonomy, whether it’s the individual tractor or swarm technology, that’s the thing we’re talking about. But that’s still probably 5-10 years away. We’re looking at some things in the interim. Right now it appears to me the optical related items are the next big thing. I also feel that mainstream is going to mean more of the pulse and sprayer type products, using PWM technology for nozzles to control droplet size and improve accuracy of coverage. That’s going to be more of a mainstream thing in the next 1-3 years.” \

We’ll have more insight from Bruce during the next edition of Day in the Cab in the upcoming summer issue of Precision Farming Dealer.

SurePoint Ag Systems Buys Product Lineups from Dawn Equipment

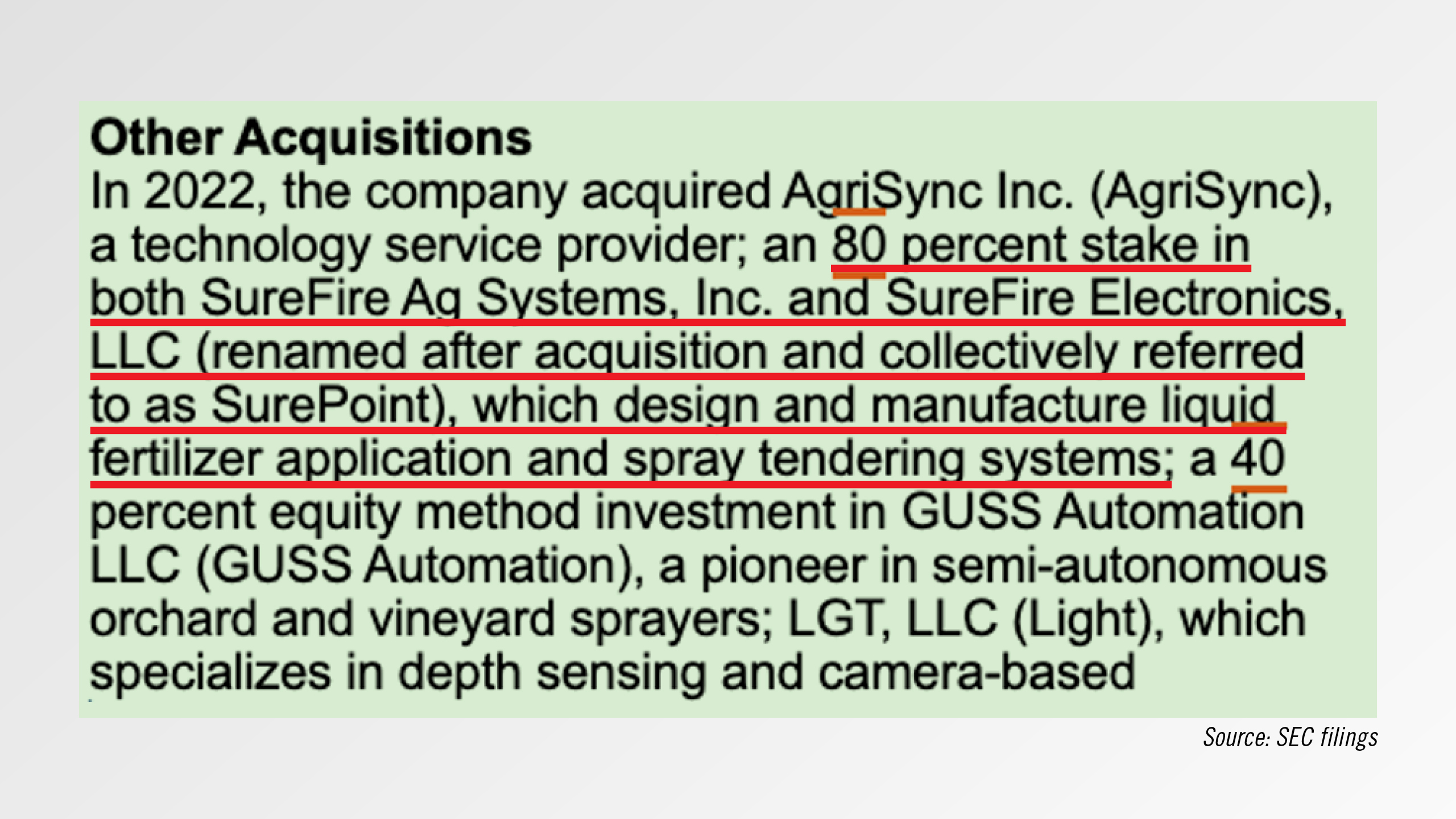

Dawn Equipment of Sycamore, Ill., announced June 1 that all sales of several of its product lines will now be sold through SurePoint Ag Systems of Atwood, Kansas. This includes its Screw-Adjust Trashwheels, Coulter attachments and Closing Wheels. Dawn said it will still offer support, service and parts for products sold prior to June 1, 2023.

In theory, the transition will connect to John Deere’s business. In March of last year, John Deere announced it had entered into a joint venture with SureFire Ag Systems, renaming it SurePoint Ag Systems and giving it access to select Deere technologies. Deere’s annual 10-K SEC filing referred to the joint venture as Deere acquiring an 80% stake in SurePoint.

At the same time, Dawn Equipment also said it will be shifting to offer complete implements and individual units in the strip-till and cover crop markets as well as other low-impact, ground-engaging products. These had formerly been marketed as Underground Agriculture.

The shift to full implement production has been on Dawn’ radar for a few years now. Back in a March 2021 interview with Ag Equipment Intelligence, Dawn Equipment’s then-CEO Joe Bassett forecast a decline in the mid-sized ag equipment manufacturer market as well as the attachment market. At the time, Dawn Equipment was in the process of adding manufacturing capacity for its full-size implements in a facility in South Milwaukee, Wis.

Basset said, “The aftermarket era, where growers assemble a lot of aftermarket options to customize their planters, I think is over. It’s gotten to be too much. There are too many gadgets. By the time you attach everything, the only thing left of the original planter is a couple pieces of metal. So we said, ‘Why don’t we just replace that too and make it a complete solution?’

Dawn Equipment and John Deere did not reply to our requests for comments.

Farm Capital Investment Index Down in May

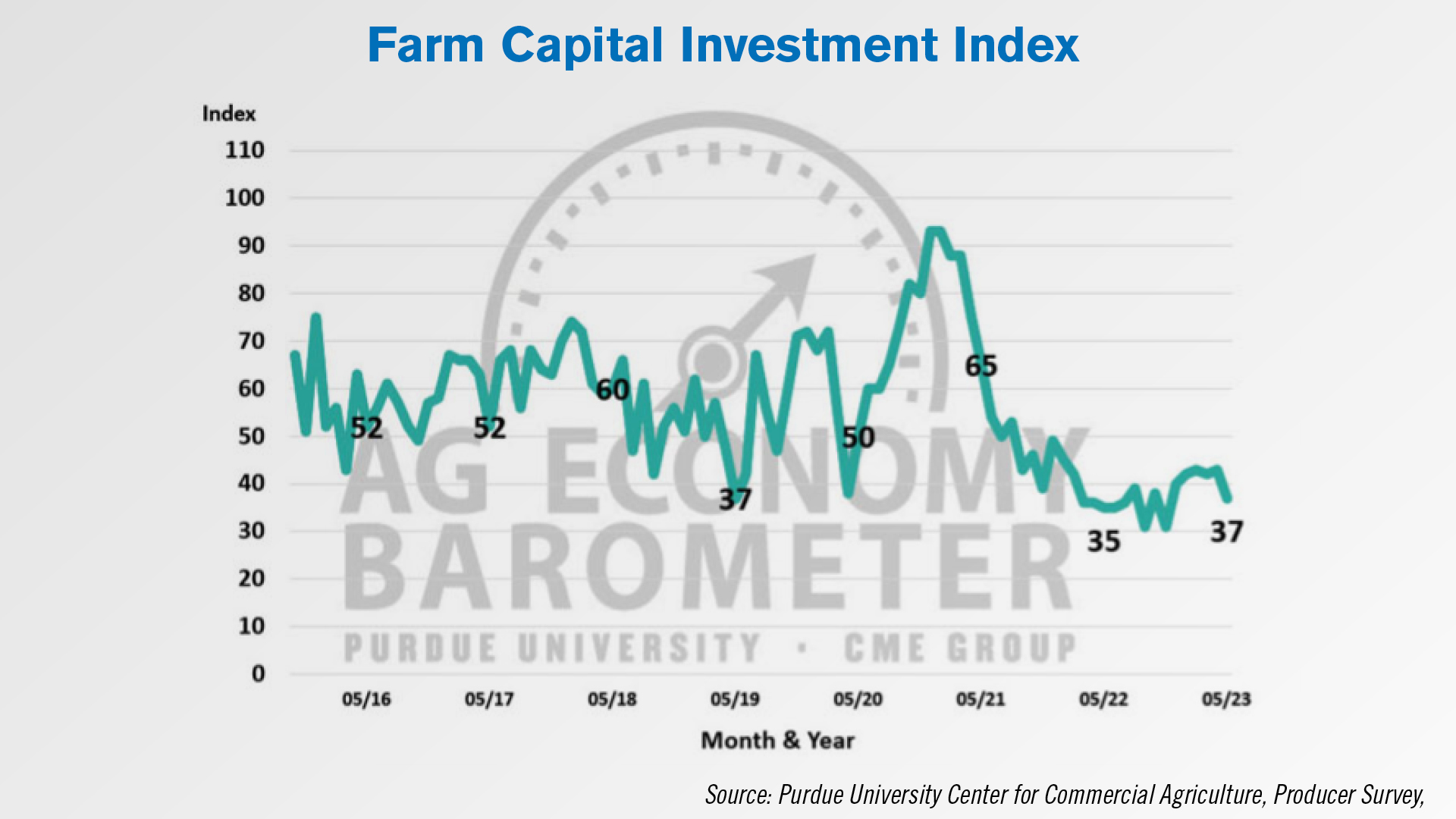

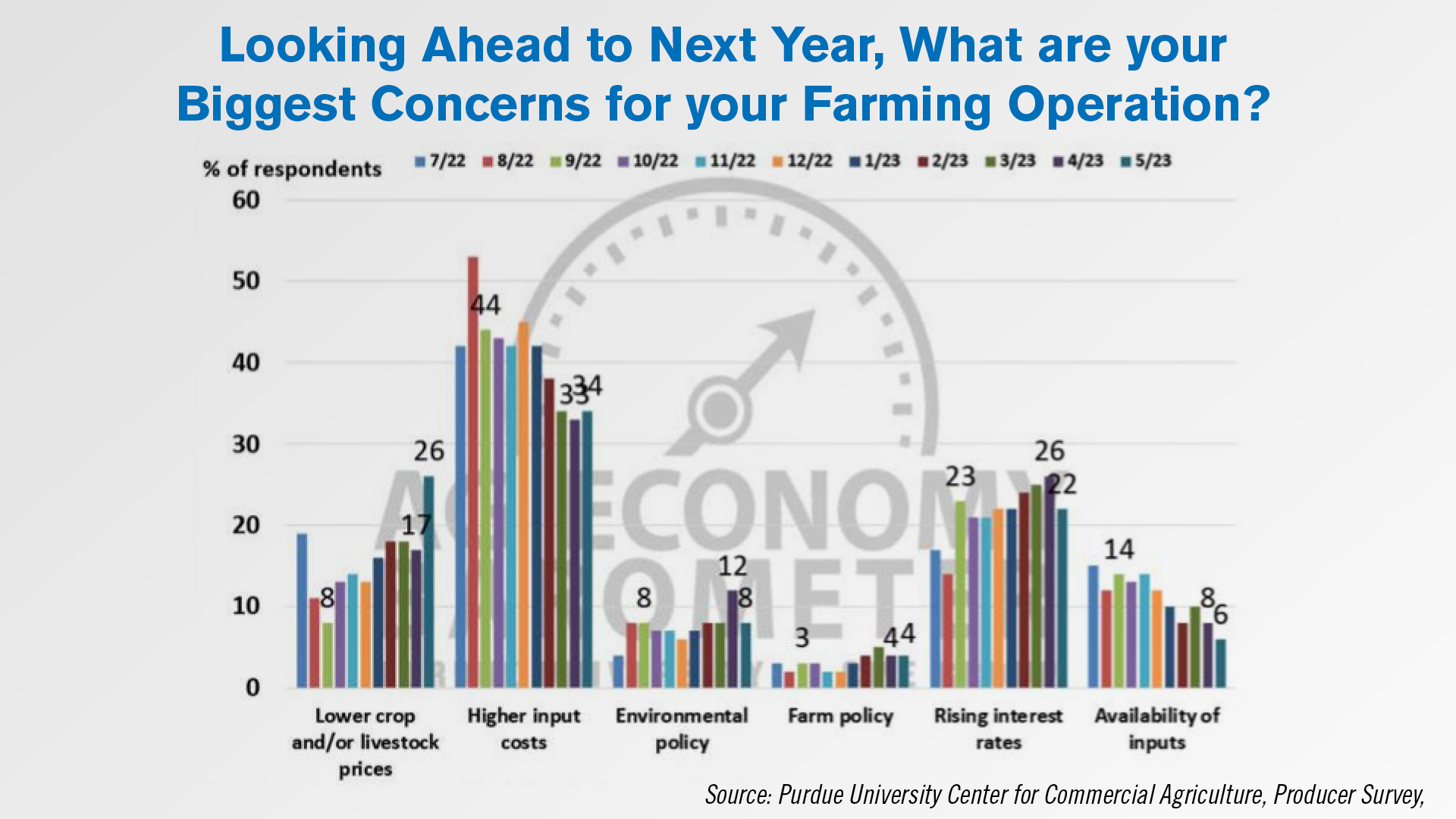

In the latest update to the Purdue University-CME Group Ag Economy Barometer, growers’ investment plans were down month-over-month.

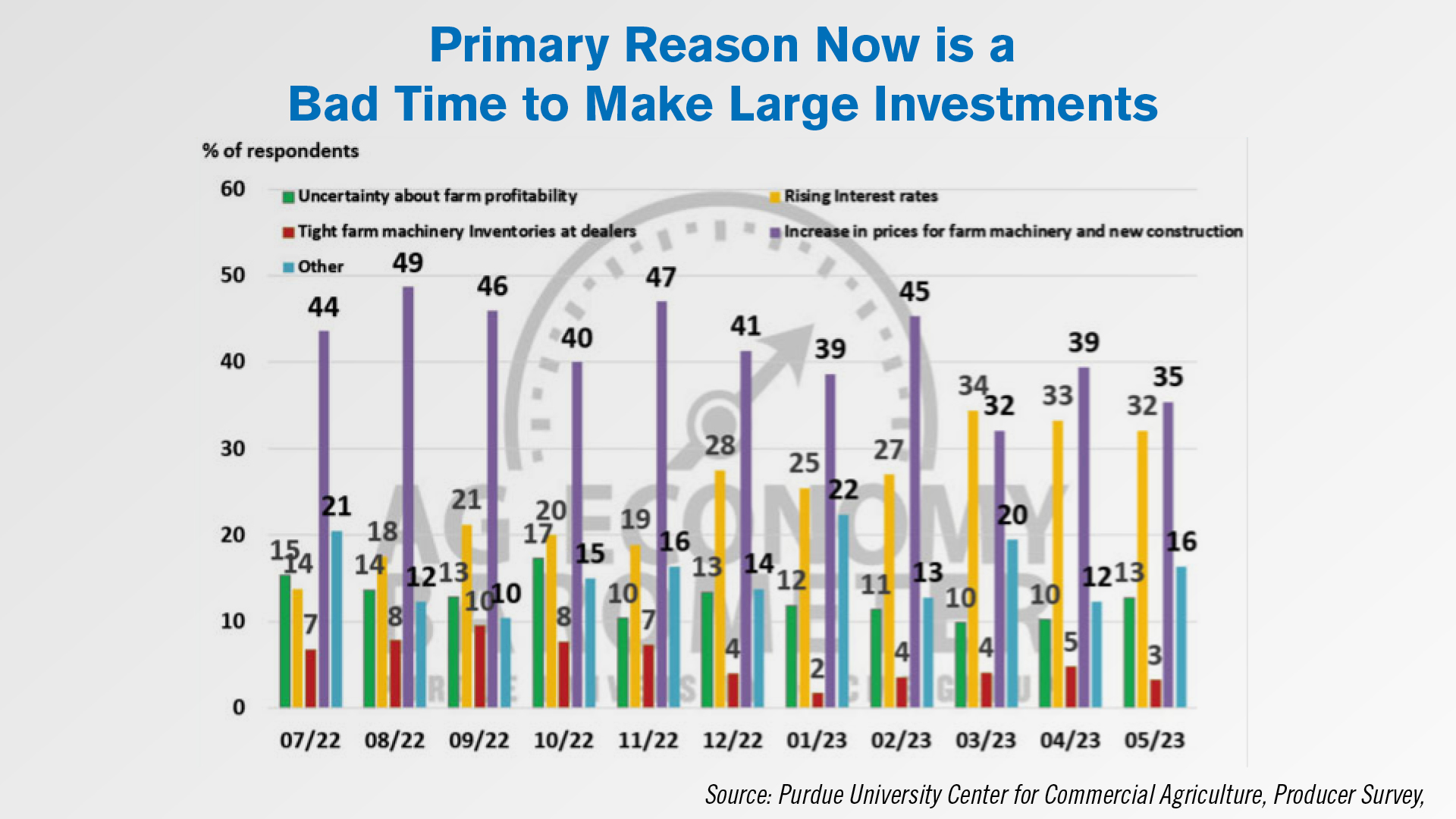

The Farm Capital Investment Index fell 6 points to 37 compared to a month earlier. This is its lowest reading since last November. Among the 76% of producers who said it’s a bad time for large investments, 67% said the key reasons are price increases for machinery and new construction as well as rising interest rates.

The percentage of growers concerned about farm machinery inventories remains low at 3%, while the percentage of those unsure about their farm profitability rose to 13%. At 35%, the percentage of growers most concerned about rising prices was at the second-lowest reading recorded since July 2022.

Among top concerns for their operations in 2024, higher input costs remained the most popular choice at 34%, while lower crop and livestock prices rose to 26% as the second-most popular option. Those most worried about rising interest rates fell to 22%.

DataPoint: Manufacturing GDP Contribution

This week’s DataPoint is brought to you by the Dealership Minds Summit.

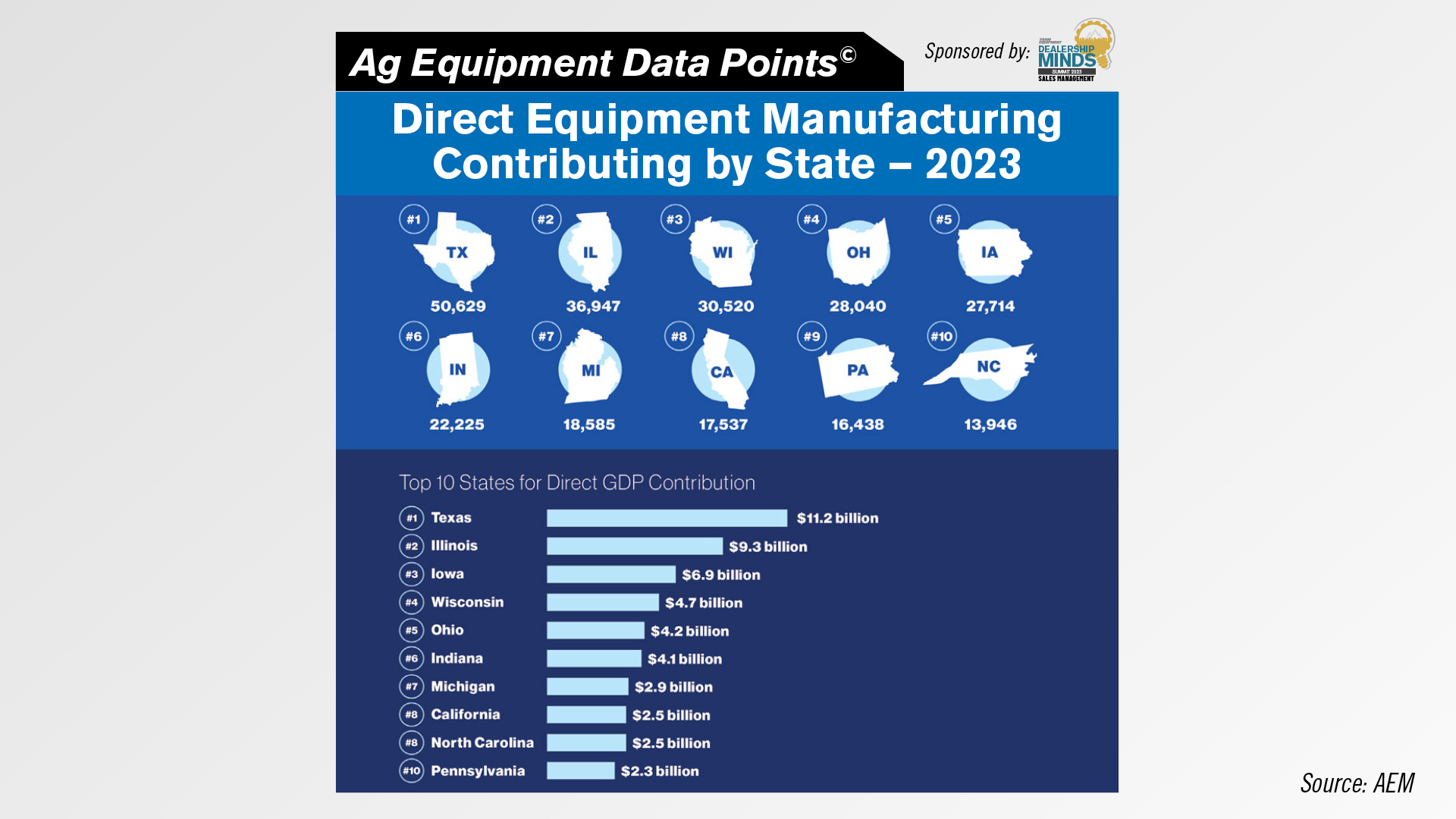

According to the Assn. of Equipment Manufacturer’s 2023 “The Economic Impact of the Equipment Manufacturing Industry” report, Texas ranks #1 among U.S. states for direct equipment manufacturing contributions. This includes having the most direct equipment manufacturing GDP contribution at $11.2 billion. Texas also contributes $11.5 billion in labor income and has the most direct equipment manufacturing jobs at over 50,000. Illinois has the second highest number of direct equipment manufacturing jobs at almost 37,000, as well as the second-highest direct GDP contribution at $9.3 billion.

On the Record is now available as a podcast! We encourage you to subscribe in iTunes, the Google Play Store, Soundcloud, Stitcher Radio and TuneIn Radio. Or if you have another app you use for listening to podcasts, let us know and we’ll make an effort to get it listed there as well.

We’re interested in getting your feedback. Please feel free to send along any suggestions or story ideas. You can send comments to bthorpe@lessitermedia.com.