“If I believed everything the dealer, salesman and retail companies told me I’d be raising 800-bushel corn!” I’ve heard similar statements across the U.S. and Canada with different crops, products and value-added sales pitches. While it grossly undervalues the importance of individual cropping decisions, it drives home the main message we will be addressing today -- how do we help customers use their biases to make informed decisions when purchasing margin-enhancing products?

Margin enhancement means spending money on things that make you money in return. However, there are several things that get in the way of accurately assessing margin enhancements.

- Accurate changes in yield or price due to the enhancement

- True cost of the enhancement

- Price of grain or end products produced and improved by the margin enhancement

- Emotional decision-making

- Lack of carrying a decision all the way through

Before we get too far into this, I’d like to show you the first or our three scenarios. These are looking at a 4,000-acre farm operation, 50/50 corn and soybean rotation. Request the tool by clicking this link

Planter

Scenario 1A

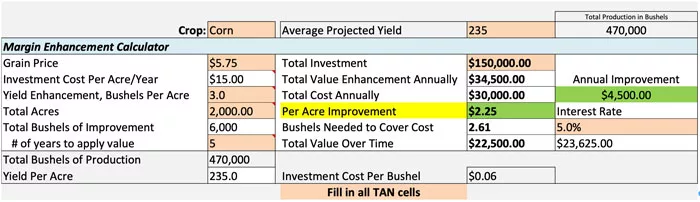

Situation: Farmer A would like to upgrade his planter row units on a 24-row planter with much newer technology.

Decisions: How much will this impact my yield? If I run these units for 5 years, will they pay off?

Variables Assessed: Yield Enhancement 1B, Grain Price Reduction 1C.

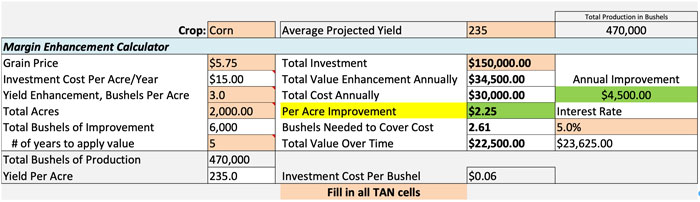

This is not an easy decision! That $150,000 is a big check and can put a major dent in working capital or create greater leverage if borrowing at the bank. What we are going to look at first is the yield. In 1A we assumed a conservative 3 bu./acre increase. Without considering other technology than being able to plant faster and get the crop in under timely conditions, this is a fair estimate. Now, if the data and research shows that these improvements could increase the yield by 15 bu./acre, the farmer might be a bit incredulous (I know I am when I hear numbers like that.) So, we ask them what they think a fair estimate is. Their response is 8 bu./acre -- let’s see how that number impacts our scenario.

Scenario 1B

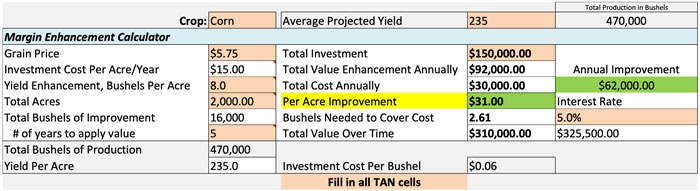

Quite a dramatic impact! Even by meeting the customer halfway, we can see that there is a huge amount of annual improvement and improvement over time by upgrading the planter. The next variable we will evaluate in the first scenario here is the price. I don’t have a crystal ball, but it is likely our grain prices will come back down sometime soon.

The farmer says “Well, I think the price needs to be closer to $4.00 for the long-term.” Fair point! What we will see this affecting is the “Bushels Needed to Cover Cost” Line Item. The same amount of capital is being contributed annually and per acre, but it takes more bushels to make up that difference. Also, with a lower price, the improvement will be less annually and long-term.

Scenario 1C

Now, the overall return is a bit lower, but it is still profitable for the farmer to make this decision. Even with more “trendline” price estimates, the farmer’s biases taken into consideration and covering the cost of the equipment purchase, this looks to be a profitable endeavor.

Let’s look at our next example, a strip-till bar.

Strip-Tillage

Scenario 2A

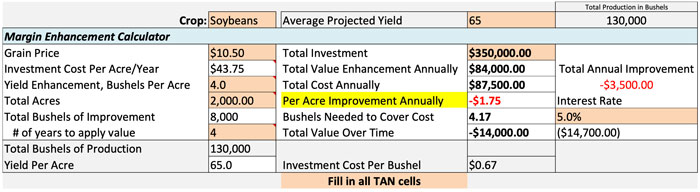

Situation: Farmer B is looking at purchasing a new strip-tillage machine.

Decisions: Can I justify a purchase just for my soybean acres? How does price impact this decision?

Variables Assessed: Price Reduction 2B, Acre Increase 2C.

The first thing I’ll note here is the tight margin. Relatively, 4 bushels is not very far away from the 3.37 bushels needed to cover the cost and this is at $13 soybeans. The investment cost/bushels is also high in this situation. It is one third of the overall equipment cost/acre in soybeans for a farm this size. While the numbers look positive, let’s stress-test this with a price reduction.

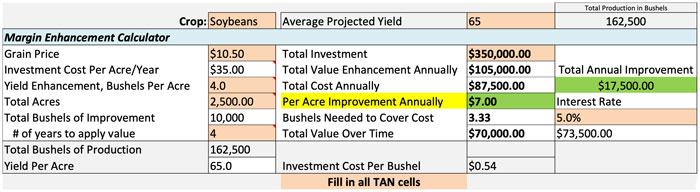

Scenario 2B

At $10.50 soybeans, this looks a bit different. With this price it will take a 4.17 bu./acre improvement to cover the cost, and Farmer B is assuming it won’t improve yields that much. Is $3,500 going to break the farm? Probably not. But this is a fair assessment of the situation. At this point it would be important to discuss the intangible benefits -- timeliness, more time with family, less time in the tractor, better seed bed preparation more accurate nutrient delivery, etc. (I’m not an equipment salesman, but I could play one on TV.)

The lenders always laugh at me when I ask if their clients are going to “do some custom acres,” but we see it can be very important and really help justify the cost in the strip-till units.

Scenario 2C

If Farmer B was able to find 500 acres of custom work, or try 500 acres of corn with strip-till, it puts them back in the positive light. It is still a close margin, but it is reducing fixed asset costs and providing an avenue for cost-share. If Farmer B really thinks they can get those acres, this might be an OK decision for them. Request the tool by clicking this link

Grain Head

Scenario 3A

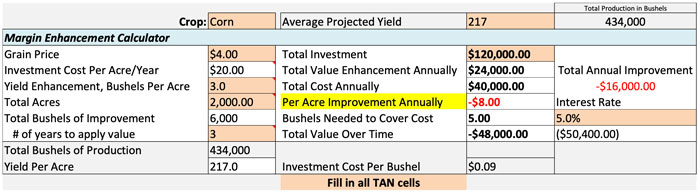

Farmer C is looking to upgrade to a new-to-them grain head on his combine. He figures he’ll see 3 bushels in kernel retention savings at the head, and more through getting more acres done in a day, capturing pre-phantom yield and better residue management for next spring’s seed emergency.

Realistically, he can only directly measure the lack of corn they see on the ground by the new head. If they stay on their 3-year trade plan, it looks like the cost doesn’t justify the purchase. While exploring their options, they start to think about whether they really need to trade every 3 years.

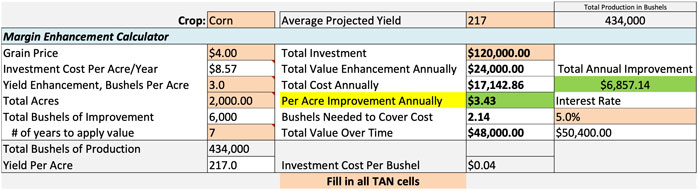

Scenario 3B

With quality maintenance, he decides he can run it over twice as long. This time dilution makes a huge impact on the cost and, over time, will pick up about $50,000 in additional savings. What mistake do many farmers and dealers make? Saying they’re going to run something longer than they are, and not accounting for the cost along the way.

We won’t run another scenario on that aspect -- I’ll let you play with it on your own time after you reach out for the tool.

Power of the Tool:

- It’s a great conversation piece for salespeople everywhere -- from fungicide to equipment improvements. Sometimes it works for the customer, and sometimes the numbers don’t lie.

- Removal of [most] emotions. No more worry about deals, cost or assumptions. Yes, there will be outside factors that may influence the customer, and lots of intangible aspects that need to be considered, but this tool facilitates the discussion with numbers and not assumptions.

- The ability to carry the decision through to completion. Side by sides, year over year averages and general yield factors can be measured to gauge if the margin enhancement paid for itself or not. It is also a great reason to follow up with the customer!

I hope you find value in this simple yet powerful tool! Request the tool by clicking this link

Coming Next: Equipment Rates Built for Individual Farms & Equipment Companies

Part 1: The 3-5 Year Equipment Outlook Tool

Part 2: Calculating Margin Enhancement on Farm Equipment

Part 3: Equipment Rates Built for Individual Farms & Equipment Companies