This year’s Farm Equipment Dealer Business Outlook & Trends survey saw significant changes relative to last year’s survey. Projections for next year’s new and used equipment sales were up compared to the 2021 survey, as well as forecasts for early orders and equipment price increases.

Considering the strength of the ag equipment market at the moment, driven by a sharp economic recovery following the crash that came with the COVID-19 pandemic, the results make sense. Farmers’ government payments, coupled with struggling equipment supply chains creating an equipment shortage, have created the perfect storm for an equipment seller’s market. What remains to be seen, however, is if the increasingly positive outlook for 2022 will come to fruition.

For the moment, it seems as though the impact of the overwhelmed supply chain will continue into the foreseeable future. A September 2021 report from Ag Equipment Intelligence quoted John Deere Director of Investment Relations Josh Jepsen as saying, “As we expected a quarter ago, we noted we thought the back half of the year would be more challenging. That’s exactly what we saw. We saw more disruptions, more impacts to production, where we were losing days of production at different facilities at different times throughout the quarter. And we think that continues; we don’t see that easing up as we get into the fourth quarter and into 2022.”

New Equipment Revenue, Prices Rise

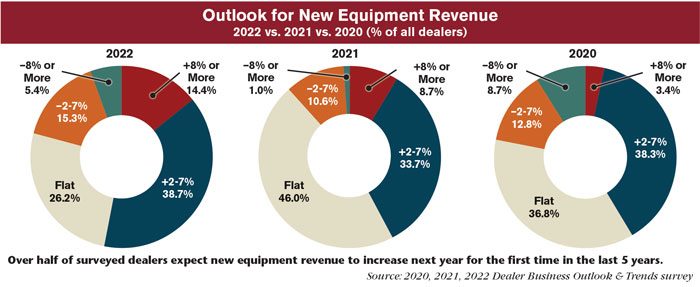

Dealers’ forecasts for 2022 new equipment revenue were much higher than either of the 2 previous years, with 53.1% of surveyed dealers expecting new equipment revenue to be up by at least 2% year-over-year. This surpassed the 42.4% who thought the same in last year’s report and the 41.7% in the 2019 report.

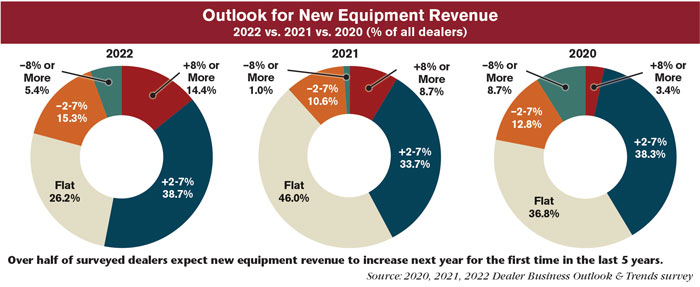

This year, 14.4% of dealers forecast new equipment revenue to increase 8% or more next year, well above the 8.7% who thought the same last year, while the percentage estimating new equipment revenue up 2-7% went from 33.7% last year to 38.7% this year. The percentage of dealers forecasting at least a 2% decrease in used equipment revenue also rose from 11.6% in last year’s report to 20.7%. A little over 5% of surveyed dealers forecast new equipment revenue down 8% or more in 2022.

A little over 26% of dealers estimate there will be little to no change in new equipment revenue for next year, a 5-year low.

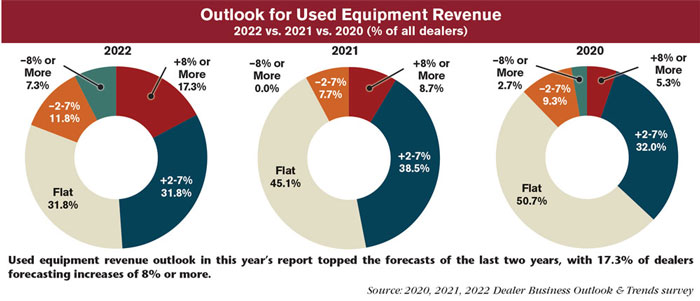

Broken down by country, Canadian dealers were more pessimistic than their U.S. counterparts. Some 7.1% of Canadian dealers forecast a new equipment revenue increase of 8% or more vs. 15.5% of U.S. dealers forecasting the same, though a greater percentage of Canadian dealers (42.9%) forecast an increase of 2-7% than U.S. dealers (38.1%).

Some 21.4% of Canadian dealers forecast new equipment revenue down 2% or more, above the 20.7% of surveyed U.S. dealers who forecast the same.

Some 1% of this year’s surveyed dealers expected no price increase from their OEMs in 2022, showcasing the severity of current price increases as global supply chains struggle to meet increasing demand.

Nearly 14% of surveyed dealers are forecasting a price increase of 10% or more from their OEMs next year vs. none in last year’s report and 1.3% in the 2019 report. Nearly 30% of surveyed dealers are expecting an increase of 7-9%, far surpassing the 0% and 2% who expected the same increases in the two previous reports. With 43.5% forecasting 4-6% increases and 12% forecasting 1-3% increases, only the 1-3% category saw decreases from the two previous studies as dealers moved their forecasts higher.

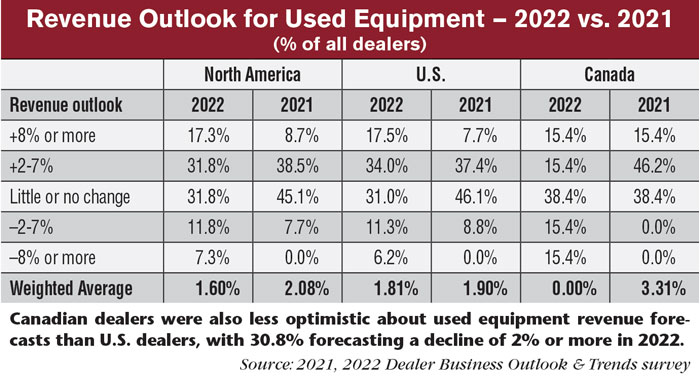

Dealers Optimistic on Used Sales

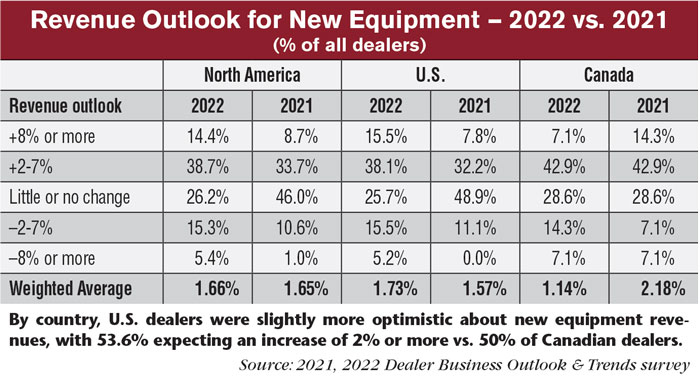

Positive outlook on used equipment revenue rose slightly compared to the previous study, but also saw an increase in negative forecasts. Some 49.1% of surveyed dealers forecast at least a 2% increase in used equipment revenue for next year, up slightly from 47.2% in last year’s study. The percentage of dealers forecasting an 8% or more increase in used equipment revenue rose from 8.7% last year to 17.3%, the highest percentage recorded in the last 5 years.

The percentage of dealers forecasting no change in revenue decreased for the second year in a row to 31.8%. A total of 19.1% of dealers forecast a decline in used equipment revenue for next year, with 7.3% forecasting a decline of 8% or more vs. none forecasting a decline that severe last year.

By country, U.S. dealers were more optimistic about the future of used equipment revenue, with 51.5% expecting an increase of at least 2% vs. 30.8% of Canadian dealers expecting an increase. Some 17.5% of U.S. dealers forecast an increase of 8% or more vs. 15.4% of Canadian dealers. Another 34% of U.S. dealers forecast an increase of 2-7% vs. just 15.4% of Canadian dealers.

Some 31% of U.S. dealers forecast no change in used equipment revenue, while 38.4% of Canadian dealers forecast no change. Some 30.8% of Canadian dealers are estimating used equipment revenue will fall by at least 2% or more in 2022, while 17.5% of U.S. dealers forecast the same.

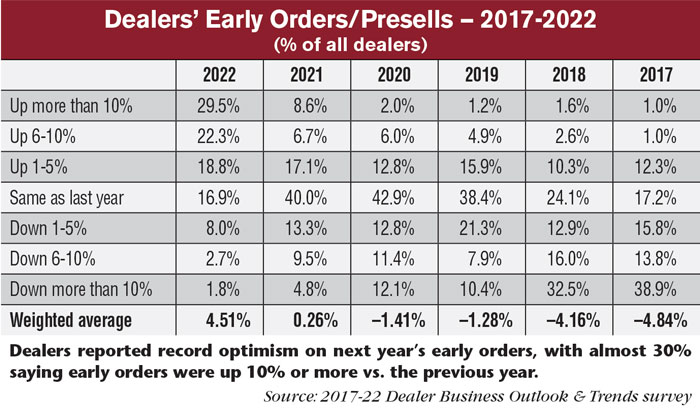

Record Highs for Early Orders

With the ongoing equipment shortage, early orders have become an increasingly important part of how dealers are doing business. As a result, this year’s early orders results are up significantly vs. last year.

Some 29.5% of dealers estimate their early orders are up 10% or more vs. the previous year, compared to 8.6% indicating the same in last year’s study. Overall, 70.6% of dealers say their early orders are up at least 1% vs. the previous year, compared to 32.4% who said the same in the previous study. Only 16.9% of dealers reported their early orders were unchanged from the previous year, a record low for the last 6 years.

Some 12.5% of dealers reported their early orders were down vs. last year, with 8% indicating early orders were down 1-5%. This is well below the 27.6% who reported a decrease of at least 1% or more in last year’s study.

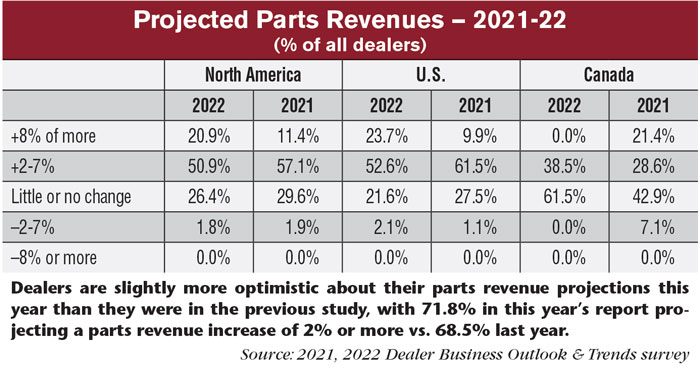

Aftermarket Financials Remain Solid

Overall dealer sentiment was up on parts revenue, 71.8% in this year’s report projecting a parts revenue increase of 2% or more vs. 68.5% last year. Among them, 20.9% forecast an increase of 8% or more. Just 1.8% of this year’s respondents forecast a decrease of 2-7% vs. 1.9% last year.

U.S. dealers were notably more optimistic about parts revenue than Canadian dealers, with 76.3% of U.S. dealers forecasting an increase of 2% or more vs. 38.5% of Canadian dealers. The majority of Canadian dealers (61.5%) forecast little to no change in their 2022 parts revenue vs. 21.6% of U.S. dealers who forecast no change.

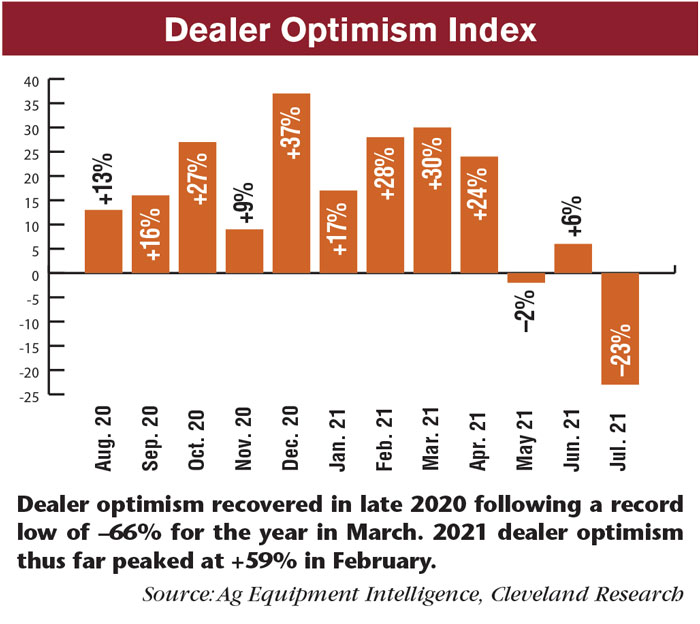

Dealer Sentiment Wavers on Equipment Shortage in 2021

Last year’s readings from Ag Equipment Intelligence’s Dealer Optimism Index were notably low, reaching a record low for the year of –66% as the pandemic took hold around the world. By August 2020, optimism had improved slightly to a reading of +13% and rose from there. Optimism reached a 2021 high of +30% in March, before declining to a record low for the year of –23% in July.

Comments from the most recent Dealer Sentiments report show dealers are most concerned about having equipment to sell to their customers and OEMs increasing prices. One dealer from the Southern Plains says, “We are less optimistic as inventories run low at the dealer level and within the manufacturers' shops. We are also concerned about the general well-being of the economy, especially inflation into next year.” Another dealer from the Northeast says, “Sales continue to be strong despite working through supply issues with the manufacturers. The OEMs are pushing further price increases each month.” One dealer from the Lake States mentioned all their OEMs issuing double-digit prices increases.

Drought also came up as a concern, with dealers in both the Mountain/Pacific region and Canada commenting on the impact droughts were having on their sales. One dealer from the Mountain/Pacific region claims hay yields on dry farmland in their area are down 60%.

At the same time, the fundamentals of commodity prices and farm financials remain strong. A note from Mig Dobre, senior research analyst with RW Baird, said, “This September’s USDA report shows increased ending stocks and lower average farm prices for corn and soybeans. Despite coming off peak pricing, commodities remain supportive of equipment investment.”

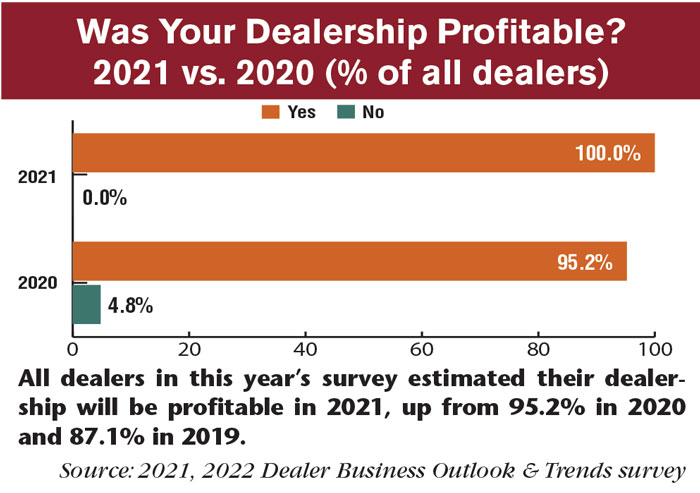

At the same time, dealers who took part in this year’s survey seemed to have a strong year, with every single dealer estimating their dealership will break a profit in 2021. This is an improvement from the 95.2% forecasting an improvement in 2020 and the 87.1% who forecast an improvement in 2019.

U.S. dealers were also more optimistic year-over-year, with 76.3% forecasting parts revenue increases vs. 71.4% who forecast the same last year. This included an increase in those forecasting a parts revenue increase of 8% or more from 9.9% last year to 23.7%. Canadian dealers, on the other hand, were notably less optimistic, with only 38.5% forecasting an increase in parts revenue compared to 50% in last year’s study.

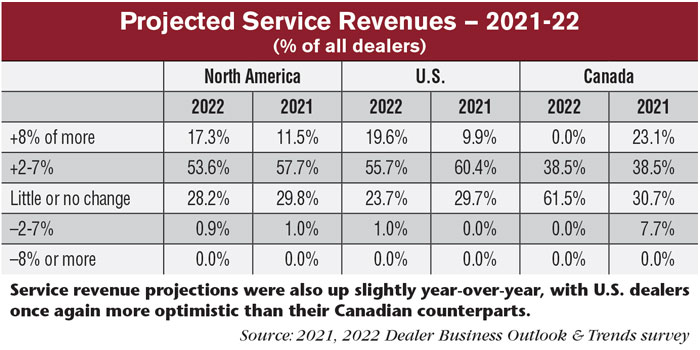

Some 70.9% of dealers forecast an increase in service revenues for 2022, including 17.3% who forecast an increase of 8% or more. This represents an increase vs. the 69.2% of dealers who forecast an increase in last year’s study, among whom 11.5% forecast an increase of 8% or more.

U.S. dealers were once again more optimistic than their Canadian counterparts, with 75.3% forecasting service revenue increases vs. just 38.5% of Canadian dealers. Some 61.5% of Canadian dealers forecast little to no change in service revenue vs. just 23.7% of U.S. dealers.

U.S. dealers were more optimistic in this year’s compared to the previous report, with 75.3% forecasting revenue increases vs. 70.3% in last year’s report. The percentage of U.S. dealers forecasting a service revenue increase of 8% or more almost doubled from 9.9% in last year’s study to 19.6%. The percentage of dealers forecasting little to no change fell from 29.7% last year to 23.7% in this year’s report.

Canadian dealers were notably less optimistic in this report, with 38.5% forecasting used equipment revenue up vs. 61.6% in last year's survey.

Dealers Plan Investments in Shops, More CAPEX in 2022

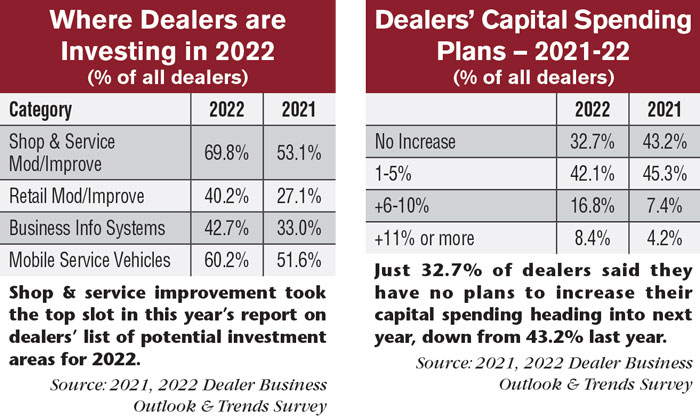

When asked where they plan to invest in 2022, shop and service improvements was dealers’ top choice with 69.8% selecting it as an investment plan. Mobile service vehicles took the second slot at 60.2%, followed by business info systems at 42.7% and retail modifications/improvements at 40.2%. Investment was up in all categories year-over-year, with the largest was in the shop & service from 53.1% of dealers indicating they planned to invest in this area last year.

In this year’s report, over two-thirds of surveyed dealers indicated they planned to increase their capital expenditure in the coming year, with 8.4% planning increases of 11% or more exactly double the percentage who said the same in the previous study. Some 16.8% plan capital expenditure increases of 6-10%, more than double the 7.4% who indicated the same last year. Another 42.1% plan increases of 1-5%, just below the 45.3% who said the same in last year’s study.

Dealers Bet on High-Horsepower Tractor, Feeders/Mixers Sales

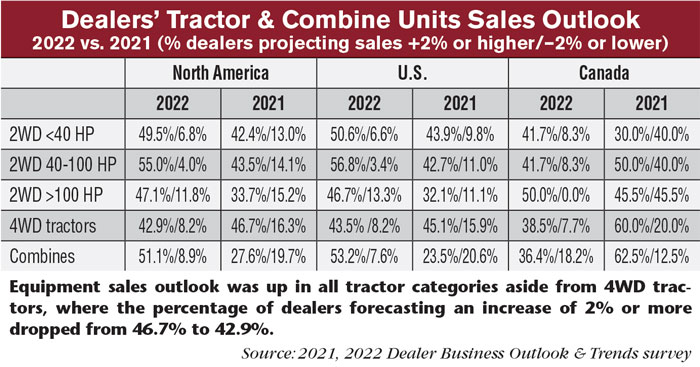

Dealers were more optimistic with their unit sales outlook for next year than they were last year, with all major categories showing increases aside from 4WD tractors. Combines saw the greatest increase, with the percentage of dealers forecasting a sales increase of 2% or more rising from 27.6% last year to 51.1% this year. Tractors with over 100 horsepower also saw a significant increase, from 33.7% last year to 47.1% this year. The percentage of dealers forecasting an increase in under 40 horsepower tractors sales also rose from 42.4% to 49.5%, while the percentages for 40-100 horsepower tractors rose from 43.5% to 55%. 4WD tractor sales saw a decline in optimism, however, falling from 46.7% of dealers forecasting increases last year to 42.9% this year.

U.S. dealers were more optimistic on all sales outlooks aside from 4WD tractors, where the percentage of optimistic dealers dropped to 43.5% from 45.1% last year. 2WD 40-100 horsepower tractors had the highest percentage of optimistic dealers at 56.8%, up from 42.7% last year. The percentage of U.S. dealers forecasting combine sales up 2% or more in the coming year more than doubled from 23.5% last year to 53.2% in this year’s report.

Canadian dealers only saw more optimism in 2WD under 40 horsepower tractors (from 30% to 41.7%) and over 100 horsepower tractors (45.5% to 50%). All other categories saw a year-over-year decrease in the percentage of Canadian dealers forecasting growth of 2% or more, with combines showing the greatest decrease from 62.5% to 36.4%.

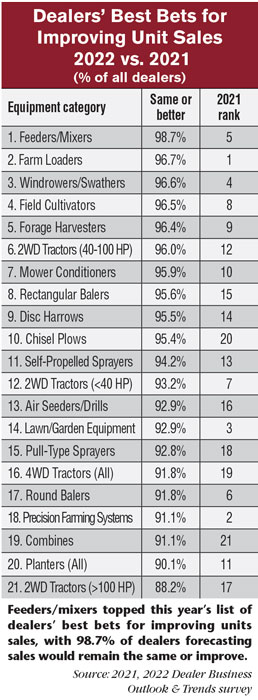

This year’s list of dealers’ best bets for improving unit sales saw significant changes in ranking, beginning with feeders/mixers taking the top slot from fifth in last year’s report. Farm loaders, windrowers/swathers, field cultivators and forage harvesters completed the top 5 best bets.

Notable changes in this year’s lineup included field cultivators going from #8 last year to #4 in the most recent report, while forage harvesters moved from #9 to #5. 2WD 40-100 horsepower tractors saw a jump in ranking as well, going from #12 last year to #6.

Some of the largest drops in ranking came from Precision Farming Systems (#2 last year to #18), round balers (#6 to #17) and lawn/garden equipment (#3 to #14). The lowest percentage of dealers forecasting unit sales to remain the same or better was for 2WD over 100 horsepower tractors at 88.2%, well above the lowest percentage recorded last year (combines at 80.3%).

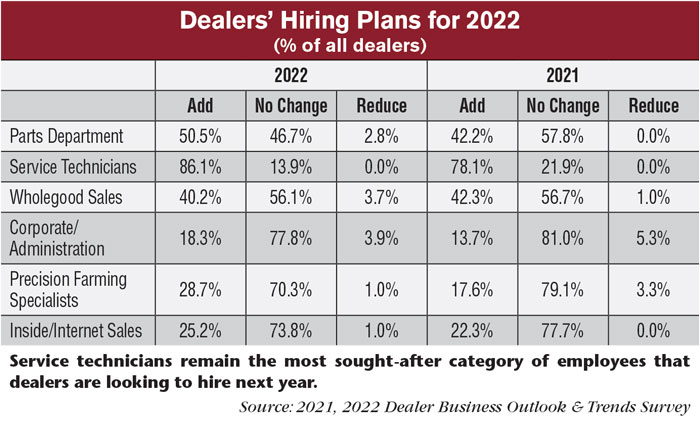

Dealers Increase Hiring Plans for 2022

Year-over-year, dealers are looking to hire more employees going into 2022 than they were last year. Over half of all surveyed dealers are looking to add parts department employee next year vs. 42.2% saying the same last year. Some 86.1% of dealers are looking to add service technicians, a notoriously difficult category of employee to find in the industry, above the 78.1% who said the same last year. No dealerships are looking to reduce their number of technicians.

Plans for wholegoods hiring are down slightly, with 40.2% of dealers planning to hire staff vs. 42.3% last year. More dealers are also looking to hire admin staff (18.3% planning to add vs. 13.7% last year), precision farming specialists (28.7% vs. 17.6%) and inside/internet sales (25.2% vs. 22.3%). Corporate/administrative staff had the highest percentage of dealers looking to reduce staff in that category at 3.9% vs. 5.3% last year.

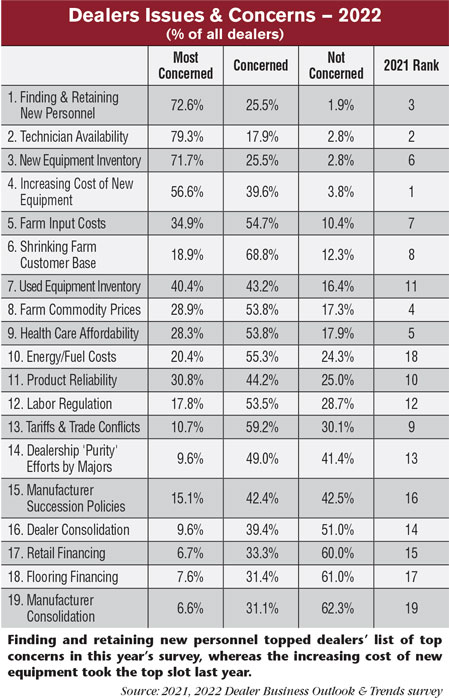

Finding and keeping staff topped dealers list of issue and concerns heading into 2022, displacing rising equipment costs from the top of last year’s list. Technician availability remained the #2 issue, while new equipment inventory concerns, likely bolstered by equipment shortages, rose to #3 from #6 last year. The increasing costs of new equipment landed at the #4 slot, with farm input costs completing the top 5 concerns.

Other notable changes to the list included used equipment inventory rising to #7 from #11 in last year’s report, energy/fuel costs rising to #10 from #18 and farm commodity prices dropping from #4 to #8.

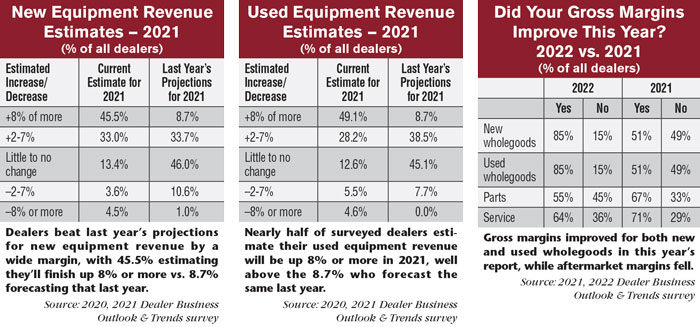

Last Year’s Forecasts vs. Current Estimates for 2021

Similar to last year, dealers beat last year’s projections for new equipment revenue by a wide margin, with 45.5% estimating they’ll finish up 8% or more vs. 8.7% forecasting that last year. Overall, 78.5% of dealers in this year’s survey estimate their new equipment revenue will be up 2% or more this year vs. 42.4% forecasting that last year. Only 13.4% estimate their new equipment revenue will be unchanged (vs. 46% last year) and only 8.1% estimate a decline in new equipment revenue (vs. 11.6% last year).

Estimates for used equipment revenue also beat out last year’s forecasts, with 77.3% of dealers estimating their used equipment revenue up 2% or more vs. 47.2% who forecast the same last year. Just 12.6% of dealers expect their used equipment revenue to be unchanged from 2020, well below the 45.1% who forecast the same last year. At the same time, a larger percentage of dealers estimate a decline in their 2021 used equipment revenue (10.1%) than forecast it last year (7.7%).

Whereas last year’s margins were a year-over-year improvement in all categories, this year saw just wholegoods margins increase. Some 85% of dealers said both their new wholegoods and used wholegoods gross margins improved year-over-year vs. 51% who said the same last year. Some 55% of dealers indicated they’d seen an increase in their parts gross margins in 2021, below the 67% from last year’s study. Service gross margins were down as well (64%) but were down less year-over-year (71%) than parts gross margins.

Post a comment

Report Abusive Comment