It’s been a strange year for dealers to say the least. Not only are dealers following a particularly wet and difficult planting season in 2019, but now they’re facing the long term effects of a global pandemic, as well as an election year in the U.S.

In spite of all that, results from the Ag Equipment Intelligence/Farm Equipment 2021 Dealer Business Outlook & Trends survey show dealers not only beat last year’s estimates for profitability in 2020, but they’re now predicting greater revenue growth in 2021 than they did for 2020.

2020 New Equipment Sales

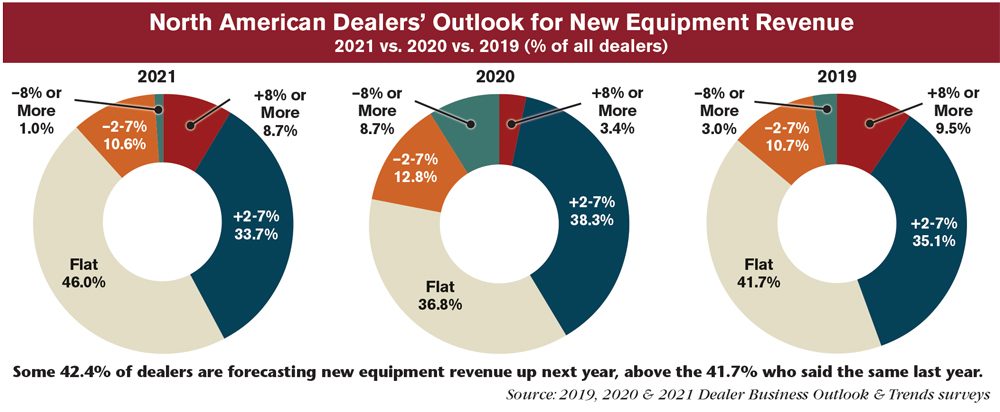

When examining the results from the 2021 Dealer Business Outlook & Trends survey, it becomes apparent that more dealers are shifting away from a negative outlook on new equipment revenue.

Some 42.4% of dealers indicated they see their new equipment revenue increasing by at least 2% in 2021, slightly more than the 41.7% in 2019 who forecast increased new equipment revenue in 2020. Dealers forecasting an increase of 8% or more in the next year came in at 8.7%, more than double the 3.4% who forecast the same increase for 2020 last year. Those forecasting a 2-7% increase dropped from 38.3% in last year’s survey to 33.7% this year.

The more notable change comes from those forecasting little to no change in new equipment revenue, which came in at 46% in this year’s survey. This surpasses both the 36.8% recorded in last year’s survey and the 41.7% recorded in the survey conducted in 2018.

A total of 11.6% of dealers indicate they expect new equipment revenue to decrease in 2021, nearly half of the 21.5% who forecast new equipment revenue would be down in 2020 and below the 13.7% who forecast a decrease for 2019. Dealers forecasting an 8% or more decrease fell to 1%, far below the 8.7% recorded last year.

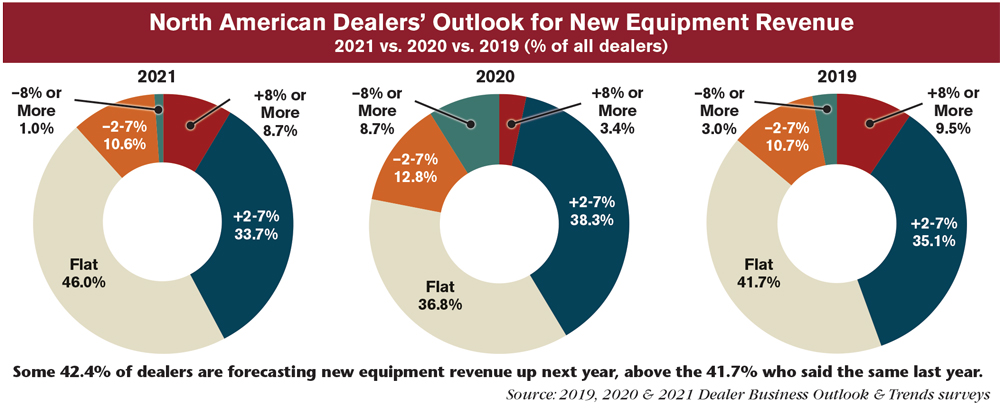

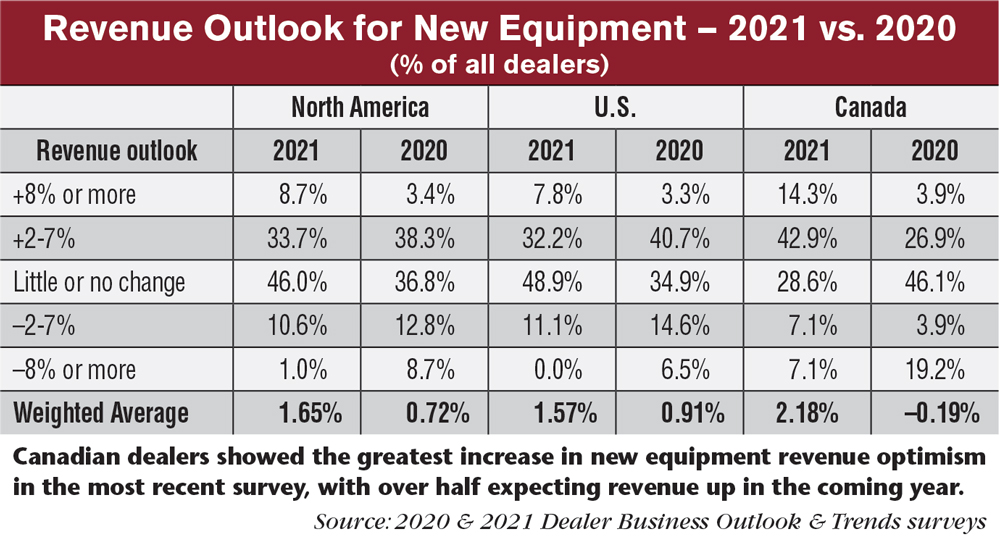

By country, Canada showed notably higher forecasts for new equipment revenues in 2021, a switch from last year’s survey. This time around, 57.2% of Canadian dealers expect their new equipment revenue to be up next year, almost double the 30.8% who expected their new equipment revenue up in 2020. Among those expecting an increase in revenue, those forecasting in increase of 8% or more went from 3.9% last year to 14.3% this year; those forecasting an increase of 2-7% was up from 26.9% last year to 42.9%.

The percentage of Canadian dealers expecting declines in their new equipment revenue was down compared to last year. Some 14.2% forecast revenues down for 2021, whereas 23.1% forecast them down for 2020.

While Canada saw a decline in dealers expecting their new equipment revenue to be pretty much the same next year (from 46.1% last year to 28.6% in this year’s survey), U.S. dealers did the opposite. In 2019, 34.9% of them said they expected little or no change in next year’s new equipment revenues. This year, 48.9% of them said the same for 2021. U.S. dealers forecasting 8% or higher increases in new equipment revenue increased year-over-year (from 3.3% last year to 7.8%), while those forecasting increases of 2-7% fell (from 40.7% to 32.2%). This led to an overall decline in U.S. dealers forecasting improvements in new equipment revenues in the coming year, from 44% in the 2019 survey to 40% in the most recent survey. No dealers are forecasting declines of 8% or more for 2021. A year ago, 6.5% forecasted declines of 8% or more.

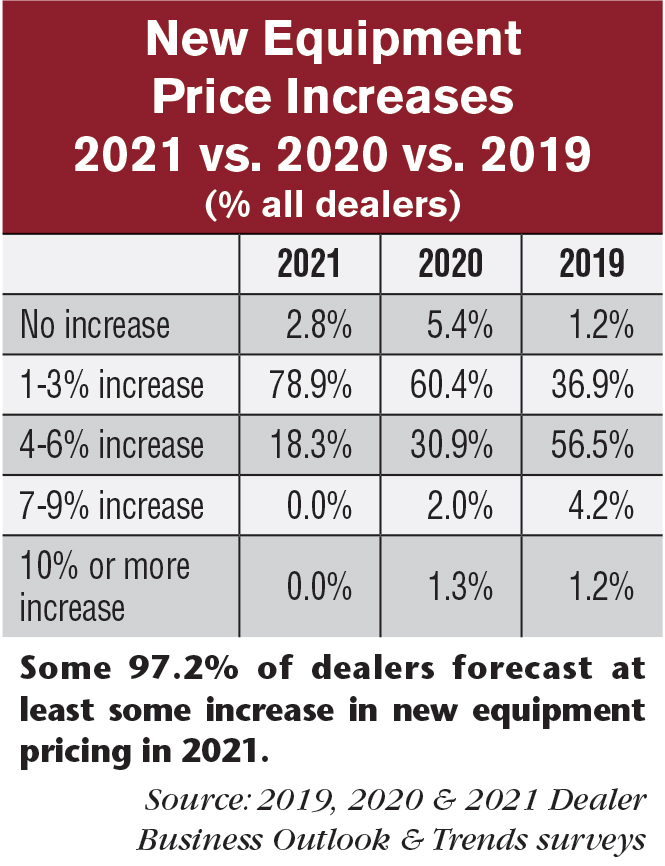

The percentage of dealers forecasting an increase in new equipment prices rose slightly in the most recent survey to 97.2%, compared to 94.6% in the previous survey and 98.8% in the 2019 survey. This year, no dealers forecast 7-9% increases nor 10% or more increases, whereas 2% and 1.3% did last year, respectively. The percentage of dealers forecasting a 4-6% increase in new equipment prices fell from 30.9% in last year’s study to 18.3% this time around.

Most dealers (78.9%) reported increases in the 1-3% range for new 2020 equipment vs. 60.4% last year. Dealers forecasting no increase came in at 2.8%, a little more than half of the 5.4% who forecast no change for 2020.

Dealer Sentiment Up Despite Economic Trouble

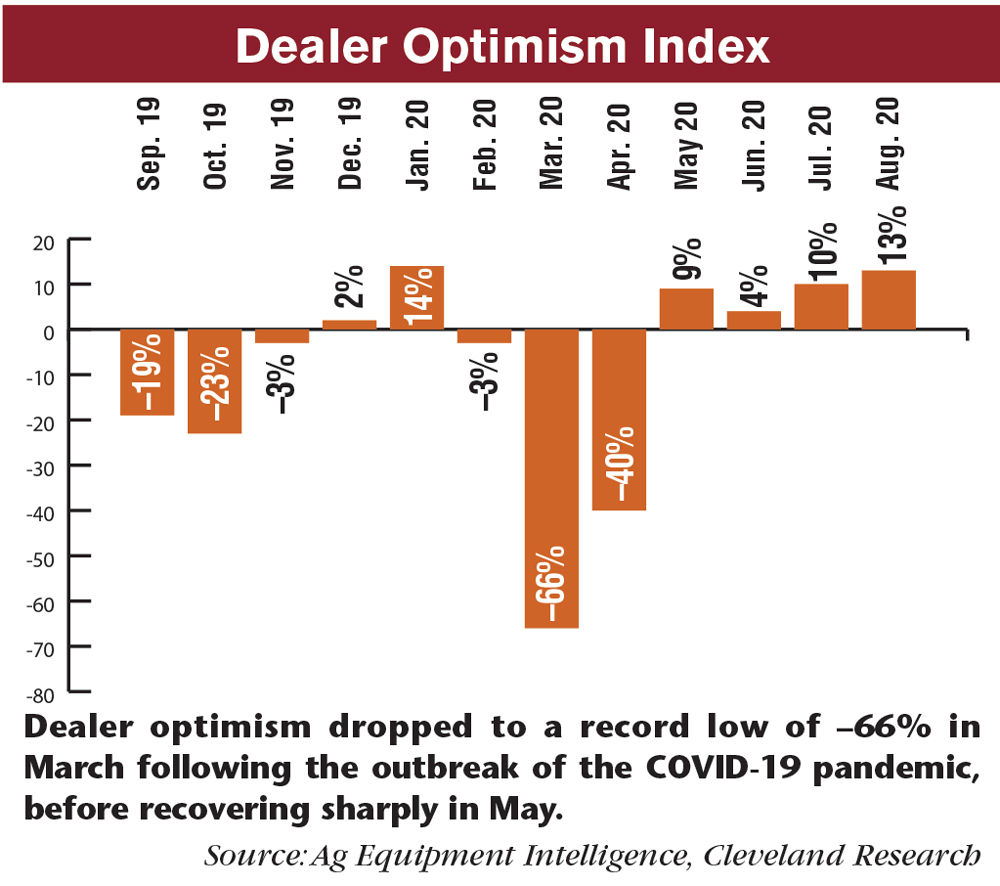

Dealer sentiment bounced back sharply in May from the double-digit decreases seen in March and April as the initial stages of the COVID-19 pandemic hit North America. Ag Equipment Intelligence’s “Dealer Optimism Index,” which measures sentiment among dealers compared to the prior month, came in at +13% (31% more optimistic, 51% the same level of optimism, 18% less optimistic) in the September Dealer Sentiment & Business Conditions Update, the second highest reading the index has seen in the last 12 months.

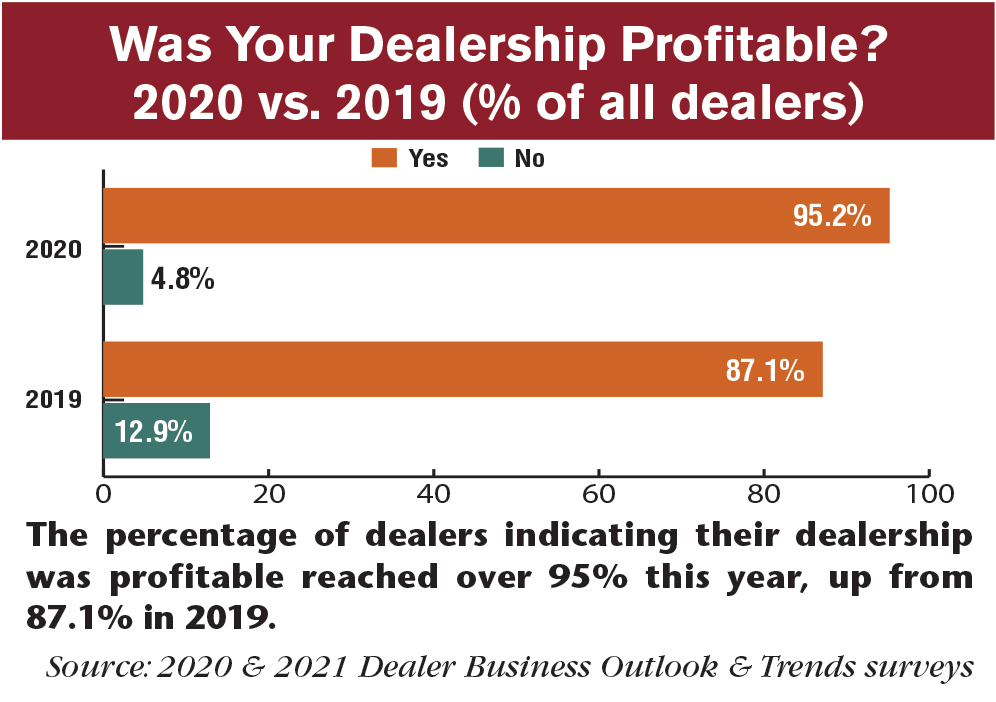

Dealers are not only more optimistic in general, but survey results show they’re particularly confident about their profitability for the year. Results from the 2021 Dealer Business Outlook & Trends survey show nearly all dealers (95.7%) are forecasting their dealership will turn a profit in 2020, an uptick from the 87.1% who estimated they’d be profitable in 2019. This also surpasses the 89% who indicated they’d be profitable in 2018.

The outbreak of the COVID-19 pandemic in March was a sharp blow to the global economy in general, including the health of the ag equipment market. Dealerships and manufacturers were thrust into a limbo of uncertainty, starting with a fight to be deemed “essential” by the FDA, followed by crashing farmer sentiment and falling commodity prices.

Dealer commentary from Ag Equipment Intelligence’s April 2020 Dealer Sentiment & Business Conditions Update sheds light on dealers’ worries in the initial stages of the pandemic. One dealer from the Delta States said, “Coronavirus changed our business immediately. Our customer base is uncertain about the general well-being of the economy and have delayed or stopped purchases.” Another dealer from Canada mentioned manufacturer production halts, saying, “Product availability is concerning. Pre-sold units on order are now being pushed back a minimum of 3 weeks due to plant shutdowns.”

Commodity prices dropped at the start of the pandemic, something one dealer from the Pacific region drew attention to back in April, saying, “Milk and cattle prices are plummeting due to restaurant closures.” Corn prices dropped as well, partly due to a decrease in ethanol demand as gasoline consumption declined amid state-wide “stay at home” orders.

2020 Used Equipment Sales

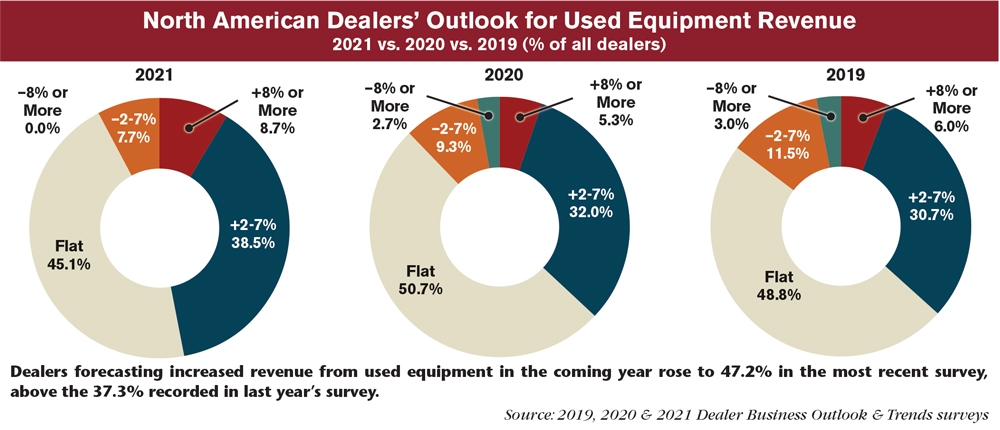

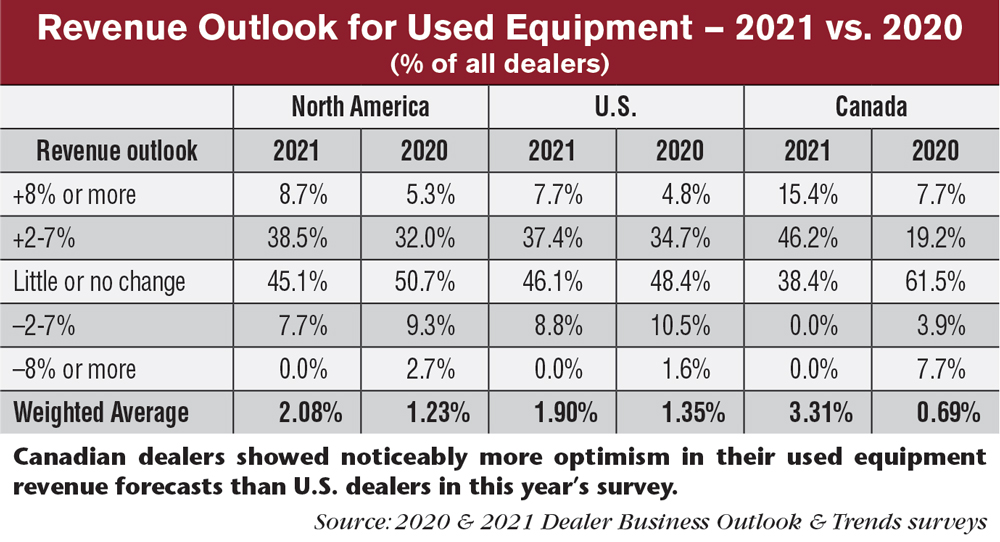

Dealers had a more positive attitude toward used equipment sales than they did new in their forecasts for 2021. Overall, dealers expecting any kind of increase in used equipment revenue for 2021 came in at 47.2%, above the 37.3% who forecast a used equipment revenue increase for 2020. Those forecasting an 8% or more increase rose from 5.3% last year to 8.7% this year, while those forecasting a 2-7% improvement came in at 38.5%, above the 32% recorded last year.

Dealers who don’t see their used equipment revenue changing in the next year came in at 45.1%, below the 50.7% recorded last year and the 48.8% reported in 2018. Negative forecasts also fell, from 12% in the 2020 forecast to 7.7% in the 2021 forecast; this included no dealers forecasting an 8% or more decrease in used equipment revenue for 2021.

Canadian dealers once again showed a strong uptick in sentiment, with 61.6% of them forecasting used equipment revenues up in 2021, more than double the 26.9% who forecast increases for 2020. The percentage of Canadian dealers expecting used equipment revenue up 8% or more next year rose from 7.7% in 2019 to 15.4% in the most recent survey. Canadians expecting used revenue up 2-7% also more than doubled since last year, from 19.2% to 46.2%.

There was also a notable drop in the percentage of Canadian dealers expecting little or no change in used equipment revenue year-over-year, from 61.5% last year to almost 38.4% this year. No dealers this year expect used equipment revenue to be down going into 2021, compared to 11.6% expecting used equipment revenue to be down in 2020.

More U.S. dealers were optimistic about the future of used equipment revenue in the most recent survey than they were last year; some 45.1% expect used equipment revenue up in 2021, compared to 39.5% who expected it up in 2020. U.S. dealers forecasting used revenue up 2-7% rose slightly to 37.4% (vs. 34.7% last year), while those expecting sales to increase 8% or more came in at 7.7% (compared to 4.8% last year).

U.S. dealers expecting little to no change in used revenue dropped slightly from 48.4% last year to 46.1% in this year’s survey. The only U.S. dealers expecting used equipment revenue down in 2021 were the 8.8% who forecast it down 2-7%; last year, 10.5% estimated this decrease for 2020.

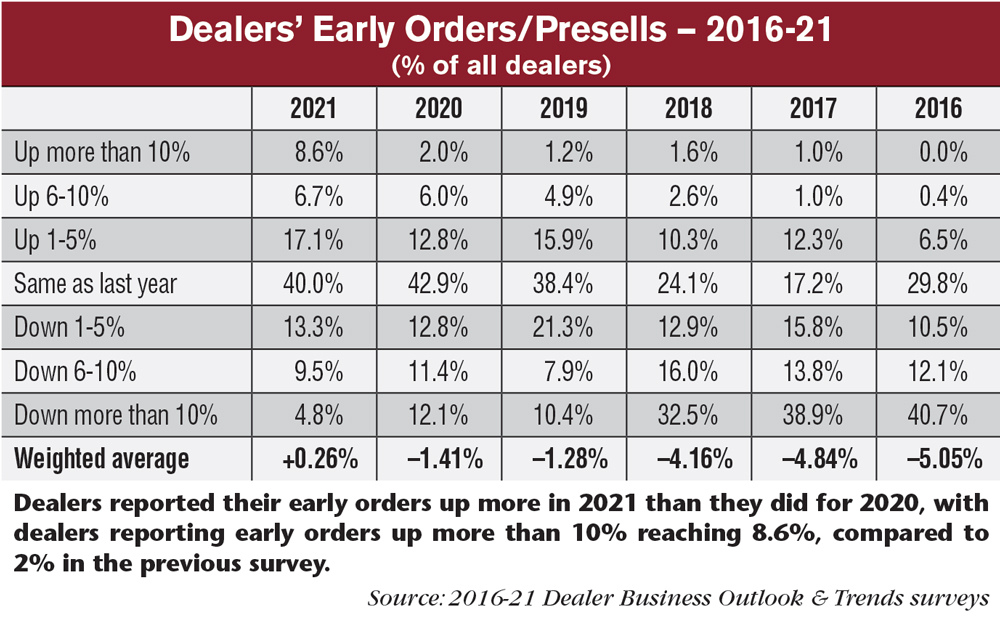

2021 Early Orders Up

Early orders for the coming year were up noticeably compared to last year. In the most recent survey, some 32.4% of North American dealers reported early orders up compared to 20.8% reporting them up last year. This is the highest percentage of dealers reporting early orders up for the coming year that has been seen in the last 5 years.

Dealers reporting little to no change in early orders dropped slightly to 40%, compared to 42.9% last year. North American dealers reporting fewer early orders for the coming year also dropped, coming in at 27.6% vs. 36.3% last year.

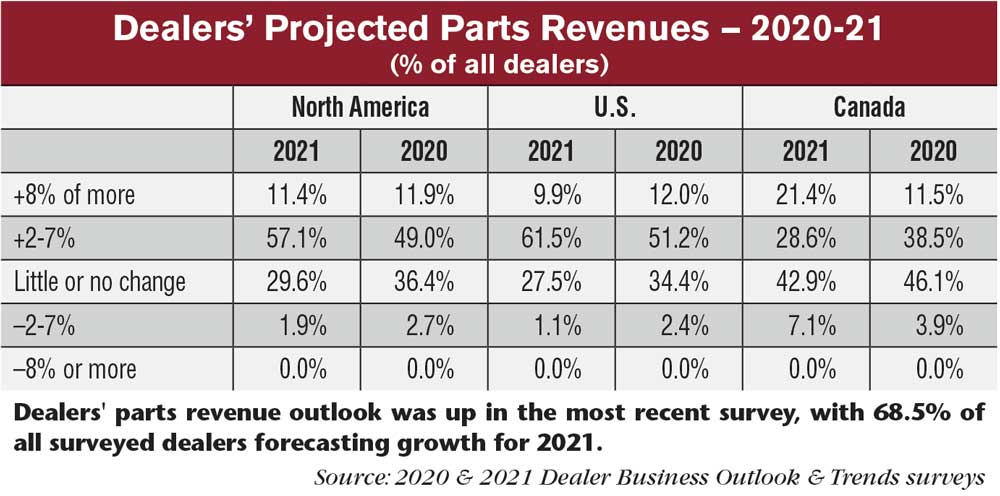

Parts & Service Revenue Forecasts Up

After being added as a question for the first time in last year’s survey, North American dealers in the 2021 Outlook & Trends survey were more optimistic about their parts revenue forecasts than in last year’s survey. Some 68.5% of all surveyed dealers forecast parts revenues up in 2021, compared to 60.9% projecting them to rise in 2020.

Overall U.S. dealers forecasting growth in parts sales rose from 63.2% in last year’s survey to 71.4% in this year’s survey. Canadian dealers’ forecasts were unchanged year-over-year at exactly 50% forecasting growth in parts revenue.

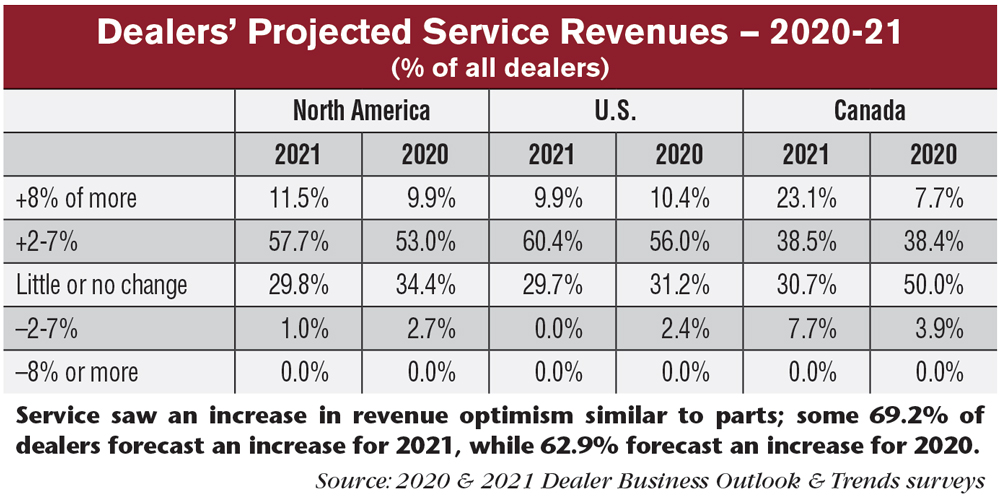

The percentage of dealers who are more optimistic about the potential for gains in service revenue is similar to those for parts sales. Some 69.2% of dealers forecast an increase for 2021, while 62.9% forecast an increase for 2020. U.S. dealers were slightly more optimistic when forecasting their service revenue, with 70.3% estimating it would grow in 2021 compared to 66.4% estimating growth for 2020. Canadian dealers, on the other hand, saw a notably brighter future for their service revenues. Some 61.6% of surveyed Canadian dealers thought service revenues would grow next year, whereas only 46.1% last year thought it would grow for 2020.

Tractor & Combine Sales on the Rise

More dealers are betting on increasing tractor and combine sales for 2021 than they did for 2020 nearly across the board. There was only one instance of decreasing forecasted sales growth: under 40 horsepower tractors, where some 30% of Canadian dealers forecast growth compared to 44.4% in last year’s survey.

Otherwise, optimism was noticeably up compared to last year’s forecasts for 2020. 4WD tractors had the greatest overall increase in optimism, coming in at 46.7% of North American dealers expecting 2% growth or more in 2021, compared to just 26.4% in last year’s survey.

The percentage of U.S. dealers expecting some form of sales growth in the coming year rose in all equipment segments, with the largest being in 4WD tractors (27.8% last year vs. 45.1% this year). The 40-100 horsepower tractor segment showed the smallest increase, rising to 42.7% from 41.6% last year. Combines also saw a similar increase in the percentage of U.S. dealers forecasting sales growth, reaching 23.5% from 22.1% last year.

Aside from the under 40 horsepower tractor segment, Canadian dealers were generous with their optimism on unit sales growth. The most noticeable increase was in the outlook on combine unit sales, which rose from just 10.5% last year to 62.5% in this year’s survey. The smallest increase Canadian dealers forecast was among over 100 horsepower tractors, which still doubled from 19.1% last year to 45.5% in this year’s survey.

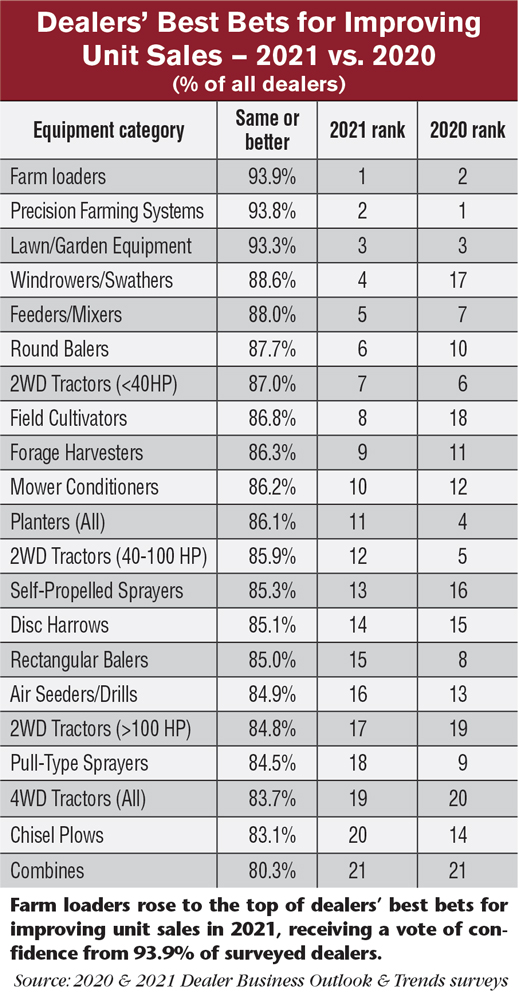

‘Best Bets’ for 2021

Dealers’ best bets for improving unit sales in 2021 showed many top ranking categories maintain their high ranking from last year (see pg. 26). Farm loaders jumped from second last year and became dealers’ #1 category for increasing unit sales next year, with 93.9% indicating unit sales would be the same or better in 2021. Precision farming systems lost its first place slot, becoming dealers’ second best bet for improving unit sales; 93.8% of dealers bet on this category to remain the same or improve unit sales next year. Lawn and garden equipment held on to its spot as dealers’ third best bet, receiving a vote of confidence from 93.3% of surveyed dealers.

There were some notable shifts in ranking from last year’s survey. Windrowers/swathers, which ranked #17 on dealers’ list of best bets last year, jumped all the way to fourth in this year’s survey, receiving optimistic forecasts from 88.6% of dealers. Field cultivators also received a boost in ranking, from #18 last year to #8 this year, receiving positive forecasts from 86.8% of dealers.

Not all changes were positive, however. Tractors in the 40-100 horsepower range, which ranked fifth last year, dropped down to #12 on this year’s list, receiving a vote of confidence from 85.9% of dealers. Rectangular balers dropped from #8 last year to #15 this year, while pull-type sprayers saw the greatest decline: from #9 last year to #18 this year.

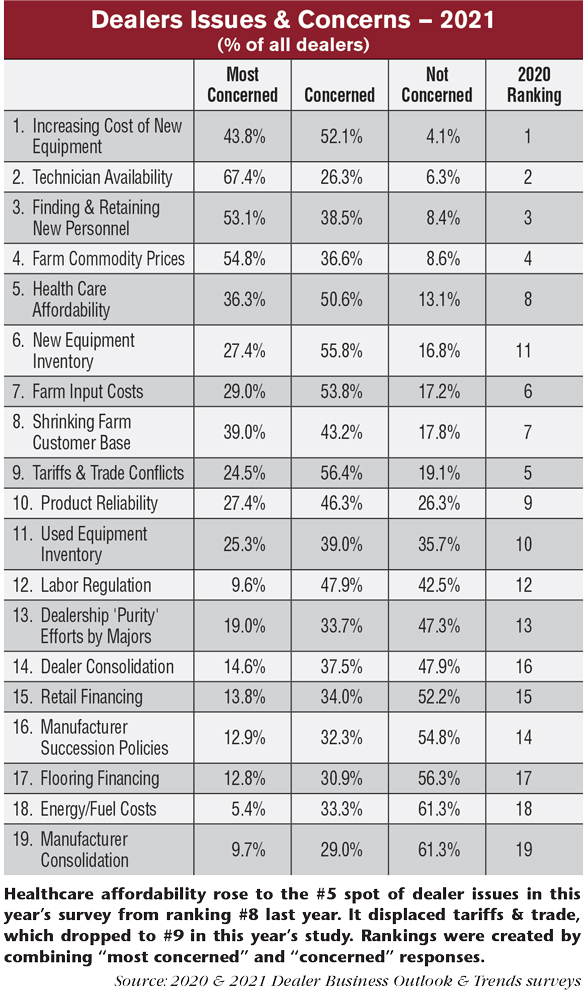

Cost of New Equipment Tops List of Concerns in 2021

Dealer’s top issues and concerns heading into the new year were mostly unchanged from the 2019 survey results. The increasing cost of new equipment maintained its top spot on the list as the #1 concern, as did technician availability at #2, finding and retaining new personnel at #3 and farm commodity prices at #4.

Healthcare affordability rose to the #5 spot this year from #8 last year. It displaced tariffs & trade, which dropped to #9 in this year’s study. New equipment inventory rose from #11 last year to #6 this year, while used equipment inventory remained in the middle of the list, dropping from #10 last year to #11 this year.

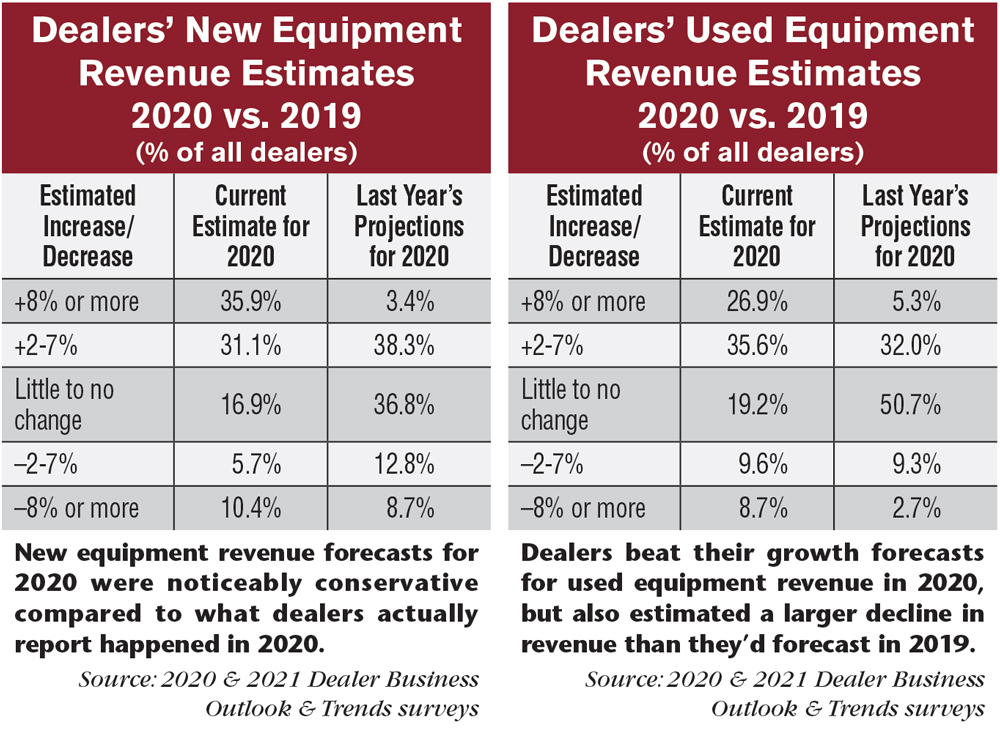

Last Year’s Forecasts for 2020 vs. Current Estimates

Last year, dealers were asked to estimate how they would finish the current year in terms of increased or decreased revenue from new and used wholegoods sales vs. the previous year. They were also asked how they would finish 2019 in terms of gross margins.

When comparing last year’s projections for 2020 with the most recent survey’s estimates for 2020, it shows dealers exceeded their own expectations by a wide margin. New equipment revenue estimates for 2020 show over two-thirds of dealers feel they’ll be up compared to last year, including over one third of them estimating they’ll be up 8% or more in new equipment revenues. This contrasts with last year’s forecast for 2020 when only 41.7% of dealers thought they’d see an increase in new equipment revenue in 2020, and only 3.4% thought it would be by 8% or more.

At the same time, the percentage of dealers expecting to be flat year-over-year in new equipment was more than cut in half (from 36.8% to 16.9%) and the number of dealers expecting losses fell from 21.5% to 16.1%.

Used equipment revenue showed a similar difference between last year’s forecasts and the current estimates. Around one third (37.3%) of dealers in 2019 thought they’d see more revenue from used in 2020, while the most recent survey shows 62.5% estimate they’ll see used revenue growth this year. The largest shift in dealers projecting growth came from those estimating revenues up 8% or more, which went from a 5.3% forecast last year to a 26.9% estimate this year.

The percentage of dealers expecting little or no change in used revenue was also more than cut in half, from 50.7% in last year’s forecasts to 19.2% in the recent estimates for 2020. Dealers expecting used revenue down 2-7% was mostly unchanged (9.3% forecast last year vs. 9.6% actual this year), but those expecting declines of 8% or more rose from 2.7% last year to 8.7% looking back in the recent survey. In total, 12% of dealers last year thought they’d be down in their used revenue in 2020, but 18.3% are now estimating that’s how they’ll finish the year.

Gross margins improvements for 2020 were up slightly compared to those reported in 2019. Some 51% of dealers reported improvements in their new wholegoods margins for 2020, compared to 45% of dealers reporting improvements last year. Used wholegoods margins showed more improvement this year as well but also showed the smallest increase, from 49% improvement last year to 51% this year.

In 2020, 67% of dealers reported better gross margins on parts and 71% said the same for service. This tops the 61% who said the same for parts last year and the 67% who reported better service margins last year.