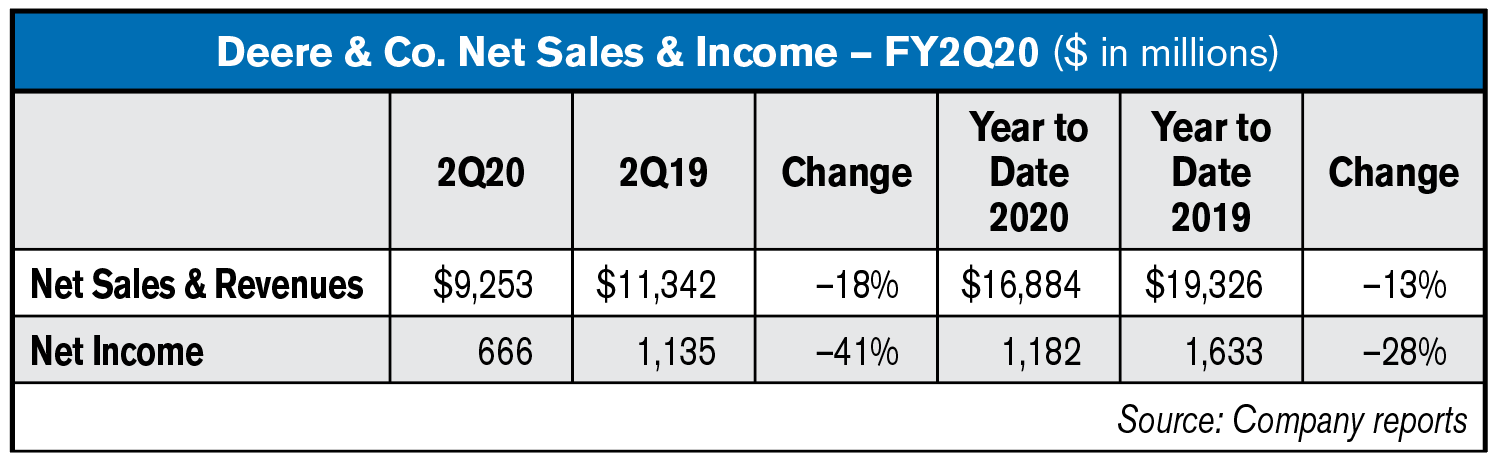

Deere & Company reported net income of $665.8 million for the second quarter ended May 3, 2020, compared with net income of $1.135 billion for the quarter ended April 28, 2019. For the first six months of the year, net income attributable to Deere & Company was $1.182 billion compared with $1.633 billion for the same period last year.

Worldwide net sales and revenues decreased 18%, to $9.3 billion, for the second quarter of 2020 and decreased 13%, to $16.9 billion, for six months. Net sales of the equipment operations were $8.2 billion for the quarter and $14.8 billion for six months, compared with $10.3 billion and $17.2 billion last year.

“John Deere’s foremost priority in confronting the coronavirus crisis has been to safeguard the health and well-being of employees while fulfilling its obligation as an essential business serving customers throughout the world,” said John C. May, chairman and chief executive officer. “We’ve had good success in these areas thanks to the proactive measures we have taken to keep employees safe and our production facilities and parts distribution centers operational. At the same time, the company has reached out to our local communities to help those in need as a result of the pandemic. Deere and its employees have provided generous support to area food banks and other organizations offering assistance during this difficult time.”

Company Outlook & Summary

Net income attributable to Deere & Company is forecast to be in a range of $1.6 billion to $2 billion for the full year. However, many uncertainties remain regarding the effects of the COVID-19 global pandemic that could negatively affect the company's results and financial position in the future.

“I would like to express my appreciation to the thousands of John Deere employees, dealers and suppliers who have worked tirelessly to keep our operations safe and our customers up and running during this challenging period,” May said. “Deere is well-known for developing strong relationships with a range of stakeholders, which prove extremely valuable in difficult times. We remain committed to offering a full suite of advanced digital tools that give our customers unique capabilities and help them do their work more efficiently and profitably. As a result, we’re confident the company will successfully manage the pandemic’s effects and strengthen its position serving customers in the future.”

In the second quarter, the company recorded impairments totaling $114 million pretax and approximately $105 million after-tax related to certain fixed assets, operating lease equipment, and a minority investment in a construction equipment company headquartered in South Africa.

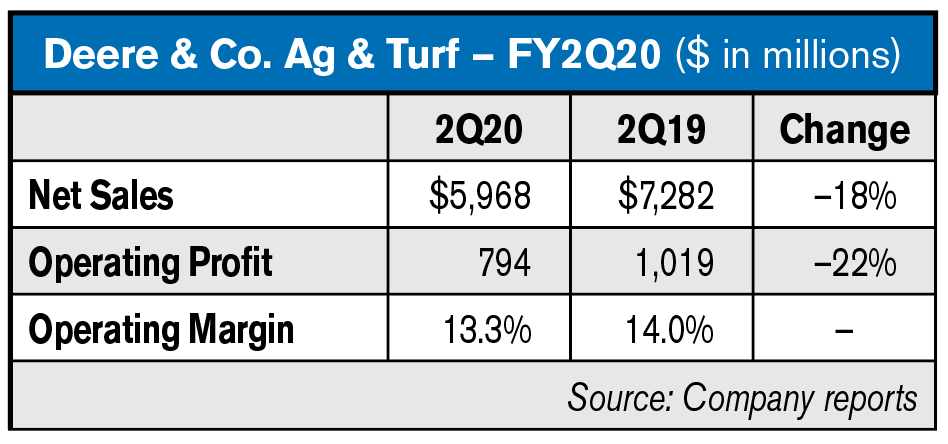

Agriculture & Turf sales decreased for the quarter due to lower shipment volumes and the unfavorable effects of currency translation, partially offset by price realization. Operating profit declined for the second quarter primarily due to lower shipment volumes/sales mix, along with the unfavorable effects of foreign-currency exchange. These factors were partially offset by price realization, lower selling, administrative, and general expenses, reduced production costs and lower research and development expenses.

Deere worldwide sales of agriculture and turf equipment are forecast to decline 10-15% for fiscal year 2020, including a negative currency-translation effect of about 2%. Industry sales of agricultural equipment are expected to be down about 10% from last year for the U.S. and Canada, while sales in Europe are expected to be down 5-10%. South American industry sales of tractors and combines are projected to be down 10-15%. Asian sales are forecast to be down moderately due in large part to the pandemic-related shutdown in India. Industry sales of turf and utility equipment in the U.S. and Canada are expected to be down about 10% for 2020.