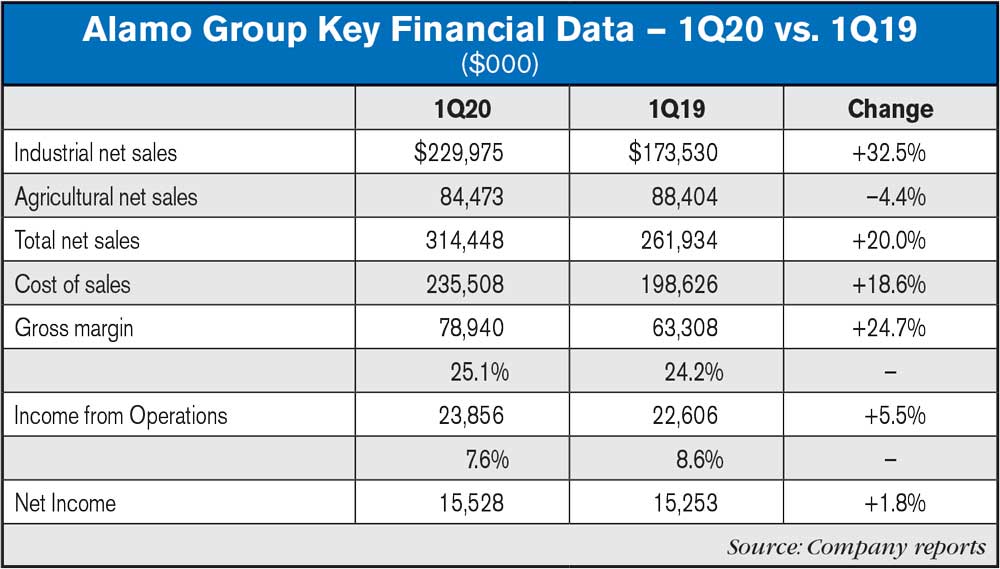

Alamo Group has reported its earnings for the first quarter of 2020. The company reported record net income for the first quarter of 2020 of $15.5 million, up 1.8%. It also reached record net sales for the first quarter of 2020 of $314.4 million, up 20%. The company's Industrial Division had net sales $230 million, up 32.5%, as well as the Agricultural Division reporting net sales $84.5 million, down 4.4%. EBITDA for the first quarter of 2020 was $35.0 million, up 20.9%.

Summary of Quarter

The results for the first quarter of 2020 include the effects of the acquisition of Dutch Power, which was completed in March 2019, and the acquisition of Morbark, completed in October 2019. Together these acquisitions contributed $66.5 million to net sales and $3.5 million to net income in the first quarter of 2020 compared to $3.6 million in net sales and $0.2 million in net income in the first quarter of 2019. The acquisition of Dixie Chopper was completed in September 2019, however its contribution to consolidated results in the quarter was not material. The above results also include the negative effects of non-cash inventory step up charges of approximately $2 million in the first quarter of 2020 related to the Morbark acquisition.

Results by Division

Net sales for Alamo Group's Industrial Division in the first quarter of 2020 were $230 million, an increase of 32.5% compared to net sales of $173.5 million in the first quarter of 2019. The Division's income from operations for the quarter was $18.1 million, compared to $16.9 million in the previous year's first quarter, an increase of 6.9%. The Division's first quarter results included the effects of the acquisitions of Dutch Power and Morbark mentioned previously. These acquisitions contributed $66.5 million to net sales and $4.3 million to income from operations in the first quarter of 2020 compared to $3.6 million in net sales and $0.3 million in income from operations contributed by Dutch Power in the previous year's first quarter. The above results include the negative effects of non-cash inventory step up charges of approximately $2 million mentioned above. The Industrial Division's first quarter sales were up significantly compared to first quarter sales in 2019, primarily due to the addition of these two acquisitions.

Income from operations was up much less because of the impact of COVID-19 issues which began to materially affect the Industrial Division in March. These COVID-19 impacts included the temporary closure of the Division's Rivard operation in France as well as temporary plant closures in Canada and other operational disruptions throughout North America which resulted from a combination of health concerns, government directives, supply chain disruptions and customer delivery restrictions.

The Company's Agricultural Division net sales in the first quarter of 2020 were $84.5 million, compared to net sales of $88.4 million in the first quarter of 2019, a decrease of 4.4%. The Division's income from operations for the quarter was $5.7 million, compared to $5.7 million in the previous year's first quarter, flat on a comparative basis. The Division's first quarter results were showing improvement from the soft agricultural market conditions of the last several years, but this trend turned negative in March as a result of the COVID-19 pandemic. The Division's North American units, which benefited from the contributions of Dixie Chopper held up reasonably well, though the Company's agricultural units in England and France both experienced temporary plant closures in March which caused the decline in the Division's overall results.

Comments on Results

"We believe we will continue to benefit from our relatively healthy backlog and are pleased that orders received in the first quarter were at a decent pace, although they certainly slowed down in March and as we moved into April," said Ron Robinson, Alamo Group's president and CEO. "There were also a few order cancellations but even more customer requests for shipment delays. However, in total, our backlog should allow us to continue to operate at a reasonable, though reduced, pace of production.

"As we have been doing since this situation began, we continue to quickly and appropriately adjust our operations in response to changes in demand while meeting any and all governmental directives. This has included closing plants temporarily as business and health conditions warrant, allowing employees who can work remotely to do so, adjusting our staffing levels through various temporary furlough measures, taking extra care to ensure our workplaces are clean and safe, and a variety of other such actions.

"In general we are pleased that as of today, all of our major facilities are operating at some, though varying, levels of production. Based on Alamo's current level of operation and in accordance with the measures outlined above, out of a total staff of approximately 4,230, at the end of April, about 744 employees were on some form of furlough, temporary layoff, or other excused absences relating to COVID-19. Approximately 35% of these are outside the U.S. In addition, Alamo has nearly 538 members of staff working remotely as of the end of April.

"As a result, we currently believe that with our current staffing availability, inventory levels, supply chain capabilities and orders in hand, Alamo Group is in a position to continue operating at a steady, but reduced level in the second quarter of 2020 assuming there are no further adverse setbacks in the overall coronavirus situation. We estimate sales in the second quarter could be off as much as 10-15% from the levels achieved in the first quarter of 2020, with an even greater impact on profitability.

"However, even if the pandemic outlook starts to improve and manufacturing companies can start to operate in a more normal fashion in the second half of 2020, order bookings will have to improve during the second quarter to ensure we have sufficient orders to maintain economic operating levels. We are pleased that customer inquiries are continuing at a healthy pace, but converting them into backlog will become more critical as the quarter progresses and this will be a key factor in deciding when furloughed employees will be recalled and at what level."

Post a comment

Report Abusive Comment