CALGARY, Alta. – Cervus Equipment Corp. (“Cervus” or the “Company”) today announced its financial results and operational highlights for the year ended Dec. 31, 2017. In addition, the Company announced that its Board of Directors has approved an increase in its March 31, 2018 quarterly dividend from $0.07 to $0.10 per share.

“I am pleased to report the substantial increase in financial performance in 2017, reflecting the collective efforts of our team in serving our customers, backed by our market leading original equipment manufacturers. These results were achieved through strength in our Agriculture segment and reflected in our record new equipment sales in the year. Further, I am proud of the efforts of our Commercial and Industrial team, which generated a $4.1 million increase in income before income tax expense, despite a soft C&I market. Based on this performance, we have increased the quarterly dividend to $0.10 per share,” said Graham Drake, President and CEO of Cervus. “We look to expand on these achievements in 2018, and to this end, we have made structural changes in our Ontario operations. I am confident in the team and their focus on delivering value to our customers’ businesses, while increasing our internal efficiencies as we execute our strategy through 2018.”

Highlights for the Year

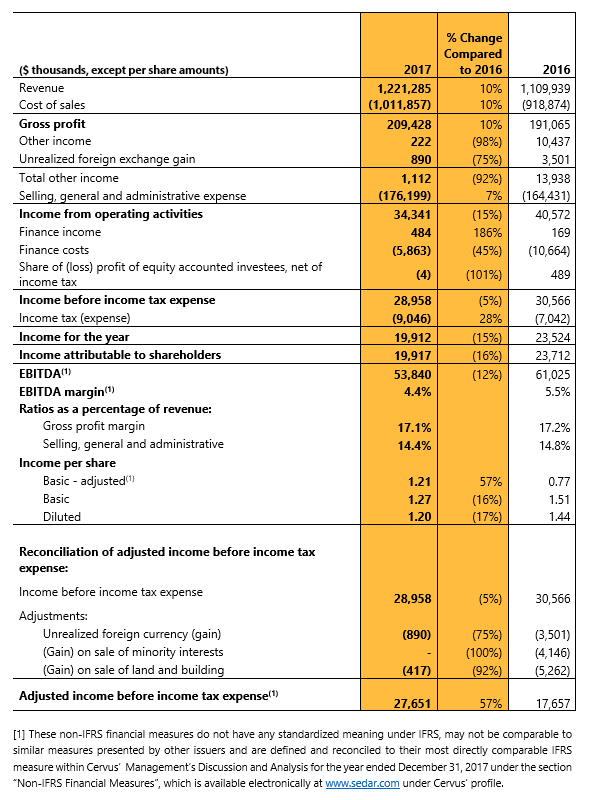

- The Company generated adjusted income1 of $19.0 million for the year ended Dec. 31, 2017 and adjusted basic earnings per share1 of $1.21. For the comparable period in 2016, the Company generated adjusted income of $12.1 million and adjusted basic earnings per share of $0.77.

- The Company generated income of $19.9 million in 2017, compared to income of $23.5 million in 2016.

- The Company generated $1.2 billion of revenue in 2017, a 10% increase over 2016, while reducing selling, general and administrative (“SG&A”) expenses as a percentage of revenue.

- The Company achieved record new equipment sales in the Agriculture segment, increasing 20% over the prior year.

- Parts and service revenue increased across the Company compared to the prior year.

- Interest and depreciation savings facilitated by the sale and leaseback conducted in the fourth quarter of 2016, more than offset incremental lease costs and generated $1.7 million of the increase in income before income tax expense in 2017.

- Dividends of $0.28 per share were declared to shareholders during 2017.

- Since commencement of the Company’s Normal Course Issuer Bid, Cervus has repurchased 240 thousand common shares under the NCIB.

- The Company rose to #33 from #49 on the Alberta Venture’s 2017 Venture 250 ranking.

- The Alberta John Deere dealerships were awarded John Deere’s Leaders Club status for the fourth consecutive year, an award recognizing the top John Deere dealers in Canada.

1 The Company calculates adjusted income as income attributed to shareholders adjusted to exclude the impact of: unrealized foreign currency gains and losses, acquisition and integration costs, gains and losses on the sale of real estate and minority interests. The Company calculates adjusted income before income tax expense as adjusted income, adjusted for any income tax expense or recovery in the period. The Company considers adjusted income and adjusted income before income tax expense as useful metrics in assessing the period to period changes in operating results of the Company’s reportable segments.

2017 Financial Highlights

Adjusted income before income tax expense increased by $10.0 million in 2017, compared to 2016. This was achieved through record equipment sales in the Agricultural segment, operational efficiencies in the C&I segment, partially offset by underperformance of the Ontario transportation dealerships. In the third and fourth quarters of 2017, actions were taken to reorganize Ontario transportation operations toward the objective of profitability in 2018.

Within the Agricultural segment, adjusted income before income tax expense increased $8.2 million, while income before income tax expense increased $1.1 million. This performance reflects the record new agricultural equipment sales achieved in 2017, a 20% increase compared to 2016. The increase in new equipment sales had a positive impact on original equipment manufacturer incentives received in the fourth quarter of 2017. Organic growth in parts and service revenue along with improved gross profit margins also contributed to the financial performance of the year, reflecting a continued focus on efficiently servicing our customers’ growing equipment population.

Within the Transportation segment, adjusted loss before income tax expense increased $3.6 million. A significant factor was the $3.5 million incurred in the year related to reorganization costs and valuation adjustments to the Ontario lease fleet. Loss before income tax expense increased $6.8 million compared to 2016, principally due to the non-recurrence of a $0.5 million gain on sale of real estate in 2016, $3.5 million of reorganization and lease fleet revaluation expenses, and a $2.8 million decrease in unrealized foreign exchange gains in 2017 compared to 2016.

Within the C&I segment, adjusted income before income tax expense increased $5.4 million, while income before income tax expense increased $4.1 million. An 11% increase in revenue reflected improving market sentiment, while internal efficiencies delivered increased gross profit margins. Further, a year over year reduction in SG&A expenses was achieved in the segment, demonstrating the benefits of cost structure decisions made in 2015 and 2016.

Selected Financial Information

Quarterly Dividend Increase

Cervus’ Board of Directors has approved a cash dividend to Cervus shareholders of $0.10 per share for the first quarter of 2018. Payment will be made on or about April 16, 2018 to shareholders of record as of the close of business on March 30, 2018.

This is an increase from the previous quarterly dividend of $0.07 per share. Investors are cautioned that quarterly dividends are always subject to approval from the board of directors of Cervus, and may be increased, decreased or suspended by the board at anytime.