Pictured Above: John Deere’s all-electric 6R prototype tractor swaps the diesel engine for a pair of 150 kW electric motors and a 130 kilowatt-hour lithium-ion battery pack to produce 402 horsepower. Although draft performance of the electric tractor is equivalent to its diesel counterpart, current battery technology limits fieldwork to 4 hours between charges or ready access to charging infrastructure and swap-out battery packs.

For 50 years diesel power has ruled the roost on the world’s farms, providing fuel-efficient, rugged power plants that operate dependably at nearly full power throughout seasons of use.

Driven largely by clean air concerns, however, today’s diesels have taken on added weight, girth, complexity and expense as regulators on both sides of the Atlantic mandate ever-tighter exhaust emission rules. Those mandates first drove billions of dollars into a massive overhaul of diesel fuel formulations in Europe and the U.S. to limit sulfur content to under 15 ppm. The cleaner fuel was necessary to launch the on-going series of phased-in emission controls on the engines themselves to remove sulfur-dioxide and particulate matter from the exhaust stream.

Today, that quest for even cleaner exhaust air continues, with 5th generation mandates being implemented in Europe in 2019 to further limit CO2 and nitrous oxide and other so-called “greenhouse gasses.”

Throughout, OEMs have rallied to meet the government mandates and continue to plan for further tightening of limits on what can exit the stack of a diesel. Still, the escalating cost of eliminating ever-smaller amounts of exhaust stream impurities to comply with regulations, plus political pressure in Britain and France for an outright ban on diesel engines for highway use, has engine builders eager to explore alternatives.

Enter engines that burn natural gas (both compressed and liquefied), electric drives (both hybrid and battery power), spark-ignited gasoline engines, exotic automotive designs that combine both compression-ignition and spark-ignition, and one 2-Stroke diesel that uses opposed pistons and two crankshafts.

A Move to Electricity?

History shows regulations that affect commercial transportation and the automotive industry ultimately have an impact on agricultural equipment. Clean air standards are no exception.

Navigant Research reports bus and truck builders worldwide see a move to electric drives by 2030 that will make them the second most popular powertrain in medium and heavy duty commercial vehicles — surpassing those using alternative fuels.

In its recent Transportation Forecast: Medium and Heavy Duty Vehicles, the research firm says advances in electric drives in the automotive industry are encouraging commercial adoption of electricity as a prime mover. “While electric powertrains are expected to remain under 25% of total truck and bus sales, electric drive vehicles are finally reaping the benefits of significant investments made for their use in automobiles,” says Lisa Jerram, Navigant research analyst.

Most markets for electric drive vehicles remain in a trial or early adoption phase of plug-in electric trucks and buses, but cost reduction and improvements in battery technology are increasing interest from fleets and municipalities, she adds.

Navigant says alternative fuel applications such as natural gas (CNG and LNG) and propane are still expected to outsell electric drive powertrains through 2035, but electric drive options will have much higher growth rates — even excluding China with its dominate share of electric drive commercial vehicles.

An American Prototype

John Deere’s SESAM tractor (Sustainable Energy Supply for Agricultural Machinery) unveiled in 2016 gives a glimpse of how electric-drive technology might appear in the farm field.

The prototype tractor is powered with a 130 kilowatt-hour (approx. 175 horsepower) lithium-ion battery pack and is based on Deere’s 6R platform. The 6R’s diesel engine has been replaced with a pair of 150 kW (approx. 200 horsepower) electric motors generating a total 402 horsepower running torque through a mechanical transmission. Power from the motors can be dedicated to drive the tractor, to the PTO shaft, or split with each motor taking on a separate duty.

Published reports indicate the battery life of the prototype under field conditions is about 4 hours with a 3 hour recharge period, meaning the current machine (with today’s battery technology) would require several power packs and on-farm charging infrastructure to operate continuously.

Deere officials say they retained a mechanical transmission for torque-to-wheel distribution to avoid the cost of an electrical transmission for high power.

In North Dakota, Autonomous Tractor Corporation (ATC) took an alternate route from the mechanical gear train Deere installed in the SESAM. CEO Kraig Schulz says ATC’s current work on driverless farm equipment led his company to develop its eDrive system that uses proprietary electric wheel motors and an electronic torque controller.

“Much of today’s electric drive technology didn’t really work because of high starting torque needed,” he explains. “Tractors use their transmissions to basically transfer all their horsepower to the ground at 0 rpm wheel speed, and the industry didn’t have an electric motor drive system to do that.”

ATC’s eDrive system replaces a tractor’s differential and axles with 4 simple motors powered by a 400 horsepower diesel-electric power plant (think railroad locomotive), and provides 20-30% better fuel efficiency, simplified repair and quieter operation than an equivalent diesel-powered tractor using a mechanical transmission.

Improved efficiency in diesel-electric power stems from matching a generator with a consistent speed, fuel efficient engine.

Manufacturers explain that a smaller tractor, such as a 125 horsepower model, may only use full engine power 20-25% of the time. The same tractor usually operates at minimum load 30-40% of the time including idling. This allows a smaller engine to be used to drive a generator which charges large battery packs during low load cycles with energy that can be drawn upon when the tractor is required to perform high load duties. During idling, the diesel engine can be stopped while auxiliary systems continue to be powered by batteries — reducing fuel consumption and emissions.

A number of manufacturers including Deere, AGCO, Caterpillar and Belarus have demonstrated various prototypes of diesel-electric farm equipment over the last decade.

Meanwhile, the race is on by major global equipment manufacturers — many with indirect ties to agricultural equipment — to develop or buy electric power expertise and technology with a flurry of acquisitions announced over the past year.

Cummins Inc. is acquiring Europe’s Brammo Inc., which designs and develops battery packs for mobile and stationary applications. “To be a leading provider of electrified power systems, just as we are with diesel and natural gas driven powertrains, we must own key elements and subsystems of the electrification work,” says Cummins CEO Tom Linebarger. “When the markets are ready, Cummins will bring our customers the right power solution at the right time.” The company recently introduced the Aeos all-electric truck in the EU.

In Germany, engine maker Deutz has its eye on electric and hybrid drive systems for agricultural applications and bought Torqeedo GmbH, a leading German manufacturer of electric propulsion equipment for leisure and commercial boats.

Deutz Chairman Frank Hiller says buying the company launches the E-Deutz strategy and will enhance Deutz electrification knowledge and the introduction of new products quicker than starting from scratch. Torqeedo has extensive experience with electric motors, battery management, power electronics and system integration.

Royal Dutch Shell, already a player in developing liquefied natural gas vehicles and fueling infrastructure in selected markets around the world, recently purchased NewMotion, the owner of one of Europe’s largest electric vehicle charging networks. The acquisition is Shell’s first venture into electric mobility.

AxleTech International of Troy, Mich., is entering a partnership with TM4, Coucherville, Que., to develop integrated electric axles for heavy duty vehicles used in transportation and off-highway applications.

California’s Efficient Drivetrains Inc., manufacturer of hybrid and electric drivetrain systems and components has announced it will be collaborating with Master Transportation, a bus manufacturer in Taiwan. Lightning Systems of Loveland, Colo., is unveiling a full electric drive system for Ford Transit passenger wagons and vans it has developed in partnership with New Eagle.

And, Ford is entering a $750 million joint venture with Chinese automaker Anhui Zotye to build battery powered cars for sale in China, the world’s largest market for electric cars. The move comes in the wake of announcements by Ford that it plans to offer electric versions of 70% of its models sold in China by 2025.

Daimler AG’s Mercedes Benz also makes an electric car with a Chinese partner, and General Motors, Volvo and Volkswagen AG have announced or are exploring similar ventures.

Internal Combustion Resilience

While electric and variations of hybrid-electric power will likely make inroads against the piston and crankshaft crowd over the next several decades, the internal combustion engine is far from retirement age — particularly with the recent emergence of the U.S. as a major producer and exporter of natural gas.

Advanced drilling techniques have unearthed vast quantities of clean burning natural gas, which encourages continued use of existing fuel infrastructure along with spark-ignited engine technology. The combination allows OEMs to meet stringent emission controls with much simpler pollution control equipment than is required by diesel technology.

CNH Industrial has fielded more than 30,000 natural gas engines running on CNG and LNG since entering the market more than 20 years ago. Throughout Europe nearly 22,000 natural gas powered trucks and buses operate with IVECO engines produced by FPT Industrial, CNH’s powertrain brand.

New Holland’s biomethane-powered concept tractor builds on CNH Industrial’s 2 decades of experience in producing spark-ignited natural gas burning engines. The 180 horsepower machine is designed to use compressed biomethane produced from farm residues and wastes for extremely low overall emission levels.

An offshoot of that technology spawned New Holland’s recent biomethane powered concept tractor designed to operate in a “closed loop” cycle that powers tractors with energy produced on a farmer’s own land using waste products.

The tractor sports a 180 horsepower FPT Industrial spark-ignited engine that produces maximum torque identical to an equivalent diesel power plant and better fuel economy. If powered by farm-grown energy crops, crop residue and other waste products used to make biomethane, the resulting fuel has virtually no CO2 profile and delivers an 80% reduction in overall emissions.

The tractor features a front mounted fuel storage structure and a pair of similar internally mounted tanks to provide a full day of farm work autonomy and can be refilled as easily and quickly as its diesel powered counterparts. The machine also can be powered with traditional CNG.

In late 2017, FTP Industrial also unveiled its Cursor 13 NG engine, a 460 horsepower 6 cylinder engine capable of burning CNG or LNG and benchmarked against a similarly sized diesel.

FPT Industrial recently introduced its 2018 line of spark-ignited engines capable of burning CNG or LNG and designed to perform comparably to like-size diesel engines. The latest of the new line is the Cursor 13 NG, a 460 horsepower, 6 cylinder model.

“To make natural gas appealing we needed to provide performance, ability and total cost of ownership equivalent or better than diesel,” explains Pierpaolo Biffali, FPT head of product engineering.

Biffali says the spark ignition engine relies on a single fuel technology, reducing the number of tanks required and uses only one emission technology, a 3-way catalyst. “That single emission system is much better than the four required by diesels. That translates into compactness, lightness and overall reductions in complexity,” he says.

IVECO, the commercial vehicles brand of CNH Industrial, is busy filling orders for its Stralis NP (Natural Power) engine designed to run on LNG in a deal with Jost Group, a pan-European transport and logistics company. The agreement calls for a fleet of 500 Stralis NP trucks with the first 150 vehicles entering operation in 2018. The order will replace 4-5 year old, pre-Euro VI diesel powered vehicles in the company’s fleet of 1,400 trucks.

CNH says the Stralis NP running on LNG emits 10% fewer CO2 emissions than a comparably sized diesel powered engine, and up to 95% lower when fueled with biomethane.

Meanwhile, the German Ministry of Transport and Digital Infrastructure has identified LNG as the best solution for long distance road transport over the next 10-15 years, a testament to the rapidly growing demand for LNG on the Continent.

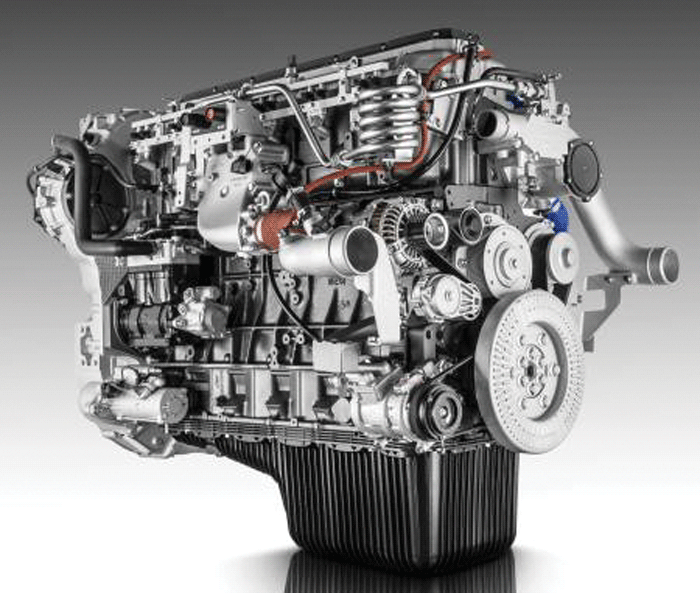

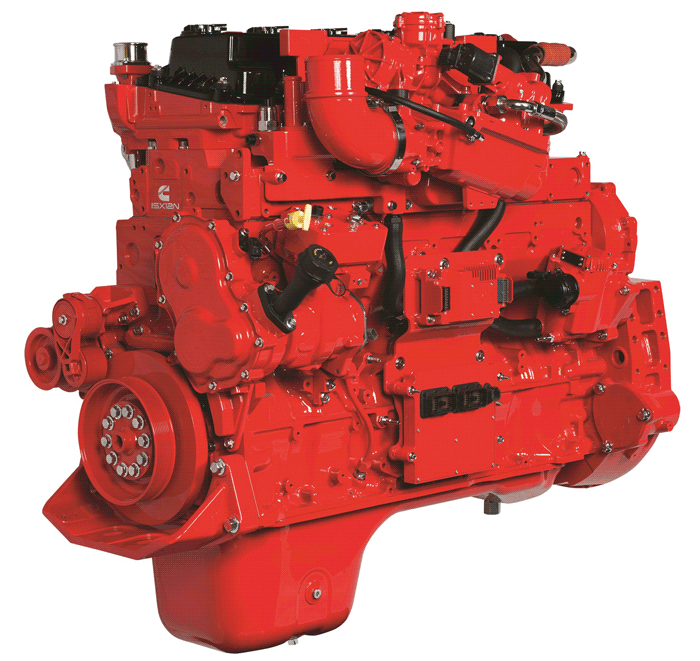

Cummins Westport’s 2018 lineup of spark-ignited natural gas engines include models from 6.7 liter to its newest 12 liter ISX12N. The California company is a leading supplier of truck and bus engines.

Another OEM seeking relief from the expense of “global diesel red tape” is Kubota. The Japanese manufacturer recently introduced the WG line of spark-ignited engines based on the same block architecture as the company’s 0.74-3.8 liter diesel engines.

The engines are capable of operating on gasoline, CNG or propane for nearly identical power output as the diesels they can replace. Kubota designed the WG line as a “drop-in” replacement for the counterpart diesels.

Likewise, Cummins Westport continues to shine in the high power, low emission truck and bus category with its spark-ignited natural gas engines ranging from 6.7-12 liters for 2018.

Exotic Designs

Clearly, alternative fuels such as CNG, LNG and biomethane offer clean burning power from traditional spark-ignited engines and are readily available when market and political conditions signal their need and economy. Still, some manufacturers are unveiling imaginative upgrades of existing engine technology for emission compliance and more power from smaller packages with both gasoline and diesel fuel.

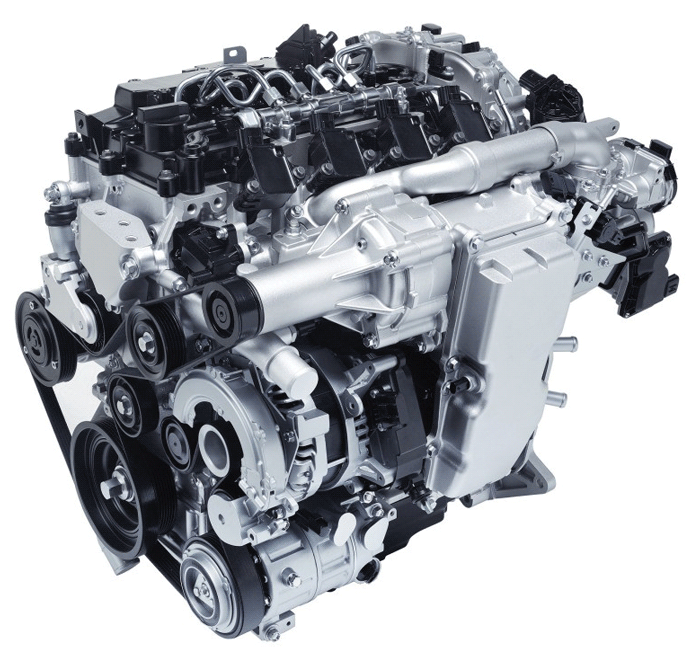

For instance, Mazda, Japan’s smallest automaker, plans to equip some of its 2019 vehicles with its SkyActiv-X gasoline engine that combines both compression ignition of diesel fame and spark-ignition in what it calls Spark Controlled Compression Ignition.

Mazda’s new for 2019 SkyActiv-X engine combines diesel-like compression ignition with computer controlled high pressure direct fuel injection and spark ignition to boost power and cut emissions. The innovative engineering is sure to be noticed by engine OEM’s around the world.

The computer laden SkyActiv-X engine is the third iteration of Mazda’s SkyActiv power plant series and boasts a 20-30% boost in fuel economy over earlier similar size models. Pollution control comes from a proven, off-the-shelf, catalytic system.

Car and Driver reports say the new 2.0 liter engine produces 190 horsepower and 207 foot-pounds of torque compared with 155 horsepower and 150 foot-pounds. of torque for the previous model.

So is it a gasoline fueled diesel? No. Although at times it does operate solely with compression ignition, throughout much of its duty cycle it will use a spark plug to eliminate noisy and destructive pre-ignition “knock.”

Performance improvements for the “X” engine stem from improved air flow through a super charged intake that is boosted not so much for power but for a dependable air supply across a wide range of engine speeds. Also, bumping the compression ratio to 16:1 and adding a high pressure direct fuel-injection system that continually monitors in-cylinder conditions allows Mazda to vary the fuel mixture within the cylinder with each stroke.

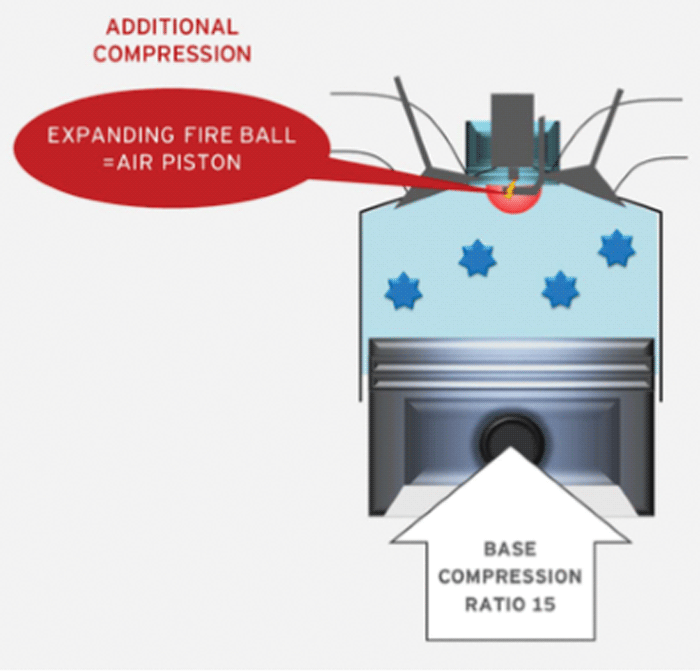

Taking cues from proprietary software, Mazda’s SkyActiv-X engine uses an ultra-lean gasoline/air fuel mixture compressed 16:1 and ignited by an accurately timed fuel injection and spark. The spark-ignited fireball in the top of the cylinder acts as a “virtual piston” and further compresses the lean fuel/air mixture in the cylinder for a controlled compression ignition event.

On intake, the “X” engine cylinder is charged with a cyclonic swirl of an ultra-lean gasoline/air mixture (too lean to ignite by mechanical compression heat alone). As the piston moves upward in compression, Mazda uses a high-pressure injector to accurately time a localized enriched fuel mixture into the “eye” of the swirling super-lean cylinder charge. The spark plug then lights the second charge which creates a fireball that acts as a “virtual piston” moving downward to further compress the lean mixture below, triggering complete ignition of the cylinder charge. The result is no pre-ignition “knock,” extremely efficient fuel combustion, lower emissions because of effective use of EGR to lower cylinder temperatures and most importantly — more power.

Mazda says the engine’s impressive fuel economy is apparent across a wide rpm and load range, uncoupling fuel efficiency from engine speed. Such characteristics likely could allow simpler transmissions since higher engine speeds don’t necessarily equate to reduced fuel economy.

Mazda’s 2019 use of the “X” engine will certainly be in commuter cars and limited to overall highway use, but engineers in the U.S. and Europe are taking note of company’s blending of diesel technology with that of 4 stroke spark ignition engines. Lessons learned with this engine could conceivably find their way into heavy equipment of the future.

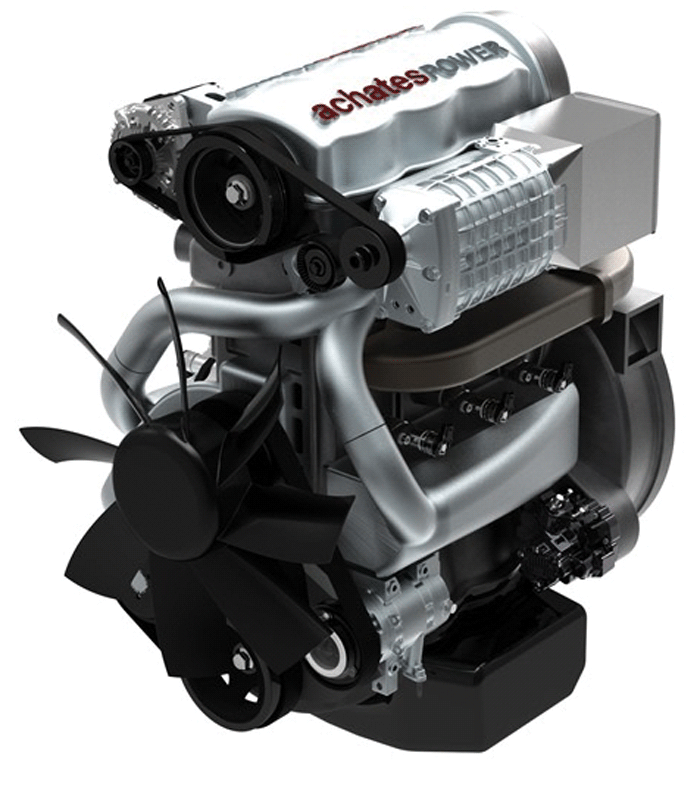

California’s Achates Power has revived a 1930s German aircraft engine design that uses opposed pistons in a long cylinder driving two crankshafts. The 2 stroke diesel gains thermal efficiency and power-to-weight advantages by eliminating a mechanical valve train and a heavy cylinder head.

2-Stroke Diesel

Another interesting engine design currently being developed by Achates Power and Cummins is a 2 stroke diesel engine that uses opposed pistons in a long cylinder and two crankshafts. During the 1930s German engineers produced a number of compact, efficient Junkers Jumo diesel engines of this design for powering cargo aircraft, some of which successfully flew regular 5,000 mile mail routes between Germany and Brazil. After World War II, however, the rapid development of jet engines eclipsed interest in the opposed-piston aircraft engine.

Although the proven design involves two crankshafts, it eliminates a heavy cylinder head and complicated valve train to gain power-to-weight and thermal efficiency. Those attributes have driven California’s Achates Power to continue development of the non-traditional engine over the past 14 years.

Achates officials are currently working with Cummins on a 3.0 liter 3 cylinder version of the opposed piston engine as a possible power plant for future U.S. combat vehicles.

David Johnson, CEO of Achates, says work on the “Advanced Combat Engine” under a $47.4 million contract through the National Advanced Mobility Consortium could provide a test bed for transportation and industrial engines of the future. Johnson says while the current models of the Achates engine are diesel-powered, developers are confident they can configure the compression-ignited engine to use gasoline to meet current and future emission standards despite their “two-stroke” design.

Future Power: A Mixed Bag

Current electric drive research and further innovation with various internal-combustion engine designs and digital controls are sure signs mid-Century farming will be done with a variety of power sources.

While electric (battery-dependent) alternatives continue to rely on a power grid not designed for widespread vehicular use, improvements to the infrastructure are occurring, as well as rapid development of more efficient battery technology. Those factors, and the “no emissions while in use” argument for battery-powered equipment, likely will continue to be selling points for moving away from internal combustion power plants, but the changes will come gradually.

The ready access to an infrastructure that currently supplies liquid and natural gas fuels to end users on a day-to-day basis will provide strong impetus for continued use of fossil fuels in farm equipment — particularly because of the need for remote autonomy of tractors and harvesters. Also, as OEM’s turn their attention back to spark-ignited engines, which are being shown capable of competing with diesels in performance, they likely will readily adopt these power plants and their significantly less complex pollution control systems.

Given the abundance of fossil fuel alternatives and infrastructure, it’s likely the ultimate mix of electric and fossil fuel power on the farm will be shaped by political decisions and not insurmountable engineering challenges.

When Will Artificial Intelligence Become A Natural Ingredient In Ag Equipment?Universal Data Exchange Platform Offers Broad Potential for Mixing & Matching Ag SystemsWhat is Driving the Driverless Momentum in the Ag Equipment Industry?Is Diesel’s Half-Century Farm Reign Ebbing?Your Dealership Could Soon Be Printing 3-D Parts