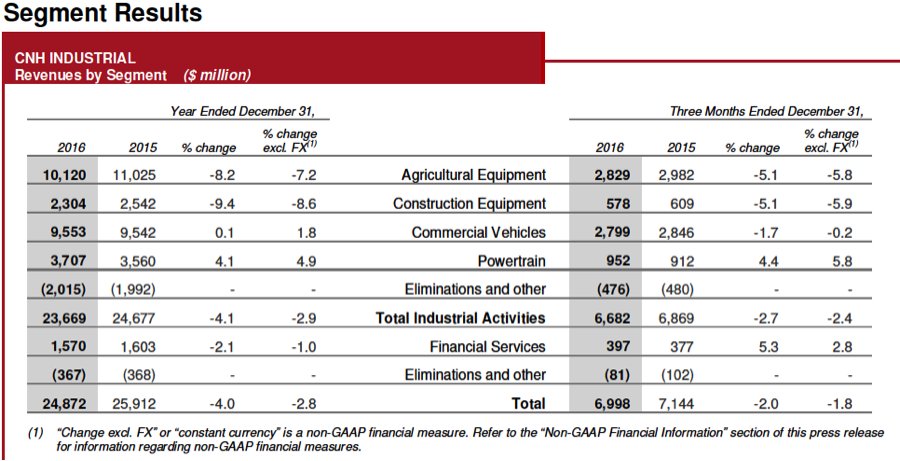

CNH Industrial N.V. (NYSE:CNHI / MI:CNHI) today announced consolidated revenues of $24,872 million for the full year 2016, down 4% compared to 2015. Net sales of Industrial Activities were $23,669 million for the year, down 4.1% compared to 2015.

In the fourth quarter of 2016, consolidated revenues were $6,998 million, down 2% compared to the fourth quarter of 2015. Net sales of Industrial Activities were $6,682 million for the fourth quarter of 2016, down 2.7% compared to the fourth quarter of 2015.

Reported net loss was $249 million for the full year 2016.

Operating profit of Industrial Activities was $1,291 million for the full year 2016 ($1,432 million in 2015), with an operating margin of 5.5% (5.8% in 2015). In the fourth quarter of 2016, operating profit of Industrial Activities was $412 million, compared to $563 million for the fourth quarter of 2015, with an operating margin of 6.2% (8.2% for the fourth quarter of 2015).

“While the Agricultural Equipment market remained at historically low demand levels in 2016, our margin performance was in line with our expectations and we made significant progress on further reducing channel inventory,” said Richard Tobin, chief executive officer of CNH Industrial.

“The Commercial Vehicles segment continues to improve in profitability and market share in the EMEA region. While the LATAM market was generally challenging for all segments, we are starting to see signs of recovery there, especially in the Agricultural Equipment segment with shipments up 30% in the fourth quarter of 2016 compared to the fourth quarter of 2015. In addition to solid operating execution, we were able to significantly over-achieve on our net industrial debt target for the year and to reduce our future interest costs through two capital markets transactions, both of which further our efforts to achieve an investment grade credit rating.”

Agricultural Segment

Agricultural equipment’s net sales decreased 8.2% for the full year 2016 compared to 2015 (down 7.2% on a constant currency basis), primarily as a result of unfavorable industry volume and product mix in the row-crop sector in NAFTA, and in the small grain sector in EMEA. Net sales increased in LATAM, mainly due to improvement in the Brazilian market and the positive impact of currency translation, and were flat in APAC. In the fourth quarter of 2016, Agricultural Equipment’s net sales decreased 5.1% compared to the fourth quarter of 2015 (down 5.8% on a constant currency basis).

Full year 2016 operating profit was $818 million, a $134 million decrease compared to 2015, mainly due to lower volume and unfavorable product mix in NAFTA and EMEA, partially offset by favorable price realization and cost containment actions, including lower material cost. Operating margin was 8.1% (down 0.5 p.p. compared to 2015). In the fourth quarter of 2016, operating profit was $272 million ($348 million in the fourth quarter of 2015). Operating margin decreased 2.1 p.p. to 9.6%.

2017 Outlook

In an effort to drive incremental structural improvements to its cost base, the Company intends to undertake several restructuring actions during 2017 as part of its Efficiency Program. The estimated 2017 expense of approximately $100 million will result in incremental savings of approximately $60 million in 2017, included in the adjusted diluted EPS guidance below, and $80 million on an annualized basis.

CNH Industrial is setting its 2017 guidance(1) as follows:

- Net sales of Industrial Activities between $23 billion and $24 billion;

- Adjusted diluted EPS(2) between $0.39 and $0.41

- Net industrial debt at the end of 2017 between $1.4 billion and $1.6 billion.