Marty Buck, the CFO for Kern Machinery and the other Camp family entities (based in Bakersfield, Calif.), explained to Farm Equipment some of the differences in financial management responsibilities as dealerships grow in scale. He joined Kern 7 years ago, after previously leading financial departments at Unisys and Bolthouse Farms.

Most businesses in the farm equipment industry are financially managed by comptrollers, which he says is a different function than the CFO. “The comptroller’s purpose is to manage the general ledger, to tie things out and to pass the audits. A CFO is a much larger role — it’s a much broader and strategic-type thinking.”

The need for a CFO, he says, is predicated on the strategy of the company.

“For the owner of a small dealership, a comptroller may be all they need. But if they are going to be in a strategy of growing beyond their ability to manage in person, they’ll need to go to a management of processes and one based on a continuum of controls. They’ll have to manage differently. That’s when they should start thinking about a CFO.”

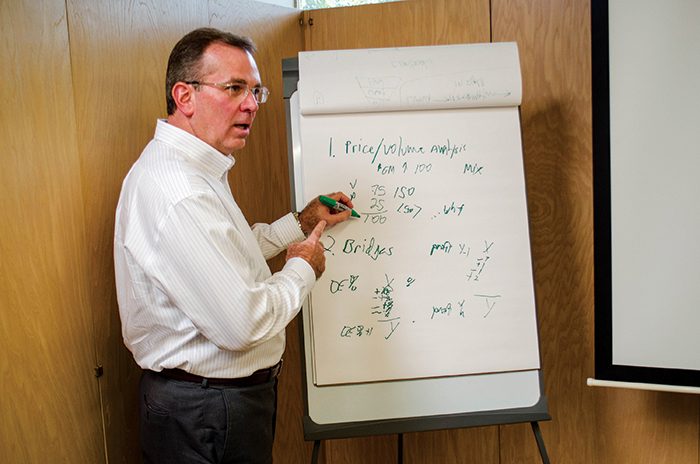

Marty Buck, CFO of Kern Machinery in Bakersfield, Calif., gives an overview of his definition of what a CFO is and the position's role in the larger organization. This video is part of the Dealership Minds Video Series, brought to you by Charter Software.

He says, “When you’re a principal running a business with a footprint when you can be in the store every day and you know every single person, well, that whole process breaks down when you take that to 2-3 times more stores.”

The questions that principal needs to ask are whether he/she can manage in a completely different way, Buck says. Their strengths may be person-to-person instead of head-down into the financial reports and diagnosing the business from those financial reports. As a business grows, the old question of how much money is in the bank is no longer adequate.

So at some point to grow, that principal has to say ‘I’m willing to relinquish that absolute power I’ve always had in favor of managing by processes so that we can be bigger,’ he says. “It’s easy to say, but not easy to do, particularly when you’ve been successful in the past. You have to let go of what you used to have to be able to move over and grab what you’re going to have. If you can’t cross that divide, then you’ve got to hire a professional manager who can, and be smart enough to know that you need to do that. Not everybody can do that.

But when to hire a CFO? “You do it when your strategy requires it,” says Buck. There’s no need to do it before then, he says, because the person won’t stay.